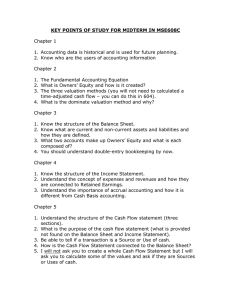

FINC 301: INTRODUCTION TO BUSINESS FINANCE 2022/2023 Professor Godfred A. Bokpin BSc Admin (Accounting), MPhil (Finance), PhD (Economics), Email: gabokpin@ug.edu.gh COURSE DESCRIPTION AND OBJECTIVES As an introductory finance course, it offers an overview of the finance function from the perspective of the corporate financial manager. Specifically, this course will cover: (i) the role of the finance manager and a working knowledge of financial markets, (ii) corporate financial concepts such as the time value of money, financial statement analysis, sources of financing to a firm, and (iii) some basic decision-making frameworks, namely, working capital management and shortterm financing. This course also introduces students to the nature and workings of financial markets and their use by corporations and investors. Course Overview No matter how brilliant a business idea is, without funding, it cannot generate wealth. On the other hand, given that financial resources are limited, these resources must always be utilized in the most efficient manner given the goals of the firm. This course seeks to situate the finance function within the broader organizational setting and outline its role in achieving stellar financial performance. Slide 3 Course Objectives You will learn how to use financial management for problem-solving and decision-making in your personal life and professional role as managers, financial analysts etc. Specifically, on successful completion of this subject, students would be able to: i. Explain the various decision roles of a financial manager, ii. Diagnose the financial health of an organization, prepare financial analysis reports and offer appropriate financial advice, iii. Determine the relevant components that drive profits for a business venture, iv. Determine the growth potential of an organization based on its funding capacity, Select the appropriate funding method for an organization’s growth agenda, v. Determine the appropriate balance between working capital management and firm performance, vi. Make simple investment decisions by applying the time value of money concept TGBTG Slide 4 Overview of Corporate Financial Management and the Financial Environment Effective financial management is the defining characteristic between successful firms and failed firms. Finance plays a critical role in business and society. This session seeks to introduce students to the financial manager’s role and the financial management decisions. It also exposes students to the competing goals to the ultimate goal of value maximization. At the end of this session, students should be able to: – Differentiate between the financial implications of the different forms of business organization – Explain the basic types of financial management decisions and the role of the financial manager – Explain the goal of financial management – Illustrate the agency problem and the role of corporate governance. – Identify the various types of financial markets, transactions and financial institutions Session Objectives At the end of the session, the student will 1. Explain the decision roles of the finance manager 2. Identify the various forms and implications of business organizations available 3. Explain the concept of financial markets and related issues 4. Explain the concept of wealth maximization, agency and governance Slide 6 Session Outline The key topics to be covered in the session are as follows: Topic 1 - The Various Forms of Business Organizations Topic 2 - The Role and Goal of the Finance Manager Topic 3 -Ownership versus control of corporations and Agency Issues Topic 4 - Financial Markets Slide 7 FORMS OF BUSINESS ORGANIZATION In Practice, businesses can be setup using any one of the following forms of business organizations: – Sole proprietorship – Partnership – Corporation (center of our financial management sessions) Which form of business organisation is dominant in Ghana and why What kind of support do they need to excell Are these support mechanisms available & working Sole Proprietorship A business that is organized as a sole proprietorship has a single owner who usually provides all the capital from personal resources. Banks, friends and relatives are the primary sources available to the sole proprietor for raising borrowed funds. A sole proprietor is personally liable for all the debts of the business. For tax purposes in most settings, all income of the business is treated as the proprietor's personal income and taxed at tax rates applicable to personal income. The Sole Proprietorship This business is normally owned and run by one person(in numbers) and typically has few, if any, employees Advantages – No formal charter required (easy to create) – Less or possibly no regulation – Significant tax savings – Minimal organizational costs – Profits and control not shared with others Disadvantages – Limited ability to raise large sums of money – Unlimited liability for the owner – Limited to the life of the owner – Usually no tax deductions for employees health, life or disability Slide 10 insurance Partnership A partnership is an agreement between two or more persons to operate a business; (2-20 for Ghana). The partners are "jointly and severally" responsible for the debts of the partnership. A partnership is not taxed as a business. Instead, the income of the business is allocated to the partners and each partner's share of the income is taxed as if it were income from a proprietorship. In general a partnership interest cannot be sold without the consent of the other partners. The Partnership Advantages – Minimal organizational effort and costs – Easy to raise capital Disadvantages – Unlimited liability for the individual partners – Limited ability to raise large sums of money – Dissolved upon the death or withdrawal of any of the partners Slide 12 The Corporation Corporation is a legal entity separate from its owners – Owners are known as stockholders/shareholders, – Ownership is evidenced by the possesion of shares or stocks – Most important of all the business organizations in terms of Total sales, Assets ,Profits, Contribution to national income Has many of the legal powers individuals have such as the ability to enter into contracts, own assets, and borrow money The corporation is solely responsible for its own obligations. Its owners are not personally liable for any obligation the corporation enters into. Slide 13 The Corporation Advantages – Unlimited life – Limited liability for its owners, as long as no personal guarantee on a business-related obligation such as a bank loan or lease – Ease of transfer of ownership through transfer of stock – Ability to raise large sums of capital Disadvantages – Difficult and costly to establish, as a formal charter is required – Subject to double taxation on its earnings and dividends paid to stockholders – Bankruptcy, even at the corporate level, does not discharge tax obligations Slide 14 Limited Liability Company Ownership interest is called "equity" which is represented by "shares". A limited liability company is an independent legal entity. A limited liability company is a taxable entity and pays tax on its taxable income at the corporate tax rate. Dividends are taxed in the hands of shareholders as their personal income. Thus the limited liability company is subject to "double taxation". Limited Liability Company Many limited liability companies are "private" or "closely held" in the sense that they do not issue shares to the public. Companies that can legally issue shares to the public are called "public companies". One of the advantages of the limited liability company is that it can raise capital by borrowing and issuing additional shares The Corporation Advantages – Unlimited life – Limited liability for its owners, as long as no personal guarantee on a business-related obligation such as a bank loan or lease – Ease of transfer of ownership through transfer of stock – Ability to raise large sums of capital Disadvantages – Difficult and costly to establish, as a formal charter is required – Subject to double taxation on its earnings and dividends paid to stockholders – Bankruptcy, even at the corporate level, does not discharge tax obligations Slide 17 Concept of Finance Finance as a subject is thought to relate to three areas of studies constituting Economics, Accounting and Mathematics. But studying finance is not the same as studying any of these related disciplines but an understanding of the basic relationship is necessary for the finance student. Finance theory is a set of concepts that help think through resource allocation over time. Finance may then be looked at as the study of allocation of scarce resources over time. Finance can be understood as an extension of economics, but studying finance is not identical to studying economics Finance can be said to be applied economics or economics of time and risk Finance concerns more about valuation reflecting passage of time and risk or a science of valuation Finance also involves decision making including: investment, financing and working capital management/dividend policy decisions FINANCE FUNCTIONS IN A COMPANY I. PLANNING III. ADMINISTRATION OF FUNDS – Long and Short-term corporate plans – Manage cash; Manage investments – Budgeting for capital expenditures and – Make banking arrangements operations – Receive, keep and disburse the firm’s money – Sales forecasting – Credit and Collection management – Performance evaluation – Management of provident/pension funds – Pricing IV. ACCOUNTING AND CONTROL – Economic appraisal – Establishment of accounting policies – Analysis of acquisitions and disinvestments, – Development and reporting of accounting etc. II. PROVISION OF CAPITAL – Establish and execute plans to acquire capital PROTECTION OF ASSETS – Provision of insurance coverage – Assure protection of business assets and loss prevention through internal and external auditing – Real estate management – – – – – – data Cost standards Internal auditing Systems and procedures (accounting) Government reporting Report and interpretation of results of operations to management Comparison of performance with operating plans and standards FINANCE FUNCTIONS IN A COMPANY Finance Function Finance Function VI. TAX ADMINISTRATION VIII. EVALUATION AND CONSULTING – Establishment and administration – Consultation and advice to other of tax policies and procedures corporate executives on company policy, operations, objectives and effectiveness – Relations with tax agencies thereof – Preparation of tax reports IX. MANAGEMENT INFORMATION – Tax planning SYSTEMS – Development and use of electronic data VII. INVESTOR RELATIONS processing facilities – Establishment and maintenance of – Development and use of management liaison with investment community information systems – Establishment and maintenance of – Development and use of systems and communications with company procedures stockholders – Counseling with analysts - public financial information The Goal of Financial Management Main goal of the financial manager is to add value to the organisation Stock holder wealth maximization – Modern managerial finance theory operates on the assumption that the primary aim of the firm is to maximize the wealth of its stock holders. • Alternative Goals of Financial Management Profit maximization Managerial reward maximization Behavioral goals and Social responsibility Slide 21 The Goal of Financial Management Stock holder wealth maximization – Modern managerial finance theory operates on the assumption that the primary aim of the firm is to maximize the wealth of its stock holders. • Alternative Goals of Financial Management Profit maximization Managerial reward maximization Behavioral goals and Social responsibility Slide 22 The Goal of Financial Management Slide 23 Wealth Maximization How can the financial manager affect stockholder’s wealth maximization? By influencing the – Present and future earnings per share (EPS) – Size, timing and the risk of these earnings – Dividend policy – Manner of financing the firm In essence, how excellently the financial manager executes these functions determine the ultimate success of the business. Slide 24 Session 1: Exercise 1 Discuss the advantages and disadvantages of pursuing Managerial reward maximization, behavioral goals and social responsibility as goals of the finance function in an organisation. Slide 25 OWNERSHIP VERSUS CONTROL OF CORPORATIONS AND AGENCY ISSUES TGBTG Slide 26 Separation of Ownership & Control A situation in which the owners of a business do not manage it or control it. This applies particularly in large publicly-owned companies. It can also apply to smaller family-owned companies where the business is run by managers. This separation of ownership and management gives rise to an agency relationship: when one or more persons(principals) employ one or more other persons (agents) to perform some task. Primary agency relationship exist between – Shareholders and managers – Managers and creditors These relationships are major source of agency problems Slide 27 PRINCIPAL-AGENT PROBLEM In economic terms, the manager’s mandate will be to maximize owner’s wealth. That is, there is now a SEPARATION OF OWNERSHIP from MANAGEMENT This gives rise to a Principal-Agent relationship Management need not know anything about shareholder tastes or consumption preferences. His/Her task is to maximize the value of investment. However, owners run the risk that managers may look after their own interest at the expense of owners who provide the funds. The potential that this may happen is referred to as the, PRINCIPALAGENT PROBLEM or AGENCY PROBLEM 28 Agency Problem The agency problem is a conflict of interest inherent in any relationship where one party is expected to act in another's best interests including in democracy. In business/corporate finance, the agency problem usually refers to a conflict of interest between a company's management and the company's shareholders. – For E.g. Managers take decisions which are not in line with the goal of maximizing stock holders wealth – Managers work less eagerly and benefit themselves in terms of salaries and perks Slide 29 Agency Costs and Corporate Governance Agency costs are thus the tangible and intangible expenses borne by shareholders because of disagreement between shareholders and managers or the self-serving actions of managers. These costs can be explicit, out-of-pocket expenses – E.g. the costs of auditing financial statements to verify their accuracy Or more implicit ones – e.g. Reduced stock price. Slide 30 Corporate Governance In order to minimize this agency problems and its associated costs, a corporate governance system is instituted. Corporate governance is typically explained as the manner in which firms are governed. The most visible mode of corporate governance is the corporate board of directors, which is a group of persons acting as representatives of a firm’s shareholders and responsible for establishing corporate management related policies and making decisions on major company issues. In essence, the expertise and integrity of the board determines how successful a firm will be. Slide 31 FINANCIAL MARKETS TGBTG Slide 32 Financial Markets Explained A financial market is a broad term describing any marketplace where buyers and sellers participate in the trade of financial assets such as equities, bonds, currencies, and derivatives. Is a system rather than a physical location including its regulation that brings suppliers of funds and users together and not a central location necessarily The importance of financial markets for the development of a country's economy cannot be overemphasized. The financial market gives strength to the economy by making finance available in the right place. Slide 33 Financial Markets & Corporate Governance Market for financial securities – Money Markets and Capital Markets – Suppliers of funds – Users of funds – Financial securities/assets/vehicles/instruments – Intermediaries – Regulators Efficient financial markets allow for efficient allocation of resources from units with surpluses to units in need What does this mean? 34 The Classification of Financial Markets There are different ways of classifying financial markets. One way is to classify financial markets by the type of financial claim. – The Debt market is the financial market for fixed claims of debt instruments and – the Equity market is the financial market for residual claims or equity instruments. A second way is to classify financial markets by the maturity of claims. – The market for short-term financial claims is referred to as Money Market and – the market for long-term financial claims is called the Capital market. – Traditionally, the cutoff between short-term and long-term financial claims has been one year – though the dividing line is arbitrary, it is widely accepted. Since short-term financial claims are invariably debt claims, the money market is the market for short-term debt instruments. The capital market is the market for long-term instruments and equity instruments. TGBTG Slide 35 The Classification of Financial Markets A third way to classify financial markets is based on whether the claims represent new issues or outstanding issues. – The market where issuers sell new claims is referred to as the Primary market and – the market where investors trade outstanding securities is called the Secondary market. A fourth way to classify financial markets is by the timing of delivery. – A Cash or Spot market is one where the delivery occurs immediately and – a Forward or Futures market is one where the delivery occurs at a predetermined time in the future. A fifth way to classify financial markets is by the nature of its organizational structure. – An Exchange-traded market is characterized by a centralized organization with standard procedures. – An Over-the-counter market is a decentralized market with customized procedures. TGBTG Slide 36 Cash flows to and from the firm Slide 37 Financial Markets issues Risk - return tradeoff/risk that determines returns. Time value of money. Focus on Cash - not profits Incremental cash flows count. The curse of competitive markets. Efficient capital markets. The agency problem. Taxes bias business decisions. All risk is not equal. Ethical dilemmas are everywhere in finance All cash flows occur at the year end Rates are always quoted per annum. FINANCIAL STATEMENT ANALYSIS 39 LEARNING OBJECTIVES 1. Describe and discuss financial performance evaluation by internal and external users. 2. Describe and discuss the standards for financial performance evaluation. 3. State the sources of information for financial performance evaluation. 40 LEARNING OBJECTIVES (CONT’D…) 4. Identify Tools and Techniques of Performance Evaluation. 5. Discuss Major Categories of Accounting Ratios. 6. Discuss Significance and Limitations of Ratio Analysis. 41 Financial Performance Evaluation by Internal and External Users OBJECTIVE 1 Describe and discuss financial performance evaluation by internal and external users. 42 The Purpose of Accounting: Financial Information Financial analysis is a process of selecting, evaluating, and interpreting financial data, (along with other pertinent information) with the purpose of formulating an assessment of a company’s present and future financial condition and performance Financial Statement Analysis is the process of identifying the financial strengths and weaknesses of a business by establishing a relationship between the elements of the balance sheet and income statement. The focus is typically on the financial statements, as they are a disclosure of financial performance of a business entity but other reports are also important Financial Performance Evaluation Financial performance evaluation, also called financial statement analysis, comprises all the techniques employed by users of financial statements to show important relationships in the financial statements and the trend in those numbers over time. Users of financial statements fall into two broad categories: internal users and external users. Users of a financial statement may be classified into those with direct financial interest and indirect financial interest 44 A Hierarchy of Accounting Qualities Traditional Assumptions of the Accounting Model • Business Entity • Going Concern or Continuity • Time Period • Monetary Unit • Historical Cost • Conservatism • Realization • • • • • • • • Matching Consistency Full Disclosure Materiality Industry Practices Transaction Approach Cash Basis Accrual Basis Financial Statement Analysis: Players in the Communication Process… Management Preparation CFO, CEO, Accounting Staff Guided by GAAP Management Accounting input Independent Auditors Verification Partners, Managers, Staff Guided by GAAS Information Intermediaries Government Regulators Financial analyst/services SEC,GSE Analysis and Advice Verification Guided by Code. Guided by SEC regs. Users Analysis and Decision Investors, Lenders, etc. 47 Public companies only Financial Statement Analysis: Common Objectives 1. 2. Assessing the historical operating performance and financial health of a supplier, customer, or competitor. To understand the economics of a firm in order to forecast its future profitability and risks – Profitability is an increase in wealth – Risk is the probability that a specific level of profitability will not be achieved. 48 Financial Statement Analysis: Common Objectives (Cont’d…) 3. An assessment of future profitability and risks is often meant to provide a basis for – making an investment in a firm’s common/ordinary or preferred stock. – extending credit (short or long-term) – valuing a firm in settings such as an IPO, an acquisition candidate, in court-directed bankruptcy hearings, or in liquidation actions. – forming an opinion on a client’s financial statements with respect to whether the client is a “going concern.” – assessing whether combinations in an industry might generate unreasonable (monopoly) returns, thus prompting antitrust action by government regulators. 49 The Users of Accounting Information DECISION MAKERS Management Various functional areas in Organizations Those with Direct Financial Interest Those with Indirect Financial Interest Owners Government Creditors Agencies Labour Unions Public 50 Internal User Management is an internal user Management’s primary objective is to increase the wealth of the owners or stockholders of the business. Management’s main responsibility is to carry out plans to achieve the financial performance objectives. Management develops monthly, quarterly, and annual reports that compare actual performance with objectives for key financial measures. 51 External Users Creditors make loans in various forms. Investors buy shares, from which they hope to receive dividends and an increase in value. Both groups face risks and for both the goal is to achieve a return that makes up for the risk. 52 Others Users of Financial Information Government and its Agencies Employees and Trade Unions Company’s Publics 53 Standards for Financial Performance Evaluation (Benchmarking) OBJECTIVE 2 Describe and discuss the standards for financial performance evaluation. 54 Standards for Financial Performance Evaluation (Benchmarking) The general standards of comparison include: Company’s own set of data – Past data – Future data Inter-firm comparison (Benchmarking against a competitor etc) Industry Average 55 Sources of Information OBJECTIVE 3 State the sources of information for financial performance evaluation. 56 Reports Published by the Company The annual report of a company is an important source of financial information. The main parts of an annual report are: – Management's analysis of the past year's operations. – The financial statements. – The notes to the statements, including the principal accounting procedures used by the company. – The auditors' report. – A summary of past operations. 57 Tools and Techniques of Performance Evaluation OBJECTIVE 4 Apply horizontal analysis, trend analysis, and vertical analysis and Ratio Analysis to financial statements. 58 Tools and Techniques of Financial Performance Evaluation Few numbers are very significant when looked at individually. It is the relationship between various numbers or their change from year to year that is important. The tools of financial performance evaluation are intended to show relationships and changes. 59 Horizontal Analysis Horizontal analysis is the process of computing changes in like items from one year to another The horizontal analysis begins with the computation of changes from the previous year to the current year. The base year is the first year considered. Then dividing the cedi amount of change by the base period amount. The horizontal analysis uses both cedi amounts and percentages. Percentage Change = 100 x ( ) Amount of Change Base Year Amount 60 Financial Statement Analysis: Horizontal Analysis Tool Increase (Decrease) 1998 Sales 1997 Amount Percent 9.5% $18,284 $16,701 $1,583 3,141 3,205 (64) Net income Prepared by F. AboagyeOtchere & J.K. Otieku 61 (2.0%) Financial Statement Analysis: Trend Analysis Tool A form of horizontal analysis that examines more than a two- or three-year period – Use a selected base year whose amounts are set equal to 100 percent – Compute trend percentages, each item for following years is divided by the corresponding amount during the base year – Trend analysis is important because it may point to basic changes in the nature of a business. Any year $ Trend % = Base year $ 62 Financial Statement Analysis: Trend Analysis Tool (Cont’d…) (in millions) 1998 Net Sales $18,284 Cost of products sold 4,856 Gross profit 13,428 1997 1996 1995 1994 1993 $16,701 4,464 12,237 $15,065 3,965 11,100 $13,767 3,637 10,130 $11,984 3,122 8,862 $11,413 3,029 8,384 The resulting trend percentages follow: 1998 1997 1996 1995 1994 1993 Net sales 160% Cost of products sold 160 Gross profit 160 146% 147 146 132% 131 132 121% 120 121 105% 103 106 100% 100 100 Sales, cost of products sold, and gross profit have trended 63 upward at almost identical rates throughout the five-year period Vertical Analysis Percentages are used to show the relationship of the different parts to a total in a single statement. The analyst sets a total figure in the statement equal to 100% and computes each component’s percentage of that total. The statement of percentages is called a common-size statement. Vertical analysis is useful for comparing the importance of specific components in the operation of a business and changes in the components from one year to the next. 64 Financial Statement Analysis: Vertical Analysis Tool Vertical analysis of a financial statement reveals the relationship of each statement item to a specified base, which is the 100% figure Every other item on the financial statement is then reported as a % of that base (common-size ratios) – When an income statement is analyzed vertically, net sales is usually the base – Vertical analysis of balance sheet amounts are shown as a percentage of total assets Vertical analysis % = Each income statement item Net Sales 65 Financial Statement Analysis: Vertical Analysis Tool (Cont’d...) FINC 301 COMPANY Income Statement (Adapted) Years Ended December 31, 1998 and 1997 Dollar amounts in millions Net sales $18,284 100.0% Cost of products sold 4,856 26.6 Gross profit 13,428 73.4 Operating expenses : Marketing, selling, and administrative 4,418 24.2 Advertising and products promotion 2,312 12.6 Research and development 1,577 8.6 Special charge 800 4.4 Provision for restructuring 201 1.1 Other (148) (0.8) Earnings before income taxes 4,268 23.3 Provision for income taxes 1,127 6.1 66 Net earnings $ 3,141 17.2% $16,701 4,464 12,237 100.0% 26.7 73.3 4,173 25.0 2,241 1,385 13.4 8.3 225 (269) 4,482 1,277 $ 3,205 1.3 (1.5) 26.8 7.6 19.2% Ratio Analysis The way to compare companies of different sizes is to use standard measures Financial ratios are standard measures that enable analysts to compare companies of different sizes A Financial Ratio is a relationship between two accounting figures expressed mathematically. Ratios are guides or shortcuts that are useful in: – Evaluating a company’s financial position and operations. – Making comparisons with results in previous years or with other companies. The primary purpose of ratios is to point out areas needing further investigation. 67 Major Categories of Ratios OBJECTIVE 5 Discuss major categories of Accounting ratios. 68 Financial Statement Analysis: Ratio Analysis The ratios used to make business decisions may be classified broadly as follows: – Ratios that measure the company’s ability to pay or the risks of not meeting current liabilities [liquidity ratios] – Ratios that measure the company’s ability to sell inventory, collect receivables, etc [activity ratios] – Ratios that measure the company’s ability to pay or the risks of not meeting long-term debt [solvency ratio] – Ratios that measure the company’s profitability – Ratios used to analyze the company’s shares as an investment [investment ratios] 69 Evaluating Liquidity Liquidity is a company's ability to pay bills when they are due and to meet unexpected needs for cash. All ratios that relate to liquidity involve working capital or some part of it. – Current ratio: measures short-term debt-paying ability. – Quick ratio: measures short-term debt-paying ability. – Acid-Test ratio: measures short-term debt-paying ability. 70 Analysis of Risk and Liquidity • Factors that affect risk of a firm – – – Economy-wide factors such as inflation Industry-wide factors such as competition Firm-specific factors such as potential for a labour strike • Questions or issues on liquidity a) Can the firm pay short-term obligations like workers' wages? That is, what are measures of short term risk? b) Can the firm pay long-term obligations like debt? That is, what are long-term measures of risk? 71 Liquidity Ratio Current Ratio = Current Assets Current Liabilities Quick Ratio = Current Assets - Stock Current Liabilities Acid-Test Ratio = Cash + cash Equivalents Current Liabilities 72 Working Capital Financing Policy Working capital financing policies may include – Moderate: Match the maturity of the assets with the maturity of the financing. – Aggressive: Use short-term financing to finance permanent assets. – Conservative: Use permanent capital for permanent assets and temporary assets. 73 Evaluating Profitability Profitability reflects a company's ability to earn a satisfactory income. A company's profitability is closely linked to its liquidity because earnings ultimately produce cash flow. Profitability ratios include: – Profit margin: measures net income produced by each sales cedi. – Asset turnover: measures how efficiently assets produce sales. – Return on assets: measures overall earning power. – Return on equity: measures profitability of shareholder investments. 74 Profitability Ratios Return on Assets = Net Income Total Assets Profit Margin = Net Income Net Sales Asset Turnover = Net Sales Average Total Assets Return on Equity = Net Income Stockholders’ Equity Evaluating Activity Ratios Activity ratios measure how efficient a firm is at using the firm's resources. Activity ratios include: – Rate of Stock Turnover – Average Collection period – Average Payment Period – Fixed Assets Turnover 76 Activity Ratios Rate of Stock Turnover = Cost of Sales Average Stock Average Collection Period = Receivables * 360 Days Credit Sales Average Payment Period = Trade Creditors * 360 Days Credit Purchases Fixed Assets Turnover = Fixed Assets Turnover 77 Activity Ratios Rate of Stock Turnover = Cost of Sales Average Stock Average Collection Period = Receivables * 360 Days Credit Sales Average Payment Period = Trade Creditors * 360 Days Credit Purchases Fixed Assets Turnover = Fixed Assets Turnover Evaluating Long-Term Solvency Long-term solvency has to do with a company's ability to survive for many years. The aim of long-term solvency analysis is to detect early signs that a company is headed for financial difficulty. Early signs that a company is on the road to bankruptcy include: – Declining profitability and liquidity ratios. – Unfavorable debt to equity ratio. – Unfavorable interest coverage ratio. 79 Solvency Analysis A company’s business risk is determined, in large part, from the company’s line of business. Financial risk is the risk resulting from a company’s choice of how to finance the business using debt or equity. We use solvency ratios to assess a company’s financial risk. There are two types of solvency ratios: component percentages and coverage ratios. ◦ Component percentages involve comparing the elements in the capital structure. ◦ Coverage ratios measure the ability to meet interest and other fixed financing costs. Risk Business Risk Financial Risk Sales Risk Operating Risk 80 Long-Term Solvency Debt to Equity Ratio = Long-term Liabilities Stockholders’ Equity Measures capital structure and leverage. Failure to honor debt can result in bankruptcy, so debt is risky. BUT debt provides flexible financing: – It can be temporary. – Interest is tax deductible. – It leverages stockholders’ investments if the company earns a return on assets greater than the cost of interest. Long-Term Solvency (Cont’d…) Interest Coverage Ratio = Income Before Income Taxes + Interest Expense Interest Expense Measures creditors’ protection from default on interest payments. 82 Summary of Solvency ratios Component-Percentage Solvency Ratios Proportion of assets financed with debt. Proportion of assets financed with long-term debt. Debt financing relative to equity financing. Reliance on debt financing. Coverage Ratios Ability to satisfy interest obligations. Ability to satisfy interest and lease obligations. Ability to satisfy interest obligations with cash flows. Length of time needed to pay off debt with cash flows. 83 Evaluating Investment Ratios Investment ratios are used to analyze and evaluate a company’s shares as an investment. Investment ratios include: – Earnings per share – Price-Earnings ratio (P/E ratio) – Dividend Yield etc. 84 Earnings per Share • This ratio is the profit that is attributable to each share of common stock. • It would be simply the net income less preferred dividends divided by the number of common shares. • However, the number of common shares is complicated by certain securities that may become (converted to) common share. How to account for these is a complex issue. • For example, if there are 100 common shares but 50 preferred shares that could convert to 50 common shares, do you divide earnings by 100 or 150? The answer depends on how likely it is that the convertible securities will convert. 85 Earnings Per Share (Cont’d…) • • Most companies strive to increase EPS by about 10 -15% annually EPS does not consider the amount of assets or capital required to generate earnings; making it of limited use in comparing two firms. • For investment purposes, the price to earnings ratio (P/E ratio) or P/E multiple is preferably used 86 Price-Earnings Ratio (P/E) • This is the return to the purchaser of a share. – P/E = (market price of a share of stock)/(EPS) – The PE ratio measures the market’s perception of the quality of a company’s earnings by indicating the price multiple the capital market is willing to pay for the company’s earnings. – Presumably, this ratio reflects the info provided by all financial info. in that, the market price reflects analysts’ perceptions of the company’s growth potential, stability and risk. 87 Price-Earnings Ratio (Cont’d…) » The P/E ratio commonly serves as a useful proxy for the expected growth rate in dividends or earnings. – In fact, a common Wall Street rule of thumb is that the growth rate ought to be roughly equal to the P/E ratio e.g., see Peter Lynch’s book “One Up on Wall Street”. – Ceterus paribus, riskier firms will have lower P/E ratios because they have higher rates of return. There are two types of price earnings (PE) ratios or multiples. – The trailing PE equals the current market price per share of common stock (CS) divided by the last year’s EPS. – The forward PE equals the current price per share of CS divided by next year’s forecasted EPS. Dividend Yield » Dividend yield is the ratio of dividends per share of stock to the stock’s market price per share This ratio measures the percentage of a stock’s market value that is returned annually as dividends Dividend Payout ratio – expresses the % of earnings that is distributed to shareholders as dividends. It is calculated by dividing dividends per share by earnings per share. – it provides an indication of a firm’s managerial or reinvestment strategy. A low payout suggests that a firm is retaining a large portion of earnings for reinvestment e.g., growth industries 89 Significance and Limitations of Ratio Analysis OBJECTIVE 6 Discuss the significance and limitation of ratio analysis. 90 Significance of Ratio Analysis Ratio Analysis is a powerful tool which is used to gauge the financial strengths and weaknesses of a business organization, Assess profitability Risk associated with an investment decision Performance of management Control operations 91 Limitations of Ratio Analysis There are some limitations associated with the use of accounting ratios. The financial statements used are historical in nature Using quantitative data to take decisions that are qualitative Standard of comparison Skills required 92 The DuPont Formulas The DuPont formula uses the relationship among financial statement accounts to decompose a return into components. Three-factor DuPont for the return on equity: ◦ Total asset turnover ◦ Financial leverage ◦ Net profit margin Five-factor DuPont for the return on equity: ◦ Total asset turnover ◦ Financial leverage ◦ Operating profit margin ◦ Effect of nonoperating items ◦ Tax effect Return on Equity Net Profit Margin Total Asset Financial Turnover Leverage Operating Profit Margin Effect of Non-operating Items Tax Effect 93 Five-Component DuPont Model 94 Example: The DuPont Formula Suppose that an analyst has noticed that the return on equity of the D Company has declined from FY2012 to FY2013. Using the DuPont formula, explain the source of this decline. (millions) Revenues 2013 2012 $1,000 $900 $400 $380 $30 $30 $100 $90 Total assets $2,000 $2,000 Shareholders’ equity $1,250 $1,000 Earnings before interest and taxes Interest expense Taxes 95 Example: the DuPont Formula 2013 2012 Return on equity 0.20 0.22 Return on assets 0.13 0.11 Financial leverage 1.60 2.00 Total asset turnover 0.50 0.45 Net profit margin 0.25 0.24 Operating profit margin 0.40 0.42 Effect of non-operating items 0.83 0.82 Tax effect 0.76 0.71 96 Financial Analysis Report A financial analysis report is, basically, a document that attracts high interest of investors as it contains a detailed appraisal of a company’s financial health. A comprehensive financial analysis report accentuate the strengths and weaknesses of a company. Communicating the company’s strengths and weaknesses in an accurate and honest manner is helpful for attracting investors. TGBTG Slide 97 The Basics of Financial Reports An “Executive Summary” of important findings from the financial analysis. Set up an introduction emphasizing the objectives of the report. Also define financial terms necessary for understanding those objectives A section which includes a comprehensive analysis returns, balance sheets, income statement, and productivity ratios. Also comment on each of these factors in addition to providing support for your statements with graphs and tables. Evaluate results from various periods in a section titled “Analysis of Variance”. Conclude the report with a statement projecting future performance on the basis of past years’ performance. TGBTG Slide 98 Financial Planning for Growth: Sub-Topics Percent of sales approach to growth; Indifference analysis; Breakeven analysis Session Overview Every firm that wants to exist and effectively operate in the foreseeable future needs to ascertain its financial needs and actively prepare beforehand to achieve them. Corporate financial planning enables managers to select the most appropriate investments and activities that would be of help in achieving financial objectives. Also, it helps a firm to adequately prepare for and take advantage of opportunities. Students will be well equipped with the financial planning process and making major decisions for growth after going through this session. Session Objectives At the end of this session, students should be able to: 1. Understand the financial planning process and how decisions are interrelated 2. Be able to develop a financial plan using the percentage of sales approach and be able to compute external financing needed 3. Understand the four major decision areas involved in long-term financial planning and identify the determinants of a firm’s growth 4. Understand how capital structure policy and dividend policy affect a firm’s ability to grow. Session Objectives 5. Understand growth and external financing. 6. Understand indifference analysis 7. Understand the break even analysis 8. Use breakeven analysis to make business decisions for profit What is Financial Planning? • The process of determining a company's financial needs or goals for the future and how to achieve them. • Corporate financial planning involves deciding what investments and activities would be most appropriate under both the company's individual and broader economic circumstances. • Financial planning establishes the way in which financial objectives can be achieved Objectives of Financial Planning To ascertain required Investment in new assets To determine the Degree of financial leverage required by the business in order to achieve its strategic goals. – This includes decisions of debt- equity ratio- both short-term and long- term. To determine cash that can be paid to shareholders in view of the firm’s growth agenda To assess the liquidity requirements of a firm and ensure that the limited financial resources are maximally utilized in the best possible manner The Importance of a Corporate Financial Plan • • • • It ensures that adequate funds are available to support the future agenda of the business. Financial Planning helps in ensuring a reasonable balance between outflow and inflow of funds so that stability is maintained. Financial Planning reduces uncertainties with regards to changing market trends which can be faced easily through enough funds. Financial Planning helps in reducing the uncertainties which can be a hindrance to growth of the company. This helps in ensuring stability and profitability in concern. Percentage of Sales Approach The percentage-of-sales method is a type of financial statement analysis tool in which all relevant accounts are expressed as a ratio of sales. – In other words, financial statement line items such as cash, inventory, accounts receivable/payable, net income, and cost of goods sold, are each calculated as a percentage of revenue. All historical expense percentages are then applied to the forecasted sales level in the budget period. Pro Forma Analysis Estimate typical relation between revenues and salesdriven accounts. Estimate fixed burdens, such as interest and taxes. Forecast revenues. Estimate salesdriven accounts based on forecasted revenues. Estimate fixed burdens. Construct future period income statement and balance sheet. 107 Issues to Note Some items vary directly with sales, while others do not Income Statement: Costs may vary directly with sales - if this is the case, then the profit margin is constant – Depreciation and interest expense may not vary directly with sales – if this is the case, then the profit margin is not constant – Dividends are a management decision and generally do not vary directly with sales – this influences additions to retained earnings Balance Sheet: Initially assume all assets, including fixed, vary directly with sales – Accounts payable will also normally vary directly with sales – Notes payable, long-term debt and equity generally do not vary directly with sales because they depend on management decisions about capital structure – The change in the retained earnings portion of equity will come from the dividend decision Issues to Note The percentage of sales method thus generates a set of pro forma or forecasted balance sheets and income statements for the firm. The analyst projects what will happen to the firm’s accounts over time, which supports an estimate of the firm’s external financing needs for a particular period. Percentage of Sales Approach – Steps: Step 1: Express balance sheet items that vary directly with sales as a percentage of sales. – Items that do not vary directly with sales e.g. long term debt, retained earnings, common stock & property/plant/equipment are designated as not applicable (n/a). Step 2: Estimate sales revenue for the future period Step 3: Multiply the percentages from step 1 by the sales projected (step 2) to obtain the amounts for future periods. TGBTG Slide 110 Percentage of Sales Approach-Steps: (Cont’d…) Step 4: Where no percentage applies (e.g. for long term debt, common stock or retained earnings numbers), take the figures from the present balance sheet in the column for the future period. Step 5: Calculate the projected retained earnings and add to the retained earnings account in the balance sheet Step 6: Total up the assets account to obtain a total projected assets value, then add projected liabilities & equity accounts to determine the total shortfall. – This shortfall indicates the total external financing that is required to keep the company running at present operational levels. TGBTG Slide 111 Pro Forma Income Statement FINC 301 Company Income Statement (in millions) Sales revenues Cost of goods sold Gross profit Selling, General &Admin Year 0 €1,000.0 600.0 €400.0 100.0 One Year Ahead €1,050.0 630.0 €420.0 105.0 Growth at 5% 60% of revenues Revenues less cost of goods sold 10% of revenues Operating income €300.0 €315.0 Gross profit less operating exp. Interest expense Earnings before taxes 32.0 €268.0 33.6 8% of long-term debt €281.4 Operating income less interest exp. Taxes Net income Dividends 93.8 €174.2 €87.1 98.5 35% of earnings before taxes €182.9 Earnings before taxes less taxes €91.5 Dividend payout ratio of 50% 112 Pro Forma Balance Sheet FINC 301 Company Balance Sheet, End of Year (in millions) One Year Year 0 Ahead Current assets €600.0 €630.0 60% of revenues Net plant and equipment 1,000.0 1,050.0 100% of revenues Total assets €1,600.0 €1,680.0 Current liabilities Long-term debt Common stock and paid-in capital Treasury stock Retained earnings Total liabilities and equity €250.0 400.0 25.0 925.0 €1,600.0 €262.5 25% of revenues 420.0 Debt increased by €20 million to maintain the same capital structure 25.0 Assume no change (44.0) Repurchased shares 1,016.5 Retained earnings in Year 0, plus net income, less dividends €1,680.0 113 Example Balance Sheet December 31, 2020 Assets 1000 Debt Equity Total 1000 Total Income Statement For Year Ended December 31, 2020 400 600 Revenues 2000 Less: costs (1600) 1000 Net Income 400 Slide 114 4-114 Example: Pro Forma Income Statement • Initial Assumptions – Revenues will grow at 15% (2,000*1.15) – All items are tied directly to sales, and the current relationships are optimal – Consequently, all other items will also grow at 15% Pro Forma Income Statement For Year Ended 2017 Revenues 2,300 Less: costs (1,840) Net Income 460 Slide 115 4-115 Example: Pro Forma Balance Sheet • Case I – Dividends are the plug variable (adjusted variable), so equity increases at 15% Pro Forma Balance Sheet Case 1 Assets 1,150 Debt 460 Equity • Case II – Debt is the plug variable and no dividends are paid, all profits transferred to the equity account, requiring adjustment in debt to balance the balance sheet. Total Assets 1,150 Total TGBTG 1,150 Pro Forma Balance Sheet Case 2 1,150 Debt Equity Total 690 1,150 Total 90 1,060 1,150 Slide 116 4-116 Growth and External Financing • At low growth levels, internal financing (retained earnings) may exceed the required investment in assets • As the growth rate increases, the internal financing will not be enough, and the firm will have to go to the capital markets for money • Examining the relationship between growth and external financing required is a useful tool in longrange planning Slide 117 4-117 Growth and External Financing • It is important to note that the extent of growth of a firm is largely dependent on the financial capacity of the firm, especially from external sources. • Firms that are constrained in terms access to external financing can therefore only grow as much as the retained earnings available for expansion Slide 118 4-118 The Internal Growth Rate ROA b Internal Growth Rate 1 - ROA b .1263 .5 .0674 1 .1263 .5 6.74% Slide 119 4-119 The Sustainable Growth Rate ROE b 1 - ROE b .2927 .5 .1714 1 .2927 .5 17.14% Sustainabl e Growth Rate Slide 120 4-120 Indifference Analysis Given a level of EBIT, a particular combination of different sources of finance will yield a particular EPS and therefore, for different financing patterns, there would be different levels of EPS. Indifference point analysis is the process of determining the point at which any two modes of external financing yield the same impact on earnings per share (EPS) – Its value lies in the ability to forecast, ahead of time, which mode of financing will deliver the best in terms of shareholder wealth maximization. Slide 121 Indifference Point Formula Slide 122 Breakeven Analysis In the case of new businesses or projects, financial planning also entails an analysis of the point where the business is able to cover all of its fixed and variable costs. The point at which total of fixed and variable costs of a business becomes equal to its total revenue is known as break-even point (BEP). In essence, it determines the minimum level of sales needed to keep the business afloat. TGBTG Slide 123 Benefits of BEP Analysis Facilitates appropriate pricing Provides insights into cost structures and facilitates cost efficiency moves Predicts the effect of price changes on profit Informs production levels and possible implications of changes in plant size Slide 124 Break Even Analysis Mathematical Presentation of BEP Slide 126 Caveats In financial planning processes such as forecasting financial statements or breakeven analysis, the output is only as good as the input. In other words, unrealistic assumptions, wrong estimates, or inappropriately defined relationships would yield useless output that have no relevance for the strategic planning process. Slide 127 Operating Leverage Fixed cost do not change as quantity changes Variable costs increase as quantity of output rises Firms often face a trade-off between fixed and variable costs Example, a firm can build its factory incurring a high level of fixed costs in the process or it can outsource production to a supplier, typically generating lower fixed costs but high variable costs Operating Leverage Fixed cost must be paid even at the lower level of sales, leaving the firm with the possibility of large losses. And with fixed costs replacing variable costs, any additional sales generate low marginal costs, leaving the firm with a substantial increase in profit Firms with high fixed costs and low variable costs are generally said to have high operating leverage Operating leverage measures a company’s fixed costs as a percentage of its total costs Cash Forecasting The Cash Forecasting Model • What to look out for: Accurate forecasting of Receipt Accurate forecasting of Payments Automation of the Receipts and Payments • • The Bullwhip Effect of cash Forecasting: This occurs when a company runs into a materials or capacity shortage and informs its customers that they are being put on an allocation basis. Customers usually increase their orders, but reduce it later when company is able to continue its supply. Company can minimize effect of this if inventory orders are adjusted by unusual hikes. TGBTG 130 Cash Forecasting The Cash Forecasting Model • Business Cycle Forecasting Forecasting cash into the longer periods needs to be adjusted by business cycles. The following steps can be taken to accurately forecast business cycles. Report on published forecasts: Information forecasted is accurate but may not be relevant to chosen industry. Subscribe to a forecasting service: may be expensive for smaller company Develop an in-house forecasting model 1 131 Cash Forecasting The Cash Forecasting Controls • Investigate significant variances: Relevant for periodic cash forecasts • Obtain the approval of a knowledgeable person • Match latest forecast against preceding forecasts. • Match forecast against standard forecast checklist. • Obtain approvals. • Retain a copies of previous cash forecasts. 1 132 Cash Budget Forecast of cash inflows and outflows over the next short-term planning period Primary tool in short-term financial planning Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover workingcapital requirements Allows a company to plan ahead and begin the search for financing before the money is actually needed 133 18-133 Cash Forecasting Question: Prepare a Cash forecast for the below information The sales and purchases for Ahemba Ltd are as follows: Month Credit Sales April $160,000 Credit Purchase $ 68,000 May June $140,000 $192,000 $64,000 $80,000 The company will pay wages of $8,000, $7,000 and $8,400 in April, May and June respectively. Interest payments are 3,000 per month during the period. The company will purchase equipment costing $50,000 and $4,000 in June. Ahemba Ltd estimates that 10% of its sales will be collected in the month of the sales; and the rest of its sales will be collected in the following month. Purchases on trade accounts will be paid in the month following the purchase. In March the sales were $180,000. The company has $20,000 cash at the end of March and normally keeps $10,000 minimum cash balance each month against contingencies. 1 134 Example: Cash Budget Information Pet Treats, Inc. specializes in gourmet pet treats and receives all income from sales Sales estimates (in millions) Q1 = 500; Q2 = 600; Q3 = 650; Q4 = 800; Q1 next year = 550 Accounts receivable: Beginning receivables = GHS250 – Average collection period = 30 days Accounts payable – Purchases = 50% of next quarter’s sales – Beginning payables = 125 – Accounts payable period is 45 days Other expenses: Wages, taxes, and other expense are 30% of sales – Interest and dividend payments are GHS50 – A major capital expenditure of GHS200 is expected in the second quarter The initial cash balance is GHS80, and the company maintains a minimum balance of GHS50 135 18-135 Example: Cash Budget – Cash Collections • ACP = 30 days; this implies that 2/3 of sales are collected in the quarter made and the remaining 1/3 are collected the following quarter • Beginning receivables of GHS250 will be collected in the first quarter Q1 Q2 Q3 Q4 Beginning Receivables 250 167 200 217 Sales 500 600 650 800 Cash Collections -583 -567 -633 -750 Ending Receivables 167 217 267 200 18-136 Sources and Uses of Cash Balance sheet identity (rearranged) NWC + fixed assets = long term debt + equity NWC = cash + other CA – CL Cash = long term debt + equity + CL – CA other than cash – fixed assets Sources – Increasing long-term debt, equity, or current liabilities – Decreasing current assets other than cash, or fixed assets Uses – Decreasing long-term debt, equity, or current liabilities – Increasing current assets other than cash, or fixed assets 137 18-137