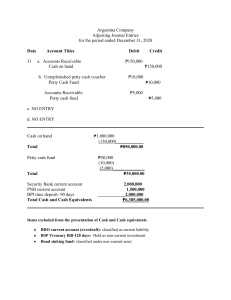

Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department Course Learning Outcome Prepare the current asset section of the statement of financial position Student Learning Outcomes 1. Identify items considered as cash 2. Identify items considered as cash equivalents 3. Compute the correct balance for cash and cash equivalents 4. Prepare journal entries to account for petty cash fund Learning Content CASH AND CASH EQUIVALENTS Introduction Welcome to the first lesson in Intermediate Accounting focuses on the accounting for cash and cash equivalents. In this lesson, you will learn the items to be included in cash and cash equivalents and compute the correct cash and cash equivalent balances. Lesson Content Definition of Cash Cash – simply means money Money – a standard of medium of exchange in business transactions In accounting, cash includes money and any other negotiable instrument that is payable in money andacceptable by the bank for deposit and immediate credit. To be included as cash, it must be unrestricted in use. 1. Cash on hand a) Undeposited cash collections b) Undeposited dated customer’s checks (customer’s checks awaiting deposit) c) Traveler’s check – a certified bank draft that travelers may use the same way they use regular paper currency.1 d) Cashier’s check – a type of official check that banks issue and sign. When you purchase a cashier’s check, the bank takes the money from your checking or savings account and puts it in its own account. The bank then writes out a check to the person or business you need to pay. You’ll typically pay a fee for a cashier’s check to the bank.2 e) Manager’s check – is a check issued by the bank’s manager upon the bank itself promising to pay to the payee or its order an amount certain in money at a certain date.3 f) Money orders – a certificate, usually issued by a government or banking institution, that allows the stated payee to receive cash on demand. A money order functions much like a check, in that the person who purchased the money order may stop payment.4 g) Bank drafts – a written order addressed to the bank to pay an amount of money to the order of themaker. It is a check that is drawn on a bank’s funds and guaranteed by the bank that issues it. To get a banker’s draft, a bank customer must have funds (or cash) available. The bank will freeze theamount needed or move those funds into the bank’s accounts to complete the payment. Simplified Notes in Intermediate Accounting 1 | 2023 1 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department 2. Cash in bank a) Demand deposit/commercial deposit/current account/checking account b) Savings deposit (savings account) 3. Cash fund (current operations) a) Petty cash fund (for small and miscellaneous disbursements) b) Change fund c) Payroll fund d) Purchasing fund (for purchasing of inventories) e) Revolving fund (fund that is used for limited or specific purpose set by management) f) Interest fund g) Dividend fund h) Travel fund i) Tax fund Other Funds Fund for Non-current Operations Pension fund Preferred redemption fund Acquisition of property, plant, and equipment Contingent fund Insurance fund Sinking fund Classification if related liability is current, then pension fund is current, thus partof cash noncurrent investment (unless the preferred share capital has a mandatory redemption, and the redemption is already within oneyear from the reporting period in which case this fund is already part of ash equivalent) always noncurrent even if expected to be disbursed next year Non-current investment Non-current investment Always noncurrent even if expected to be disbursed next year Classification of cash fund as current or non-current should parallel the classification applied to therelated liability. Thus, an entity should classify such non-current asset if the related liability becomes current. Definition of Cash Equivalents are short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates. ▪ only highly liquid investments that are acquired three months before maturity can qualify as cash equivalents Examples: • Time deposit – acquired within three months from maturity date • Three-month treasury bill • Three-year treasury bills purchased three months before date of maturity • Three-month money market instrument and commercial paper • Redeemable preference shares with mandatory redemption period and acquired three months before maturity ▪ Investment of excess cash Term ≤ Three months 1 year ≥ x > three months >1 year Classification cash equivalents short-term financial assets/temporary investments long-term investments Simplified Notes in Intermediate Accounting 1 | 2023 Presentation “Cash and cash equivalents” Current assets Non-current assets 2 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department Measurement and Classification of Cash, Cash Equivalents and other items 1. Cash 2. Cash in foreign currency 3. Deposit in foreign bank 4. Cash in closed bank/banks in bankruptcy 5. Bank overdraft – when cash in bank accounthas a credit balance which results from the issuance of checks in excess of the deposits 6. Compensating balance – the minimum checking or demand deposit account balance that must be maintained in connection with a borrowing agreement with a bank) 7. Undelivered/unreleased check 8. Stale checks – checks outstanding for morethan six months from the date of check 9. Postdated checks – checks dated after the reporting period 10. IOUs (I owe you) 11. Equity securities 12. Redeemable preference shares 13. Callable preference shares 14. Expenses advances 15. Temporary investments in shares of stocks 16. Unused credit line 17. Treasury warrants – a warrant for the payment of money into or from public treasury 18. Escrow deposit – restricted amount held in trust for another party, i.e. deposit requiredby court of law for a pending case 19. Unrecorded cash disbursements 20. Unrecorded cash collections 21. Certificate of deposits 22. Postage stamps on hand Measured at face value Translated to Philippine Peso included as cash (if unrestricted deposit) classified separately among noncurrent assets as receivables (if restricted and material) Estimated realizable value (if Recoverable amount < face value; Non-current asset) Different banks - current liabilities Same bank - netted against the account with positive balance but cannot be offset against restricted account not legally restricted as to withdrawal – part of cash legally restricted because of formal compensating balance agreement • Related loan is short-term - presented as “cash held as compensating balance” under current assets • Related loan is long-term – non-current investment Reverted back to cash Reverted back to cash Company’s check issued – reverted back to cash Customer’s check received – not yet cash (A/R) Part of receivable cannot be classified as cash equivalents because shares do not have maturity date (except redeemable preference shares) specified redemption date and acquired three months before maturity date are classified as cash equivalents Reverted back as part of receivables. Receivable or prepaid expenses either FVTPL or FVTOCI Disclosed in the notes Included as part of cash Other current or noncurrent increase recording of disbursements increase recording of receipts invested 3 months before maturity - cash equivalents Invested for more than three months – investment (short or long term) Office supplies Undelivered/unreleased check ▪ ▪ Check merely drawn and recorded but not given to the payee before the end of the reporting period No payment is made since check is pending delivery to the payee at the end of reporting period Adjusting Entry: Cash Accounts payable xx xx Simplified Notes in Intermediate Accounting 1 | 2023 3 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department Postdated check delivered Check drawn, recorded and already given to the payee but it bears a date subsequent to the end of the reporting period Adjusting Entry: Cash xx Accounts payable xx ▪ Stale check ▪ A check not encashed by the payee within a relatively long period of time In banking practice, a check becomes stale if not encashed within six months from the time of issuance. a. If the amount of stale check is immaterial, it is simply accounted for a miscellaneous income as follows: Cash xx Miscellaneous income xx b. If the amount is material and liability is expected to continue, the cash is restored, and the liability is again set up. Cash xx Accounts payable or appropriate account xx Cash shortage and overage SHORTAGE = Cash count shows: cash < balance per book AJE: Cash short or over xx Cash xx a) If cashier or cash custodian is held responsible for the shortage: Due from cashier xx Cash short or over xx b) If reasonable efforts fail to disclose the cause of shortage: Loss from cash shortage xx Cash short or over xx OVERAGE = Cash count shows: cash > balance per book AJE: Cash a) xx Cash short or over xx If there is no claim on the overage: Cash short or over xx Miscellaneous income xx b) If the overage belongs to the cashier or cash custodian Cash short or over xx Payable to cashier xx Simplified Notes in Intermediate Accounting 1 | 2023 4 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department Illustration 1 – Computation of cash balance The data from the books of ABC Co. as of December 31, 20x1 are shown below: Cash on hand P 100,000 Cash in bank – current account P 350,000 Cash in bank – peso savings deposit 2,000,000 Cash in bank – dollar deposit $ 100,000 (unrestricted) Cash in bank (restricted) – dollar deposit Cash in money-market account 6-month time deposit 20,000 P 250,000 $ 60,000 Treasury bill, purchased 12/1/20x1, maturing 2/28/20x2 Treasury note Unused credit line Redeemable preference shares, purchased 12/1/20x1, due on 3/1/20x2 Treasury shares, purchased 12/15/20x1, to be reissued on 3/5/20x2 Sinking fund P 800,000 200,000 2,000,000 370,000 50,000 200,000 Additional information: a) Cash on hand includes a P20,000 check payable to ABC Co.dated January 10, 20x2. b) During December 20x1, checks amounting to P60,000 and P40,000 were drawn against the Cash in bank – current account in payment of accounts payable. The P60,000 check is dated January 15, 20x2.The P40,000 check is dated December 31, 20x1, but was delivered to the payee only on January 18, 20x2. c) The cash in bank-peso savings deposit includes a deposit in escrow in the amount of P340,000 and a compensating balance amounting to P250,000 which is legally restricted. d) The cash in bank – dollar deposit (unrestricted) account includes interest of $2,000, net of tax, directly credited to ABC Co.’s account. Year-end exchange rate is $1 to P40. Question: What is the total cash and cash equivalent? Solution: Cash on hand (100,000 – 200,000 PDC) 80,000 Cash in bank – current account (350,000 + 60,000 PDC + 40,000 UC) 450,000 Cash in bank – peso savings deposit (2,000,000 – 340,000 deposit in escrow – 250,000 1,410,000 restricted compensating balance) Cash in bank – dollar deposit (100,000 x P40) 4,000,000 Cash in money-market account 250,000 Treasury bill, purchased 12/1/20x1, maturing 2/28/20x2 800,000 Redeemable preference shares, purchased 12/1/20x1, due on 3/1/20x2 370,000 Total 7,360,000 Illustration 2 – Bank overdraft The cash balance of ABC Co. comprises the following: Cash on hand 100,000 Cash in bank – Savings – BPI 200,000 Cash in bank – current – BPI (80,000) Cash in bank – deposit in escrow – Metrobank 100,000 Cash in bank – current – Metrobank (20,000) Cash in bank – current – BDO (30,000) Total 270,000 Additional information: • Cash on hand includes undeposited collections of P20,000. • The cash in bank – savings maintained at BPI includes a P50,000 compensating balance which is not restricted. Required: Compute for cash to be reported in the financial statements. Solution: Cash on hand Cash in bank – Savings – BPI Cash in bank – current – BPI Total 100,000 200,000 (80,000) 220,000 Simplified Notes in Intermediate Accounting 1 | 2023 5 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department IMPREST SYSTEM A system of control of cash which requires that all cash receipts should be deposited intact and all cash disbursements should be made by means of check. However, it is sometimes impossible to issue check for all payments especially for small amounts. Petty cash fund ▪ Money set aside to pay small expenses which cannot be paid conveniently by means of check ▪ Journal entries - Imprest fund system a Check drawn to establish the fund Petty cash fund b Payment of expenses out of the fund Cash in bank No journal entry however the petty cashier prepares memorandum entries in the pettycash journal. c Replenishment of petty cash payments ▪ Whenever the petty cash fund runs Expenses xx low, a check is drawn to replenish the xx Cash in bank fund. Thereplenishment check is usually equal to the petty cash disbursements. Petty cash disbursements should be replenished only by means of check and not fromundeposited receipts Expense xx Adjust unreplenished expenses to state the correct petty cash balance. Petty cash fund xx ▪ The adjustment is to be reversed at the beginning of the next accounting period in order that the normal replenishment procedures may be followed by simply debiting expenses and crediting cash in bank whether the expenses pertain to the current period or prior period. d e xx Petty cash fund Increase in fund xx Cash in bank f xx Cash in bank Decrease in fund xx xx Petty cash fund xx Illustration 2.1. Imprest Fund System 2019 Nov 10 Nov 29 The entity established an imprest fund of P10,000. JE: Petty cash fund 10,000 Cash in bank Replenished the fund. The petty cash items include the following: Currency and coins 2,000 Supplies 5,000 Telephone 1,800 Postage 1,200 JE: Dec. 31 Supplies Telephone Postage 10,000 5,000 1,800 1,200 Cash in bank 8,000 The fund was not replenished. The fund was composed of the following: Currency and coins 7,000 Supplies 1,500 Postage 500 Miscellaneous expense 1,000 JE: Supplies Postage Miscellaneous expense Petty cash fund Simplified Notes in Intermediate Accounting 1 | 2023 1,500 500 1,000 3,000 6 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department 2020 January 1 February 1 The adjustment made on December 31, 2019 was reversed. JE: Petty cash fund 3,000 Supplies 1,500 Postage 500 Miscellaneous expense 1,000 The fund was replenished and increased to P15,000. The composition of thefund are as follows: Currency and coins 1,000 Supplies 4,500 Postage 3,000 Miscellaneous expense 1,500 Total 10,000 JE: Petty cash fund Supplies Postage Miscellaneous expense Cash in bank 5,000 4,500 3,000 1,500 14,000 Review Questions Recall the lesson and try to answer the following review questions: 1. Differentiate cash from cash equivalents. 2. What are examples of cash items? 3. What are examples of cash equivalents? 4. What is the purpose of a petty cash fund? Exercises Instruction: Try to answer the following problems on your own. PROBLEM 1.1 On December 31, 2020, Albania Company provided the following data: Cash in bank 3,000,000 Time deposit – 30 days 1,000,000 Money market placement due on June 30, 2021 2,000,000 Saving deposit in closed bank 100,000 Sinking fund for bond payable due June 30, 2022 1,500,000 Petty cash fund 20,000 ▪ The cash in bank included customer check of P200,000 outstanding for 18 months. ▪ Check of P250,000 in payment of accounts payable was dated and recorded on December 31, 2020, but mailed to creditors on January 15, 2021. ▪ Check of P100,000 dated January 31, 2021 in payment of accounts payable was recorded and mailed December 31, 2020. ▪ The reporting period is the calendar year. The cash receipts journal was held open until January 15, 2021 during which time an amount of P450,000 was collected and recorded on December 31, 2020. Required: 1) Prepare adjusting entries on December 31, 2020. 2) Compute the total amount of cash and cash equivalents that should be reported on December 31, 2020. 3) Explain the presentation of the items excluded from cash and cash equivalents. Simplified Notes in Intermediate Accounting 1 | 2023 7 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department PROBLEM 1.2 Argentina Company reported the following accounts on December 31, 2020: Cash on hand Petty cash fund Security bank – current account PNB current account BDO current account (overdraft) BSP Treasury bill – 120 days BPI time deposit – 90 days Bond sinking fund ▪ ▪ ▪ ▪ 1,000,000 50,000 2,000,000 1,500,000 (200,000) 3,000,000 2,000,000 2,500,000 The cash on hand included a customer post-dated check of P150,000 and postal money order of P50,000. The petty cash fund included unreplenished petty cash vouchers for P10,000 and an employee check for P5,000 dated January 31, 2021. The BPI time deposit is set aside for acquisition of land to be made in early January 2021. The bond sinking fund is set aside for payment of bond payable due December 31, 2021. Required: 1. Prepare the adjusting entries on December 31, 2020. 2. Compute the total amount of cash and cash equivalents. 3. Explain the presentation of the items excluded from cash and cash equivalents. Problem 1.3 Armenia Company reported the following information on December 31, 2020: Cash on hand 1,000,000 Petty cash fund 50,000 Cash in bank 4,000,000 Savings deposit 2,000,000 ▪ Cash on hand included the following: a. Customer check of P100,000 returned by bank December 26, 2020 due to insufficient fund but subsequently redeposited and cleared by bank January 5, 2021. b. Customer check for P150,000 dated January 15, 2021 received December 22, 2020. c. Postal money orders received from customers, P200,000. ▪ The petty cash fund consisted of the following items: Currency and coins 2,000 Employees’ IOUs 10,000 Currency in envelope marked collections for Christmas 5,000 party Check drawn by Armenia payable to petty cashier 33,000 ▪ Check written and dated December 22, 2020 and delivered to payee on January 5, 2021, P200,000. ▪ Check written December 26, 2020 and dated January 31, 2021, delivered to payee on December 26, 2020, P300,000. Required: 1. Prepare adjusting entries on December 31, 2020. 2. Compute the total cash on December 31, 2020. Simplified Notes in Intermediate Accounting 1 | 2023 8 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department Problem 1.4 Callous Company reported the following accounts on December 31, 2020: Cash on hand 200,000 Petty cash fund 20,000 Philippine Bank – current account 5,000,000 City Bank – current account no. 1 4,000,000 City bank – current account no. 2 (overdraft) (100,000) Asian Bank Saving account 250,000 Asian Bank time deposit, 90 days 2,000,000 ▪ Cash on hand included the following items: Customer check for P35,000 returned by bank December 26, 2020 due to insufficient fund but subsequently redeposited and cleared by the bank on January 10, 2021. Customer check for P15,000 dated January 10, 2021, received December 23, 2020. ▪ The petty cash fund consisted of the following items: Currency and coins 5,000 IOUs from officers 2,000 Unreplenished petty cash vouchers 12,000 ▪ Included among the checks drawn by Callous Company against the Philippine Bank current account and recorded in December 2020 were the following: ▪ Check written an dated December 23, 2020 and delivered to payee on January 31, 2021, P25,000. ▪ Check written December 26, 2020, dated January 30, 2021, delivered to payee on December 28, 2020, P45,000. Required: 1. Compute the total cash and cash equivalents. 2. Prepare adjusting entries on December 31, 2020. Problem 1.5 Laborious Company closed the accounts on June 30. The entity provided the following transactions: May 2 29 June 30 July 15 The entity established an imprest fund of P10,000 The fund was replenished. The petty cash items include: Currency and coin 2,000 Postage 1,000 Supplies 3,000 Transportation 2,500 Miscellaneous expense 1,500 The fund was not replenished. The fund is composed of the following: Currency and coin 6,000 Supplies 2,000 Postage 1,000 Transportation 1,000 The fund is replenished and increased to P15,000. Currency and coin 3,000 Postage 3,500 Supplies 1,500 Transportation 1,500 Miscellaneous expense 500 Required: Prepare the journal entries to record the transactions under imprest fund system. Simplified Notes in Intermediate Accounting 1 | 2023 9 Mater Dei College | Tubigon, Bohol | (038)508-8106 College of Accountancy, Business and Management - Business Department Problem 1.6 Tacit Company provided the following transactions; 2020 Nov Dec 2021 Jan 2 30 31 2 31 The entity established an imprest petty cash fund of P10,000. An examination of the cash fund disclosed Currency and coin 3,000 Memoranda showing expenditures for: Postage 2,000 Supplies 5,000 A check written drawn to replenish the fund and to increase its amount to P20,000. The fund was not replenished. Currency and coin 11,000 Memoranda showing expenditures for: Postage 3,000 Supplies 4,000 Deposit for 20 cases of softdrinks 2,000 The deposit for the 20 cases of softdrinks is collected. A check was drawn to replenish the fund. Currency and coin Postage stamps Memoranda showing expenditures since November 30, 2020 for: Postage Supplies Payment of account 1,000 500 5,000 6,000 7,000 Required: Prepare journal entries to record the transactions. Simplified Notes in Intermediate Accounting 1 | 2023 10