Prechter R. - The Elliot Wave Theorist (July 30, 2002) (2002)

advertisement

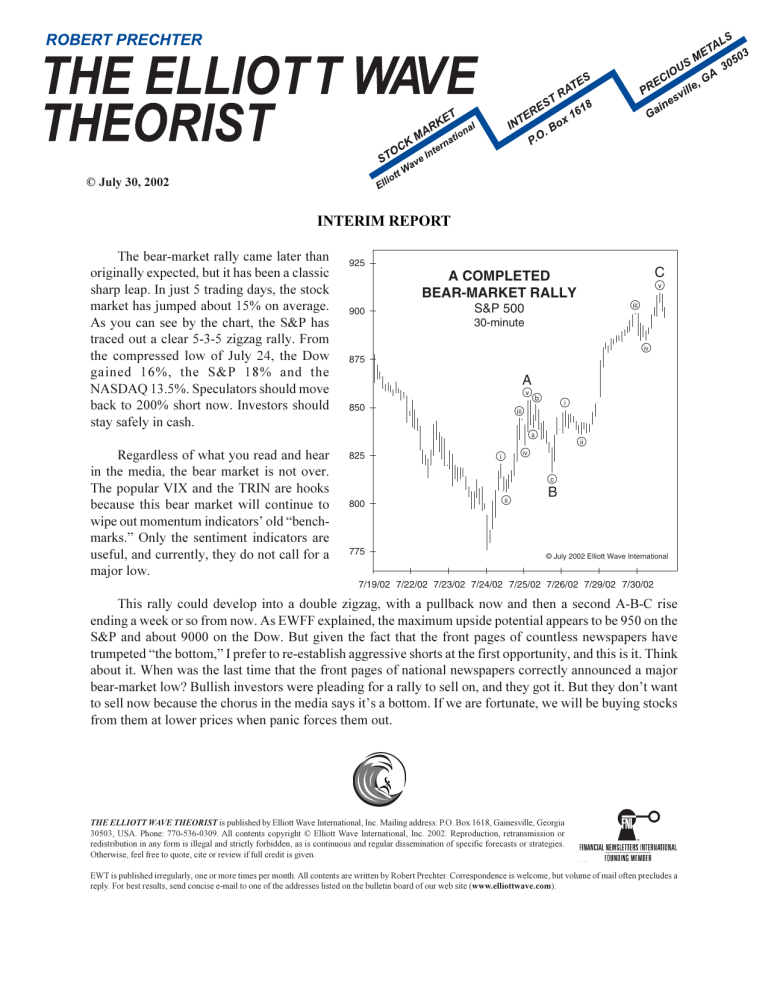

© July 30, 2002 INTERIM REPORT The bear-market rally came later than originally expected, but it has been a classic sharp leap. In just 5 trading days, the stock market has jumped about 15% on average. As you can see by the chart, the S&P has traced out a clear 5-3-5 zigzag rally. From the compressed low of July 24, the Dow gained 16%, the S&P 18% and the NASDAQ 13.5%. Speculators should move back to 200% short now. Investors should stay safely in cash. Regardless of what you read and hear in the media, the bear market is not over. The popular VIX and the TRIN are hooks because this bear market will continue to wipe out momentum indicators old benchmarks. Only the sentiment indicators are useful, and currently, they do not call for a major low. 925 900 A COMPLETED BEAR-MARKET RALLY S&P 500 C 0 8 30-minute 9 875 A 850 0b 8 825 9 6 a 6 7 c 800 775 7 B © July 2002 Elliott Wave International 7/19/02 7/22/02 7/23/02 7/24/02 7/25/02 7/26/02 7/29/02 7/30/02 This rally could develop into a double zigzag, with a pullback now and then a second A-B-C rise ending a week or so from now. As EWFF explained, the maximum upside potential appears to be 950 on the S&P and about 9000 on the Dow. But given the fact that the front pages of countless newspapers have trumpeted the bottom, I prefer to re-establish aggressive shorts at the first opportunity, and this is it. Think about it. When was the last time that the front pages of national newspapers correctly announced a major bear-market low? Bullish investors were pleading for a rally to sell on, and they got it. But they dont want to sell now because the chorus in the media says its a bottom. If we are fortunate, we will be buying stocks from them at lower prices when panic forces them out. THE ELLIOTT WAVE THEORIST is published by Elliott Wave International, Inc. Mailing address: P.O. Box 1618, Gainesville, Georgia 30503, USA. Phone: 770-536-0309. All contents copyright © Elliott Wave International, Inc. 2002. Reproduction, retransmission or redistribution in any form is illegal and strictly forbidden, as is continuous and regular dissemination of specific forecasts or strategies. Otherwise, feel free to quote, cite or review if full credit is given. EWT is published irregularly, one or more times per month. All contents are written by Robert Prechter. Correspondence is welcome, but volume of mail often precludes a reply. For best results, send concise e-mail to one of the addresses listed on the bulletin board of our web site (www.elliottwave.com).