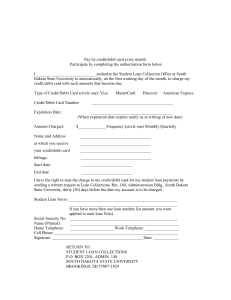

Name: Date: FINANCIAL LITERACY: QUIZ 3 1. What is the key difference between a credit card and a debit card? a. Credit cards allow you to borrow money to pay for things, while debit cards take money straight from your own checking account b. Wealthy people use credit cards, while people with lower incomes use debit cards c. Credit cards come from credit unions, while debit cards come from banks d. You can only use credit cards if you are over 25, but you can use debit cards as long as you are over 18 2. Craig isn't sure if he should open up a credit card account or get a bank loan. What question is MOST useful in helping him decide which financial product he should get? a. b. c. d. Are you responsible with your money? Are you trying to make a bunch of small purchases over time or one large purchase? Are you using the money to purchase an item that is a need or a want? How much money do you have in your bank account? 3. Kevin really wants to buy a new bike because his old one is too small now. He's trying to decide if he should use his debit card or credit card. What's one reason he should be careful about using credit? a. b. c. d. Credit will take the money straight from his checking account, lowering his bank balance Credit will force him to pay taxes on his bike purchase Credit will charge him interest every month until he repays his full balance Credit will force him to buy a cheaper bike than he could with debit 4. Which statement about credit card interest rates is TRUE? a. b. c. d. The more money you spend on purchases, the higher your interest rate will be A high interest rate means you'll pay MORE money total A high interest rate means you'll pay LESS money total Most credit cards do not charge any interest rate 5. Which age group tends to have the most credit card debt? a. Young adults 1 b. Middle-aged people c. Senior citizens d. Credit card debt is evenly distributed among all age groups 6. What is the best way to avoid going into large debt on your credit card? a. b. c. d. Avoid paying the bill every month so your bank account stays high Pay the minimum monthly payment on time every month Pay half your balance every month Pay your full balance every month Here's a Credit Card Statement. Use it to answer the next three questions. 7. Using this portion of a credit card statement, how much did the credit card owner pay toward their bill last month? a. b. c. d. $167.49 $267.49 $400 $2,425 2 8. According to this portion of a credit card statement, how much did the cardholder pay in total interest this billing cycle? a. b. c. d. $1.60 $31.50 $33.10 $2,458.10 9. What is the minimum amount this cardholder must pay on this month's statement? a. b. c. d. $167.49 $400 $2,590.61 You can't tell from this portion of the statement 10. Each of the following factors impacts your credit score EXCEPT... a. b. c. d. Payment history Bank account balance Mix of credit types Length of credit history 11. Katherine has been using her credit card very responsibly in hopes of raising her credit score. Which score would indicate that Katherine now has a prime score? a. b. c. d. 350 550 750 950 12. Miguel's parents keep telling him he should worry about his credit score. He says, "Why bother?" Why should Miguel care? a. A high credit score will make it easier for him to get loans or credit cards with better interest rates b. A low credit score will make it easier for him to get loans or credit cards with better interest rates c. If his credit score is positive, lenders will allow him to pay back only a portion of his loan instead of the whole balance d. Miguel will not be able to apply for colleges if he doesn't have a strong credit score 3 13. When discussing a loan, such as a college loan or auto loan, what does the word "principal" mean? a. b. c. d. The total amount you borrowed The amount of interest you pay over the whole length of the loan The total amount of money you owe The total number of months you will have to repay the loan 14. What is considered a low credit score? a. b. c. d. 350 - 500 501 - 720 720-800 None of the above 15. True or False: A credit card is an example of an unsecured loan. a. True b. False Part 2: Extra Credit 1. What is a bad credit score range (low)? What is a good credit score range (prime)? 2. What is the biggest factor in your credit score? 3. What animal was used in the credit score video we watched? What was it’s name? 4