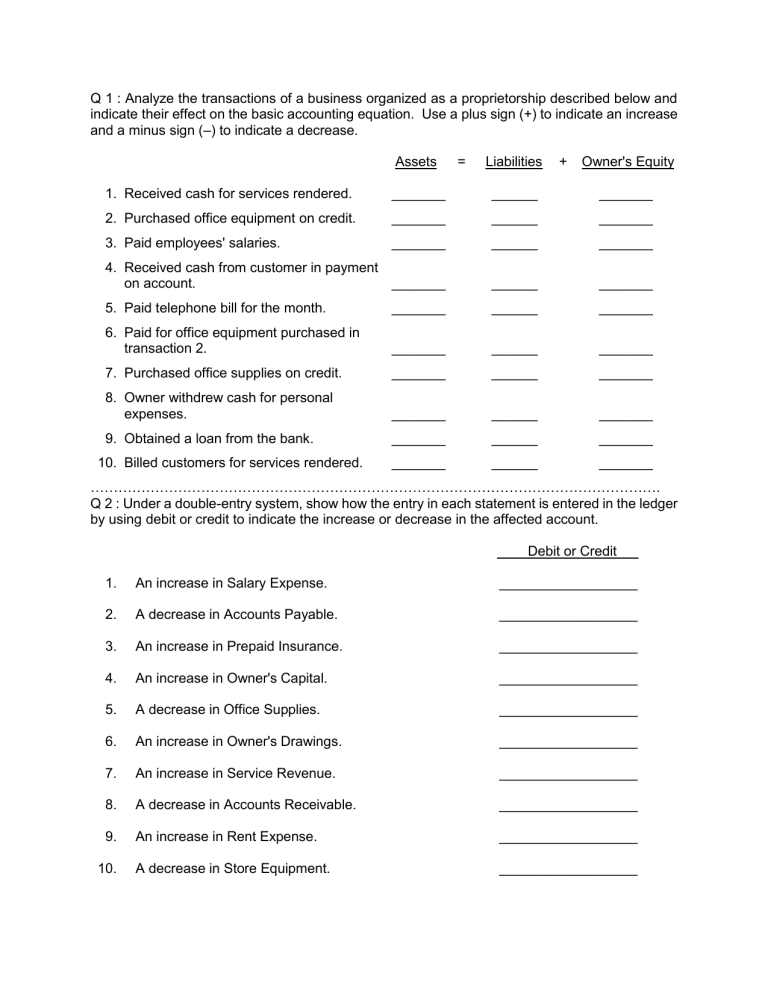

Q 1 : Analyze the transactions of a business organized as a proprietorship described below and indicate their effect on the basic accounting equation. Use a plus sign (+) to indicate an increase and a minus sign (–) to indicate a decrease. Assets = Liabilities + Owner's Equity 1. Received cash for services rendered. _______ ______ _______ 2. Purchased office equipment on credit. _______ ______ _______ 3. Paid employees' salaries. _______ ______ _______ 4. Received cash from customer in payment on account. _______ ______ _______ 5. Paid telephone bill for the month. _______ ______ _______ 6. Paid for office equipment purchased in transaction 2. _______ ______ _______ 7. Purchased office supplies on credit. _______ ______ _______ 8. Owner withdrew cash for personal expenses. _______ ______ _______ 9. Obtained a loan from the bank. _______ ______ _______ _______ ______ _______ 10. Billed customers for services rendered. ……………………………………………………………………………………………………………. Q 2 : Under a double-entry system, show how the entry in each statement is entered in the ledger by using debit or credit to indicate the increase or decrease in the affected account. Debit or Credit 1. An increase in Salary Expense. __________________ 2. A decrease in Accounts Payable. __________________ 3. An increase in Prepaid Insurance. __________________ 4. An increase in Owner's Capital. __________________ 5. A decrease in Office Supplies. __________________ 6. An increase in Owner's Drawings. __________________ 7. An increase in Service Revenue. __________________ 8. A decrease in Accounts Receivable. __________________ 9. An increase in Rent Expense. __________________ A decrease in Store Equipment. __________________ 10. Q 3 : Transactions for Zaid Company for the month of October are presented below. Journalize each transaction and identify each transaction by number. 1. Invested an additional $40,000 cash in the business. 2. Purchased land costing $28,000 for cash. 3. Purchased equipment costing $12,000 for $4,000 cash and the remainder on credit. 4. Purchased supplies on account for $800. 5. Paid $1,000 for a one-year insurance policy. 6. Received $3,000 cash for services performed. 7. Received $4,000 for services previously performed on account. 8. Paid wages to employees for $2,500. 9. Zaid withdrew $1,000 cash from the business. ………………………………………………………………………………………………………………. . Q 4 : The ledger account balances for Zaid Company are listed below. Accounts Payable Accounts Receivable Cash Zaid, Capital Zaid, Drawing Repair Revenue Salaries Expense Unearned Revenue Utilities Expense $ 5,000 7,000 10,000 11,000 4,000 40,000 25,000 2,000 12,000 Instructions Prepare a trial balance in proper form for Zaid at December 31, 2005. …………………………………………………………………………………………………………… Q 5: On July 1, 2005, Zaid Company pays $6,000 to its insurance company for a 2-year insurance policy. On July 2, 2005, Zaid Insurance Company received $12,000 from a client for a 2-year insurance policy. Instructions Prepare the necessary journal entries for Zaid on July and December 31 …………………………………………………………………………………………………………….. Q 6: Prepare the necessary adjusting entry for each of the following: 1. Services provided but unrecorded totaled $700. 2. Accrued salaries at year-end are $1,000. 3. Depreciation for the year is $600. …………………………………………………………………………………………………………… Q 7 : Prepare the necessary closing entries based on the following selected accounts. Accumulated Depreciation $10,000 Depreciation Expense 5,000 Jones, Capital 20,000 Jones, Drawing 12,000 Salaries Expense 15,000 Service Revenue 30,000 …………………………………………………………………………………………………………. Q 8 : As Zaid was doing his year-end accounting, he noticed that the bookkeeper had made errors in recording several transactions. The erroneous transactions are as follows: (a) A check for $700 was issued for goods previously purchased on account. The bookkeeper debited Accounts Receivable and credited Cash for $700. (b) A check for $680 was received as payment on account. The bookkeeper debited Accounts Payable for $860 and credited Accounts Receivable for $860. (c) When making the entry to record the year's depreciation expense, the bookkeeper debited Accumulated Depreciation for $1,500 and credited Cash for $1,500. When accruing interest on a note payable, the bookkeeper debited Interest Receivable for $200 and credited Interest Payable for $200. (d) Instructions Prepare the appropriate correcting entries. (Do not reverse the original entries.)