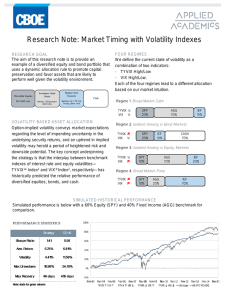

Alpha Generation and Long Volatility Strategies in Inflationary Regimes Wednesday, November 30, 2022, 12:00 Noon ET Cem Karsan Nishank Modi Matt Moran Founder and Senior Managing Partner Senior Director – Cboe Labs Head of Index Insights KAI Volatility Advisors Cboe Global Markets Cboe Options Institute Webinar #45 in the Cboe Options Insights Webinar Series www.cboe.com/insights/webinars Please read the important disclosures on pages 2 through 5. © 2022 Cboe Exchange, Inc. All Rights Reserved. 1 Important Disclosures General ▪ The information provided is for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice. ▪ In particular, the inclusion of a security or other instrument within an index is not a recommendation to buy, sell, or hold that security or any other instrument, nor should it be considered investment advice. ▪ Other than the references below to options on futures, references below to options are to securities options, such as options on the stocks of individual corporations, options on securities indices, and options on exchange-traded products, such as exchange-traded funds and exchange-traded notes." Options ▪ Options involve risk and are not suitable for all market participants. Prior to buying or selling an option, you should discuss with your broker whether trading options is right for you and should review the Characteristics and Risks of Standardized Options (ODD), which is required to be provided to all such persons. Copies of the ODD are available from your broker or from The Options Clearing Corporation, 125 S. Franklin Street, Suite 1200, Chicago, IL 60606. ▪ Trading FLEX options may not be suitable for all options-qualified market participants. FLEX options strategies only should be considered by those with extensive prior options trading experience. ▪ Uncovered option writing is suitable only for the knowledgeable market participant who understands the risks, has the financial capacity and willingness to incur potentially substantial losses, and has sufficient liquid assets to meet applicable margin requirements. In this regard, if the value of the underlying instrument moves against an uncovered writer's options position, the writer may incur large losses in that options position and the participant’s broker may require significant additional margin payments. If a market participant does not make those margin payments, the broker may liquidate positions in the market participant’s account with little or no prior notice in accordance with the market participant’s margin agreement. Futures ▪ Futures trading is not suitable for all market participants and involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a futures position. You should, therefore, carefully consider whether futures trading is suitable for you in light of your circumstances and financial resources. You should put at risk only funds that you can afford to lose without affecting your lifestyle. ▪ For additional information regarding the risks associated with trading futures and security futures, see respectively the Risk Disclosure Statement set forth in Appendix A to CFTC Regulation 1.55(c) and the Risk Disclosure Statement for Security Futures Contracts. Before engaging in any transactions in Cboe Company products, it is important for market participants to carefully review the disclosures and disclaimers contained at https://www.cboe.com/options_futures_disclaimers. 2 Important Disclosures VIX® Index and VIX® Index Products ▪ The Cboe Volatility Index® (known as the VIX Index) is calculated and administered by Cboe Global Indices, LLC. The VIX Index is a financial benchmark designed to be a market estimate of expected volatility of the S&P 500® Index, and is calculated using the midpoint of quotes of certain S&P 500 Index options as further described in the methodology, rules and other information here. ▪ VIX futures and Mini VIX futures, traded on Cboe Futures Exchange, LLC, and VIX options, traded on Cboe Options Exchange, Inc. (collectively, “VIX® Index Products”), are based on the VIX Index. VIX Index Products are complicated financial products only suitable for sophisticated market participants. ▪ Transacting in VIX Index Products involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a VIX Index Product position (except when buying options on VIX Index Products, in which case the potential loss is limited to the purchase price of the options). ▪ Market participants should put at risk only funds that they can afford to lose without affecting their lifestyles. ▪ Before transacting in VIX Index Products, market participants should fully inform themselves about the VIX Index and the characteristics and risks of VIX Index Products, including those described here. Market participants also should make sure they understand the product specifications for VIX Index Products (VIX futures, Mini VIX futures and VIX options) and the methodologies for calculating the underlying VIX Index and the settlement values for VIX Index Products. Answers to questions frequently asked about VIX Index products and how they are settled is available here. ▪ Not Buy and Hold Investment: VIX Index Products are not suitable to buy and hold because: ▪ On their settlement date, VIX Index Products convert into a right to receive or an obligation to pay cash. ▪ The VIX Index generally tends to revert to or near its long-term average, rather than increase or decrease over the long term. ▪ Volatility: The VIX Index is subject to greater percentage swings in a short period of time than is typical for stocks or stock indices, including the S&P 500 Index. ▪ Expected Relationships: Expected relationships with other financial indicators or financial products may not hold. In particular: ▪ Although the VIX Index generally tends to be negatively correlated with the S&P 500 Index – such that one tends to move upward when the other moves downward and vice versa – that relationship is not always maintained. ▪ The prices for the nearest expiration of a VIX Index Product generally tend to move in relationship with movements in the VIX Index. However, this relationship may be undercut, depending on, for example, the amount of time to expiration for the VIX Index Product and on supply and demand in the market for that product. ▪ Mini VIX futures contracts trade separately from regular-sized VIX futures, so the prices and quotations for Mini VIX futures and regular-sized VIX futures may differ because of, for example, possible differences in the liquidity of those markets. ▪ Final settlement Value: The method for calculating the final settlement value of a VIX Index Product is different from the method for calculating the VIX Index at times other than settlement, so there can be a divergence between the final settlement value of a VIX Index Product and the VIX Index value immediately before or after settlement. (See the SOQ Auction Information section here for additional information.) 3 Important Disclosures Exchange Traded Products (“ETPs”) ▪ Cboe does not endorse or sell any ETP or other financial product, including those investment products that are or may be based on a Cboe index or methodology or on a non-Cboe index that is based on investment products trading on a Cboe Company exchange (e.g., VIX futures); and Cboe makes no representations regarding the advisability of investing in such products. An investor should consider the investment objectives, risks, charges, and expenses of these products carefully before investing. Investors also should carefully review the information provided in the prospectuses for these products. ▪ Investments in ETPs involve risk, including the possible loss of principal, and are not appropriate for all investors. Non-traditional ETPs, including leveraged and inverse ETPs, pose additional risks and can result in magnified gains or losses in an investment. Specific risks relating to investment in an ETP are outlined in the fund prospectus and may include concentration risk, correlation risk, counterparty risk, credit risk, market risk, interest rate risk, volatility risk, tracking error risk, among others. Investors should consult with their tax advisors to determine how the profit and loss on any particular investment strategy will be taxed. Cboe Strategy Benchmark Indices ▪ Cboe Strategy Benchmark Indices are calculated and administered by Cboe Global Indices, LLC as described in the methodologies, rules and other information available here using information believed to be reliable, including market data from exchanges owned and operated by other Cboe Companies. ▪ Strategy Benchmark Indices are designed to measure the performance of hypothetical portfolios comprised of one or more derivative instruments and other assets used as collateral. Past performance is not indicative of future results. Strategy Benchmark Indices are not financial products that can be invested in directly, but can be used as the basis for financial products or managing portfolios. ▪ The actual performance of financial products such as mutual funds or managed accounts can differ significantly from the performance of the underlying index due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the subject index. Index and Benchmark Values Prior to Launch Date ▪ Index and benchmark values for the period prior to an index’s launch date are calculated by a theoretical approach involving back-testing historical data in accordance with the methodology in place on the launch date (unless otherwise stated). A limitation of back-testing is that it reflects the theoretical application of the index or benchmark methodology and selection of the index’s constituents in hindsight. Back-testing may not result in performance commensurate with prospective application of a methodology, especially during periods of high economic stress in which adjustments might be made. No back-tested approach can completely account for the impact of decisions that might have been made if calculations were made at the same time as the underlying market conditions occurred. There are numerous factors related to markets that cannot be, and have not been, accounted for in the preparation of back-tested index and benchmark information. 4 Important Disclosures Taxes ▪ No Cboe Company is an investment adviser or tax advisor, and no representation is made regarding the advisability or tax consequences of investing in, holding or selling any financial product. A decision to invest in, hold or sell any financial product should not be made in reliance on any of the statements or information provided. Market participants are advised to make an investment in, hold or sell any financial product only after carefully considering the associated risks and tax consequences, including information detailed in any offering memorandum or similar document prepared by or on behalf of the issuer of the financial product, with the advice of a qualified professional investment adviser and tax advisor. ▪ Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options and futures are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the market participants involved and the strategy employed satisfy the criteria of the Tax Code. Market participants should consult with their tax advisors to determine how the profit and loss on any particular option or futures strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations. ▪ The inclusion of research should not be construed as an endorsement or indication of the value of that research." General ▪ Past performance of an index or financial product is not indicative of future results. ▪ Brokerage firms may require customers to post higher margins than any minimum margins specified. ▪ No data, values or other content contained in this document (including without limitation, index values or information, ratings, credit-related analyses and data, research, valuations, strategies, methodologies and models) or any part thereof may be modified, reverse-engineered, reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of Cboe. ▪ Cboe does not guarantee the accuracy, completeness, or timeliness of the information provided. THE CONTENT IS PROVIDED “AS IS” WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY WITH RESPECT MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. ▪ Hypothetical scenarios are provided for illustrative purposes only. The actual performance of financial products can differ significantly from the performance of a hypothetical scenario due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences and other considerations that may not be applicable to the hypothetical scenario. ▪ Supporting documentation for statements, comparisons, statistics or other technical data provided is available by contacting Cboe Global Markets at www.cboe.com/Contact. ▪ The views of any third-party speakers or third-party materials are their own and do not necessarily represent the views of any Cboe Company. That content should not be construed as an endorsement or an indication by Cboe of the value of any non-Cboe financial product or service described. Trademarks and Intellectual Property ▪ Cboe®, Cboe Global Markets®, Bats®, BIDS Trading®, BYX®, BZX®, Cboe Options Institute®, Cboe Vest®, Cboe Volatility Index®, CFE®, EDGA®, EDGX®, Hybrid®, LiveVol®, Silexx® and VIX® are registered trademarks, and Cboe Futures ExchangeSM, C2SM, f(t)optionsSM, HanweckSM, and Trade AlertSM are service marks of Cboe Global Markets, Inc. and its subsidiaries. Standard & Poor's®, S&P®, S&P 100®, S&P 500® and SPX® are registered trademarks of Standard & Poor's Financial Services LLC and have been licensed for use by Cboe Exchange, Inc. Dow Jones®, Dow Jones Industrial Average®, DJIA® and Dow Jones Global Indexes® are registered trademarks or service marks of Dow Jones Trademark Holdings, LLC, used under license. Russell, Russell 1000®, Russell 2000®, Russell 3000® and Russell MidCap® names are registered trademarks of Frank Russell Company, used under license. FTSE® and the FTSE indices are trademarks and service marks of FTSE International Limited, used under license. MSCI and the MSCI index names are service marks of MSCI Inc. (“MSCI”) or its affiliates and have been licensed for use by Cboe. All other trademarks and service marks are the property of their respective owners. Copyright © 2022 Cboe Exchange, Inc. All Rights Reserved. 5 Interactive Features Technical Issues Webinar Interface Webinar interface is interactive and customizable. Click and hold on a box to drag it around to another position If you experience any technical difficulties, please try refreshing your browser, as that clears up many local network issues. If your issue persists, you can send your issue to our webcast tech visa the Q icon. Questions Handouts Questions and Comments Ask a question or submit a comment at any time by typing it in the Q&A box, which is located under the Slides box on your interface. Handouts Click on the Handouts icon for links to key literature. Replays and Slide Decks Replays and slide decks are NOT publicly available now for some Cboe webinars. Visit www.cboe.com/insights/webinars for webinar replays and upcoming webinars 6 Topics for Today’s Webinar ❖ ❖ ❖ Active Options Strategies that Seek Alpha Generation and Provide Convex Protection as Volatility and Skew Have Explosive Upside Moves Offering Diversification Potential and Negative Beta with Options Strategies Exploring Hedging Strategies with Cboe’s PPUTSM, PPUT3MSM, VXTHSM, and CLLSM Indices 7 S&P 500 Options Volume and Inflation in Recent Months Growth in Volume for S&P 500 Options Since March 2021 (when U.S. CPI was at 2.7%) Growth in Volume in 2022 for S&P 500 Options with ShortDated Expirations 8 Key Options Greeks Risk Variables Market risk variables are measured through option Greeks Delta (Δ) Gamma (Γ) Theta (Θ) Vega (v) Rho (ρ) • The change in the price of an option for a $1 change in the price of the underlier • The change in delta for a $1 change in the price of the underlier • The change in the price of an option given a one day decrease in time to expiration • The change in the option price for a 1-point change in volatility • The change in the price of an option given a 1 percentage point change in the risk-free rate Vanna • Measures the sensitivity of the option delta with respect to change in volatility Charm • Measures the instantaneous rate of change of delta over the passage of time 9 Key Options Greeks Spot Price Volatility Time to Expiration First Order (Value) Delta Δ Vega V Theta Θ Second Order (Delta) Gamma Γ Vanna Charm Interest Rates Rho ρ 10 Thetas for S&P 500 Puts on Oct. 23, 2021 Theta – • • • Measures the sensitivity of an option’s value to the passage of time, Usually is expressed as the change in value per one day’s passage of time Usually is negative for both calls and puts There is more time decay for the options with nearterm expirations 11 Deltas for S&P 500 Puts on Oct. 23, 2021 Delta • Measures the rate of change of the theoretical option value with respect to changes in the underlying asset's price • Is positive for both calls and puts Source: Cboe Global Markets 12 Gammas for S&P 500 Puts on Oct. 23, 2021 Gammas measure the rate of change in an option’s delta with respect to movement in the price of the underlying contract, and generally are: • Positive long calls and long puts • Higher for short-dated at-the-money options 13 Four of Cboe’s Options-Buying Benchmark Indices Ticker Index Description CLL CLLSM - Cboe S&P 500 95-110 Collar Index - tracks the performance of a strategy that purchases stocks in the S&P 500 Index, and each month sells SPX call options at 110% of the index value, and each quarter purchases SPX put options at 95% of the index value PPUT PPUTSM - Cboe S&P 500 5% Put Protection Index - tracks the performance of a hypothetical strategy that holds a long position indexed to the S&P 500 Index, and buys a monthly 5% out-of-the-money (OTM) S&P 500 Index (SPX) put option as a hedge PPUT3M PPUT3MSM - The Cboe S&P 500 Tail Risk Index (PPUT3M) is a benchmark index designed to track the performance of a hypothetical risk-management strategy that consists of (a) holding the S&P 500 portfolio and collecting dividends and (b) buying 10% out-of-the-money SPX puts that expire on the quarterly cycle, i.e. March, June, September and December VXTH VXTHSM - Cboe VIX Tail Hedge Index tracks the performance of a hypothetical portfolio that – (1) Buys and holds the performance of the S&P 500® index (the total return index, with dividends reinvested), and (2) Buys one-month 30-delta call options on the Cboe Volatility Index® (VIX Index)®. VIX calls are purchased monthly, a procedure known as the "roll." The weight of the VIX calls in the portfolio varies at each roll and depends on the forward value of the VIX Index, an indicator for the perceived probability of a "swan event" 14 Four of Cboe’s Options-Buying Indices Annual Returns for 7 Indices (2008 - Oct. 2022) 2014 2015 2016 2017 2018 2019 2020 2021 JanOct'22 15.8% 11.4% 11.2% 9.2% -5.5% -3.2% -5.1% -4.0% 1.0% 7.6% 8.3% 4.1% 21.8% 19.3% 18.6% 16.7% -8.4% 0.1% -4.1% 2.9% 18.7% 27.4% 25.3% 25.2% 113.8% 23.9% 29.1% 18.0% 13.8% 21.3% 18.3% 17.7% -24.6% -15.6% -18.2% -13.6% -37.0% 26.5% 15.1% 2.5% 15.5% 32.4% 13.7% 1.4% -53.3% 78.5% 18.9% -18.4% 18.2% -2.6% -2.2% -14.9% -46.5% 13.5% 9.0% -1.2% 0.1% -1.2% -33.1% -32.9% 12.0% 11.2% 11.4% 21.8% 37.3% 5.8% -5.2% -14.8% -13.7% 31.5% 18.4% 17.6% 18.4% 18.3% -23.7% 28.7% -2.5% 40.4% -17.7% S&P 500 Index -29.4% MSCI Emerging Markets Index (USD) 30.0% S&P GSCI 2008 81.8% -25.6% -20.1% -23.6% 2009 2010 2011 2012 2013 -43.6% -12.5% 28.5% -30.3% -21.1% 14.4% 7.8% -5.9% 9.9% 28.0% 8.7% 11.7% -1.4% 10.0% 27.1% 17.6% 4.1% -8.8% 6.8% 23.8% VXTH - Cboe VIX Tail Hedge Index PPUT3M - Cboe S&P 500 Tail Risk Index PPUT - Cboe S&P 500 5% Put Protection Index CLL - Cboe S&P 500 95-110 Collar Index Past performance is not predictive of future returns. Total return (pre-tax) indices. Source: Cboe Global Markets. The Cboe VIX Tail Hedge Index (VXTH) (which buys VIX® Index calls) rose by more than 80% in 2008 and 2020 15 Less Severe Downside Deviation Certain strategies that buy SPX puts or buy VIX calls may have the potential to help lower the downside deviation of some portfolios 16 Diversification Potential Strategies with lower betas to the S&P 500 may have potential to help diversify stock portfolios 17 Returns and Risk-Adjusted Returns 18 Alpha Generation & Long Vol Strategies In Inflationary Regimes The Long-term Outlook for Equities In An Inflationary Regime Is Poor Long-term Outlook for Equities in an Inflationary Regime is Poor The 40 Year Trend In Liquidity Interest rates declined secularly for 40+ years and then hit the lower bound. This trend was a major tailwind for equities. Its reversal is a secular headwind for equities… 21 Long-term Outlook for Equities in an Inflationary Regime is Poor Various Metrics Point to Historical Market Overvaluation The excess liquidity from historic central bank activism created a liquidity bubble with record equity valuations 22 Long-term Outlook for Equities in an Inflationary Regime is Poor Disappointing Equity Returns Ahead S&P 500 CAPE Ratio Pointing To Underperforming Returns over next 10 years ➢ Historically when the CAPE ratio has climbed above 22, S&P 500 returns over the ensuing decade were significantly below average (transparent red boxes in graph) ➢ The current CAPE value is approximately 38.36, > 3 standard deviations above the mean... “Median real returns were negative over the subsequent decade when CAPE values exceed 30” Source: US Treasury Office of Financial Research (OFR) Quicksilver Markets, by Ted Berg June 2021 38.36 ? ? Source: Robert Shiller data (http://www.econ.yale.edu/~shiller/data.htm ? ? 23 What Does This Mean For Equity Volatility In An Inflationary Regime? The Outlook For Passive Equity Exposure Is Poor A Tale of 2 Markets… 25 The Outlook For Passive Equity Exposure Is Poor SPX Realized Volatility: Inflationary vs. Non-Inflationary Period How Is Realized Volatility Different During Inflation? • Short-term Realized Volatility Somewhat Higher In Inflationary Periods • Long-term Realized Volatility Is Dramatically Lower In Inflationary Periods • Upside Realized Volatility Compression Is The Primary Driver of Long-term Volatility Compression 26 The Outlook For Passive Equity Exposure Is Poor SPX Realized Volatility: Inflationary vs. Non-Inflationary Period Inflationary (1971-1986) Non-Inflationary (1990-2019) 27 The Outlook For Passive Equity Exposure Is Poor SPX Realized Volatility: Inflationary vs. Non-Inflationary Period Difference: Inflationary (1971-1986) vs Non-Inflationary (1990-2019) 28 The Outlook For Passive Equity Exposure Is Poor SPX Realized Volatility: Inflationary vs. Non-Inflationary Period Why Is Realized Volatility Different During Inflation? THERE’S A CRITICAL PUSH AND PULL BETWEEN “FIRST ORDER” & “SECOND ORDER” EFFECTS OF INFLATION • “FIRST ORDER” EFFECTS CREATE VALUATION IMPROVEMENTS OF ASSETS IN NOMINAL TERMS • BUT “SECOND ORDER” EFFECTS TEND TO BE MORE IMPORTANT… DIRECTLY REDUCING LONG-TERM EQUITY DEMAND (DIMINISHING UPSIDE BIAS) 1. 2. 3. 4. 5. CONTRACTIONARY FED POLICY DRIVES LESS DEMAND FOR ASSETS REVERSE TINA EFFECT DRIVES LESS DEMAND FOR EQUITIES (MORE COMPETITIVE BOND YIELDS) MARGIN COMPRESSION EFFECTS OF HIGHER RATES HIGHER DISCOUNT RATE REDUCES VALUE OF FUTURE EARNINGS HIGHER RISK PREMIA DUE TO LESS LIQUIDITY… AND THEREFORE REMOVAL OF UPSIDE RV OVER LONGER TIME FRAMES 29 The Outlook For Passive Equity Exposure Is Poor The Return Of Active Long Volatility Management? Historically, when interest rates rally off their floor, expect multiple contraction and potentially a lost decade for equities, as we saw 1968-1982. Periods such as this represent an immense opportunity for active hedging and portfolio management 61.4% 62.3% -23.8% 69.1% -19.0% -32.9% -42.6% S&P 500 1968 - 1982 S&P 500 1968 - 1982 Inflation Adj Source: MacroTrends Although the S&P 500 was essentially flat over this 14 year period, there were 4 secular declines of greater than 19% and 3 secular rallies of greater than 60%, creating an ideal environment for active hedging and portfolio management. 30 Poor Hedging Alternatives Amidst a Liquidity Bubble Poor Hedging Alternatives Traditional Hedging Alternatives Are Historically Overvalued Bonds ● Yields near all time lows ● Bond sensitivity to interest rate, given current price sensitivity, is extremely high: A bond ETF like TLT is likely to lose over 90% of its value in a move back to the historical average of 6.5% in the 30 year Treasury Bond.* Gold ● Prices near historic highs ● Historically gold is an inconsistent hedge in stock market downturns: During many recessionary periods in the last 100 years gold has actually fallen in value * Based on current TLT price sensitivity of 18.42, inferring a 18.42% loss for every 1% change in interest rates as of April 5th, 2021 32 Poor Hedging Alternatives Long Volatility Alternatives Also Have Poor Long-term Returns & Require Alpha Naïve Put Strategy ➢ An investment of $1000 in a naïve put strategy in 2009 had lost approximately 95% of its value* ➢ A naïve put strategy had a backtested annualized return of -28% since 1992.* VIX/Long Vol ➢ An investment in the VXX exchange traded note has lost 99.99% of its value over the 10 year period since its inception, due to the high cost of trading in VIX futures contracts ➢ VXX has an annualized return of -55% since inception * As of December 2019 33 Two Unique Opportunities To Drive Alpha To Fund Long Volatility Strategies 1. The Volatility Arbitrage Opportunity The Volatility Arbitrage Opportunity Stock Option Volumes Have Exploded 36 The Volatility Arbitrage Opportunity The Volatility Arbitrage Opportunity The Opportunity: ○ Anyone who has a job, owns a home or participates in the economy is long the market, whether they realize it or not. This simple fact, drives arguably the single largest supplydemand imbalance in the world. ○ Volatility Risk Premium (VRP) as well as equity market implied volatility skew are just a few examples of well documented structural mispricings driven by the largest “insurance market” in the world. As many seasoned investors can attest (ie. Buffett), insurance is one of the most consistent sources of yield available. ○ With the dramatic increase in options volume, relative value dislocations have increased. ○ Unlike most opportunities in a liquidity bubble, these opportunities are actually increasing. 37 The Volatility Arbitrage Opportunity The Opportunity: Implied Volatility Overvalued “A simulated trading strategy that sells options … generates significant paper profits for the index.” Source: Does Net Buying Pressure Affect the Shape of Implied Volatility Functions, by Whaley, et al Implied Volatility Has Consistently Exceeded Realized Volatility ○ Over 28 years (1990-2018), the market has overpriced volatility by an average of 4.2 vol points ■ Implied volatility has exceeded realized volatility in all but one year since 1990 (97%) Source: Historical Performance of Put-Writing Strategies, by Oleg Bondarekno, Ph.D. ○ Overvaluation of implied volatility is a structural phenomenon broadly attributed to investor demand for insurance in the form of options ■ Data “does NOT provide evidence that the options market is becoming more rational over time.” Source: Mispricing of S&P 500 Index Options, by Constantinides, et al Average of Implied Vol Risk Premium 38 The Volatility Arbitrage Opportunity The Opportunity: Implied Skew Even More Overvalued Implied Volatility Skew Is Even More Overvalued Than At-The-Money Implied Vol ➢ Implied skew relative to realized data has been historically overestimated by 200% to 300% “For a variety of option classes, but particularly short-term out-of-the-money puts, the magnitude of mispricing remains large.” Source: A Nonlinear Factor Analysis of S&P 500 Index Option Returns, by Chris Jones Inherent Supply/Demand Imbalance • Market long $25 trillion of S&P500 equity and $80 trillion of global equity • Liquidity of S&P500 options (“insurance” market) is a mere fraction of that (billions). Demand For Insurance Is Increasing • Availability and publicity of options trading as a hedge to market exposure increasing significantly in the last decade VIX • Advent of products like the VIX have drawn in more volume and naive demand from less experienced hedgers • VIX is 1-month based, which drives even more demand for short-dated vol and skew Structural Mispricing Of Short-Dated Skew 39 THe Volatility Arbitrage Opportunity Portfolio Diversification Vol Arb Strategies tends to generate alpha that have low correlation to S&P 500 & Alternative Investments ➢ ➢ KAI’s VOL Neutral AlphaGen strategy has backtested returns with a low .2 Beta to the S&P 500 over 29 years. While also carrying even lower correlation to other conventional hedge fund strategies: Backtested Correlations to Industry Benchmarks Equity Market Neutral -0.14 Hedge Fund Index 0.12 Fixed Income Arbitrage -0.14 Long/Short Equity 0.24 Multi-Strategy -0.02 ➢ Backtest analysis shows investment in Volatility Arbitrage Strategies can significantly diversifies away from traditional market risks, providing truly non-correlated positive alpha. Commodity trading involves substantial risk of loss. Past performance is no guarantee of future results. Future results may differ significantly from past performance. There is the possibility of loss and all investment involves risk including the loss of principal. Please refer to the disclaimers at the end of this presentation when reviewing the performance herein. 40 2. The Predictive Power of Dealer Positioning: The Market Timing Opportunity The Market Timing Opportunity Secular Increase in Options Volumes 42 The Market Timing Opportunity Network Effects: Ease of Market Access 43 The Market Timing Opportunity Network Effects: More Products, Flexibility Meets Demand History: ● On March 26, 2004, the VIX Index is calculated and disseminated in real-time by the Cboe & trading in futures on the VIX began ● On February 2006, it became possible to trade options on the VIX. ● In October 2011 UVXY the largest Volatility ETF, which holds mixtures of VIX futures that attempt to enable stock-like trading in those futures was launched This Year Alone: ● On March 14, 2022 Cboe launches Nanos Options ● On April 25, 2022 Cboe & CME will be launching SPX & Emini expirations for every day 44 The Market Timing Opportunity Network Effects: Increased Awareness & Education Google Trends search for “trading options” 45 The Market Timing Opportunity What Makes Options A Superior Product w/ Secular Growth? ➔ Options are not an asset class, they represent the full distribution of probabilities of any & all underlying outcomes in time and moneyness ★ Traditional assets simply are the “Expected Value” or Summary of this rich underlying distribution. In effect, an asset’s option chain is the Real Underlying & are in the process of moving to this status ★ Superior infrastructure, Access. Liquidity. Education. Are accelerating to a “Tipping Point” 46 The KAI Dealer Flow AlphaGen Strategy Explained What is Dealer Positioning? People like to refer to options as market ‘insurance,’ but the problem with this analogy is that it fails to contemplate the crucial fact that market ‘insurance’ itself is reflexively involved in the probabilities of its own outcomes. Buying puts in an asset isn’t like tornado, life, or fire insurance, where the outcome is completely independent of the security, because when these contracts are bought or sold, their positioning ultimately drives flows in the underlying assets they represent. The reality is that when people are all hedged (or “insured” in this example), market events tend not to realize. Conversely, when market participants are not hedged, market events do tend to realize. This critical understanding is the basis for Kai’s Dealer Flow Strategy’s predictive modeling. Measuring and systematically tracking the positioning of dealers across options as well as other products allows the strategy to proactively get ahead of supply and demand flows that this positioning generates. 47 How Can You Use Dealer Positioning To Drive Alpha? Using Dealer Positioning to Drive Alpha Option Dealer Positioning & It’s Effects On Equities Options represent the full distribution of probabilities of any & all underlying outcomes in time and moneyness. Traditional assets simply are the “Expected Value” or “Summary” of this underlying distribution. Q: How do changes in the distributions get translated to the summary value of their assets? A: ”Options Dealers” (MMakers, Banks, etc.) who warehouse options risk model these changes in the distributions and use quantitative models to equalize risk across the distribution. This is the underlying basis of Volatility Arbitrage. Dealers’ hedging of these changes in the distribution are the supply and demand that ultimately drives changes in assets. This is a major driver of Market Reflexivity and how specific information on the option chain gets translated into equity values. 49 Using Dealer Positioning to Drive Alpha Dealer Positioning Effects Aren’t New, But Are Accelerating Market Adages ❖ ❖ ❖ ❖ ❖ ❖ Markets climb a wall of worry Markets take the stairs up and the elevator up Never short a dull market Sell the rumor, buy the news Never catch a falling knife Dead cat bounce A Primary Drivers of “Seasonal” Calendar Effects ❖ Santa Claus rally/January effect 50 Using Dealer Positioning to Drive Alpha Option Dealer Positioning & It’s Effects On Equities This “Dealer Hedging” can be broken up into 2 major Delta One Effects 1. Gamma Effects 1. Vanna/Charm Effects 51 Gamma Effects Gamma Effects Gamma Effects Gamma Exposure: An option dealer's delta sensitivity to changes in the price of the underlying. 53 Gamma Effects Short Gamma Effects & The Covid Crash/Recovery SPX Daily - March 1, 2020 through May 31, 2020 Feb OpEx Mar OpEx 54 Gamma Effects Long Gamma Effects: 2017 Historic Vol Pinning ➔ In 2017 realized volatility in the S&P 500 index dipped to 30% below its all time historical low and measured correlation across its constituent equities also declined to more than 20% below its lowest levels in over 200 years of market history. Clearly something was very different in markets. Why was realized index volatility so low and why was correlation among the securities making up the index so low all of a sudden? ➔ Implied volatility in the indices became compressed due to a dramatic increase in customer supply. This forced dealers into dramatically long volatility positioning. As shown in the below figure, this served to reflexively pin the index. Source: Newfound Research ➔ That said, dealer hedging only suppressed index level volatility. Underlying components still exhibited idiosyncratic volatility, hence the only reconciliation was a historic 6-sigma decline in correlations, system-wide. In other words, if the index level is pinned by dealer hedging and a single stock price idiosyncratically must move, then it must be the case that the price of other components have declined, in order for the index to remain pinned. 55 Vanna & Charm Effects Vanna and Charm Effects Vanna & Charm Vanna Exposure: An option dealer's delta sensitivity to changes in options' implied volatility Charm Exposure: An option dealer's delta sensitivity to changes in time 57 Vanna and Charm Effects Vanna & Charm: The 2020 Trump Election 58 Vanna and Charm Effects Vanna/ Charm Effects: The 2020 Trump Election Q: On the day after the 2020 US presidential election the stock market ripped higher in the face of the worst possible outcome: no clear winner on election night combined with a high likelihood of split power in congress. What caused markets to rally on this event as well as many other similar such “worst case scenario’ events such as Brexit and the 2016 Trump election? A: The answer lies in the extraordinarily high level of implied volatility that had been priced into the event for months – culminating in a VIX spike above 40 before the election and dealer’s reaction functions tied to it. In the course of the market rout a lot of put options on the S&P 500 were bought to protect portfolios against a worst case scenario. These expensive, mostly near-dated puts were sold by dealers who needed to hedge their exposure by selling S&P 500 futures and buying longer dated cheaper puts – this action further pressured prices down and implied volatility up in a negative feedback loop. On election day, regardless of the outcome, the event had passed, and with the positive cascade of changes in Vanna and Charm with the removal of the event risk premium, the negative feedback loop began to unwind in the opposite direction. The VIX started to fall and stock prices to rise as dealers were forced to unwind their high levels of hedging by buying back S&P 500 futures. The backwardation of term structure only exacerbated these situations as dealers decayed longer cheaper vol as high short dated hedges quickly decayed away. Despite an outcome that on its face was less than desirable from a macro perspective, stocks soared higher as dealers scrambled to buy back their short delta hedges. 59 Vanna and Charm Effects Vanna & Charm: The 2020 Trump Election SPX Daily - October 1, 2020 through December 31, 2020 Election Day 60 Portfolio Diversification A Dealer Flow focused market-timing strategy tends to generate alpha that has Low Correlation to S&P 500 & Alternative Investments ➢ The strategy’s historic returns have a low .18 Beta to the S&P 500 over the last 1.33 years. ➢ The strategy carries even lower correlation to other conventional hedge fund strategies: Backtested Correlations to Industry Benchmarks Equity Market Neutral -0.17 Hedge Fund Index 0.00 Fixed Income Arbitrage -0.29 Long/Short Equity 0.10 Multi-Strategy -0.08 ➢ Investment in Dealer Positioning Strategies can significantly diversifies away from traditional market risks, providing truly non-correlated positive alpha as well. Commodity trading involves substantial risk of loss. Past performance is no guarantee of future results. Future results may differ significantly from past performance. There is the possibility of loss and all investment involves risk including the loss of principal. Please refer to the disclaimers at the end of this presentation when reviewing the performance herein. 61 Contact Information Kai Volatility Advisors 401 W Superior St Suite 101 Chicago, IL 60654 www.kaivolatility.com Cem Karsan Senior Managing Partner 312-605-8020 office cem.karsan@kaivolatility.com 62 Disclaimers/Certain Risk Factors Performance Results Comparisons Results are compared to the performance of the S&P 500 Index (“S&P500”) for informational purposes only. The investment program does not mirror this index and the volatility may be materially different than the volatility of the S&P500. Results are compared to the performance of the Chicago Board Options Exchange Market Volatility Index (“VIX”) for informational purposes only. The investment program does not mirror this index and the volatility may be materially different than the volatility of the VIX. Results are compared to the performance of the Dow Jones Credit Suisse Hedge Fund Index (“DJCS Hedge Fund Index”) for informational purposes only. All correlations calculated herein are calculated against these indices. The investment program does not mirror this index and the volatility may be materially different than the volatility of the DJCS Hedge Fund Index. The earliest any displayed DJCS data begins is Dec 1993 and the earliest CBOE VARB-XTM data begins is July 2004 and ends in Nov 2013 , whereas all other benchmark data begins in Dec 1991. Strategy and Investment Descriptions The description herein of the approach of KAI Volatility Advisors and the targeted characteristics of its strategies and investments is based on current expectations and should not be considered definitive or a guarantee that the approaches, strategies, and investment portfolio will, in fact, possess these characteristics. In addition, the description herein of KAI Volatility Alpha Gen Fund’s risk management strategies is based on current expectations and should not be considered definitive or a guarantee that such strategies will reduce all risk. These descriptions are based on information available as of the date of preparation of this document, and the description may change over time. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss and all investment involves risk including the loss of principal. Fund Terms and Conditions The summary provided herein of KAI Volatility Advisors Fund’s terms and conditions does not purport to be complete. The Fund’s Memorandum should be read in its entirety prior to an investment in the Fund. Forward Looking Statements Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, these projections are only an estimate. Actual results will differ and may vary substantially from the results shown. General Disclaimer An investment in any strategy, including any strategy described in this presentation, involves a high degree of risk. There is no guarantee that the investment objective or targeted performance will be achieved. Moreover, past performance does not guarantee future returns and the potential for gains is accompanied by the possibility of loss. The nature of and risks associated with the investments to be made in connection with KAI Volatility Advisors LLC (“KAI Volatility Advisors” or “KAI Volatility”) may differ substantially from the nature of and risks associated with investments undertaken historically by KAI Volatility’s principles and/or employees. Nothing set forth herein shall constitute an offer to sell any securities or constitute a solicitation of an offer to purchase any securities. Any such offer to sell or solicitation to an offer to purchase shall be made only by formal offering documents. Each potential investor should read the formal offering documents in their entirety and should carefully consider the risks, warnings and disclosures. The information contained in this document is strictly confidential and supplied with the understanding that it will be held in confidence and not copied or disclosed to third parties without prior consent of KAI Volatility Advisors LLC. 63 Discussion and Q&A YOUR QUESTIONS AND COMMENTS Submit via the Q icon TOPICS Active Options Strategies that Seek Alpha Generation and Provide Convex Protection as Volatility and Skew Have Explosive Upside Moves Offering Diversification Potential and Negative Beta with Options Strategies Exploring Hedging Strategies with Cboe’s PPUTSM, PPUT3MSM, VXTHSM, and CLLSM Indices ❖ ❖ ❖ SPEAKERS Cem Karsan and Nishank Modi MORE INFORMATION ▪ ▪ ▪ ▪ ▪ ▪ ▪ Click on the Handouts icon on your screen Cboe Risk Mgt. Conf. (RMC) – Oct. 17 – 20, 2023 in Austin, TX - https://go.cboe.com/global-rmc-2023 Webinar replays and upcoming webinars www.cboe.com/insights/webinars Options Education - www.cboe.com/education White Papers - www.cboe.com/education/research Cboe Blogs – www.cboe.com/insights Cboe Indices - www.cboe.com/index THANK YOU to the speakers and attendees! 64