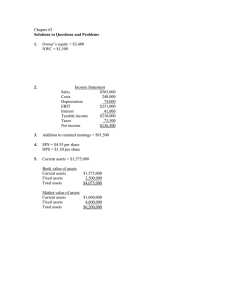

BA 321 Chapter 2 HW 2: Net sales Costs Depreciation EBIT Interest Taxable income Taxes (21%) Net Income $742,000 $316,000 $39,000 $387,000 $34,000 $353,000 $74,130 $278,870 13: (in thousands) Net sales $336 Costs $194.7 + 9.8 Depreciation $20.6 EBIT $110.9 Interest $14.2 Taxable income $96700 Taxes $21.275 Net Income $75425 A: OCF=110900+20,600-21,275=$110225 B: CFC=14,200+5,400= $19600 C: CFS= 21,450-7,100=$14,350 D: CFFA= 19600+14,350=33950 NCS=53200+20600=73800 CFFA=OCF-NCS-NWC 33950=110225-73800-NWC NWC=110225-73800-33950=2475 17: Net sales Costs Depreciation EBIT Interest Taxable income Taxes Net Income A: Net income = -$55,000 B: OCS= 35000+170000-0= $205,000 $865000 $535000+$125000 $170000 $35000 $90000 $0 $0 $-55,000 C: Net income is negative due to the massive costs and depreciation reducing the gross profit to only $35,000 and with a $90,000 interest expense the total expenses supersede the net sales resulting in a $55,000 loss. The Operating cashflow remains positive despite the company having a negative net income as the OCS demonstrates that the company can still produce a profit if not accounting for the heavy depreciation hits for the year that they would still be profitable. 19: A: Net sales Costs Depreciation EBIT Interest Taxable income Taxes (22%) Net Income $38,072 $27,168 $6,759 $4,145 $3,050 $1,095 $240.9 $854.1 B: OCF= $4,145+$6,759-$240.9=$10663 C: CFFA=10663- NCS(12,022)- 1129= -2488 NWC 1: 3514 NWC 2: 4643 The company has a negative CFFA which means they are putting more money into the company than they are actually earning D: CFC=3050 CFS=CFFA-CFC=-5538 Net new equity = 20: A:2020: TA-TL = 3376 2021: TA-TL= 4355 B:NWC= 2021(1438-595)-2020(1327-530)=46 C: NCS= 6587-5470+1499=2616 2616=2740-SOLD SOLD=124 OCF= 7483+1499-1481.76=7500 CFFA=7500-2616-46=4838 D: Net new borrowing= Borrowed amt- paid off amount CFC= 427-184=243 Net new borrowing=3075-2891=184=554=paid off =370 21: CFFA= CFC+CFS CFC=25630-20900=4730 CFS=14200-73371+27883=-31288 Net new borrowing 201900-181000=20900 CFFA=4730-31288=-26558