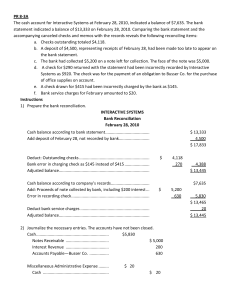

Sample Problems BANK RECONCILIATION PROBLEM 8-2 Apathy Company provided the following information: Date Dec. 2 Apathy Company Check no. Withdrawal 18 104 20 101 22 106 27 29 29 103 29CM 31Service charge DM Deposits 100,000 10,000 5,000 25,000 50,000 10,000 40,000 30,000 2,000 Balance 100,000 90,000 85,000 60,000 110,000 120,000 80,000 110,000 108,000 PROBLEM 8-2 Apathy Company provided the following information: Dec. 1 21 27 31 Deposit Deposit Deposit Deposit FIRST BANK 100,000 Dec. 4 Check No. 50,000 6Check No. 10,000 8Check No. 80,000 8Check No. 10Check No. 14Check No. 28Check No. 101 102 103 104 105 106 107 5,000 15,000 40,000 10,000 30,000 25,000 50,000 PROBLEM 8-2 The credit made by the bank on December 29 represents the proceeds of a note received from a customer which was given to the bank for collection by the entity on December 26. REQUIRED: a. b. Prepare a bank reconciliation using adjusted balance method. Prepare the adjusting entries. PROBLEM 8-2 Date Dec. 2 Apathy Company Check no. Withdrawal 18 20 22 27 29 29 29 CM 31 Service charge DM Dec. 1 21 27 31 Deposit Deposit Deposit Deposit 104 101 106 Deposits 100,000 10,000 5,000 25,000 50,000 10,000 103 100,000 50,000 10,000 80,000 40,000 30,000 2,000 FIRST BANK Dec. 4 6 8 8 10 14 28 Check No. Check No. Check No. Check No. Check No. Check No. Check No. Balance 100,000 90,000 85,000 60,000 110,000 120,000 80,000 110,000 108,000 101 102 103 104 105 106 107 5,000 15,000 40,000 10,000 30,000 25,000 50,000 PROBLEM 8-2 Adjusting entries: Dec. 31 Cash in bank Notes receivable # Bank service charge Cash in bank # 30,000 30,000 2,000 2,000 PROBLEM 8-2 Apathy Company Bank Reconciliation December 31, 20A Book balance Add: Credit memo from note collected Total Less: Debit memo (service charge) Adjusted book balance Bank balance Add: Deposit in transit Total Less: Outstanding checks No. 102 No. 105 No. 107 Adjusted bank balance 65,000 30,000 95,000 (2,000) 93,000 108,000 80,000 188,000 15,000 30,000 50,000 (95,000) 93,000 PROBLEM 8-3 The following ledger account is a copy of the bank account in the ledger of Sensible Company. Dec . 1 6 12 24 31 Balance Deposit Deposit Deposit Deposit Second Bank Dec Check 100,000 . 1 no. 30,000 4 40,000 6 50,000 10 30,000 14 18 24 771 772 773 774 775 776 777 20,000 5,000 35,000 15,000 30,000 25,000 40,000 PROBLEM 8-3 The following bank statement was received from the Second Bank by Sensible Company. Date Checks Dec. 1 Balance Check no. 1 4 6 12 12 Deposits 768 771 772 773 774 776 104 2 24 28 NSF Check 28 Service charge 10,000 20,000 5,000 35,000 15,000 52,000 8,000 10,000 5,000 Balance 130,000 30,000 40,000 50,000 45,000CM PROBLEM 8-3 Other information 1. Sensible Company reconciled its bank balance on November 30 with two checks, No. 768 for P10,000 and No. 770 for P20,000 outstanding. 2. Check no. 1042 was drawn by Sensitive Company. The bank charged it in error to the account of Sensible Company. 3. Check No. 776 was incorrectly drawn for P52,000 in payment of an account. The amount P25,000 was entered in the books of original entry. 4. The bank credit on December 28 represents the proceeds of a P50,000 note, less a collection fee of P5,000 collected by the bank and credited to the account. 5. The NSF check was received from a customer in payment of an account. Required: a. Prepare a bank reconciliation statement on December 31. b. Prepare adjusting entries on December 31. PROBLEM 8-3 Dec. 1 6 12 24 31 Balance Deposit Deposit Deposit Deposit Date Dec. 1 100,000 30,000 40,000 50,000 30,000 Checks Balance Check no. 1 4 6 12 12 24 28 NSF Check 28 Service charge Second Bank Dec. 1 Check no. 771 4 772 6 773 10 774 14 775 18 776 24 777 Deposits 768 771 772 773 774 776 1042 10,000 20,000 5,000 35,000 15,000 52,000 8,000 10,000 5,000 30,000 40,000 50,000 45,000CM 20,000 5,000 35,000 15,000 30,000 25,000 40,000 Balance 130,000 PROBLEM 8-3 Sensible Company Bank Reconciliation December 31, 20A Book balance Add: Credit memo from note collected Total Less: Debit memo (service charge) NSF Check Book error (52,000-25,000) Adjusted book balance Bank balance Add: Deposit in transit Erroneous bank debit Total Less: Outstanding checks No. 770 No. 775 No. 777 110,000 45,000 155,000 (5,000) (10,000) (27,000) (42,000) 113,000 135,000 60,000 8,000 (20,000) (30,000) (40,000) 68,000 203,000 (90,000) PROBLEM 8-3 Adjusting entries: Dec. 31 Cash in bank Bank service charge Notes receivable # 31 Bank service charge Accounts receivable Accounts payable Cash in bank # 45,000 5,000 50,000 5,000 10,000 27,000 42,000 PROBLEM 8-4 Xanthous Company provided the following bank reconciliation on January 31 of the current year: Bank balance Add Deposit in transit Total Deduct Outstanding checks: No. 114 115 116 Adjusted bank balance 300,000 600,000 900,000 240,000 160,000 60,000 460,000 440,000 All receipts of cash are deposited in the bank account. The bank statement for the month of February is presented below: Checks 240,000 200,000 900,000 160,000 THIRD BANK Deposit Balance forwarded 600,000 2,000,000 400,000 1,000,000 500,000 1,200,000 1,300,000 550,000 5,000SC 1,000,000 800,000 550,000 270,000CM Date Jan. 31 Feb. 1 3 5 7 9 10 13 16 21 23 24 27 28 Balance 300,000 660,000 2,660,000 2,460,000 1,960,000 1,800,000 2,800,000 2,300,000 3,500,000 4,800,000 4,250,000 4,245,000 3,795,000 3,265,000 PROBLEM 8-4 The following information was taken from the credit memo of February 28: Face of the note Interest on the note Maturity value of the note Collection charge Credit to your account 250,000 30,000 280,000 10,000 270,000 The following data were taken from the cash journals of Xanthous Cash Receipts Journal Cash Disbursement Journal Company: Date Debit Cash Check No. Credit Cash Feb. 2 6 9 10 15 20 24 28 2,000,000 400,000 800,000 200,000 1,200,000 1,300,000 550,000 450,000 6,900,000 117 118 119 120 121 122 123 124 125 200,000 900,000 800,000 500,000 550,000 180,000 1,000,000 120,000 250,000 4,500,000 REQUIRED: a. b. Prepare bank reconciliation on February 28, showing the book balance before and after adjustment. Prepare journal entries to record the adjustments that are indicated by the bank reconciliation. Xanthous Company Bank Reconciliation February 28, 20A Balance per book Add: CM for note collected Total Less: DM for service charge Adjusted book balance 2,840,000 270,000 3,110,000 5,000 3,105,000 Balance per bank Add: Deposit in transit Total Less: Outstanding checks No. 116 122 124 125 Adjusted bank balance 3,265,000 450,000 3,715,000 60,000 180,000 120,000 250,000 610,000 3,105,000 ADJUSTING ENTRIES a) Cash in bank 270,000 Bank service charge 10,000 Note Receivable 250,000 Interest Income 30,000 # b) Bank Service charge Cash in Bank # 5,000 5,000 PROBLEM 8-5 Adept Company provided the following data for the month of December of the current year: Balance per book 5,000,000 Balance per bank 4,,450,000 Deposit in transit 3,000,000 Outstanding check 850,000 Bank service charge for the month of December50,000 Customer’s check returned by bank marked “NSF” 500,000 Customer’s note collected by bank Face, P2,000,000; Interest, P200,000; Collection fee, P50,0002,150,000 Required: a. Prepare a bank reconciliation on December 31. b. Prepare adjustments to correct the cash balance per book. PROBLEM 8-5 Adept Company Bank Reconciliation December 31, 20A Book balance Add: Credit memo from note collected by bank Total Less: Debit memo (service charge) NSF Check Adjusted book balance Bank balance Add: Deposit in transit Total Less: Outstanding checks Adjusted bank balance 5,000,000 2,150,000 7,150,000 (50,000) (500,000) (550,000) 6,600,000 4,450,000 3,000,000 7,450,000 (850,000) 6,600,000 ADJUSTING ENTRIES a) Cash in bank 2,150,000 Bank service charge 50,000 Note Receivable 2,000,000 Interest Income 200,000 # b) Bank Service charge Accounts receivable Cash in Bank # 50,000 500,000 550,000 PROBLEM 8-6 Chivalry Company prepared the following bank reconciliation on Book balance 1,405,000 March 31: Add: March 31 deposit Collection of note Interest on note Total Less: Calvary Company's deposit to our account Bank service charge Adjusted book balance Bank balance Add: Error on check No. 175 Total Less: Preauthorized payment for light and water NSF check Outstanding checks 750,000 2,500,000 150,000 1,100,000 5,000 3,400,000 4,805,000 1,105,000 3,700,000 5,630,000 45,000 5,675,000 245,000 220,000 1,650,000 2,115,000 3,560,000 Check No. 175 was made for the proper amount of 249,000 in payment of account. However it was entered in the cash disbursement journals as 294,000. Chivalry Company authorized the bank to automatically pay its light and water bills as submitted directly to the bank. REQUIRED: a. b. Prepare the corrected bank reconciliation. Prepare the adjusting entries on March 31. Chivalry Company Bank Reconciliation March 31, 20A Book balance Add: Collection of note Interest on note Book error on check no. 175 Total Less: Bank service charge Payment for light and water NSF check Adjusted book balance Bank balance Add: Deposit in transit Total Less: Bank error Outstanding checks Adjusted bank balance 1,405,000 2,500,000 150,000 45,000 5,000 245,000 220,000 2,695,000 4,100,000 470,000 3,630,000 5,630,000 750,000 6,380,000 1,100,000 1,650,000 2,750,000 3,630,000 ADJUSTING ENTRIES a) Cash in bank 2,695,000 Note Receivable 2,500,000 Interest Income 150,000 Accounts payable 45,000 b) Bank Service charge 5,000 Light and water 245,000 Accounts receivable 220,000 Cash in Bank 470,000 PROBLEM 8-7 Zodiac Company provided the following information : Balance per book, March 31 800,000 Cash Receipts for April 4,100,000 Cash Disbursements for April 3,800,000 Outstanding checks as of April 30 of which No. 1333 had been certified : No.1331 40,000 No.1332 30,000 No.1333 50,000 No.1334 60,000 No.1335 10,000 April debit memos were : For bank service charge 5,000 For NSF check 25,000 April Credit Memo for note collected REQUIRED Prepare a Bank Reconciliation on April 30 following the book to bank approach and prepare adjusting entries . Zodiac Company Bank Reconciliation March 31, 20A Balance per book – April 30 Add: Credit memo for note collected Outstanding checks : NO.1331 NO.1332 NO.1334 No.1335 1,100,000 60,000 40,000 30,000 60,000 10,000 TOTAL Less: Bank Service Charge NSF Check Undeposited collections Adjusted balance per bank-April 30 5,000 25,000 270,000 140,000 1,300,000 (300,000) 1,000,000 ADJUSTING ENTRIES a) Cash in Bank Note Receivable b) Bank Service charge Accounts Receivable Cash in Bank 60,000 60,000 5,000 25,000 30,000 Balance per bank statement 4,000,000 Balance per cash book 2,700,000 Outstanding checks 600,000 Deposit in transit 475,000 Service charge 10,000 Proceeds of bank loan, December 1 discounted for 6 months at 12%, not recorded on company books 940,000 Customer's check charged back by bank for absence of counter signature 50,000 Deposit of 100,000 incorrectly recorded by bank as 10,000 Check of Rancid Company charged by bank against Rancor Company account 150,000 Customer's note collected by bank in favor of Rancor Company. Face Interest Total Less: Collection fee 400,000 40,000 440,000 5,000 435,000 Erroneous debit memo of December 28, to charge company's account with settlement of bank loan 200,000 Deposit of Rancid Company credited to Rancor account 300,000 REQUIRED a. b. Prepare a bank reconciliation using the adjusted balance approach. Prepare adjusting entries on December 31. RANCOR COMPANY BANK RECONCILIATION DECEMBER 31, 20A Balance per book Add: Proceeds of bank loan Note collected by bank 2,700,000 940,000 435,000 Total 1,375,000 4,075,000 Less: Service charge Customer’s check charged back 10,000 50,000 60,000 Adjusted book balance 4,015,000 Balance per bank 4,000,000 Add: Deposit in transit Incorrect deposit 475,000 90,000 Erroneous bank charge 150,000 Erroneous debit memo 200,000 Total Less: Outstanding checks Erroneous bank credit Adjusted bank balance 915,000 4,915,000 600,000 300,000 900,000 4,015,000 ADJUSTING ENTRIES a) Cash in bank 1,375,000 Bank service charge 5,000 Interest expense (60,000 x 1/6) 10,000 Prepaid interest expense 50,000 Loan payable (940,000/94%) 1,000,000 Note receivable 400,000 Interest income 40,000 b) Bank service charge Accounts receivable Cash in bank 10,000 50,000 60,000 PROBLEM 8-12 Magnificent Company Cash balance per accounting record provided the following data for the month of1,719,000 Cash balance per bank statement 3,195,000 May: Bank service charge Debit memo for the cost of printed checks delivered by the bank; the charge has not been recorded in the accounting record Outstanding checks Deposit of May 30 not recorded by bank until June 1 Proceeds of a bank loan on May 30 not recorded in the accounting record, net of interest of 30,000 Proceeds from a customer's promisory note, principal amount P800,000 collected by the bank not taken up in the book with interest Check No. 1086 issued to a supplier entered in the accounting record as P210,000 but deducted in the bank statement at an erronous amount of Stolen check lacking an authorized signature, deducted from the entity's account by the bank in error Customer's check returned by the bank marked NSF, indicating that the customer's balance was not adequate to cover the check; no entry has been made in the accounting record to record the returned check 10,000 12,000 685,000 500,000 570,000 810,000 120,000 80,000 77,000 REQUIRED a. b. Prepare a bank reconciliation statement. Prepare adjusting entries. Magnificent Company Bank Reconciliation May 31, 20A Balance per book Add: Proceeds of bank loan Proceeds of customer's note Total Less: Bank service charge Debit memo for printed checks NSF check Adjusted book balance Balance per bank Add: Deposit in transit Stolen check deducted by bank in error Total Less: Outstanding checks Bank error in recording Adjusted bank balance 1,719,000 570,000 810,000 10,000 12,000 77,000 1,380,000 3,099,000 99,000 3,000,000 3,195,000 500,000 80,000 685,000 90,000 580,000 3,775,000 775,000 3,000,000 ADJUSTING ENTRIES(PLS EDIT) a) Cash in bank 1,375,000 Bank service charge 5,000 Interest expense (60,000 x 1/6) 10,000 Prepaid interest expense 50,000 Loan payable (940,000/94%) 1,000,000 Note receivable 400,000 Interest income 40,000 b) Bank service charge Accounts receivable Cash in bank 10,000 50,000 60,000