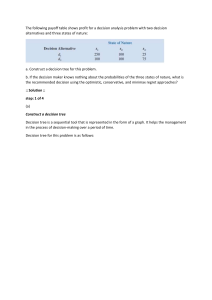

Payoff profiles of price-contingent orders Solid lines represent the transactions that occur with the execution of the order Dotted lines are existing exposures that are reversed by the execution of the order Price below limit Price above limit Payoff Buy Payoff 50 Price 0 50 55 Price -5 The LIMIT BUY order initiates a long exposure. The client believes that this stock is not worth more than 50. She instructs the broker: “Buy at ANY price below 50” Sell Payoff 0 The STOP BUY order reverses a short exposure. The existing short means that the client is losing when the price goes up. To limit her loss, she instructs the broker: “Buy the moment the price hits 55” Payoff 45 50 Price 50 Price -5 The STOP LOSS order reverses a long exposure. The client is worried that the price is falling and wants to limit her loss to at most 5. She instructs the broker: “Sell the moment the price hits 45” The LIMIT SELL order initiates a short exposure. The client wants to bet on a downward movement in price and instructs the broker: “Sell at ANY price above 50”