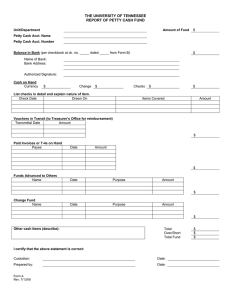

INTACC REVIEWER EPISODE 1: CASH Cash- includes money and any other negotiable instrument that is payable in money and accepted by the bank for deposit and immediate credit. Presentation- Current Asset (Unrestricted less than 12 months) Measurement- Face Value 2 Methods of Recording: Initially (First) Subsequently (In future change) Estimated Recoverable Amount- Amount change due to unexpected problems occur. Cash Items: CASH ON HAND Undeposited Collection (Bills and Coins) Customer’s Check (Risky as fuck, not sure if it has value or not) Manager’s Check (Certified) Cashier’s Check (Certified) Traveler’s Check (Certified) Bank Draft (Certified from bank) Money Order (Certified from pawn shops) CASH IN BANK Checking Account (or Demand Deposit)- for everyday transactions Savings Deposit- for savings CASH FUND (Restriction for current operation) Change Fund (Panukli) Tax Fund (Payment of tax) Payroll Fund (Salaries) Dividend Fund (Dividend) Plant Expansion- Long term investment Loan/Bonds Payable- Sinking fund Compensating Balance- Beginning Deposit (Restriction but still depends; Formal- long term investment, Informal- Cash) Kinds of Checks: Undelivered Check- not claimed (Reverse entry if happen) Postdated Checks- future date (Reverse entry if date is in the future) Stale Checks (Expired check can be replaced (reverse entry) or not (misc. gain)) Bank Overdraft- illegal in the PH, in cash higher than value of deposit (Current Liability in bank) Offsetting- not allowed in different bank (Exception: Same bank) EPISODE 2: CASH EQUIVALENT Cash Equivalents- short term (3 months) and highly-liquid investment (base on companies) that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates. Examples: 3-month BSP Treasury Bills (T-bills with interest) 3-month time deposit (cannot be withdrawn as deposit for interest) 3-month money market instrument (invest in bank- invest in other private corp) or commercial paper (Like T-bills but not BSP basta highly liquid) Xxx-year BSP treasury bills/commercial paper/redeemable preference share purchased 3 months before maturity date (Purchase date reference to grant 3 months rule) Excess Cash Investment: 3 months- Cash Equivalent More than 3 months but not more than 12 months- short-term investments More than 12 months- long-term investment EPISODE 3: PETTY CASH FUND Petty Cash Fund- money set aside to pay small expenses which cannot be paid conveniently by means of check. Cash In- Receipts Cash Out- Disbursement Imprest System- Depositing all cash collection within the day in bank 2 Kinds of Petty Cash System Imprest Fund System- accumulated expense before recording it 1. Establishment (Dr- Petty Cash Fund, Cr- Cash in Bank) 2. Expense- No entry 3. Replenishment- moment where expenses are recorded (Dr- Expenses, Cr- Cash in Bank) 4. Inc/Dec ((Dr- Petty Cash Fund, Cr- Cash in Bank) 5. End of Reporting Period (Dr- Expense, Cr- Petty Cash Fund) 6. Cash Short/Over (Dr-Cash Shortage, Cr- CIB) (Dr-CIB, Cr-Cash Overage) Fluctuating System- you record every movement 1. 2. 3. 4. 5. 6. Establishment (Dr- Petty Cash Fund, Cr- Cash in Bank) Expense (Dr- Expense, Cr- Petty Cash Fund) Replenishment (Dr-Petty Cash Fund, Cr- Cash In Bank) Inc/Dec ((Dr- Petty Cash Fund, Cr- Cash in Bank) End of Reporting Period (No Entry) Cash Short/Over (Dr-Cash Shortage, Cr- PCF) (Dr-PCF, Cr-Cash Overage) NOTE: Cash Short/Over is just a temporary account, it will be recorded again after investigation. (Receivable/Payable from/to Custodian, Miscellaneous Inc/Exp) Petty Cash Custodian- handles petty cash fund. Records in Petty Cash Memorandum Book