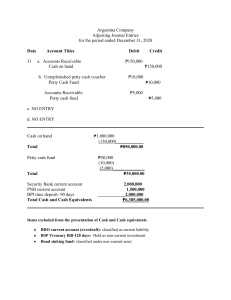

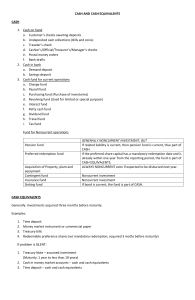

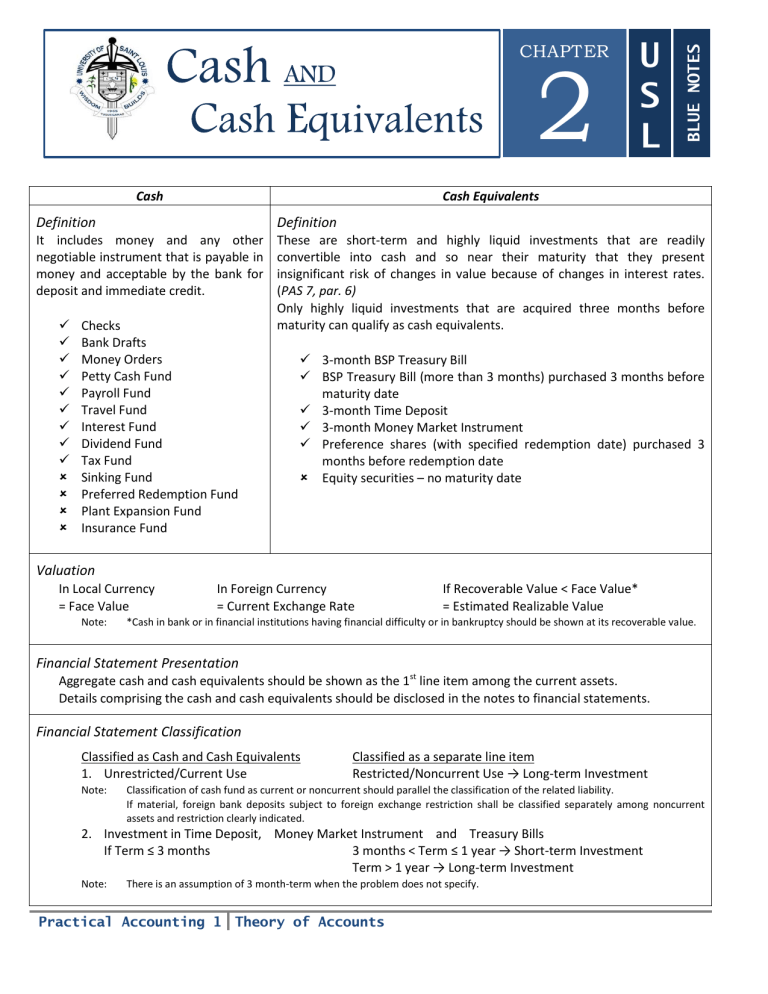

2 Cash U S L BLUE NOTES CHAPTER Cash Equivalents Definition Definition It includes money and any other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. These are short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates. (PAS 7, par. 6) Only highly liquid investments that are acquired three months before maturity can qualify as cash equivalents. Checks Bank Drafts Money Orders Petty Cash Fund Payroll Fund Travel Fund Interest Fund Dividend Fund Tax Fund Sinking Fund Preferred Redemption Fund Plant Expansion Fund Insurance Fund 3-month BSP Treasury Bill BSP Treasury Bill (more than 3 months) purchased 3 months before maturity date 3-month Time Deposit 3-month Money Market Instrument Preference shares (with specified redemption date) purchased 3 months before redemption date Equity securities – no maturity date Valuation In Local Currency = Face Value Note: In Foreign Currency = Current Exchange Rate If Recoverable Value < Face Value* = Estimated Realizable Value *Cash in bank or in financial institutions having financial difficulty or in bankruptcy should be shown at its recoverable value. Financial Statement Presentation Aggregate cash and cash equivalents should be shown as the 1st line item among the current assets. Details comprising the cash and cash equivalents should be disclosed in the notes to financial statements. Financial Statement Classification Classified as Cash and Cash Equivalents 1. Unrestricted/Current Use Note: Classified as a separate line item Restricted/Noncurrent Use → Long-term Investment Classification of cash fund as current or noncurrent should parallel the classification of the related liability. If material, foreign bank deposits subject to foreign exchange restriction shall be classified separately among noncurrent assets and restriction clearly indicated. 2. Investment in Time Deposit, Money Market Instrument and Treasury Bills If Term ≤ 3 months 3 months < Term ≤ 1 year → Short-term Investment Term > 1 year → Long-term Investment Note: There is an assumption of 3 month-term when the problem does not specify. Practical Accounting 1 Theory of Accounts Chapter 2 – Cash and Cash Equivalents USL Blue Notes 9 3. General Rule: Bank overdraft (Credit Balance Bank Account) → Current Liability Exception: It can be an offset against other bank account if the amount is immaterial and/or when the entity maintains 2 or more accounts in 1 bank. 4. Informal Compensating Balance ─ not legally restricted Formal Compensating Balance ─ legally restricted If related loan is short-term → Cash held as compensating balance If related loan is long-term → Noncurrent Investment Note: In the absence of any information, compensating balance is always considered not available for an unrestricted use. Restoration of Cash Balance from: Check as payment Check as receipt Unreleased Check Postdated Check Stale Check* ↑Cash ↓Account Payable ↑Cash ↓Account Payable ↑Cash ↓Account Payable ↓Cash ↑Account Receivable ↓Cash ↑Account Receivable ↓Cash ↑Account Receivable Note: *A check becomes stale if not encashed within 6 months from the issuance date. However, the entity may issue a “stop payment order” for cancelation of stale check even for less than 6 months. Misstatement Practices Concerning Cash Balance: 1. Window Dressing is a practice of opening the books of accounts beyond the close of the accounting period for the purpose of showing a better financial position and performance. 2. Lapping consists of misappropriating a collection from one customer and concealing this defalcation when collection is made from another customer. 3. Kiting is a transfer of cash from one bank to another bank usually employed at the end of the month. Petty Cash Fund 1. Imprest Fund System Petty cash expenses are recorded upon replenishment. Replenishment amount = Petty cash disbursements 2. Fluctuating Fund System Petty cash expenses are immediately recorded. Replenishment amount = or > or < Petty cash disbursements Bank Reconciliation Book reconciling items 1. Credit Memos – deposits credited by the bank; not yet recorded as cash receipts in books 2. Debit Memos – checks debited by the bank; not yet recorded as cash disbursements in books Bank reconciling items 1. Deposits in transit – already recorded as cash receipts in books; not yet credited by the bank 2. Outstanding checks – already recorded as cash disbursements in books; not yet debited by the bank Forms 1. Adjusted balance method – book balance and bank balance → correct cash balance 2. Book to bank method 3. Bank to book method Proof of cash is an expanded reconciliation in that it includes proof of receipts and disbursements. Theory of Accounts Practical Accounting 1 10 USL Blue Notes Chapter 2 – Cash and Cash Equivalents Illustrative Problem 1. On December 31, 2014, the cash account of Maktech Company showed the following details: Undeposited collections Cash in bank – PCIB checking account Cash in bank – PNB (overdraft) Undeposited NSF check received from the customer, dated Dec. 1, 2014 Undeposited check from a customer, dated Jan. 15, 2015 Cash in bank – PCIB (fund for payroll) Cash in bank – PCIB (saving deposit) Cash in bank – PCIB (money market instrument, 90 days) Cash in foreign bank (restricted) IOUs from officers Sinking fund cash Listed shares held as trading investment Petty cash fund (all funds were reimbursed on 12/31/2014) Time deposit (due February 1,2015) Treasury bills Traveler’s check 60,000 500,000 (50,000) 15,000 25,000 150,000 100,000 2,000,000 100,000 30,000 450,000 120,000 50,000 250,000 1,000,000 50,000 Solution: Undeposited collections PCIB checking account PCIB payroll fund PCIB saving deposit Petty cash fund Time deposit Treasury bills Traveler’s check PCIB money market Total cash and cash equivalents Practical Accounting 1 Theory of Accounts 60,000 500,000 150,000 100,000 50,000 250,000 1,000,000 50,000 2,000,000 4,160,000