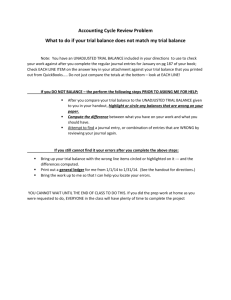

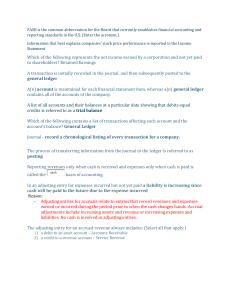

1. Users of Accounting Information: Accounting is of primary importance to the owners and managers. However, creditors, bankers, etc. are also interested in the accounting reports of the organization. Following is the list of Users of Accounting Information Owners/Shareholders Managers Prospective Investors Creditors, Bankers, and other Lending Institutions Government Employees Regulatory Agencies Researchers Customers 2. GAAP (generally accepted accounting principles): GAAP (generally accepted accounting principles) is a collection of commonly followed accounting rules and standards for financial reporting. The acronym is pronounced gap. GAAP specifications include definitions of concepts and principles, as well as industry-specific rules. The purpose of GAAP is to ensure that financial reporting is transparent and consistent from one public organization to another, and from one accounting period to another. Historical Cost Principle: The historical cost principle states that businesses must record and account for most assets and liabilities at their purchase or acquisition price. In other words, businesses have to record an asset on their balance sheet for the amount paid for the asset. The asset cost or price is then never adjusted for changes in the market or economy and changes due to inflation. The historical cost principle is a tradeoff between reliability and usefulness. The historical cost of an asset is completely reliable. After all, that’s how much the company paid for the asset. It might not be very useful however. Knowing that a company purchased a piece of land in 1950 for $10,000 does not really tell financial statement users how much the land is currently worth. In this case a fair market value would be more useful. Since fair market values and replacement costs are left up to estimates and opinions, the FASB has decided to stick with the historical cost principle because it is reliable and objective. In current years, the FASB as well as the IASB has become more open to fair value information. Liabilities are also accounted for using the historical cost principle. When bonds or other debts are issued or received, they are recorded on the balance sheet at the original acquisition price. Fair Value Fair value is the current price or value of an item. More specifically, it is the amount that the item could be sold for that is fair for both the buyer and the seller. Fair value does not relate to products being sold in liquidation; rather it refers to products that are being sold under normal, reasonable conditions. Fair value becomes increasingly important when assets are sold or a company is acquired. Using fair value allows a fair and appropriate sales price to be determined for individual items or an entire business. When a company is purchased, the fair value helps determine the value of the assets and arrive at a reasonable sales price for the business. Fair value is also important when valuing assets on financial statements. If a product falls in value, it may affect the depreciation costs of the business and lower the value of the assets. On the other hand, if a product increases in value, it will cause the value of the asset and company to increase. Fair value can also apply to the value of a stock or security in the open market. Monetary Unit Assumption: Let's meet Jake who has just assumed ownership of the family's manufacturing business. He recently purchased some new equipment and his accountant indicated that the cost should be added to the cost of his existing equipment. He doesn't understand how equipment purchased this year could be grouped with equipment purchased by his father ten years ago as the value of a dollar has changed over that period of time. Let's see if we can help Jake with this problem. The monetary unit assumption states that a company must record its business transactions in dollars or some other unit of currency. Companies use the dollar since it is stable in value and available everywhere. It also provides a consistent method of comparing the results of one company with those of another. So when Jake paid $100,000 for the new equipment, this amount would be added to the cost of his dad's purchases in the assets section of his company's financial records. Economic Entity Assumption: The economic entity assumption is an accounting principle that states that all transactional data associated with a specific entity is assumed to be clearly attributed to the entity, and does not include other transactional data associated with the entity’s owners or business partners. While this assumption applies to all varieties of businesses, it most notably applies to sole proprietorships, for which the transactional records are maintained by the entity’s owners. The 8 Steps of the Accounting Cycle: The eight steps of the accounting cycle include the following: Step 1: Identify Transactions The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company’s books. Recordkeeping is essential for recording all types of transactions. Many companies will use point of sale technology linked with their books to record sales transactions. Beyond sales, there are also expenses that can come in many varieties. Step 2: Record Transactions in a Journal The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine steps one and two, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind that accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale. Cash accounting requires transactions to be recorded when cash is either received or paid. Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement. With double-entry accounting, each transaction has a debit and a credit equal to each other. Single-entry accounting is comparable to managing a checkbook. It gives a report of balances but does not require multiple entries. Step 3: Posting Once a transaction is recorded as a journal entry, it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities by account. This allows a bookkeeper to monitor financial positions and statuses by account. One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available. The ledger used to be the gold standard for recording transactions but now that almost all accounting is done electronically, the ledger is less of an active concern as all transactions are automatically logged. Step 4: Unadjusted Trial Balance At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance tells the company its unadjusted balances in each account. The unadjusted trial balance is then carried forward to the fifth step for testing and analysis. This is the first step that takes place once the accounting period has ended and all transactions have been identified, recorded, and posted to the ledger (this is usually done electronically and automatically, but not always).1 The purpose of this step is to ensure that the total credit balance and total debit balance are equal. This stage can catch a lot of mistakes if those numbers do not match up. Step 5: Worksheet Analyzing a worksheet and identifying adjusting entries make up the fifth step in the cycle. A worksheet is created and used to ensure that debits and credits are equal. If there are discrepancies, then adjustments will need to be made. In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting. Step 6: Adjusting Journal Entries In the sixth step, a bookkeeper makes adjustments. Adjustments are recorded as journal entries where necessary. Step 7: Financial Statements After the company makes all adjusting entries, it then generates its financial statements in the seventh step. For most companies, these statements will include an income statement, balance sheet, and cash flow statement. Step 8: Closing the Books Finally, a company ends the accounting cycle in the eighth step by closing its books at the end of the day on the specified closing date. The closing statements provide a report for analysis of performance over the period. After closing, the accounting cycle starts over again from the beginning with a new reporting period. Closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks. 3. Trial Balance Definition: A trial balance often gets confused with a balance sheet or an income statement. So what is a trial balance? According to Investopedia, it is an in-house report, usually in the form of a spreadsheet, generated at the end of every accounting period. The main purpose of a trial balance is to ensure that the list of credit and debit entries in a general ledger are mathematically correct. 7 Importance of Trial Balance: Hence, for checking the accuracy of ledger postings, a statement of the trial balance is prepared. Trial Balance is important because of the following points: 1. Checking Arithmetical Accuracy: The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books, sales books, cash books, etc. Trial Balance, aside from general ledger accounts, is also useful to check the accuracy of special-purpose accounting books. 2. Assist in Preparing Financial Statements: Profit and Loss Account, Balance Sheet, and Cash Flow Statement must be prepared at the end of each accounting year. The balances of all the ledger accounts used to prepare financial statements are already available in the trial balance. Hence, it makes the preparation and analysis of financial statements easier. 3. Assist in Rectifying errors: The debit total of the trial balance must equal to credit total of the trial balance. This checks the arithmetical accuracy of ledger postings. If this does not happen, it will make the accountant find and rectify the error. Accountants, therefore, feel relieved when the trial balance debit totals and credit totals match. 4. Assist in Adjustments: Adjustment accounts like prepaid expenses, outstanding liabilities, closing stock, etc., need to be prepared during the preparation of the trial balance. This assists in making adjustments only relevant to the current accounting year. Businesses prepare adjustment accounts generally at the end of the accounting year. However, there is no restriction to open these adjustment accounts as they occur. 5. Assist in Comparative Analysis: Preparation of Trial Balance helps to compare balances of the current year with past year balances and peer analysis. This helps the business to make important decisions regarding income, expenses, production costs, etc. It helps to recognize the trend in the business and take action wherever necessary. 6. Assist in preparation of Audit Reports: Trial Balance helps the auditors to locate the entries in the original books of accounts. Basically, the audit trail is what auditors need to audit, and this is what trial balance provides. Auditors are then able to comment on the preparation of financial statements in their audit report. 7. Assist in Decision Making regarding budget: As we have seen above, trial balance helps compare ledger balances with the past balances. Such comparison helps the management to create a trend regarding the performance of the business. After analyzing the comparisons, the financial budget can be prepared for the upcoming accounting periods to assist the management. 4. Adjusting entries: Adjusting entries are accounting journal entries made at the end of the accounting period after a trial balance has been prepared. After you make a basic accounting adjusting entry in your journals, they’re posted to the general ledger, just like any other accounting entry. But why do you need to use adjusting entries? Let’s find out. Calendar Year: A calendar year is a one-year period that begins on January 1 and ends on December 31, based on the commonly-used Gregorian calendar. For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally comprises all of the year's financial information used to calculate income tax payable. Fiscal Year: A fiscal year is a one-year period that companies and governments use for financial reporting and budgeting. A fiscal year is most commonly used for accounting purposes to prepare financial statements. Although a fiscal year can start on Jan. 1 and end on Dec. 31, not all fiscal years correspond with the calendar year. For example, universities often begin and end their fiscal years according to the school year. 5. Accrual Accounting Under this method, revenue is accounted for when it is earned. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. In other words, money is accounted for before it's received. Likewise, expenses for goods and services are recorded before any cash is paid out for them. Cash Basis Accounting Under this method, revenue is reported on the income statement only when cash is received. Expenses are recorded only when cash is paid out. The cash method is typically used by small businesses and for personal finances. Revenue Recognition Principle: The revenue recognition principle states that you should only record revenue when it has been earned, not when the related cash is collected. For example, a snow plowing service completes the plowing of a company's parking lot for its standard fee of $100. It can recognize the revenue immediately upon completion of the plowing, even if it does not expect payment from the customer for several weeks. This concept is incorporated into the accrual basis of accounting. A variation on the example is when the same snow plowing service is paid $1,000 in advance to plow a customer's parking lot over a four-month period. In this case, the service should recognize an increment of the advance payment in each of the four months covered by the agreement, to reflect the pace at which it is earning the payment. Full Disclosure Principle: Full disclosure principle refers to the concept that suggests that a business should report all the necessary information in their financial statements, so that the users who are able to read the financial information are in a better position to make important decisions regarding the company. Full disclosure is especially beneficial for creditors and investors. The disclosing of financial information helps in decision making. The information is readily available to investors and creditors in the financial statements or as a note in the end of the financial statements. A company can have various stakeholders which include creditors, suppliers, customers, investors, etc who use the financial information for deciding on the course of action to be taken regarding their stance in the business. Since, the external users of financial information lack any kind of information on how business is run, the full disclosure principle makes it easier to determine how a company is functioning. 6. 10 Steps of Accounting Cycle are: 1. Analyzing and Classify Data about an Economic Event. 2. Journalizing the transaction. 3. Posting from the Journals to General Ledger. 4. Preparing the Unadjusted Trial Balance. 5. Recording Adjusting Entries. 6. Preparing the Adjusted Trial Balance. 7. Preparing Financial Statements. 8. Recording Closing Entries. 9. Preparing a Closing Trial Balance. 10. Recording Reversing Entries. Analyzing and Classify Data about an Economic Event Identifying the transactions from the events is the first step in the accounting process. Events are analyzed to find the impact on the financial position or to be more specific the impacts on the accounting equation. Documents such as; a receipt, an invoice, a depreciation schedule, and a bank statement, etc. provide evidence that an economic event has actually occurred. Journalizing the transaction Transactions having an impact on the financial position of a business are recorded in the general journal. In the general journal, the transactions are recorded as a debit and a credit in monetary terms with the date and short description of the cause of the particular economic event. Posting from the Journals to the General Ledger Transactions recorded in the general journal are then posted to the general ledger accounts. The accounts classify accounting data into certain categories and they are recorded in general journal entries according to that classification. Preparing the Unadjusted Trial Balance To determine the equality of debits and credits as recorded in the general ledger, an unadjusted is prepared. It is a way to investigate and find the fault or prove the correctness of the previous steps before proceeding to the next step. Unadjusted trial balance makes the next steps of the accounting process easy and provides the balances of all the accounts that may require an adjustment in the next step. The unadjusted balance sheet is for internal use only. Recording Adjusting Entries Adjusting entries ensure that the revenue recognition and matching principles are followed. To find the revenues and expenses of an accounting period adjustments are required. Adjusting entries are required to be is because a transaction may have influence revenues or expenses beyond the current accounting period and to journalize to the events that not yet recorded. Preparing the Adjusted Trial Balance An adjusted trial balance contains all the account titles and balances of the general ledger which is created after the adjusting entries for an accounting period have been posted to the accounts. It is an internal document and is not a financial statement. It helps to create the income statement and balance sheet and provide enough information for preparing the cash flow statement. Preparing Financial Statements Financial statements are prepared from the balances from the adjusted trial balance. The financial statements are made at the very last of the accounting period. Cash flow statement, income statement, balance sheet and statement of retained earnings; are the financial statements that are prepared at the end of the accounting period. This is the output of the accounting process, which is used by the interested parties both within and out of the organization. Recording Closing Entries At the end of an accounting period, Closing entries are made to transfer data in the temporary accounts to the permanent balance sheet or income statement accounts. Transferring the balances of the temporary accounts or nominal accounts (e.g. revenue, expense, and drawing accounts) to the owner’s equity or retained earnings account is used because these types of accounts only affect one accounting period. Preparing a Closing Trial Balance To make sure that debits equal credits, the final trial balance is prepared. As the temporary ones have been closed only the permanent accounts appear on the closing trial balance to make sure that debits equal credits. Recording Reversing Entries Posit closing entries is an optional step of the accounting cycle. A reversing journal entry is recorded on the first day of the new period for avoiding double counting the amount when the transaction occurs in the next period. Current Liability: A current liability is an obligation that is payable within one year. The cluster of liabilities comprising current liabilities is closely watched, for a business must have sufficient liquidity to ensure that they can be paid off when due. All other liabilities are reported as long-term liabilities, which are presented in a grouping lower down in the balance sheet, below current liabilities. In those rare cases where the operating cycle of a business is longer than one year, a current liability is defined as being payable within the term of the operating cycle. The operating cycle is the time period required for a business to acquire inventory, sell it, and convert the sale into cash. In most cases, the one-year rule will apply. Since current liabilities are typically paid by liquidating current assets, the presence of a large amount of current liabilities calls attention to the size and prospective liquidity of the offsetting amount of current assets listed on a company's balance sheet. Current liabilities may also be settled through their replacement with other liabilities, such as with short-term debt. Long-Term Liabilities: Long-term liabilities are financial obligations of a company that are due more than one year in the future. The current portion of long-term debt is listed separately to provide a more accurate view of a company's current liquidity and the company’s ability to pay current liabilities as they become due. Long-term liabilities are also called long-term debt or noncurrent liabilities. Long-term liabilities are listed in the balance sheet after more current liabilities, in a section that may include debentures, loans, deferred tax liabilities, and pension obligations. Long-term liabilities are obligations not due within the next 12 months or within the company’s operating cycle if it is longer than one year. A company’s operating cycle is the time it takes to turn its inventory into cash. An exception to the above two options relates to current liabilities being refinanced into longterm liabilities. If the intent to refinance is present and there is evidence that the refinancing has begun, a company may report current liabilities as long-term liabilities because after the refinancing, the obligations are no longer due within 12 months. In addition, a liability that is coming due but has a corresponding long-term investment intended to be used as payment for the debt is reported as a long-term liability. The long-term investment must have sufficient funds to cover the debt. 7. Capital Expenditure: Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company. Making capital expenditures on fixed assets can include repairing a roof, purchasing a piece of equipment, or building a new factory. This type of financial outlay is made by companies to increase the scope of their operations or add some economic benefit to the operation. Revenue Expenditure: Revenue expenditures are short-term expenses that are also known as revenue expenses and operational expenses (OPEX). Revenue expenditure is generally spoken to in relation to fixed assets as it records the expenses which have occurred in connection to a fixed asset. For example, if you have a piece of equipment that requires monthly maintenance then the expense will be termed under revenue expenditure. It involves all costs that are required for the successful running of a business such as salaries for employees and property taxes. Revenue expenditure is recorded during an accounting period or a single year. Factors in Computing Depreciation: Three factors affect the computation of depreciation: 1.Cost.Earlier, we explained the issues affecting the cost of a depreciable asset. Recall that companies record plant assets at cost, in accordance with the cost principle. 2.Useful life. Useful life is an estimate of the expected productive life, also called service life, of the asset. Useful life may be expressed in terms of time, units of activity (such as machine hours), or units of output. Useful life is an estimate. In making the estimate, management considers such factors as the intended use of the asset, its expected repair and maintenance, and its vulnerability to obsolescence. Past experience with similar assets is often helpful in deciding on ex-pected useful life. We might reasonably expect Rent-A-Wreck and Avisto use different estimated useful lives for their vehicles. 3.Salvage value. Salvage value is an estimate of the asset’s value at the end of its useful life. This value may be based on the asset’s worth as scrap or on its expected trade-in value. Like useful life, salvage value is an estimate. In making the estimate, management considers how it plans to dispose of the asset and its experience with similar assets. Depletion: Depletion is an accrual accounting technique used to allocate the cost of extracting natural resources such as timber, minerals, and oil from the earth. Like depreciation and amortization, depletion is a non-cash expense that lowers the cost value of an asset incrementally through scheduled charges to income. Where depletion differs is that it refers to the gradual exhaustion of natural resource reserves, as opposed to the wearing out of depreciable assets or aging life of intangibles. Amortization: Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. Concerning a loan, amortization focuses on spreading out loan payments over time. When applied to an asset, amortization is similar to depreciation. Patent: A patent is the granting of a property right by a sovereign authority to an inventor. This grant provides the inventor exclusive rights to the patented process, design, or invention for a designated period in exchange for a comprehensive disclosure of the invention. They are a form of incorporeal right. Government agencies typically handle and approve applications for patents. In the United States, the U.S. Patent and Trademark Office (USPTO), which is part of the Department of Commerce, handles applications and grants approvals. Copyright: Copyright refers to the legal right of the owner of intellectual property. In simpler terms, copyright is the right to copy. This means that the original creators of products and anyone they give authorization to are the only ones with the exclusive right to reproduce the work. Copyright law gives creators of original material the exclusive right to further use and duplicate that material for a given amount of time, at which point the copyrighted item becomes public domain. Trademark: The term trademark refers to a recognizable insignia, phrase, word, or symbol that denotes a specific product and legally differentiates it from all other products of its kind. A trademark exclusively identifies a product as belonging to a specific company and recognizes the company's ownership of the brand. Trademarks are generally considered a form of intellectual property and may or may not be registered.