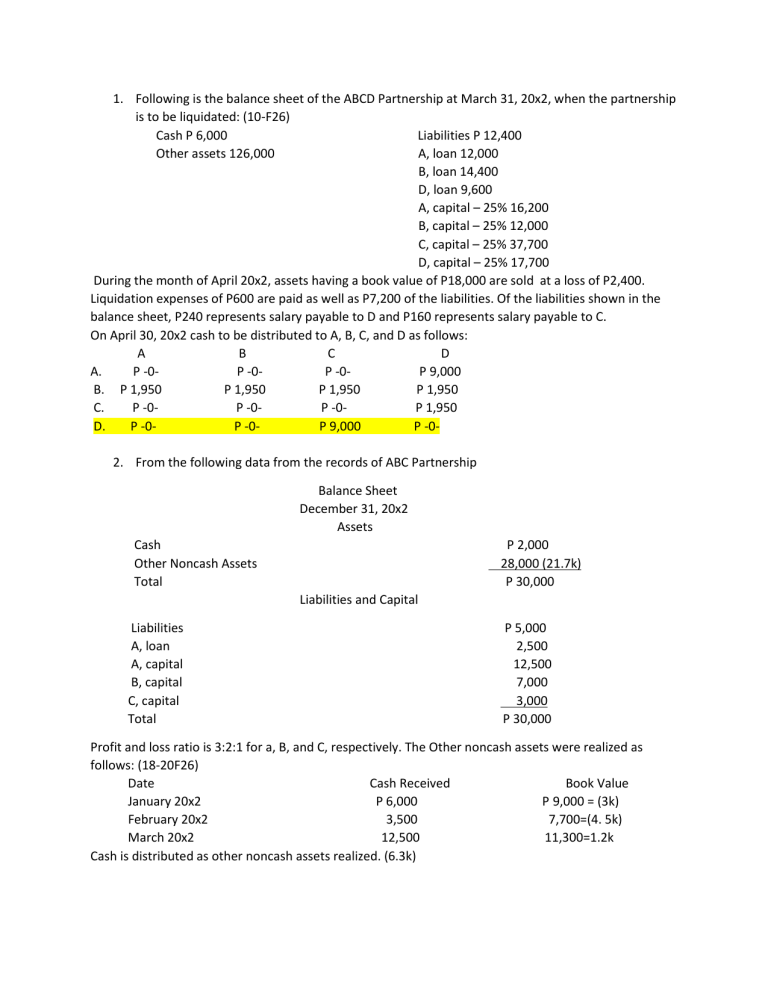

1. Following is the balance sheet of the ABCD Partnership at March 31, 20x2, when the partnership is to be liquidated: (10-F26) Cash P 6,000 Liabilities P 12,400 Other assets 126,000 A, loan 12,000 B, loan 14,400 D, loan 9,600 A, capital – 25% 16,200 B, capital – 25% 12,000 C, capital – 25% 37,700 D, capital – 25% 17,700 During the month of April 20x2, assets having a book value of P18,000 are sold at a loss of P2,400. Liquidation expenses of P600 are paid as well as P7,200 of the liabilities. Of the liabilities shown in the balance sheet, P240 represents salary payable to D and P160 represents salary payable to C. On April 30, 20x2 cash to be distributed to A, B, C, and D as follows: A B C D A. P -0P -0P -0P 9,000 B. P 1,950 P 1,950 P 1,950 P 1,950 C. P -0P -0P -0P 1,950 D. P -0P -0P 9,000 P -02. From the following data from the records of ABC Partnership Balance Sheet December 31, 20x2 Assets Cash Other Noncash Assets Total P 2,000 28,000 (21.7k) P 30,000 Liabilities and Capital Liabilities A, loan A, capital B, capital C, capital Total P 5,000 2,500 12,500 7,000 3,000 P 30,000 Profit and loss ratio is 3:2:1 for a, B, and C, respectively. The Other noncash assets were realized as follows: (18-20F26) Date Cash Received Book Value January 20x2 P 6,000 P 9,000 = (3k) February 20x2 3,500 7,700=(4. 5k) March 20x2 12,500 11,300=1.2k Cash is distributed as other noncash assets realized. (6.3k) 1. The total loss on liquidation to A is: A. P3,000 C. P1,000 B. P2,000 D. P 0 2. Total cash received by B is: A. P 0 B. P1,500 C. P2,000 D. P5,000 3. Cash received by C in January is: A. P 0 B. P 200 C. P 500 D. P1,000