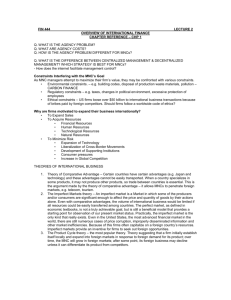

The world has become a single entity – global entity Globalization, WTO, GATT, mutual trade agreements etc has removed almost all barriers in trade and commerce Trade and commerce has become more international than the past We consume more goods produced in countries and are familiar to commodities and brands of other nations than that of our country Free flow of goods, services, funds in the world People are ready to invest in any part of the world A separate and new discipline, developed recently It is the management of international finance Concerned with the management of international business related financial function, commonly, known as international financial function MULTINATIONAL CORPORATIONS (MNC) Firms engaged in international trade can be called by different names , viz., International firms Multinational firms and Transnational firms International Firms :Firms engaged in cross border activities of import and export Goods produced in country are exported to other countries and vice versa Financial operations of such firms are limited to receiving and paying of the sales proceeds across the national frontiers / boundaries Multinational Firms Growth and expansion of international firms compel them to move more closer to the customers Set up factories and other production operations both at home and aboard, Such firms are known as MNCs MNCs carryout some of their productions operations or activities abroad by establishing presence in foreign countries through subsidiaries or joint ventures Financial operations become complex – subsidiaries deals with different currencies, which are liable to high risk (political / valuation etc) An MNC is considered to belong one country “home country” and has its operations aboard – two identities “HOME” ,“ABROAD” MNC is “ a firm having a substantial portion of its operation and assets deployed in different countries” Transnational companies Further, expansion leads to reduce the gap between the “home” and “abroad” It becomes difficult to identify which country is “home” and which is “abroad”. Such companies are known as transnational companies What is IFM? IFM is the process of making financial decisions pertaining to the foreign business in such a way as to maximize the value of the firm and its stock owners These decisions include decisions regarding Acquisition of funds (financing decisions) Deployment (utilization) of funds (investment decisions) Dividend/retentions (dividend) decisions Firm has to take apt/judicious decisions to achieve the objectives of the firm. All the above decisions are made by a domestic manager also In addition to the functions performed by a domestic finance manager, an international finance manger has to deal with several factors like Exchange rates, inflation risks, international difference in tax rates, multiple money markets with limited access, currency controls, exchange controls, political risk etc. Socio-cultural factors(religious, ethnic groups) “The management of whole gamut (aspects) of financial operations relating to international activities of organizations” It includes, expansion of business to foreign countries, setting up of plants and factories abroad, investing in another company, acquisition of business in foreign countries etc -include, import, export, financing subsidiaries, dividend distribution -In other words all financial activities which involve foreign exchange. “is the process of making financial decisions pertaining to foreign business in such a way as to maximize the value of the firm and its stock owners” Scope is very wide Includes the scope of domestic financial management and a variety of other activities A domestic financial manager has to take three major decisions (perform three major functions) Financing decisions (financing faction) Investment decisions (investment functions) Dividend decision (dividend function) In addition to these functions, a international financial manger has to deal with different aspects of foreign trade and exchange, balance of payments, international financial markets, international financial institutions etc. Decision making the most important function I. Investment decisions Related with investment / deployment of funds in fixed assets and current assets or capital expenditure and working capital management In investment decision, he has to decide, what type or types assets are to be acquired, risks involved in the acquisition of assets In MNC, the International Finance manager’s responsibility is to identify and exploit profitable opportunities for long term investment Survival and growth of MNC depends upon investment decisions Has to employ capital budgeting techniques like NPV, IRR Specific feature is investment in foreign countries and parent or subsidiary companies etc. In addition to profitability Though the subsidiary company may have made profits and due to the parent company. But the entire profits due cannot be transferred to the parent company due to the restrictions imposed by the host country or foreign country The parent company make several charges for different kinds of services. This is an income to the parent company but an expense to the subsidiary company Exchange rate variations / oscillations affect the amount paid and received. A subsidiary company in a country with high inflation rate might have made good profits, but it becomes less when paid to the home country of the parent company In addition to these, various kinds of risks involved need to be considered Exchange rate risk, political risk, interest rate risk, tax rate difference Financing Decision Financing decision is concerned with determining the source and quantum of funds to be raised from different sources Different sources – different kinds of securities Depend on several factors like, capital market conditions, attitude of investors, legal, political economic and social environments In addition to the above general factors in international financing and MNCs, different kinds of risks, such as exchange rate risk, interest difference, govt. subsidies etc Financing decision is concerned with determination of capital structure and tapping of different sources of funds Multinationals can raise funds from different countries, may plough back of profits earned from different subsidiaries may list securities in different stock exchanges of different countries Though there are different sources, the manager has to consider different factors Dividend Decision Dividend payout ratio is very important Affect several factors in different countries – tax rate, exchange control and regulations, double taxation, tax avoidance agreements etc. Free flow of capital between parent and subsidiary companies in different countries are also affected by legal restrictions and regulations and bi-lateral agreements Managing Working Capital Optimal working capital is to be maintained for smooth operations of the business. Adequate working capital is essential for survival, growth and expansion of the entity To meet current obligations Maintain proper equilibrium between cash inflows and outflows, through proper time planning To maintain optimum levels of cash to minimize idle cash flows The above functions are performed both domestic and international finance manager In addition to the above functions:He has to consider availability of specific currency and exchange rate risks and variations Wide geographical dispersion of the operation of MNCs having several subsidiaries in different countries make co-ordination of financial aspects difficult. Thus, to co-ordinate, different costs are necessary (carrying costs and transfer costs of surplus funds). Has to try these costs to the minimum While transferring funds from one country to another country special cares are to be taken – Govt. restrictions, regulations, exchange variations, risk variations etc Inflation rates of different countries Inter-firm transfer should be considered to minimum costs, cost effective Controlling Financial Activities An MNC constitutes different entities in the form of parent – subsidiaries at different regions Both parent and subsidiary companies spend money The IF Manager has to control and co-ordinate overall financial activities, which requires special control system May adopt any of the following controlling system or approaches Approaches for controlling financial activities The local level manager is given full responsibility of spending and his achievements are evaluated by the parent company through profits earned The responsibility of financing is left to the parent company and the local manager is evaluated only in terms of operating profit However, many MNCs follow middle path – depends upon the philosophy of top level managers, laws and regulations of both the countries, competency level of managers Estimating, Evaluating And Minimizing Risk Domestic companies face two major kinds of risk Business risk an financial risk MNCs, are exposed to additional risks, like Political risk and Exchange rate risk Political Risk : arise from political factors – different countries have different political setups – political changes will lead to changes in policies and international relations and international trade - might be a great blow or impetus Exchange Rate Risk : Constant flow of funds between parent and subsidiaries in different countries – different ways – profit, capital, royalty etc. these fund transfers are influenced by exchange rates Role of International Financial Manager Forecasting of financial environment – Prices – inflation rates – interest rates – and exchange rates of different countries Management of assets From cash management to international capital budgeting, at home and abroad, both in domestic countries and foreign countries Management of liabilities Borrowing relationship and decisions in domestic and foreign countries and markets – short term and long term Exchange risk management – Measuring the effect of exchange rate risk on balance sheet, income, cash flows, and manage these risks Performance evaluation and control Accounting for outsiders and to the management, tax authorities etc to meet the requirements of both domestic and foreign countries Identifying global investment opportunities Assessing national and international capital and debt market conditions to increase financial resources Establishing ethical and healthy corporate practices and governance, adhere to the laws and regulations of different countries Forecast exchange rate behavior Devising suitable hedging strategies to cover exchange rate risk, political risk, inflations risk etc. Responsibilities of International Financial Manager The important responsibility of an IFM is to enable the corporation to cope up with the changes and challenges in the financial markets – both at the domestic and international Assess the financial environmental changes: Financial environments change and may create threat or provide opportunities to the organization ( financial and taxation policies, foreign policies, credit policies, interest rates, foreign exchange rates, money market and capital market conditions) He has to monitor assess and evaluate the changes. Analyze the changes: he has to analyze the changes by studying the inter-relationship between different variables in the environment and corporate responses. Responses of his firm as well as that of competitors (Eg. Effect stock market crash) Equip the firm to adapt to the environmental challenges and changes (through product diversification – mergers, acquisition etc) Analyze and evaluate past failures and try to prevent their recurrences Design and implement effective solutions to take advantage of opportunities offered by the markets Challenges faced by international financial manager Firm is an entity and a social system with own environment Environmental changes affect Recent changes in the socio-economic and political environments create challenges Globalization and liberalization is rampant Almost all countries in the world are liberalized and globalized – absence of control and regulations in economic activities, including flow of capital The world has become more or less a single financial market A small movement, change in financial factors in any corner of the world will affect their entire international financial system. Political uncertainties, social unrest in the world affect, international relations and trade relations as well as flow of funds Inflation, revaluation, corruption, etc Difference in culture, believes and values followed by different countries, culture and cultural transformation Difference in attitude about returns expected from investment An international financial manager has to be aware of all these. 1. Exposure to Foreign Currency 2. Exchange Rate 3. Different instruments are used in IFM 4. Wealth Maximization 5. Micro/Macro Business Environment 6. Legal & Tax Environment 7. Different group of stakeholders 8. FOREX derivatives (Options, Futures, Swaps, Hedging) 9. Different standards of reporting 10. Capital Management 11. PESTEL