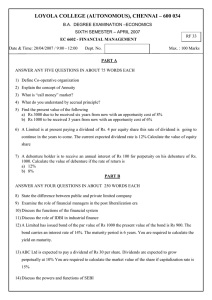

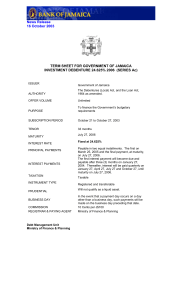

BUSN 7008 FINANCIAL STATEMENTS & REPORTING Lecturer: Dr. Lijuan (Lily) Zhang Week 6: Accounting for non-current liabilities & Financial Statement Analysis (Textbook Chapter12 &18) 1 NON-CURRENT LIABILITIES AND DEBENTURES PAYABLE (Chapter 12) LEARNING OBJECTIVES 1. Unsecured notes payable & mortgages payable 2. Describe debentures payable: their different types, prices and interest rates 3. Measure interest expense, and account for premiums and discounts on debentures, using the straight-line amortisation method UNSECURED NOTES PAYABLE AND MORTGAGES PAYABLE Unsecured notes are borrowings that are not secured by any legal charge over the assets of the borrower They are often repayable in instalments Mortgages payable are long-term debts that are backed with a legal charge (a mortgage) over land (real estate or real property in legal language) The mortgage will state that the borrower promises to transfer the legal title to the property if the mortgage is not paid on schedule Like long-term notes payable, the total mortgage payable amount will have a portion due within one year (current) and a portion that is due more than one year from a specific date UNSECURED NOTES PAYABLE AND MORTGAGES PAYABLE The principal portion of the total mortgage payable that is due within one year is current. To calculate the amount of each payment to apply to the mortgage payable and how much is interest expense, we create an amortisation schedule An amortisation schedule details each loan payment’s allocation between principal and interest Example: Assume on 31 December 2020 , Smart Touch Purchases land and a building for $150000, paying $49925 in cash and signing a $100075, 6%, 30-year mortgage payable that requires $600 monthly payments, which include principal and interest, beginning on 31 January 2021. Smart Touch determined that $40000 of the purchase price of $150 000 was allocated to the land and $110000 was allocated to the building. Dec 31 Dr. Building 110 000 Land 40 000 Cr. Mortgage payable Cash 100075 49925 Journal entries to record the first mortgage payment Jan 31, 2021 Dr. Interest expense ($100 075 × 0.06 × 1/12) (E+) Mortgage payable ($600.00 – $500.38) (L–) Cr. Cash (A–) 500.38 99.62 600.00 DEBENTURES: AN INTRODUCTION • Debentures (sometimes called bonds payable) are borrowings from multiple lenders, called debenture holders • Under the Australian Corporations Act 2001, the term ‘debenture’ may be used only to describe loans secured by a legal charge over assets of the borrower – If the loan is secured by a mortgage over land, the description – mortgage debenture can be used If the loan is not secured by a legal charge (or mortgage), it is an unsecured loan • There are two main types of debenture – Term debentures (the most common type) all mature at the same – specified time Serial debentures mature in instalments at regular intervals DEBENTURES: AN INTRODUCTION Each debenture holder receives a debenture certificate that shows the name of the company that borrowed the money The certificate states the principal, which is the amount borrowed (also called maturity value, face value or par value) The company must then pay each debenture holder the principal amount at a specific future date, called the maturity date The debenture certificate states the interest rate (stated interest rate or nominal interest rate) that the company will pay and the dates the interest is due 8 DEBENTURE PRICES A debenture can be issued at any price agreed upon by the issuer and the debenture holders There are three basic categories of debenture prices Maturity (or par or face) value A discount, a price below maturity (par) value A premium, a price above maturity (par) value The issue price of a debenture does not affect the required payment at maturity As a debenture approaches maturity, its market price moves towards maturity value PRESENT VALUE Money earns income over time, a fact called the time value of money The amount that a person would invest at the present time is called the present value. The present value is the debenture’s market price DEBENTURE INTEREST RATES Debentures are sold at their market price, which is the present value of the interest payments the debenture holder will receive while holding the debenture plus the debenture principal paid at the end of the debenture’s life Market price (present value)= PV(of interest payments ) + PV of the principal amount. Two interest rates work together to set the price of a debenture The stated interest rate determines the amount of cash interest the borrower pays each year, and does not change The market interest rate (effective interest rate) is the rate that investors demand to earn for lending their money, and varies constantly DEBENTURE INTEREST RATES Interaction of the stated interest rate and the market interest rate to determine the price of a debenture ISSUING DEBENTURES AT MATURITY (PAR) VALUE Smart Touch issues $1 00, 000 of 9%, five-year debentures that pay interest halfyear at maturity (par) value on 1 Jan. 2021. To record the issue (one-time Journal entry) Date Account title Dr 2021 Jan 1 Cash (A+) 100 000 Debentures payable (L+) Cr 100 000 Issued debentures. To record payments of half-yearly interest at 9% 2021 Jun 30 Interest expense ($100 000 × 0.09 × 6⁄12) (E+) Cash (A–) Paid half-yearly interest. 4 500 4 500 ISSUING DEBENTURES AT MATURITY (PAR) VALUE To record payments of the debentures at maturity ( in 5 years’ time) Date Account title Dr Debentures payable (L–) 100,000 Cr 2026 Jan 1 Cash (A–) Repaid debentures at maturity. 100,000 ISSUING DEBENTURES AT A DISCOUNT Smart Touch issues $100, 000 of its 9%, five-year debentures that pay interest halfyear when the market interest rate is 10% on Jan 1, 2021. The market price of the debenture drops to 96.149, which means 96.149% of par value. Date Account title Dr 2021 Jan 1 Cash ($100 000 × 0.96149) (A+) 96 149 Discount on debentures (CL+) 3 851 Debentures payable (L+) 100 000 Issued debentures at a discount. Note: CL = contra liability account Carrying amount of the debentures Non-current liabilities: Debenture payable Less: Discount on debenture $100 000 (3 851) Cr $96 149 ISSUING DEBENTURES AT A DISCOUNT Smart Touch issues $100, 000 of its 9%, five-year debentures that pay interest halfyear when the market interest rate is 10% on Jan 1, 2021. The market price of the debenture drops to 96.149, which means 96.149% of par value. Date Account title Dr 2021 Jan 1 Cash ($100 000 × 0.96149) (A+) 96 149 Discount on debentures (CL+) Debentures payable (L+) Cr 3 851 100 000 Issued debentures at a discount. The company borrowed $96,149 but must pay $100,000 when the debentures mature 5 years later The discount is additional interest expense for the company, and raises its true interest expense on the debentures to the market interest rate ISSUING DEBENTURES AT A DISCOUNT A debenture discount can be amortised by dividing it into equal amounts for each interest period (in this case, half-yearly payments for 5 years = 10 interest periods) To record interest and straight-line amortisation of the debenture discount: Date Account title Dr Cr 2021 Jun 30 Interest expense (E+) Cash ($100 000 × 0.09 × 6/12) (A–) Discount on debentures (3,851 × 1/5 years × 6/12) (CL–) Paid half-yearly interest and amortised discount. 4,885 4,500 385 ISSUING DEBENTURES AT A DISCOUNT The Discount on debentures account has a debit balance, and is credited to amortise (reduce) its balance Ten amortisation entries will reduce the account’s balance to zero and the carrying amount of the debentures will be $100,000 at maturity To redeem the debenture at maturity, Date Account title Dr Cr 2026 Jan 1 Debentures payable (L–) Cash (A–) Repaid debentures at maturity. 100,000 100,000 ISSUING DEBENTURES AT A PREMIUM Smart Touch issues $100 000 of its 9%, five-year debentures that pay interest halfyear when the market interest rate is 8% on Jan 1, 2021 The debentures are priced at 104.1 (104.1% of maturity value). To record the issue of the debentures: Date Account title Dr Cash ($100,000 × 1.041) (A+) 104,100 Cr 2021 Jan 1 Debentures payable (L+) Premium on debentures (AL+) Issued debentures at a premium. Note: AL = Adjunct liability account Adjunct accounts are related accounts that have the same normal balance and which are reported together on the balance sheet. 100,000 4,100 Issuing debentures at a premium Carry amount of debenture payable Non –current liabilities: Debentures payable $100 000 Plus: Premium on debentures 4 100 $104 100 The premium cuts the cost of borrowing and reduces the company’s interest expense to the market rate The company has borrowed $104,100 but must only pay back $100,000 at maturity 20 ISSUING DEBENTURES AT A PREMIUM Smart Touch issues $100 000 of its 9%, five-year debentures that pay interest halfyear when the market interest rate is 8% on Jan 1, 2021 The debentures are priced at 104.1 (104.1% of maturity value). Date Account title Dr Cr Jan 1,2021 Cash ($100,000 × 1.041) (A+) 104,100 Debentures payable (L+) 100,000 Premium on debentures (AL+) 4,100 Issued debentures at a premium. To record interest and straight-line amortisation of the premium: Jun 30,2021 Interest expense (E+) Premium on debentures ($4,100 × 1/5 years × 6/12) (AL–) Cash ($100 000 × 0.09 × 6⁄12) (A–) 4,090 410 4,500 Paid interest and amortised premium. At maturity, the debenture premium has been fully amortised and the debenture’s carrying amount (which the company must repay) will again be $100,000 SUMMARY: CHAPTER 12 Mortgages payable are long-term debts that are backed by a legal charge (a mortgage) over land Debentures (sometimes called bonds payable) are borrowings from multiple lenders A debenture can be issued at any price agreed upon by the issuer and the debenture holders Investors are generally interested in the present value of their investment LECTURE 6 (CONTINUED) Financial Statement Analysis (Textbook Chapter 18) 23 LEARNING OBJECTIVES 1. 2. 3. 4. 5. Perform a horizontal analysis of financial statements Perform a vertical analysis of financial statements Prepare and use common-size financial statements Calculate and evaluate the standard financial ratios Analyse the non-financial elements of a company annual report FINANCIAL ANALYSIS Financial analysis of companies covers at least two periods, and typically examines trends over three to five years Analytical tools allow: Small-business owners to measure performance Financial analysts to analyse share investments Auditors to assess a company’s financial health Creditors to determine credit risk Any other person to compare financial data in relevant terms FINANCIAL ANALYSIS • Comparisons can be made: – from year to year – with a competing company – with the industry as a whole • There are three main ways to analyse financial statements --horizontal analysis – vertical analysis – financial ratio analysis HORIZONTAL ANALYSIS The study of percentage changes in comparative statements is called horizontal analysis It provides a year-to-year comparison of a company’s performance in different periods; it compares one year with the next Two steps to calculate percentage change: Step 1: Calculate the dollar amount of the change from the earlier period to the later period Step 2: Divide the dollar amount of change by the earlier period (base period) amount TREND ANALYSIS Trend analysis is a form of horizontal analysis Trend percentages indicate the direction a business is taking Trend analysis percentages are calculated by: -Selecting a base year, and setting the base year amounts equal to 100% -Expressing the amounts for each subsequent year as a percentage of the base amount (in $ millions) Net sales Trend percentages 2021 2020 2019 2018 2017 3,189 1,466 1,280 976 1,000 318.9% 146.6% 128% 97.6% 100% VERTICAL ANALYSIS Vertical analysis of a financial statement shows the relationship of each item to its base amount, which is the 100% figure Every other item on the statement is then reported as a percentage of that base Vertical analysis % Each income statement item/Revenues (net sales) 100 VERTICAL ANALYSIS 30 How do we compare one company with another? 31 HOW DO WE COMPARE ONE COMPANY WITH ANOTHER? Common-size statements are used to compare one company with another, regardless of company size A common-size statement reports only percentages—the same percentage that appear in a vertical analysis By only reporting percentages, it removes dollar value bias when comparing one company with another company Dollar value bias is the bias one sees from comparing numbers in absolute (dollars) rather than relative (percentage) terms HOW DO WE COMPARE ONE COMPANY WITH ANOTHER? Benchmarking is the practice of comparing a company with other leading companies It often uses the common-size percentages in a graphical manner to highlight differences Benchmarking against a key competitor and benchmarking against the industry average are the main types Graphical analysis highlights differences USING RATIOS TO MAKE DECISIONS A ratio expresses the relationship of one number to another number No single ratio tells the whole picture of any company’s performance Ratios may be classified as follows Evaluating the ability to pay current liabilities Evaluating the ability to sell inventory and collect receivables Evaluating the ability to pay long-term debt Evaluating profitability Evaluating shares as an investment Caroline wants you to write a report commenting on profitability, liquidity and financial position of the business after this first month of operations in comparison with the cleaning industry averages listed in the table below. ability to pay current liabilities Ability to pay Long-term debt Profitability Ratios Current Ratio Formula Current Assets Current Liabilities Industry Average 1.80 Debt-to-equity Ratio Total Liabilities Total Equity 0.25 Debt-to-assets Ratio Total Liabilities Total assets 0.20 Profit margin Net Profit Total Revenue 0.35 Rate of return on total assets Net Profit Total assets 0.3 Rate of return on total assets = (Profit before tax+ Interest expense) Average total assets 35 EVALUATING THE ABILITY TO PAY CURRENT LIABILITIES Working capital Current assets Current liabilities Working capital measures the ability to meet short-term obligations with current assets Two decision tools based on working capital data are the current ratio and the acid-test ratio EVALUATING THE ABILITY TO PAY CURRENT LIABILITIES The most widely used ratio is the current ratio, which is current assets divided by current liabilities Current ratio = Current assets / Current liabilities The current ratio measures a company’s ability to pay current liabilities with its current assets A high current ratio indicates that the business has sufficient current assets to maintain normal business operations An acceptable ratio depends on the industry. EVALUATING THE ABILITY TO PAY CURRENT LIABILITIES The acid-test ratio (or quick ratio) tells us whether the entity could pay all its current liabilities if they came due immediately Acid-test ratio = (Cash + Short-term investments + Net current receivables ) Current liabilities The norm for the acid-test ratio ranges from industry to industry EVALUATING THE ABILITY TO SELL INVENTORY AND COLLECT RECEIVABLES The inventory turnover ratio measures the number of times a company sells its average level of inventory during a year Inventory turnover = Cost of sales / Average inventory A high rate of turnover indicates ease in selling inventory Inventory turnover varies widely with the nature of the business Days in inventory ratio measures the average number of days inventory is held by the company Days in inventory = 365 days / Inventory turnover ratio EVALUATING THE ABILITY TO SELL INVENTORY AND COLLECT RECEIVABLES The accounts receivable turnover ratio measures the ability to collect cash from credit customers Accounts receivable turnover = Net credit sales Average net accounts receivable The higher the ratio, the faster the cash collections The days’ sales in receivables ratio also measures the ability to collect receivables Days’ sales in average accounts receivable = 365 days / Accounts receivable turnover ratio Days’ sales in receivables tell us how many days’ sales remain in Accounts receivable EVALUATING THE ABILITY TO PAY LONG-TERM DEBT Three key indicators of a business’s ability to pay non-current liabilities are the debt ratio, the debt to equity ratio, and the times-interest-earned ratio The debt ratio shows the proportion of assets financed with debt Debt ratio = Total liabilities / Total assets If the debt ratio is 1, then all the assets are financed with debt The debt to equity ratio shows the proportion of total liabilities relative to the proportion of total equity that is financing the company’s assets Debt to equity ratio = Total liabilities / Total equity EVALUATING THE ABILITY TO PAY LONG-TERM DEBT The times-interest-earned ratio relates profit before interest and taxes to interest expense Times-interest-earned ratio = (Profit before tax + Interest expense) Interest expense It measures the number of times profit before interest and taxes can cover (pay) interest expense A high interest-coverage ratio indicates ease in paying interest expense EVALUATING PROFITABILITY Gross profit percentage measures the percentage of each dollar of sales that results in gross profit Gross profit percentage = Gross profit / Net sales The rate of return on net sales ratio shows the percentage of each net sales dollar earned as profit Rate of return on net sales = Profit / Net sales EVALUATING PROFITABILITY The rate of return on total assets measures a company’s success in using assets to earn a profit Rate of return on total assets = (Profit before tax+ Interest expense) Average total assets EVALUATING PROFITABILITY The asset turnover ratio measures the amount of net sales generated for each average dollar of total assets invested Asset turnover ratio = Net sales / Average total assets This ratio measures how well a company is using its assets to generate sales revenues EVALUATING PROFITABILITY Earnings per share (EPS) is the amount of profit earned for each of the company’s outstanding ordinary shares Earnings per share = (Profit – Preference dividends) Number of ordinary shares outstanding Most companies strive to increase their EPS each year EVALUATING PROFITABILITY EVALUATING SHARE INVESTMENTS The price/earnings ratio (P/E) is the ratio of the market price of an ordinary share to the company’s earnings per share P/E ratio = Market price per ordinary share / Earnings per share It shows the market price of $1 of earnings FINANCIAL STATEMENT ANALYSIS – LIMITATIONS AND RED FLAGS Limitations: – Business decisions are made in a world of uncertainty – Short-term results may not be representative of the company’s performance over the long term – Analysis signals that something is wrong, but it doesn’t identify the problem or show how to correct it. Red flags in financial statement analysis: – Movement of sales, inventory and receivables – Earnings problems – Decreased cash flow – Too much debt – Inability to collect receivables – Build-up of inventories ANALYSIS OF NON-FINANCIAL DATA • The non-quantitative parts of the annual report may hold more important information than the financial statements – The chairman’s report may describe a turnover of top managers – The managing director’s report will reveal management’s opinion of the year’s results – Both the chairman’s report and the managing director’s report express the views of corporate insiders ANALYSIS OF NON-FINANCIAL DATA • The Corporations Act 2001 requires that all financial statements of public companies be audited by independent accountants – The auditor’s report may indicate a major problem with the company – The auditor’s opinion states whether the company’s statements give a true and fair view of the company’s financial position and performance, and comply with accounting standards – This is how investors gain assurance that they can rely on a company’s financial statements (P153 Independent auditor’s report, WOW 2021) SUMMARY Horizontal analysis allows a company to see the percentage change from one year to the next Vertical analysis shows the relationship of each item on the statement to a base amount Vertical analysis can be used to prepare common-size statements to compare companies with each other Ratio analysis is used to analyse financial statement data in various areas Annual reports also include non-financial information that provides an insight into a company