VALUATION OF COMMON

STOCK

A FEW MORE LESSONS

Dangers in Constant-Growth Formulas

•

•

•

•

NO FIRM IN REALITY HAVE A PERPETUAL GROWTH AT A FIXED RATE.

FIR’M PROFITABILITY ALSO DECREASES OVER TIME.

SO WITH RETURN ON EQUITY

FOR EXAMPLE, SUPPOSE A FIRM AT PRESENT HAVING 25% RoE, FACES A SUDDEN FALL IN ITS BY

10%. SO, NOW IT BECOMES 15%. NATURALLY ITS GROWTH RATE WOULD DRASTICALLY FALL.

• SAY IT WAS RETAINING EARLIER 80% OF ITS EQUITY EARNINGS WHEREAS NOW DUE TO FALL IN

BUSINESS GROWTH IT WOULD BE WISER TO RETAIN LESS FOR OBVIOUS REASONS. THUS IF IT

REATAINS 50% INSTEAD, THE g WOULD BE 0.5*0.15, or, 7.5%. IT’S A DRASTIC FALL( EARLIER g

WAS 0.8*0.25=20%).

• THEREFORE, IN SUCH CASES, IN REALITY, IT WOULD BE WISER TO USE GENERAL DCF FORMULA

FOR VAUATION AS FOLLOWS

Po=D1 /(1+r)+ D2/(1+r)^2+ D3/(1+r)^3+….+ Dn/(1+r)^n

EXAMPLE

Phoenix produces dividends in three consecutive years of

10, 12, and 14.40, respectively. The dividend in year 4 is

estimated to be 16.56 and should grow in perpetuity at

15%. Given a discount rate of 12%, what is the price of the

stock?TWO STAGE GROWTH MODEL.xlsx

The Link between Stock Price and Earnings Per Share

If a firm elects to pay a lower dividend and reinvest

the funds, the stock price may increase because

future dividends may be higher.

Payout Ratio.

• Ratio of dividends to earnings per share.

Retention Ratio.

• Fraction of earnings retained by the firm.

1

The Link between Stock Price and Earnings Per Share

Example

Our company forecasts to pay an ₹8.33 dividend next year,

which represents 100% of its earnings. This will provide

investors with a 15% expected return. Instead, we decide

to plow back 40% of the earnings at the firm’s current

return on equity of 25%. What is the value of the stock

before and after the plowback decision?

No Growth

Po= 8.33/0.15= ₹55.53

With Growth

g= 0.4*0.25 or .010

D1= 8.33*0.6=5

Po= (5/(0.15-0.10) = ₹100

2

PRESENT VALUE OF GROWTH OPPORTUNITIES (PVGO)

Example continued

If the company did not plow back some earnings,

the stock price would remain at ₹55.56. With the

plowback, the price rose to ₹100.00.

The difference between these two numbers is

called the present value of growth opportunities

(PVGO). And in this case, it would be:

PVGO= 100-55.53= ₹44.47

The Link between Stock Price and Earnings Per Share

Concluded

Net present value of a firm’s future investments

=

PVGO of a FIRM

James Walter’s Model on Dividend

• P= D + (EPS – D)*(r/k)

k

• Where, r= return on investment; k= cost of equity

• First component, D/k= present value of an infinite stream of dividend

• Second component, [(EPS- D)*(r/k)]/k= present value of an infinite

stream of return from retained earnings

6/6/2022

Professor Manipadma Datta

8

Example

Growth firm: r>k

Normal firm: r=k

Declining firm : r<k

r=20%

k=15%

EPS=₹10

r=15%

k=15%

EPS=₹10

r=15%

k=20%

EPS=₹10

Pay 100% of EPS

P= (10/.0.15)+0= ₹66.67

Pay 100% of EPS

P= (10/0.15)+0= ₹66.67

Pay 100% of EPS

P= (10/0.15)=₹66.67

Pay 50% of EPS

P=[ (5/0.15)+{(105)*(20/15)]/0.15)}]=

33.33+44.44=₹77.77

Pay 50% of EPS

P= (5/0.15)+(5/0.15)=₹66.67

Pay 50% of EPS

P= [(5/0.15)+{(10-5)*(15/20)}/0.15}]

33.33+25=₹58.33

6/6/2022

Professor Manipadma Datta

9

So, it is vindicated,

Growth firm tends to pay lesser dividend and its share value consists of

mainly PVGO.

In in case of declining firm, it happens exactly the rese=verse.

6/6/2022

Professor Manipadma Datta

10

Valuation Format

1

Valuing a Business or Project

The value of a business or project is usually

computed as the discounted value of free cash

flows out to a valuation horizon (H).

The valuation horizon is sometimes called the

terminal value and is calculated like PVGO.

FCF1

FCF2

FCFH

PVH

PV

...

1

2

H

(1 r ) (1 r )

(1 r )

(1 r )H

Valuation Format

2

Valuing a Business or Project

FCF1

FCF2

FCFH

PV

...

1

2

H

(1 r ) (1 r )

(1 r )

PV free cash flows

PVH

H

(1 r )

PV horizon value

FREE CASH FLOW TO EQUITY(FCFE)

FCFE=

PAT− PREFERENCE DIVIDEND

−(CAPEX − DEPRECIATION)±(NET CHANGE IN

WORKING CAPITAL)

+ (NEW DEBT ISSUE − DEBT REPAYMENT

+(NEW PREFERENCE ISSUE − REDEMPTION)

Equity Value=

∞

𝑡=1 𝐹𝐶𝐹𝐸𝑡

÷ (1 + 𝑅𝑜𝐸)^𝑡

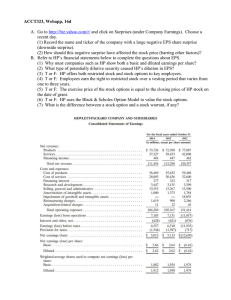

EXAMPLE

1

Asset value, start of year

2

3

4

5

6

7

8

9

10

10.00

11.20

12.54

14.05

15.31

16.69

18.19

19.29

20.44

21.67

Earnings

1.20

1.34

1.51

1.69

1.84

2.00

2.18

2.31

2.45

2.60

Investment

1.20

1.34

1.51

1.26

1.38

1.50

1.09

1.16

1.23

1.30

Free cash flow (FCF)

0.00

0.00

0.00

0.42

0.46

0.50

1.09

1.16

1.23

1.30

Asset value, end of year

11.20

12.54

14.05

15.31

16.69

18.19

19.29

20.44

21.67

22.97

Return on assets (ROA)

0.12

0.12

0.12

0.12

0.12

0.12

0.12

0.12

0.12

0.12

Asset growth rate

0.12

0.12

0.12

0.09

0.09

0.09

0.06

0.06

0.06

0.06

0.12

0.12

0.09

0.09

0.09

0.06

0.06

0.06

Earnings growth rate, from

previous year

6/6/2022

0.12

Professor Manipadma Datta

14

Example

Given the cash flows for Concatenator Manufacturing

Division, calculate the PV of near term cash flows, PV

(horizon value), and the total value of the firm when r =

10% and g = 6%.

PV(FCF)

0

0

0

0.42 0.46

.50

1.1 1.1 2 1.1 3 1.1 4 1.1 5 1.1 6

0.90

Horizon Value= 1.09/(0.10-0.06)=₹27.3 million

PV of Horizon Value= 27.3/(0.10-0.06)= ₹15.4 million

Therefore, PV of Business= 0.9+15.4= ₹16.3 million