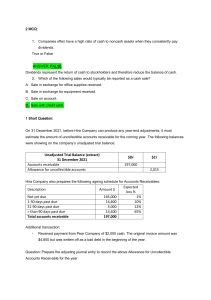

1. Inge uncollectible accounts expense - $11,000 2. Roxy Co.’s unadjusted trial balance - $ 30,000 3. On August 15, 2005, Benet Co. sold goods - Interest receivable 4. A company uses the allowance method to account for uncollectible accounts receivable. After recording the estimate of credit loss expense for the current year, the company decided to write off in the current year the $10,000 account of a customer who had filed for bankruptcy. What effect does this write-off have on the company’s current net income and total current assets, respectively? No effect. No Effect 5. Frame Co. has an 8% note receivable dated June 30, year 1, in the original amount of $150,000. Payments of $50,000 in principal plus accrued interest are due annually on July 1, year 2, year 3, and year 4. In its June 30, year 2 balance sheet, what amount should Frame report as a current asset for interest on the note receivable? - $ 8,000 6. ABC Company sold goods to its customers on credit. The entity had no cash sales. The entity used the gross method of recording sales. An analysis of accounts receivable at December 31, 2015 revealed the following: … What amount should be reported as net realizable value of accounts receivable? 7,500,000 7. Which of the following is a method to generate cash from accounts receivables? 1 8. The following information applies to a manufacturing company, which has a 6-month: $160,000 9. The following information relates to Jay Co. - $ 1,085,000 10. The following information pertains to Tara Co.'s accounts receivable at December 31, Year 2: what amount of allowance for credit losses should Tara report at December 31, Year 2? $9,000 11. A method of estimating uncollectible accounts that emphasizes asset valuation rather than income measurement is the allowance method based on: Aging Receivables 12. On Merf's April 30, 1993, balance sheet a note receivable was reported as a noncurrent asset and its accrued interest for eight months was reported as a current asset. Which of the following terms would fit Merf's note receivable? Principal is due August 31, 1994, and interest is due August 31, 1993, and August 31, 1994. 13. on december 31, 2019, ABC Company loaned one of its officers for non-interest bearing note that required five annual payments of 500,000. The first payment was made on december 31, 2019. The market rate of similar note was 8%. What is the current portion of the notes receivable on december 31, 2019? 1,995,000 14. On the December 31 balance sheet of Mann Co., the current receivables consisted of the following: At December 31, the correct total of Mann's current net receivables was $94,000 15. ABC company purchased from DEF company a 20,000, 8% five-year note that required five annual year-end payments of 5,009 (interest and principal). The prevailing effective interest rate for a note of this type on such date is 9%. At the date of purchase, ABC Company recorded the note at its present value of 19,485. What is the total interest revenue earned by ABC over the life of this note? 5,560 16. An analysis of an entity’s 150,000 accounts receivable at year end resulted in a 5,000 ending balance for its allowance for uncollectible accounts and a bad debt expense of 2,000. During the past year, recoveries on bad debts previously written off were correctly recorded at 500. If the beginning balance in the allowance for uncollectible accounts was $4,700, what was the amount of accounts receivable written off as uncollectible during the year? - $2,200 17. At January 1, year 2, Jamin Co. had a credit balance of $260,000 in its allowance for uncollectible accounts. Based on past experience, 2% of Jamin’s credit sales have been uncollectible. During year 2 Jamin wrote off $325,000 of uncollectible accounts. Credit sales for year 2 were $9,000,000… - $ 115,000 18. Open trade receivables balance to be shown on the statement of financial position for the period is - $ 250,000 19. Which method of recording uncollectible accounts expense is consistent with accrual accounting? 2 20. ABC Company provided the following information for the current year: Allowance for doubtful accounts- Jan 1 200,000= 550,000 21. Based on the industry average, The entry to record bad debt expense at the end of Year 3 would include a credit to the allowance for uncollectible accounts of $300,000 22. When the allowance method of recognizing uncollectible accounts is used, the entry to record the write-off of a specific account - Decreases both accounts receivable and the allowance for uncollectible accounts. 23. On January 1, 2021, ABC Company sold equipment with a carrying amount of 4,800,000 in exchange for a 6,000,000 noninterest-bearing note due January 1,2024. There was no established price for the equipment. - (300,000) 24. Evaluate the following statements concerning Doubtful Accounts. I. An entity has the choice of using direct-write off method or allowance method in presenting its financial statements in accordance with PFRS True?? II. Writing off an accounts receivable will reduce the entity’s working capital False?? III. Allowance method is in line with the matching principle TRUE 25. Based on the industry average, a corporation estimates that its bad debts should average 3% of credit sales. - $ 300,000 26. Which of the following will cause a decrease to the net realizable value of accounts receivable? - Only two (not sure) 27. Which method of recording uncollectible accounts expense is consistent with accrual accounting? - Yes, No 28. On December 1, Year 1, Tigg Mortgage Co. gave Pod Corp. a $200,000, 12% loan. Pod received proceeds of $194,000 after the deduction of a $6,000 nonrefundable loan origination fee. Principal and interest are due in 60 monthly installments of $4,450, beginning January 1, Year 2. The repayments yield an effective interest rate of 12% at a present value of $200,000 and 13.4% at a present value of $194,000. What amount of accrued interest receivable should Tigg include in its December 31, Year 1, balance sheet? $2000 29. The following information has been compile by a manufacturing company… 250,000 30. Evaluate the following statements regarding loans receivable. I. If the resulting carrying amount is less than the face value of loans receivable, the effective interest rate is lower than the stated interest rate in the loan. II. Where effective interest rate is unequal to stated interest rate, interest income is recorded by multiplying the effective interest rate with the carrying value of the loan at the beginning of the year. III. Origination fees received from borrower are recognized as unearned interest. True? 33. Evaluate the following statements regarding measurement of loans receivable I. Loans receivable is recorded at fair value less transaction cost. II. Direct origination costs are added while indirect origination costs are deducted to get the carrying among of loans receivable. III. Subsequent to initial measurement, the entity may choose amortized cost or straight line-method in measuring the carrying amount of loans receivable. Global Bank granted a loan to a borrower on January 01, 2019. The interest on the loan is 12% payable annually starting December 31, 2021. The effective interest rate on the loan is 14%. Round off answers to the nearest ones place. Principal Amount- 5,000,000 Origination fees received from borrower- 331,800 Direct Origination costs incurred- 100,000 Compute for the following: Initial carrying amount P4,768,200 Interest Income for the year 2021 P687,247 Carrying amount at the end of 2020 P4,912,753 An analysis of an entity’s $150,000 accounts receivable at year end resulted in a $5,000 ending balance for its allowance for uncollectible accounts and a bad debt expense of $2,000. During the past year, recoveries on bad debts previously written off were correctly ANS: 2200 ABC company provided the following information for the current year ANS: 550000 Evaluate the following statements regarding measurements of loans receivable 1. Loans receivable is recorded at fair value less trans ANS: All statements are false Evaluate the following statements regarding measurements of loans receivable 1. If the resulting carrying amount ANS: Only one statement is false Which of the following is a method to generate cash from accounts receivable? ANS: YES YES Which method of recording uncollectible accounts expense is consistent with acc ANS: Yes No A company uses the allowance method to recognize ANS: Increase No effect A method of estimating uncollectible accounts that emphasizes asset valuation rather than income ANS: Aging Based on the industry average, Davis Corporation estimates that its bad debts should average 3% of credit sales. The balance in the allowance for uncollectible accounts at the beginning of Year 3 was $140,000. During Year 3, credit sales totaled $10,000,000, accounts of $100,000 were deemed to be uncollectible, and payment was received on a ANS: 300,000 Evaluate the following statements concerning Doubtful Accounts 1. An entity has the choice of using ANS: Only one of the statements is true At January 1, year 2, Jamin Co ANS: 115,000 The following information relates to Jay Co.’s ANS: 1085000 The following accounts were abstracted from ANS: 30000 A company uses the allowance method to account for uncollectible accounts receivable after recording the estimate ANS: No effect No effect Which of the following will cause a decrease to the net realizable of accounts receivable ANS: Only one On December 31, 2019, ABC company loaned one of its officers for a non-interest ANS: 1,655,000 On December 31, year 2 balance sheet of Mann Co. ANS: 94,000 The following information pertains to Tara Co. ANS: 9000 ABC Company sold goods to its customers on credit. The entity had no cash sales. ANS:7,500,000 On December 1, year 2, Tigg Mortgage Co. gave Pod Corp ANS: 2,000 ABC company purchased from DEF ANS: 5560 The following information applies to a manufacturing company, which has a 6-month operating cycle ANS: 160,000 On January 1, 2021, ABC company sold equipment with a carrying amount of P4,800,000 ANS: (300,000) On Merf;s April 30, year 2 balance sheet a note receivable ANS: Principal is due August 31, year 3 and interest is due August 31, year 2 and August 31 Frane Co. has an 8% note receivable dated June 30 ANS: 8000 On August 15, year 2, Benet Co. Interest receivable Inge Co. determined that the net value of its accounts receivable at December 31, year 2 11,000 Global bank granted a loan to a borrower Initial carrying amount 4,768,000 Interest income for the year 2021 667,548 Carrying amount at the end of 2020 667,005