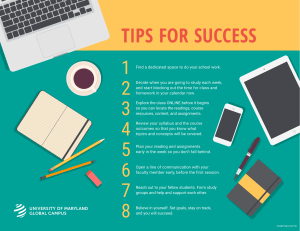

MBA Program Accounting for Managers Course Code: ACT401 Pre-requisite Courses: Nil WELCOME TO THE CLASS Introduction: I look forward to have a fruitful and meaningful interaction with each one of you during the term. This will however depend on your active participation and attention during the class sessions and an active follow up afterwards. Course Description: Accounting has often been called the language of business but now it has become everyone need. We live in an era of accountability. An individual must account for his or income and must file income tax return and supply information in order to qualify for a loan. The federal government and provinces use accounting information as the basis for controlling their resources ad measuring their accomplishments. Understanding of accounting is important whether a person work in manufacturing, trading, and service or not for private organization. Course Objective: To provide students with a better understanding of the environment in which accounting information is developed and used. Particular emphasis will be placed on the preparation of accounting information. Teaching Methodology & Requirements: Please arrive and leave on time. Class will begin promptly five minutes after the hour and will end exactly on the hour. Late arrivals and early departures disrupt class and ruin the presentations of others. They are unprofessional. Do your own work. Plagiarism and cheating will lead to dismissal. Do not copy the work of others. Do not use others to do your work. Do not pass off work done in past semesters as work done for this course. Assignments must incorporate lessons taught in class. Personal assignments must be produced individually. Group assignments must be produced by the members of the group. Students will be expected to read assignments in advance of their discussion in class. Class time will be used to emphasize and clarify some text material, but additional topics will be discussed as well. This will not be a lecture-only course. You will be asked to discuss what you have read. While you should expect to be frequently called on in class, you should also voluntarily discuss and ask questions. READ AND BE PREPARED TO DISCUSS ALL DISCUSSION QUESTIONS AND/OR CASES AT THE END OF EACH CHAPTER. Class meetings will NOT cover everything in the text. Separate instructions will be provided for assignments. All written assignments must be handed in at the beginning of class on the due dates. They will not be accepted after the class has begun. All assignments not completed on time (not handed in before class has begun) will receive a zero. Check the schedule for due dates. It is essential to keep current with the chapter assignments. Classroom conduct is predicated on the assumption that you have read the relevant material. You are most welcome to ask questions in class dealing with any material being presented, and to take an active role in class participation. Course Contents The Accounting Equation. Nature of accounts. Transaction analysis. Double Entry System Journal entries ledger and trial balance Recording changes in financial position Measuring business income Completion of the Accounting cycle Accounting for Merchandising Activities The Control of Cash transactions Accounts Receivable and Notes Receivable Liabilities Short term and long term Corporations I Measuring Cash Flow Financial Statement Analysis Testing and Grading: Learning will be accomplished through lectures, outside readings case analysis and student participation in classroom discussion and presentations. Grading will tend to focus on your overall personality rather than one or two aspects. A mid-term examination and a comprehensive final examination will be given. Another portion of the course grade will include the discussion/attendance grade, quizzes, cases and/or other assignments. Each student will also be required to complete individual project. The mid-term examination will be of 25 percent and final examination will be of 40 percent. Test questions may be taken from textbook readings, hypertext material, additional material discussed in class and /or other assigned readings. Students may prepare notebook for taking notes and for references. Marks Distribution of 100%: Quizzes Assignments Class Workshops Cases Projects Mid-term Final Exam Total ______________ ______________ ______________ ______________ ______________ _______25_____ _______40_____ 100_____ Recommended Book: Accounting: The Basis for Business Decisions by Meigs & Meigs 9th edition Hand out ( please collect your copy from photocopier) Reference Books: “Business Accounting 1,” Frank Wood, 7th Edition. “Accounting: A Business Perspective.” Hermanson, Edwards and Maher, 7th Edition Please Note: In the unlikely event of an unplanned absence by the instructor, the material to have been covered during that class meeting will be shifted to the next meeting. If a test was scheduled for that class meeting, the test will be given during the next class meeting. In the event of any necessary planned absences, information on schedule changes will be provided in advance.