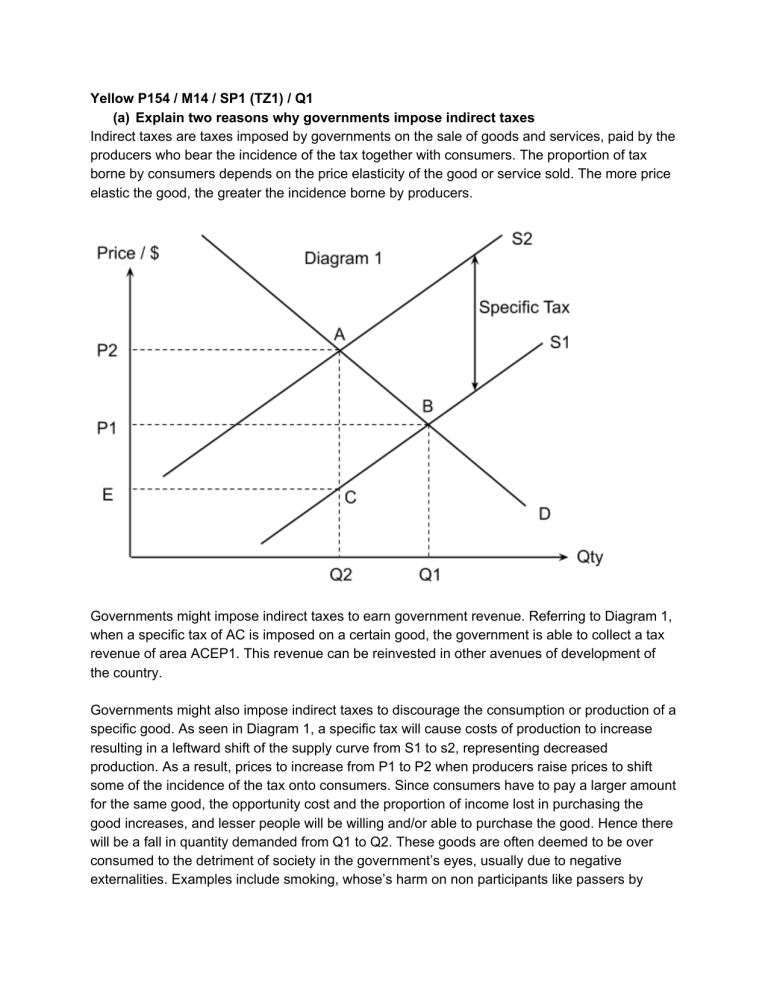

Yellow P154 / M14 / SP1 (TZ1) / Q1 (a) Explain two reasons why governments impose indirect taxes Indirect taxes are taxes imposed by governments on the sale of goods and services, paid by the producers who bear the incidence of the tax together with consumers. The proportion of tax borne by consumers depends on the price elasticity of the good or service sold. The more price elastic the good, the greater the incidence borne by producers. Governments might impose indirect taxes to earn government revenue. Referring to Diagram 1, when a specific tax of AC is imposed on a certain good, the government is able to collect a tax revenue of area ACEP1. This revenue can be reinvested in other avenues of development of the country. Governments might also impose indirect taxes to discourage the consumption or production of a specific good. As seen in Diagram 1, a specific tax will cause costs of production to increase resulting in a leftward shift of the supply curve from S1 to s2, representing decreased production. As a result, prices to increase from P1 to P2 when producers raise prices to shift some of the incidence of the tax onto consumers. Since consumers have to pay a larger amount for the same good, the opportunity cost and the proportion of income lost in purchasing the good increases, and lesser people will be willing and/or able to purchase the good. Hence there will be a fall in quantity demanded from Q1 to Q2. These goods are often deemed to be over consumed to the detriment of society in the government’s eyes, usually due to negative externalities. Examples include smoking, whose’s harm on non participants like passers by inhaling second hand smoke creates negative externalities resulting in welfare loss. Such welfare loss is reduced through reduction of production and quantity demanded of these goods. The tax revenue collected may also go towards compensating those affected by the negative externalities. (b) Discuss the consequences for consumers, producers and the government of imposing a specific tax on cigarettes Specific taxes are a form of indirect tax - imposed by governments on the sale of goods and services, paid by the producers who bear the incidence of the tax together with consumers. They are levied as a fixed amount taxed per unit of good sold. In the case of cigarettes, as cigarettes have an addictive quality to them, they have a very low price elasticity of demand (PED) that is reflected in the steep demand curve in Diagram 2. This means that consumers are more willing to pay for them even if prices increase due to their reliance on or addiction of them. Hence, when a specific tax of AC is imposed, despite an increase in prices from P1 to P2, there is a less than proportionate decrease in quantity demanded from Q1 to Q2. Since cigarettes are price inelastic, producers are able to pass off a majority of the tax incidence on consumers by raising prices, knowing that consumers will still be willing to pay due to cigarettes’ addictive nature. Consumers will bear area P2AEP1 and face a higher price of P2, causing cigarettes to cost a larger proportion of their income. This possibly results in greater financial difficulty for consumers unable to sustain such purchases at higher prices. Hence consumers largely lose out. Producers bear a small incidence of the tax of area P1ECF as the price inelasticity of cigarettes allows them to transfer the majority of their increased costs of production to the consumer. Total revenue will however decrease from area OP1BQ1 to area OQ2CF and producers hence lose out. By reducing quantity demanded through the imposition of the tax, governments successfully reduce the negative externalities of cigarette consumption, such as the presence of second hand smoke which could harm non participants like passers-by. Tax revenue of area P1EAP2 earned can also be further invested in avenues to discourage smoking, or to compensate the third parties that are victim to the negative externalities. However, such policies could also make the government less popular among cigarette producers and consumers. In conclusion, both producers and consumers seem to lose out in the imposition of a specific tax on cigarettes, losing revenue and paying higher prices respectively. The government benefits due to increased tax revenue and reducing the negative externalities of cigarette consumption. Yellow P155 / M09 / SP1 / Q1 (a) Using an appropriate diagram, explain how negative externalities are a type of market failure (10m) Negative externalities are harmful or undesirable effects on third party non-participants who are neither producers nor consumers due to the consumption or production of a particular good or service. Market failure is the market’s inability to achieve efficiency where the marginal cost of producing a good is equal to the marginal benefit of consuming the good. In a free market, it is assumed that individuals and firms will act in self interest. Hence, without intervention, equilibrium will form at E, where marginal personal benefit (MPB) of consumers and marginal personal cost (MPC) of consumers intersect. This is where the marginal benefit to consumers purchasing an additional unit of good is equal to the marginal cost of producers producing an additional unit of good. Negative externalities occur when MSC > MPC (negative externalities in production), or when MPB > MSC (negative externalities in consumption) When there are negative externalities in production - third party harm arises in the production of the good - MPC will exceed the marginal societal cost (MSC), that is, the marginal cost to society in the production of each additional unit of the good. This is because negative externalities on non participants results in a lower MSC than MPC. For example, the production of electricity involves the burning of fossil fuels that pollute the environment and harms non-participant third parties such as the future generations by depleting the supply of clean air and endangering their respiratory health. As a result, MSC<MPC and E exceeds the social equilibrium of S representing an over production of electricity, resulting in a welfare loss of are AEF and hence market failure. (b) Evaluate the measures that a government might adopt to correct market failure arising from negative externalities A possible measure the government might adopt is the imposition of indirect taxes on the sale of goods that have negative externalities. Indirect taxes reduce both the consumption and production of these goods, hence reducing negative externalities in both consumption and production. They are effective as they increase the cost of production of each unit of the good, disincentivizing production and causing a leftward shift of the supply curve. These increased costs are also partially passed onto consumers through higher prices, causing the good to cost a larger proportion of consumers’ income and hence a larger opportunity cost, reducing quantity demand. Since both quantity demand and supply decreases, negative externalities in both consumption and production are reduced. Tax revenue collected can also be used to further reduce externalities or to compensate the third parties affected. However, the effectiveness of this policy is highly influenced by the PED of the good. It will be more effective on price elastic goods, where qty demanded falls more than proportionately to an increase in prices, but more ineffective for price inelastic goods where quantity demanded falls less than proportionately to an increase in prices. Hence, despite the tax, qty demanded might not fall significantly and the negative externalities will not be as minimised. An example is casino taxes used to reduce the consumption of gambling services which have negative externalities on gamblers’ families. These taxes are limited in effectiveness due to gambling’s price inelasticity that arises from problem gamblers addicted to gambling who will continue gambling despite the higher prices. Additionally, it will be difficult for the government to accurately quantify the appropriate amount of tax, and might hence over or underestimate the correct amount needed to correct the negative externalities. An under or over correction would still result in market failure. Another possible measure is the use of legislation, where governments might ban the consumption or production of certain goods and services to reduce negative externalities. This is effective as the act of consuming and/or producing the good is outright banned, preventing its associated negative externalities from manifesting. It is also more straightforward for consumers and producers to understand, and can be quickly implemented. However, the effectiveness is dependent on the punishment for breaking such legislation. Punishments like fines are often ineffective against large corporations who are willing to pay such fines and continue in the production or consumption of their goods. Additionally, manpower and resources are needed to enforce the legislation, possibly resulting in consumers/producers successfully evading detection, or the creation of an unregulated black market. An example would be the consumption and production of narcotics which have negative externalities on family members’ of addicts and the larger society. As such, the government criminalizes the possession of most narcotics to reduce such negative externalities. However, black markets still thrive and operate unregulated, resulting in possible further abuse of narcotics to a larger extent, limiting the effectiveness of such policies. Lastly, particularly for negative externalities in production of goods that damage the environment in the process, some governments have established an emissions trading scheme, where nationwide emissions are capped at a certain level, before credits and “shares” of the allowable emission are allocated to individual firms. This gives emissions a monetary value, and hence a monetary incentive for producers to reduce their emissions. An overall cap also allows governments to keep emissions at or below a pre-determined socially optimal level, regardless of how the credits are allocated. However, such schemes often discourage competition as larger firms are able to buy a larger share of credits, leaving smaller firms or new entrants less able to compete with the restriction of their smaller amount of credits. This system is also susceptible to corruption and preferential treatment to certain companies, resulting in some companies not complying to the scheme or getting unfair amounts of credits. In conclusion, all these solutions come with benefits and limitations, and should be used selectively accordingly to the situation. If the externality is severe enough, with extreme effects, legislation might be necessary to prevent adverse harm. However, less serious externalities can be approached with market based solutions that would serve to merely internalize the externality and bring consumption and production to a more socially optimal level. Pink P103 / M18 / HP1 (TZ2) / Q1 (a) Explain why some firms might choose the goal of profit maximisation while others might choose to adopt satisficing behaviour [10] Profit maximisation occurs when firms set their prices at the point where marginal cost (MC) = marginal revenue (MR). In contrast, satisficing behaviour is when firms operate with the intention of making normal profit where average costs (AC) = average revenue (AR). In general, monopolies and oligopolies would aim for profit maximisation, while firms operating in perfect competition would adopt satisficing behaviour. In perfect competition (PC), there is an infinite number of buyers and sellers, resulting in each individual consumer / firm being a price-taker. As a result, firms are unable to set their individual prices, but instead have a fully price ineleastic demand curve, horizontal at the market equilibrium price of Pe. There is also freedom of entry and exit of firms. Hence, when firms make supernormal profit in the short run, new entrants can and will readily enter the market, competing the supernormal profits away until each firm earns normal profit. As such, firms in PC have little incentive to set profit maximisation as their goal, knowing their profits will be competed away in the long run. Instead, they will have the aim of maintaining normal profit through increasing efficiency and decreasing AC from AC1 to AC2 since they are unable to influence price as price-takers. In contrast, due to their considerable market share allowing them to be price setters in the market, monopolies and oligopolies can, and do aim for profit maximisation in their operation, For monopolies, they can either set their price or set a fixed quantity at MC=MR where profit is maximised. This allows them to earn supernormal profit of area PAEB, which they can also maintain in the long run due to the high barriers to entry into the market. (b) Discuss whether price will always be lower and output will always be higher in perfect competition compared to monopoly [15] In a perfect competition (PC) firm, MR = AR = D due to the constant market equilibrium price all PC firms within a market must follow, regardless of the quantity produced or sold. As such, a PC firm will produce at where the MC curve intersects the AR line on a monopolist diagram, which would be of quantity Qpc and at price Ppc in Diagram 1. In a monopoly, the AR and MR are divergent, and the monopolist will produce at the quantity Qm where MC = MR in order to maximise profit, with price set to where such a quantity meets the AR curve at Pm. As such, a PC will have a lower price and higher output than that of a monopoly. There will be a welfare loss of area ABC due to consumer and producer surplus no longer being maximised at the higher price and lower output quantity. However, this analysis is only valid assuming constant cost conditions between a PC firm and a monopolist, an assumption that is often untrue. Unlike PC firms, monopolists are able to reap economies of scale due to their significant market power that allows them to have a larger scale of production to satisfy the large majority of the market of which they provide for. This allows them to have lower average costs due to specialization of labour, greater credit for borrowing, indivisibilities etc and hence a lower MC compared to PC firms. Monopolists also have supernormal profits that can be invested back into research and development to create more efficient and cost-effective methods of production, such as through the development of better technology. Increased efficiency could also reduce the marginal cost of each additional unit of good produced. Lower production costs can then be transferred to consumers through lower prices, despite maintaining the profit maximisation goal. As such, PC firms will produce at a higher price of Ppc where MCpc meets AR and a lower output of Qpc compared to monopolists who produce at MC=MR where quantity is larger at Qm and prices lower at Pm. As such, it is untrue that price will always be lower and output always higher in a PC firm due to the divergence of cost conditions between PC firms and monopolies. If this divergence in cost conditions is large enough, usually due to the existence of economies of scale or the use of R&D, monopolists can have lower prices and higher output than PC firms despite maintaining the profit maximisation criteria of producing where MC=MR.