thema beleggingen

by Willem van Ruitenburg and David Schrager

HEDGING COMPLEX CROSS-GAMMA EXPOSURES:

AN ELEGANT VANILLA ALTERNATIVE

W. van Ruitenburg (boven) is

Insurance Risk Officer bij ING

Reinsurance.

D. Schrager PhD is directeur

Pricing & Product Hedging

bij Nationale-Nederlanden.

Abstract:

Over the last decennia many insurance

companies have sold insurance contracts,

either in the pension or retail markets, with

embedded guarantees on the performance of

markets and/or investment funds. More and

more insurance companies will report P&L on

these books using Market Consistent

valuation assumptions. Hedge programs are

initiated to reduce P&L volatility. As a first

step linear hedges, using e.g. futures and

forward contracts, are often considered to

eliminate the directional exposure towards

market movements. More advanced hedge

programs will include vanilla options to

(partly) protect against bigger market returns

and/or higher return volatility of single asset

classes, i.e. so-called gamma/convexity

matching, and to hedge for movements in

market implied volatilities affecting the

(Market Consistent) reserves of the embedded

options in the insurance contracts. The

investments underlying the guarantees often

contain exposures in multiple equity indices,

exchange rates and potentially bond funds.

Insurance companies are therefore exposed

to simultaneous movements across the

different markets. The option risk is

multivariate, rather than univariate in

nature. In this article we will discuss an

elegant approach to hedge these so-called

cross-gamma exposures using vanilla option

hedge strategies.

Explanation Liability Movement in Greeks:

Guarantees underlying e.g. variable annuity contracts

and separate account guarantees in pension contracts

are often on the performance of a basket of assets

potentially including a variety of equity, exchange rates

and bond exposures.

[Eq 1]: dBSK (X1,..,XN,t ) = 兺i wi dXi,t

The market value of the embedded guarantee (MVL) on

a guarantee level K can be expressed as:

[Eq 2]: MVL(BSK;K,T,Ω) = ΕQ 关 DFT ∙ Max { K - BSKT } 兴

The parameter Ω is the implied covariance matrix for

the basket elements. This matrix is typically calibrated

using historically observed correlations and implied

volatilities for the individual asset classes, if available.

First generation hedge programs target the change in

MVL due to a change in the assets in the basket or Delta

risks. Delta risks can be hedged using futures, forwards

or the asset itself. Once Delta risks are hedged specific

option, or non-linear, risks remain. Consider that when

hedging an option one has to adjust the Delta hedge

upon a move in the assets. This is due to convexity of

the MVL as a function of BSK. In other words, MVL is not

a linear function of BSK and hence a Delta hedge of a

guarantee is not static but requires rebalancing. This

article focusses on these non-linear risks, specifically

Gamma.

Just as Gamma in practice is defined as the change in

notional Delta of the underlying due to a change in the

underlying, Cross-Gamma is defined as the change in

notional Delta of an underlying due to a change in

another underlying. We will now provide more

mathematical background to this explanation of CrossGamma.

The market value movement of the MVL only as a

function of immediate return on the basket can be

approximated by a 2nd order Taylor approximation like:

34 de actuaris september 2014

thema beleggingen

[Eq 3]: dMVL(dBSK) =

∂MVL

∂BSK

1

∙ BSK ∙ dBSK + 2 ∙

∂ 2 MVL

∙

∂BSK 2

(BSK∙dBSK )2 + Ο-3

Equation [3] is more often displayed in terms of Greeks as:

[Eq 4]: dMVL(dBSK) = ΔBSK ∙ dBSK + 21 ∙ ΓBSK ∙ (dBSK) 2 + Ο-3

Substituting [Eq 1] into [Eq 3] results in:

[Eq 5]: dMVL(dX 1 ,..,X N ) = 兺i

共 ∂MVL

∂xi ∙ Xi ∙ dXi 兲

+ 21 ∙

关 兺i 兺j ∂∂xMVL

∙ ( Xi Xj ∙ dXi dXj ) 兴 + Ο-3

ixj

2

In terms of Greeks [Eq 5] translates into:

[Eq 6]: dMVL(dX1,..,XN ) = ⌊兺i Δ Xi ∙ dXi ⌋+ 21 ∙⌊兺i ΓXi ∙ (dXi ) 2 ⌋+ 12 ∙

关 兺i 兺j<>i ΓXiXj ∙ dXi dXj 兴 + Ο-3

The movement of the liability option value caused by immediate returns in the underlying assets

contains a delta return, a gamma return and a cross-gamma return.

For continuously rebalanced baskets it can be derived using the chain-rule of calculus that:

Δ Xi = ΔBSK ∙ wi

ΓXi = ΓBSK ∙ wi 2

ΓXi ,Xj = ΓBSK ∙ wiwj

Following above relations the more elements the basket contains the greater the sum of all the

cross-gamma exposures is relative to the single asset gamma exposures. For example in an

equally weighted basket of N underlying components the single asset gammas only represent 1/N

part of all the 2nd order exposures in the basket option.

Hedging programs that focus on hedging the linear exposures will have a short position in

gamma. This means options have to be bought to manage the risks in these portfolios. As these

dynamically delta hedged positions will always end up in 'buying high and selling low' the delta

hedge will typically lose money on a daily base. Typically the more futures/forwards need to be

traded to remain delta neutral the higher the realized gamma loss.

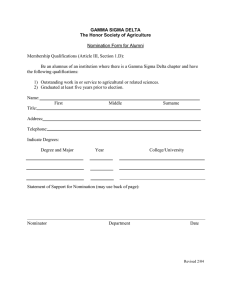

From Figure 1 it can be seen how short gamma positions leave hedge programs exposed to the

size of the market return or better said to the level of realized market return volatility1.

Gamma

Liability

Net Result

Value

Linear Hedge

-20%

1 – It should be noted that these

gamma losses are offset by

releases of the market value

reserve over time as time value

("Theta") runs out.

-15%

-10%

-5%

0%

5%

10%

15%

20%

Figure 1: Example of typical pay-off profile of linear hedge program

Equivalently the expected result of open cross-gamma exposures is a function of the covariance

among the pairs of underlying asset classes. On a daily base such positions will lose money

whenever the different assets show big market movements in the same direction.

de actuaris september 2014

35

thema beleggingen

Increases in covariance can either be caused by 1) increased

volatilities of individual assets or 2) increased correlation between the

asset classes.

The following regression will be performed:

One of the better known hedge instruments to replicate these

complex liability exposures are basket options. Basket options are

however rather illiquid instruments for which the pricing is not

transparent.

This illiquidity typically increases when less standard equity indices

and/or bonds are part of the basket.

Traders who sell these baskets will typically hedge their short

positions by going long options on the individual asset classes and

will charge the buyer of the basket options generously for the open

position/risk that the trader faces.

The fitted coefficient âi can be seen as the gamma that has been

realized.

Realized Gamma approach:

From [Eq 3] and [Eq 4] it is seen that for an option with price P on

single underlying S the delta and gamma in money terms are defined

by:

ΔS = ∂P ∙ S

∂S

2

ΓS = ∂ P2 ∙ S2

∂S

Gamma exposures change on a daily base as markets move and the

moneyness of the guarantee changes. This implies that the regression

should be based on a limited interval of recent historical observations

and that this window is being rolled forward.

In Figure 2 the outcomes of conducted analyses are shown. The green

dots are the actually observed corrected delta movements, i.e.

dΔX t - ΔX ∙ dXi,t . The red dots represent the delta movements

i,

i,t

explained by the individual gamma exposure, i.e. ΓX ∙ dXi,t and the

i,t

blue points show the fitted delta movements, ci + ai ∙ Xi,t

Effective Gamma Example (2)

Daily Change Delta Index X

As traders will hedge their short cross-gamma positions using vanilla

hedge strategies insurance companies could take a similar tactic to

replicate cross-gamma exposure. In this article the 'Realized Gamma'

approach will be further explained.

[Eq 9]: dΔX t - ΔX ∙ dXi,t = ci + ai ∙ dXi,t + εi,t

i,

i,t

-3%

Via some calculus using the chain formula it's straightforward to

derive that the changes in the notional- or money-deltas can be

approximated by:

[Eq 7]: dΔS ≈ ( ΓS+ΔS ) ∙ dS or dΔS - ΔS ∙ dS ≈ ΓS ∙ dS

The above relationship is very sound: the change in the delta of the

option is driven by the gamma of the option and the return of the

underlying2.

Replacing S with the basket BSK and substituting Eq[1] shows the

explanation of option liability delta movement dΔX as:

i

0%

1%

2%

3%

4%

5%

In the analyses that have been conducted it has been observed that

the correlation between the actual delta movements and the fitted

delta movements is typically 70%-80% for baskets containing equity

and exchange rates exposures.

In Figure 3 it is shown that for embedded insurance guarantees on a

basket of assets the force that drives the delta changes (and therefore

trading in/out of linear hedges) may be a multiple of the theoretically

calculated gamma for that single component as calculated by the

liability model in case of average positive correlations.

Effective Gamma Example (1)

i

The Realized Gamma approach is a regression based approach where

the observed changes of the individual asset deltas are regressed on

the individual asset returns.

-1%

Figure 2: Example of observed versus fitted delta movements

[Eq 8]: dΔX = wi ∙ dΔBSK ≈ wi ∙ (ΓBSK + ΔBSK ) ∙ 兺 i wi dXi

The change in delta for asset component Xi is driven by the return of

the basket as a whole and not by the return of the individual

exposures.

-2%

Value Gamma

Fitted Realized Gamma

Single assed-factor Gamma

Time

Figure 3: Fitted short realized versus calculated single asset gamma exposures

over time

2 – It should be noted that in

practice the absolute gamma in

money terms is a much bigger than

the absolute money-delta

exposure.

36 de actuaris september 2014

thema beleggingen

Insurance companies that are currently hedging the single asset

gamma exposures can improve their hedge program by focusing

hedging the realized gamma rather than the effective gamma.

Advantages of this approach are:

– Cross-gamma exposures can be hedged using simple vanilla

options, no need to buy expensive and illiquid basket options.

– Easy to implement, no need to explicitly calculate cross-gammas.

Calculation time efficient as it re-uses Delta hedge program output.

– Easy to understand concept, can be explained to management. Can

be introduced as simple risk measure alongside use as explicit

hedging tool.

– Method relies on recent observed correlations among the riskdrivers and hence is an up-to-date measure of non-linear risks

(see also disadvantages).

Some disadvantages are:

– Method relies on historically observed correlations among the riskdrivers, no guarantee that this correlation will remain in-tact.

– Movements in (aggregated) liability delta can also be caused by

e.g.: assumption changes, changes in in-force etc. This may either

distort the validity of the observed fitted gamma or may require the

time series to be cleaned-up.

Conclusion

Insurance companies write or have written guarantees on multiple

underlying assets or asset classes. In this article we discuss a new

technique for risk management of these products.

The proposed 'Realized Gamma' approach may be the best solution

for companies seeking (computational) efficient risk measurement

and a hedge based on simple instruments. @ Reacties op dit artikel graag naar redactie.actuaris@ag-ai.nl