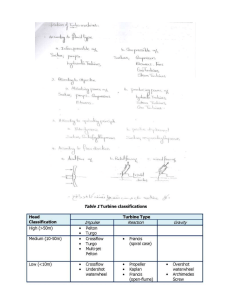

Tutorial Questions 5 Question 1 An amount of $10,000 was borrowed at a discount rate of 7% p.a. and invested in a project. The loan has to be settled in 10 years through uniform annual repayments. Calculate the amount to be paid annually a) if inflation effects are ignored b) assuming inflation of 3% p.a. Question 2 A 1.2MW turbine has expected lifetime of 20 years. The turbine factory cost is $900,000 and installation costs are 30% of factory cost. The O&M costs are estimated at 1.5% of the turbine factory cost per annum. The power purchase agreement price for selling electricity to the grid is $0.05/kWh and the capacity factor is estimated to be 32%. Assume a real discount rate of 7.5%. Calculate the net present value of a single turbine and the IRR of the turbine. Question 3 You are trying to choose between two small wind turbines. Turbine X costs $10,000 (present value) and has estimated O&M costs of $200/year, while turbine Y costs $8,000 with estimated OM costs of $400/year. Your bank is willing to finance either machine for 15 years at 6% nominal interest. You estimate that the O&M costs will be increasing at 1.5% over this period, equal to the expected inflation rate. Both turbines produce the same amount of energy each year. Which turbine should you buy (i.e. which turbine has the lowest present value of capital plus O&M costs?) Question 4 Wind turbines are available to a utility scale power generation fund at $1300/kW. The estimated capacity factor is 0.35. Expected operating lifetime of the wind farm is 30 years. The wind farm will be displacing 100MW of nominal (rated) coal generation that is assumed to have an effective capacity factor of 0.76. The coal plant typically uses 80 ktons of coal per year. The O&M costs of the wind generators are arbitrarily assumed to be the same as those for coal. At a discount rate of 8%, what is the minimum annual cost of coal (per kg) that would make the wind farm investment favourable? Comment on the economic and non-economic factors that need to be considered in addition to the price of coal when considering the replacement.