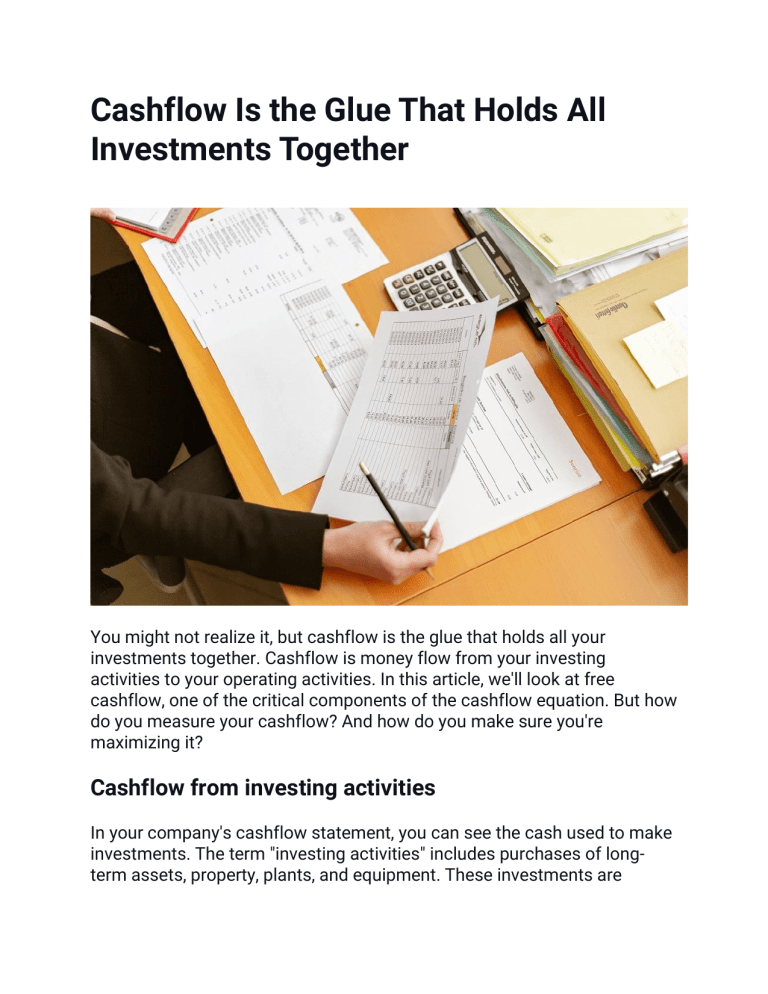

Cashflow Is the Glue That Holds All Investments Together You might not realize it, but cashflow is the glue that holds all your investments together. Cashflow is money flow from your investing activities to your operating activities. In this article, we'll look at free cashflow, one of the critical components of the cashflow equation. But how do you measure your cashflow? And how do you make sure you're maximizing it? Cashflow from investing activities In your company's cashflow statement, you can see the cash used to make investments. The term "investing activities" includes purchases of longterm assets, property, plants, and equipment. These investments are considered core non-current assets and impact cashflow, and you can also see payments associated with mergers and acquisitions. Therefore, it would be best to watch this section of your balance sheet to show you whether your business is making suitable investments. In addition to buying and selling investments, cashflow from investing activities also include the cost of making and managing other assets. These activities create a company's cashflow planning, and they often provide a clear picture of the company's financial health. This amount includes capital expenditures, the sale of investment securities, and expenses for property, plant, and equipment. These investments are the glue that holds all other assets together. Cashflow from operating activities Cashflow from operating activities (CFOA) is a financial statement that shows the cash flowing out of business. This is separate from investment revenue or long-term capital expenditures. It focuses solely on the company's core business. CFOA is also known as net cash from operating activities and operating cashflow, and it's an important benchmark to measure the financial success of a company's core activities. Operating cashflows come from the company's activities that result in net income and include cash sources from sales. Cash used for operations includes payments for salaries, inventory, and interest and dividend revenue and expense. It also provides income tax payments. While operating cashflows may be sporadic, they are the glue that holds all other investments together. And while it's true that some cashflows from investing are one-time, operating cashflows are ongoing, recurring, and core to the business. Cashflow from financing activities Cashflow from financing activities refers to the net amount of money raised by a company for various purposes. These activities include issuance and repayment of the debt, equity, and capital lease obligations. For example, a company may raise capital to fund operations by issuing debt and equity and reporting the cash flow statement amounts. In some cases, the debt financed by a company may be harmful. For example, if the part is negative, the company may need to make dividend payments and service debt. If the company is consistently turning to debt or equity to fund operations, it may not be generating enough earnings to meet its debt payments. At the same time, rising interest rates can significantly increase debt servicing costs. In such cases, investors should investigate management's actions and take steps to limit these transactions. However, a positive cash flow from financing activities does not necessarily mean under-performing a company. Free cashflow The term free cashflow is often attributed to private equity firms and is a critical metric that investors use to assess company value. This measure reflects the cash generated by a company and its ability to pay its debts and dues. It can also indicate a company's ability to expand operations or make short-term investments. Compared to earnings, free cashflow is easier to understand. For example, free cashflow is a better measure of a company's value than the earnings per share derived from wages. This measurement is particularly useful for service and manufacturing companies, since it isn't subject to the same accounting trickery as earnings per share or net income. Nevertheless, it is still a valuable tool for investors to evaluate the value of a company, since it allows them to compare the amount of cash at their disposal with its expenses.