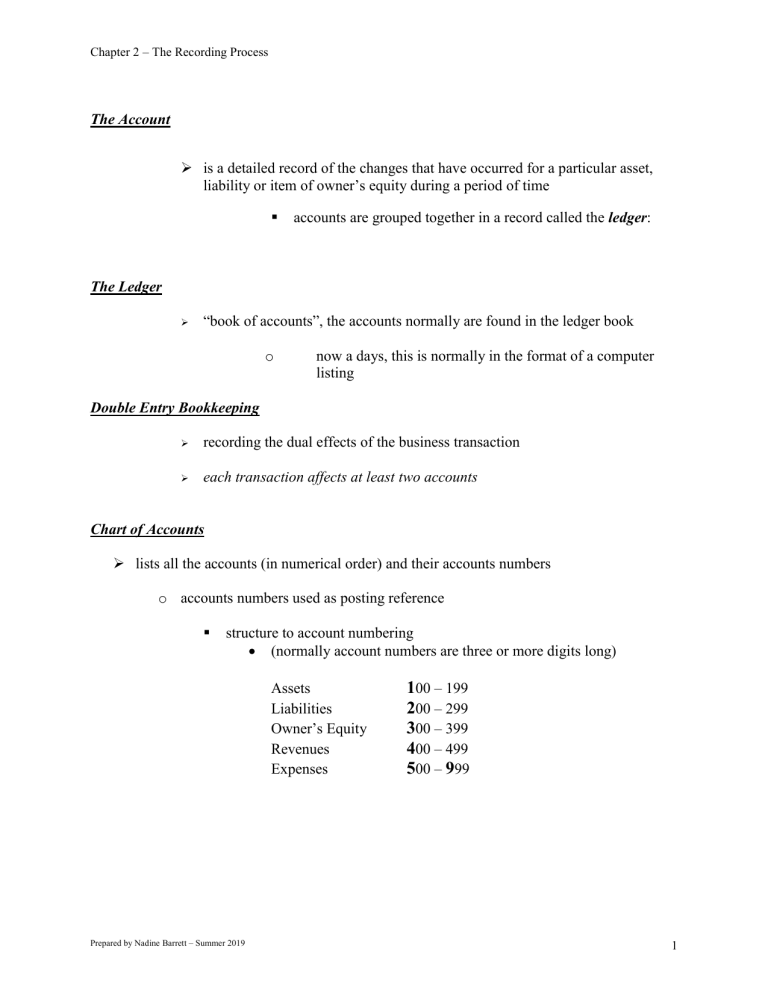

Chapter 2 – The Recording Process The Account is a detailed record of the changes that have occurred for a particular asset, liability or item of owner’s equity during a period of time accounts are grouped together in a record called the ledger: The Ledger “book of accounts”, the accounts normally are found in the ledger book o now a days, this is normally in the format of a computer listing Double Entry Bookkeeping recording the dual effects of the business transaction each transaction affects at least two accounts Chart of Accounts lists all the accounts (in numerical order) and their accounts numbers o accounts numbers used as posting reference structure to account numbering (normally account numbers are three or more digits long) Assets Liabilities Owner’s Equity Revenues Expenses Prepared by Nadine Barrett – Summer 2019 100 – 199 200 – 299 300 – 399 400 – 499 500 – 999 1 Chapter 2 – The Recording Process The T Account abbreviated form of the ledger account used to help illustrate the effect of a transaction debits and credits keep the accounting equation in balance Increases and Decreases in the Accounts the type of account determines how increases and decreases are recorded normal balance of an account is on the side an increase is recorded Debits/Credits for Assets Debits - increase Credits - decrease ASSETS Prepared by Nadine Barrett – Summer 2019 2 Chapter 2 – The Recording Process Debits/Credits for Liabilities and Owners’ Equity Debits – decrease Credits – increase OWNER’S EQUITY LIABILITIES Owners’ Equity Expanded Capital CAPITAL owner’s claims to the assets of the business amounts received from owner’s investments recorded directly in the owner’s capital account balance equals investments plus net income minus net losses and owner’s withdrawals Net Income = Total Revenues exceeding Total Expenses Net Loss = Total Expenses exceeding Total Revenues Prepared by Nadine Barrett – Summer 2019 3 Chapter 2 – The Recording Process Revenues REVENUES Debits - decrease Revenues Credits - increase Revenue Revenues created by delivering goods or services to clients or customers Expenses and Drawings Debits - increase Credits - decrease EXPENSES WITHDRAWALS Expenses use up assets or create liabilities in the course of operating a business Withdrawals/Drawings are withdrawals of cash or other assets by the owner for personal use. Prepared by Nadine Barrett – Summer 2019 4 Chapter 2 – The Recording Process Recording Transactions in the JOURNAL General Journal Can be used to record any economic transactions Process of recording the transaction in the journal is called journalizing Journalizing Process Date 1. Identify transactions from source documents. 2. Identify the accounts affected by the transactions. 3. Determine whether each account increases or decreases. Using the rules of debits and credits, determine whether to debit or credit the accounts. 4. Enter the transaction in the journal, including a brief description. The debit side of the entry is always entered first, the credit side last. Account Name and Description PR Debit Credit Example: Record the following transaction in the general journal provided above. Sept. 1 Nadine Barrett, owner of AIF, invested $30,000 into the business. Prepared by Nadine Barrett – Summer 2019 5 Chapter 2 – The Recording Process Transferring Information Posting process of transferring data from the book of original entry (journal) to the accounts in the ledger each account will have its own ledger card – see below o balance of ledger card kept after each transaction entered Account Name: Date Explanation PR Account Number: Debit Credit Balance T-accounts are often used as a substitute for the ledger card balance of the account calculated after all transactions have been posted Trial Balance lists of all accounts and their balances provides a check that debits equal credits aids in preparation of financial statements at this point the trial balance is considered to be “unadjusted” Prepared by Nadine Barrett – Summer 2019 6 Chapter 2 – The Recording Process Errors in a Trial Balance Unequal column totals indicates at least ONE error Common Errors: 1. Omitting or entering account balance in the wrong column of the trial balance. 2. Transposition error digits written in wrong order o error always divisible by 9 3. Slide error one or more zeroes are added to a number o errors always divisible by 9 4. Posting Incorrectly Examples: posting transactions as two debits posting only one side of transaction Note: An equal trial balance only proves that debits posted to accounts equal credits posted to accounts Examples of errors that will not cause the trial balance to be out of balance Prepared by Nadine Barrett – Summer 2019 not posting an entire journal entry posting one or both sides of the entry to the wrong account 7 Chapter 2 – The Recording Process Example – September transactions for AIF September 10 Nadine Barrett invests $80,000 into her new business, AIF’s bank account. September 12 AIF purchases $200 of office supplies on account from Staples. September 15 AIF pays $750 cash for September’s rent of their current office space. September 17 AIF invoiced (#101) a customer $1,000 for services provided, invoice due in 30 days. September 18 AIF hired a receptionist to start work on September 23. September 21 AIF received $800 cash from customer for services just completed, (invoice #102) September 25 AIF purchased parcel of land for $45,000 cash to house their future office. The construction of the office is to begin in October. September 26 AIF purchased a $150 newspaper advertisement to be printed in the September 29th paper, payment due on October 7. September 28 AIF paid Staples $200 for the purchase made on September 12. September 30 AIF paid the receptionist $400 for the previous week’s work. Requirement #1 - Record the above noted transactions in the journal provided on the following page. Requirement #2 - Post the transactions from the journal to the ledgers provided. Requirement #3 - Prepare a Trial Balance on the pages provided. Prepared by Nadine Barrett – Summer 2019 8 Chapter 2 – The Recording Process General Journal Page 1 Date Sep 10 Sep 12 Account Name and Description PR Debit Credit Cash Barrett Capital 101 301 80,000 To record investment by Barret Office supplies Account payable 120 205 200 534 101 750 107 402 1,000 80,000 200 To record purchase of office supplies Sep 15 Rent expense Cash 750 To record payment of rent for September Sep 17 Account receivable Service revenue 1,000 To record service revenue on account (inv#101) Sep 18 Sep 21 No Entry 800 800 Sep 25 45,000 45,000 Sep 26 150 150 Sep 28 200 200 Sep 30 400 400 Prepared by Nadine Barrett – Summer 2019 9 Chapter 2 – The Recording Process Ledger Cards Account Name: Cash Date Explanation PR Account Number: 101 Debit Credit Balance PR Account Number: 107 Debit Credit Balance Account Name: Office Supplies Date Explanation PR Account Number: 120 Debit Credit Balance Account Name: Land Date Explanation PR Account Number: 130 Debit Credit Balance Account Name: Accounts Payable Date Explanation PR Account Number: 205 Debit Credit Balance Account Name: Accounts Receivable Date Explanation Prepared by Nadine Barrett – Summer 2019 10 Chapter 2 – The Recording Process Account Name: Barrett, capital Date Explanation PR Account Number: 301 Debit Credit Balance Account Name: Service Revenue Date Explanation PR Account Number: 402 Debit Credit Balance Account Name: Advertising Expense Date Explanation PR Account Number: 509 Debit Credit Balance Account Name: Rent Expense Date Explanation PR Account Number: 534 Debit Credit Balance Account Name: Salary Expense Date Explanation PR Account Number: 546 Debit Credit Balance Prepared by Nadine Barrett – Summer 2019 11 Chapter 2 – The Recording Process AIF Enterprises Trial Balance September 30, 201X Debit Prepared by Nadine Barrett – Summer 2019 Credit 12