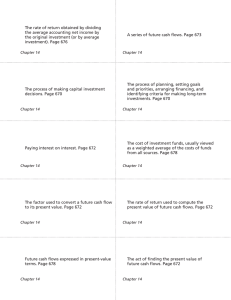

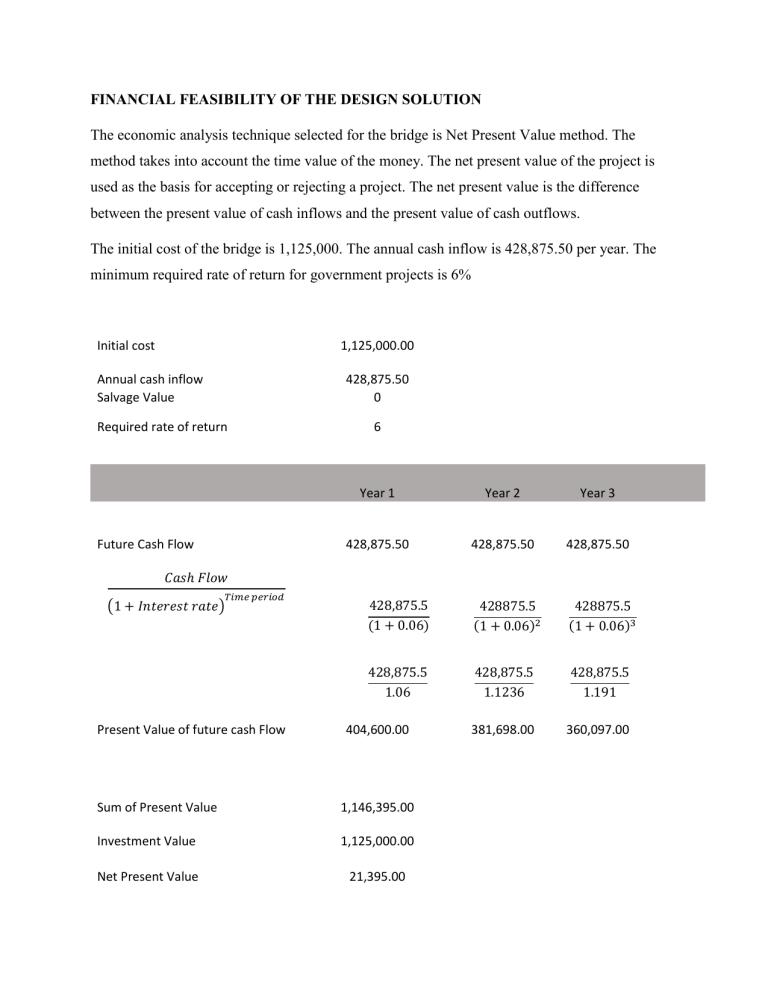

FINANCIAL FEASIBILITY OF THE DESIGN SOLUTION The economic analysis technique selected for the bridge is Net Present Value method. The method takes into account the time value of the money. The net present value of the project is used as the basis for accepting or rejecting a project. The net present value is the difference between the present value of cash inflows and the present value of cash outflows. The initial cost of the bridge is 1,125,000. The annual cash inflow is 428,875.50 per year. The minimum required rate of return for government projects is 6% Initial cost 1,125,000.00 Annual cash inflow Salvage Value 428,875.50 0 Required rate of return Future Cash Flow 6 Year 1 Year 2 Year 3 428,875.50 428,875.50 428,875.50 428,875.5 (1 + 0.06) 428875.5 (1 + 0.06)2 428875.5 (1 + 0.06)3 428,875.5 1.06 428,875.5 1.1236 428,875.5 1.191 381,698.00 360,097.00 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤 𝑇𝑖𝑚𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 (1 + 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒) Present Value of future cash Flow 404,600.00 Sum of Present Value 1,146,395.00 Investment Value 1,125,000.00 Net Present Value 21,395.00