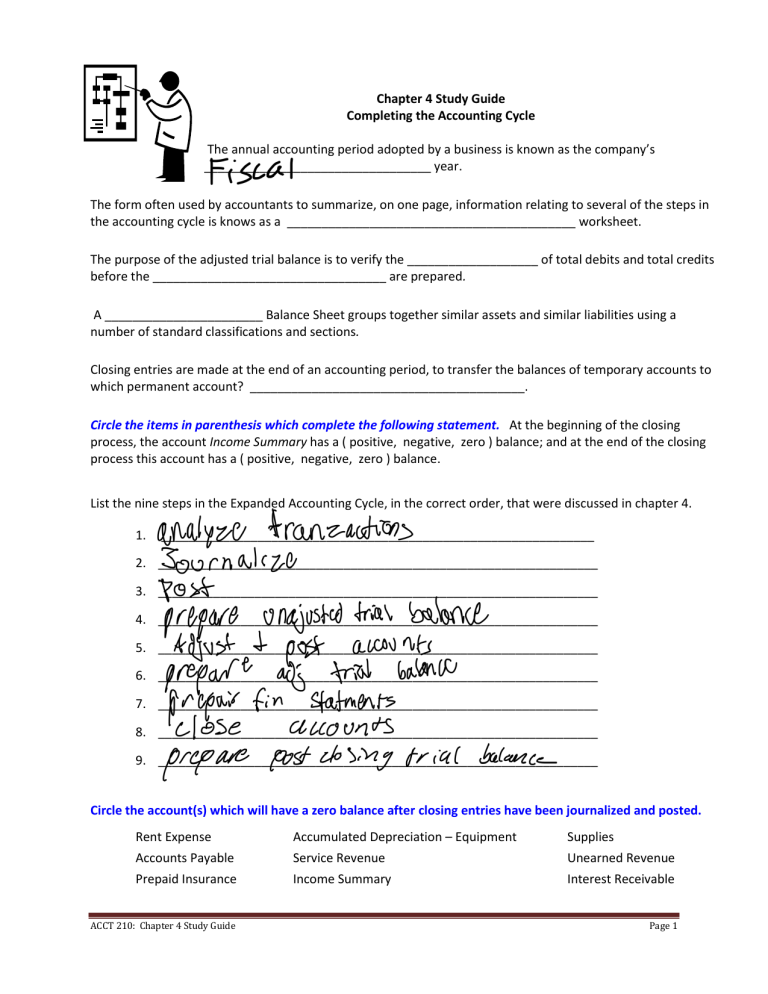

Chapter 4 Study Guide Completing the Accounting Cycle The annual accounting period adopted by a business is known as the company’s _________________________________ year. The form often used by accountants to summarize, on one page, information relating to several of the steps in the accounting cycle is knows as a __________________________________________ worksheet. The purpose of the adjusted trial balance is to verify the ___________________ of total debits and total credits before the __________________________________ are prepared. A _______________________ Balance Sheet groups together similar assets and similar liabilities using a number of standard classifications and sections. Closing entries are made at the end of an accounting period, to transfer the balances of temporary accounts to which permanent account? ________________________________________. Circle the items in parenthesis which complete the following statement. At the beginning of the closing process, the account Income Summary has a ( positive, negative, zero ) balance; and at the end of the closing process this account has a ( positive, negative, zero ) balance. List the nine steps in the Expanded Accounting Cycle, in the correct order, that were discussed in chapter 4. 1. _______________________________________________________________ 2. ________________________________________________________________ 3. ________________________________________________________________ 4. ________________________________________________________________ 5. ________________________________________________________________ 6. ________________________________________________________________ 7. ________________________________________________________________ 8. ________________________________________________________________ 9. ________________________________________________________________ Circle the account(s) which will have a zero balance after closing entries have been journalized and posted. Rent Expense Accumulated Depreciation – Equipment Supplies Accounts Payable Service Revenue Unearned Revenue Prepaid Insurance Income Summary Interest Receivable ACCT 210: Chapter 4 Study Guide Page 1 Indicate the accounts to be debited and credited when journalizing the transactions described below. Description DR CR 1. Close the Supplies Expense account 2. Accrue wages owed to employees at the end of the accounting period 3. Accrue depreciation expense for the period on office equipment 4. Close the Income Summary account (assume net loss) 5. Collect cash from customers previously billed on account 6. Owner donates Land to be used as future building site for office expansion. 7. Close the Service Revenue account 8. Supplies used during the period 9. Accrue the amount billed to clients for services performed 10. Cash collected before services are performed Short Answer “A worksheet is a permanent accounting record and its use is a required step in the accounting cycle.” Agree or disagree with this statement and defend your answer. List the two criteria which must both be met for an item to be classified as a Current Liability. ACCT 210: Chapter 4 Study Guide Page 2 Define the term “nominal accounts” and list five examples of such accounts. Compare and contrast current assets and fixed assets. (List at least two similarities and two differences). Your roommate states that adjusting entries and closing entries are really the same thing. Agree or disagree with the statement, and support your response with facts from chapters 3 and 4. Explain why the fiscal year end for Target, Wal-Mart, Home Depot, and GAP does not occur on December 31st of each year. “The Income Statement and Balance Sheet can be prepared directly from information contained in the end-ofperiod spreadsheet.” Briefly explain whether you agree or disagree with this statement. ACCT 210: Chapter 4 Study Guide Page 3