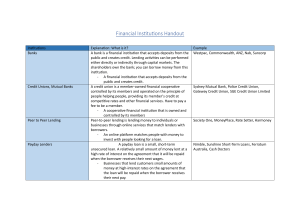

Decentralized Credit Scoring and Lending System Team Members 1. Arjun S A – 1DS18CS025 2. Ashwin Kumar – 1DS18CS026 3. Bhavin Gupta – 1DS18CS031 4. Devesh Toshniwal – 1DS18CS043 Under the Guidance of Dr. Ramya R S Assistant Professor, Dept of Computer Science and Engineering, DSCE Department of Computer Science & Engineering, DSCE Abstract Credit is a very important product in banks and financial institutions and there is always a customer who is in need of a loan. Lending money is risky but at the same time it is a very crucial source of income for banks, investors, and other financial institutions. To calculate the risk involved in lending money and the probability of the borrower defaulting on the loan, the most common method that is being used since decades is credit scoring. This method of calculating the credit score is based on the analysis of historical data that includes a wide range of parameters like age, income, purpose of loan, bank balance, nature of job, previous loan history, Income-Tax Returns (ITR), financial assets etc. Using the customer’s credit scores, lenders can define the risk of loan applicants. Credit scoring is beneficial from both the lenders and borrower’s point of view. From the lender’s perspective, it helps them in evaluating potential clients and setting a credit limit based on their credit score. From the client’s perspective, they can work on improving their credit score in order to extend their credit limit. The development of electronic commerce has led to enormous growth in online Peer-to-Peer Lending (P2PL) system. P2PL system is a micro financing platform which has two main participants: Prospective borrowers and prospective lenders. On one side, borrowers can apply for loans and on the other side, lenders can evaluate the borrower’s profile and calculate their respective credit scores before issuing loans. In recent years, a great deal of research has gone into developing recommendation systems to help lenders achieve high returns with low risk of defaults. A blockchain based Peer-to-Peer lending platform works on the mechanism of allowing borrowing and lending of funds directly between the borrowers and lenders, without the intermediation of any third party. The basic mechanism of blockchain technology also allows transactions between two parties in a secure and tamper-proof manner. It observes that funds are not merely copied but are efficiently transferred and recorded into the system to reduce the chances of double-spending. In the conventional method, intermediaries are required to maintain and record of funds but the newer version drives transactions through smart contracts. Challenges in the existing System Security attacks over unsecured channels Centralized dependency on third-party CRAs Complexity of recommender models in generation of Credit Score Non-transparency in Credit Score Evaluation Lengthy cycle of loan grants OBJECTIVES To implement a blockchain based Credit Recommender scheme to ensure transparency in lending operations between prospective borrowers and prospective lenders. To generate credit scores using the LSTM (Long short-term memory) recommender model based on the borrower’s credit history. To ensure timely repayments based on the conditions specified in the Smart Contract. Proposed System Model Flowchart Workflow 01 Building the Web App HTML,CSS,Javascript 02 Developing the Blockchain Architecture Solidity 03 Building the Deep Learning Model(LSTM) 04 Developing the Smart Contract Solidity Python 05 Integrating the application Survey Paper Contents INTRODUCTION IoT ARCHITECTURE BLOCKCHAI N APPLICATIO NS BLOCKCHAIN IN FINANCIAL SERVICES VARIOUS APPROACHES IN CREDIT SCORING AND P2P LENDING CONCLUSIONS The following table summarizes numerous Blockchain-related strategies in the financial markets: Various approaches in Credit Scoring and P2P Lending THANK YOU