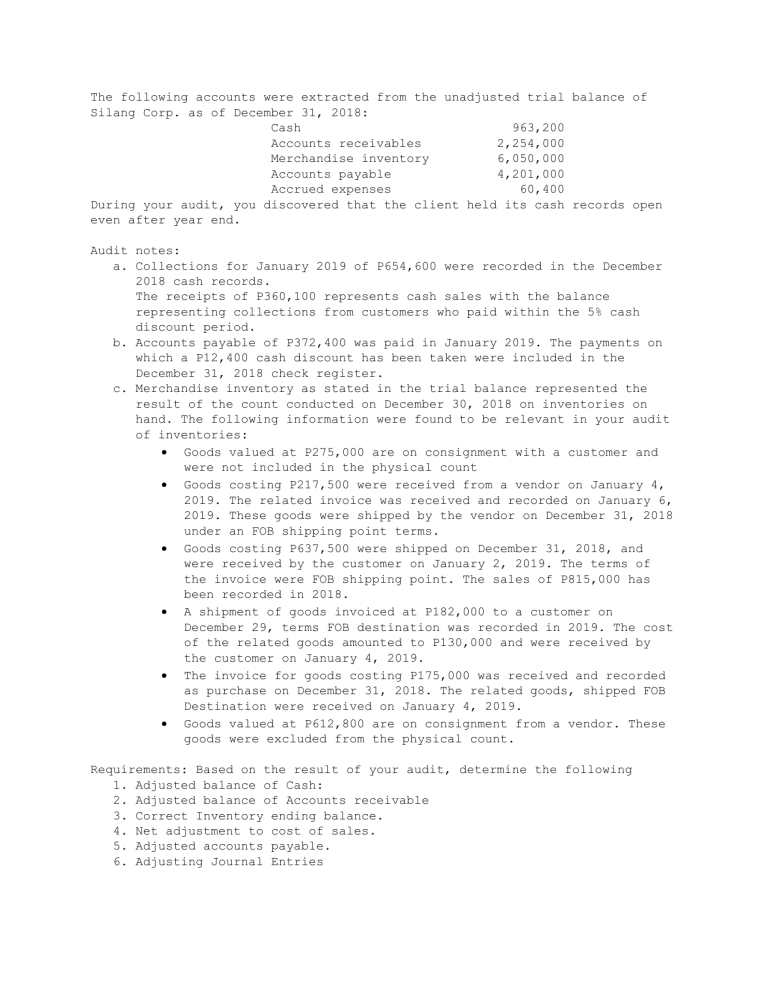

The following accounts were extracted from the unadjusted trial balance of Silang Corp. as of December 31, 2018: Cash 963,200 Accounts receivables 2,254,000 Merchandise inventory 6,050,000 Accounts payable 4,201,000 Accrued expenses 60,400 During your audit, you discovered that the client held its cash records open even after year end. Audit notes: a. Collections for January 2019 of P654,600 were recorded in the December 2018 cash records. The receipts of P360,100 represents cash sales with the balance representing collections from customers who paid within the 5% cash discount period. b. Accounts payable of P372,400 was paid in January 2019. The payments on which a P12,400 cash discount has been taken were included in the December 31, 2018 check register. c. Merchandise inventory as stated in the trial balance represented the result of the count conducted on December 30, 2018 on inventories on hand. The following information were found to be relevant in your audit of inventories: Goods valued at P275,000 are on consignment with a customer and were not included in the physical count Goods costing P217,500 were received from a vendor on January 4, 2019. The related invoice was received and recorded on January 6, 2019. These goods were shipped by the vendor on December 31, 2018 under an FOB shipping point terms. Goods costing P637,500 were shipped on December 31, 2018, and were received by the customer on January 2, 2019. The terms of the invoice were FOB shipping point. The sales of P815,000 has been recorded in 2018. A shipment of goods invoiced at P182,000 to a customer on December 29, terms FOB destination was recorded in 2019. The cost of the related goods amounted to P130,000 and were received by the customer on January 4, 2019. The invoice for goods costing P175,000 was received and recorded as purchase on December 31, 2018. The related goods, shipped FOB Destination were received on January 4, 2019. Goods valued at P612,800 are on consignment from a vendor. These goods were excluded from the physical count. Requirements: Based on the result of your audit, determine the following 1. Adjusted balance of Cash: 2. Adjusted balance of Accounts receivable 3. Correct Inventory ending balance. 4. Net adjustment to cost of sales. 5. Adjusted accounts payable. 6. Adjusting Journal Entries