toaz.info-problem-4-3-revenues-and-other-receipts-pr 1888d9561868b425efa60a0f560b3382

advertisement

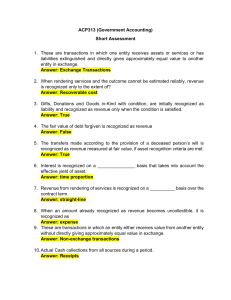

Irish Mae Abad Allyson Novicio Sofia Abiog Karla Molato Paula Bautista Isabella Ventura Iris Marigondon Problem 4-3 Revenues and Other Receipts D. 1. Which of the following is not one of the fundamental principles for revenue under P.D. No. 1445? A. All revenues shall be remitted to the BTr and included in the General Fund, unless another law specifically allows otherwise. B. Recording of revenue in other types of funds (e.g., special fund) shall be made only when authorized by law C. Collections of revenue shall be properly acknowledged through pre-numbered Official Receipts D. All collections of revenue must be in the form of cash. Checks are not acceptable. B. 2. Imposition and collection of tax revenue is considered a (an) A. Exchange transaction B. Non-exchange transaction C. Donation D. Any of these D. 3. According to the GAM for NGAs, all of the following criteria must be met before a government entity recognizes revenue from the sale of goods, except A. Significant risks and rewards of ownership of goods are transferred to the buyer and the entity does not retain control over those goods. B. It is probable that economic benefits will flow to the entity C. The amounts of revenue and related costs costs can be measured reliably D. The stage of completion can be measured reliably C. 4. According to the GAM for NGAs, when the outcome of a service contract cannot be estimated reliably, revenue is recognized. A. On a straight line basis over the periods the services are rendered. B. By reference to the contract’s stage of completion at each reporting date C. Only to the extent of costs that are expected to be recovered D. Only upon the completion of the contract. C. 5. Entity A sells goods with a list price of P100,000 on account. The credit term is 20% and 10%. The journal entry to recognize the revenue includes all of the following except? A. A debit to accounts receivable for P72,000 B. A credit to sales revenue for P72,000 C. A debit to sales discount for P28,000 D. All of these are included in the entry. Irish Mae Abad Allyson Novicio Sofia Abiog Karla Molato Paula Bautista Isabella Ventura Iris Marigondon D. 6. According to the GAM for NGAs, an exchange of goods or services of similar nature and value between entities. A. Gives rise to revenue measured at the fair value of the goods or services received, adjusted for any cash paid or received on the exchange. B. Gives rise to revenue measured at the fair value of goods or services given up, adjusted for any cash paid or received on the exchange. C. A or B, whichever is more clearly determinable D. Does not give rise to revenue B. 7. Gifts, donations and goods in-kind with condition are recognized. A. As revenue immediately upon the receipt thereof B. Initially as liability and recognized as revenue only when the condition is satisfied C. As revenue measured at fair value only when actually received. D. Directly in equity A. 8. According to GAM for NGAs, which of the following may never give rise to revenue for a government entity? A. Services in kind B. Debt forgiveness C. Concessionary loan D. Grant with condition A. 9. When an amount already recognized as revenue becomes subsequently uncollectible, it is A. Recognized as expense B. Recognized as an adjustment to the revenue originally recognized. C. either A or B as an accounting policy choice D. not recognized D. 10. Which of the following receipts of a government entity will give rise to revenue recognition? A. Receipt of excess cash advance B. Receipt of refund for overpayment of expenses C. Receipt of performance bond D. Receipt of subsidy from the National Government or other National Government Agencies.