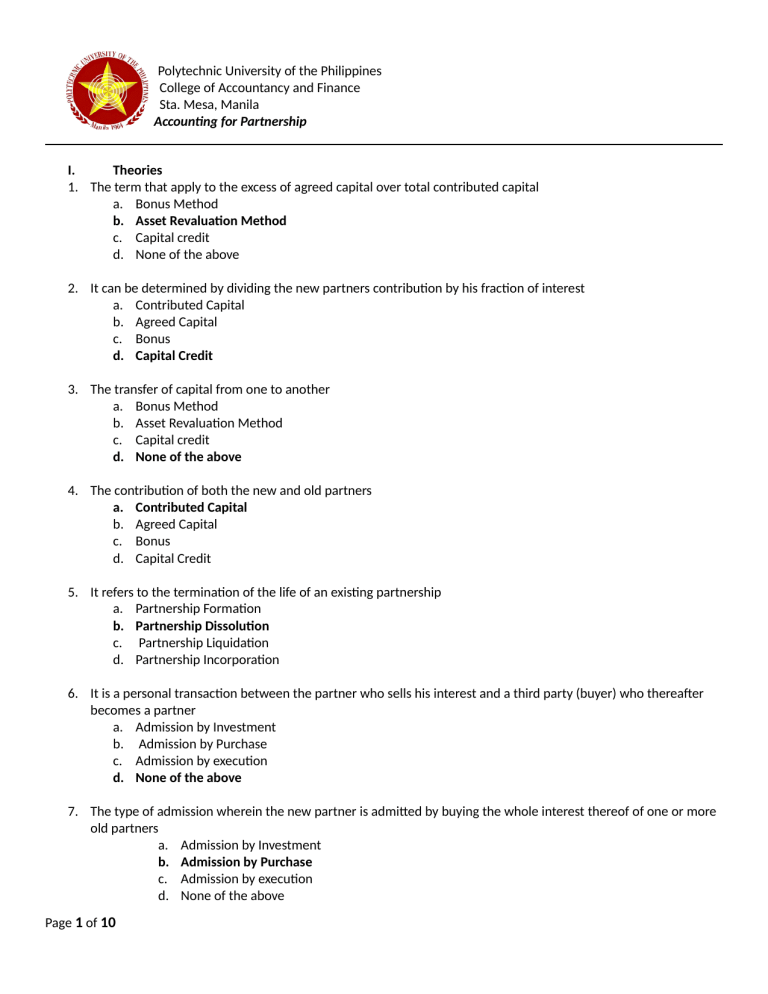

Polytechnic University of the Philippines College of Accountancy and Finance Sta. Mesa, Manila Accounting for Partnership I. Theories 1. The term that apply to the excess of agreed capital over total contributed capital a. Bonus Method b. Asset Revaluation Method c. Capital credit d. None of the above 2. It can be determined by dividing the new partners contribution by his fraction of interest a. Contributed Capital b. Agreed Capital c. Bonus d. Capital Credit 3. The transfer of capital from one to another a. Bonus Method b. Asset Revaluation Method c. Capital credit d. None of the above 4. The contribution of both the new and old partners a. Contributed Capital b. Agreed Capital c. Bonus d. Capital Credit 5. It refers to the termination of the life of an existing partnership a. Partnership Formation b. Partnership Dissolution c. Partnership Liquidation d. Partnership Incorporation 6. It is a personal transaction between the partner who sells his interest and a third party (buyer) who thereafter becomes a partner a. Admission by Investment b. Admission by Purchase c. Admission by execution d. None of the above 7. The type of admission wherein the new partner is admitted by buying the whole interest thereof of one or more old partners a. Admission by Investment b. Admission by Purchase c. Admission by execution d. None of the above Page 1 of 10 8. The type of admission where assets are contributed to the partnership a. Admission by Investment b. Admission by Purchase c. Admission by execution d. None of the above 9. This refers to the termination of the business activities carried on by the partnership a. Formation b. Dissolution c. Liquidation d. Incorporation 10. The interest or equity of a partner in the partnership upon admission a. investment b. Purchase c. execution d. None of the above 11. The situation in admission of a new partner by investment wherein the two alternative solutions are the bonus method and the asset revaluation method a. Agreed capital is given b. Agreed capital is not given c. Contributed capital is not given d. Contributed capital is given 12. The basis for the computation of the total partnership capital when the amount of a new partner's contribution has to be determined a. Fraction of interest b. Fraction of capital c. Fraction of contributed capital d. Fraction of agreed capital 13. The equity of a partner in the partnership that is usually expressed in fraction a.) a. Fraction of interest b. Fraction of capital c. Fraction of contributed capital d. Fraction of agreed capital 14. The difference between the consideration made and the interest transferred in an admission a. Partnership gain or loss b. Corporation gain or loss c. None of the above 15. Which of the following does not result in the dissolution of a partnership a. Marriage of a partner b. Withdrawal of a partner c. Addition of a new partner d. Death of a partner 16. A new partner may be admitted into a partnership by any of the following except A. Page 2 of 10 a. b. c. d. Investing in the partnership Purchasing preferred stock of the partnership Purchasing partners interest Both a and c 17. This results when there is a change in the relationship of the partners caused by any partner ceasing to be associated in the carrying on of the business or by admission of a new partner in the partnership. a. Winding up c. Reorganization b. Liquidation d. Dissolution 18. Which of the following is not closed in the closing process for a partnership? a. Depreciation c. Mr. P., Capital b. Income Summary d. Mr. P., Drawing 19. Two individuals who were previously sole proprietors formed a partnership. Property other than cash which is part of initial investments in the partnership would be recorded for financial accounting purposes at a. Proprietors’ book values or the fair value of the property at the date of the investment, whichever is higher. b. Proprietors’ book values or the fair value of the property at the date of the investment, whichever is lower. c. Proprietors’ book values of the property at the date of investment. d. Fair value of the property at the date of investment. 20. Anton and Garcia formed a partnership, each contributing assets to the business. Anton contributed inventory with a current market value in excess of its carrying amount. Garcia contributed real estate with a carrying amount in excess of its current market value. At what amount should the partnership record each of the following assets? Inventory Real Estate a. Carrying amount Market Value b. Market Value Carrying amount c. Carrying Amount Carrying amount d. Market value Market Value 21. Statement 1: A partnership that has complied with all the requirements for its establishment is called de jure partnership. Statement 2: The unlimited liability of the partners for partnership debts makes the partnership more reliable from the point of view of creditors. a. True, False c. Both are true b. False, True d. Both are false 22. Statement 1: Partnership profit or loss is shared equally unless the partnership contract specifically indicates the manner in which profit or loss is to be divided. Statement 2: No one becomes a member of the partnership without the consent of majority of the partners. a. True, False c. Both are true b. False, True d. Both are false 23. The partnership agreement of Rey and Nante provides for salary allowances of P45,000 to Rey and P35,000 to Nante, with the remaining income or loss to be divided equally. During the year, Rey and Nante each withdraw cash equal to 80% of their salary allowances. If the partnership net income is P100,000, Rey’s equity in the partnership would a. Increase more than Nante’s c. Increase the same as Nante’s b. Decrease more than Nante’s d. Decrease the same as Nante’s 24. Which of the following is not allowed if the operation resulted to a net loss? a. Salaries to partners c. Bonus to managing partners Page 3 of 10 b. Interest on capital d. Both a & b 25. When a partnership purchases the interest of a retiring partner at less than book value, there must be a: a. Bonus to the remaining partners. b. Bonus to retiring partner. c. Bonus to the remaining partners/negative revaluation or both. d. Bonus to the retiring partner/positive revaluation or both. II. Problems 1. On October 1, 2016, Albus and Newt formed a partnership and agreed to share profit and losses in the ratio of 3:7, respectively. Albus contributed a parcel of land that cost him P2,000,000. Newt contributed P3,000,000 cash. The land has a quoted price of P3,600,000 on October 1, 2016. What amount should be recorded in Albus’ capital account upon formation of the partnership? a. P2,000,000 b. P3,000,000 c. P3,480,000 d. P3,600,000 2. On April 30, 2016, Harry, Hermione and Ron formed a partnership by combining their separate business proprietorships. Harry contributed cash of P100,000. Hermione contributed a property with carrying amount of P72,000, original cost of P80,000 and fair value of P160,000. The partnership accepted responsibility for the P70,000 mortgage attached to the property. Ron contributed equipment with a carrying amount of P60,000, original cost of P150,000, and fair value of P110,000. The partnership agreement specifies that profits and losses are to be shared equally but is silent regarding capital contributions. Which partner has the largest capital account balance as of April 30, 2016? a. Harry b. Hermione c. Ron d. All capital account balances are equal 3. De Castro and Carpio formed a partnership and agreed to divide initial capital equally, even though De Castro contributed P100,000 and Carpio gave P84,000 in identifiable assets. Under bonus approach to adjust capital accounts, Carpio’s capital account should be credited for a. P50,000 b. P84,000 c. P92,000 d. P100,000 4. Molino and Nuevo entered into a partnership agreement in which Molino is to have a 60% interests in capital and profits and Nuevo is to have a 40% interests in capital and profits. Molino contributes the following : Land Building Equipment Cost P20, 000 P200,000 P40,000 Fair Value P40,000 P120,000 P30,000 There is a P60,000 mortgage on the building that the partnership agrees to assume. Nuevo contributes P100,000 cash to the partnership. The partnership formation provided for a. Bonus of P8,000 to Nuevo Page 4 of 10 b. Bonus of P8,000 given by Nuevo c. Bonus of P8,000 given by Molino d. Bonus of P8,000 to Molino and Nuevo 5. On March 1, 2016, Boruto and Mitsuki decided to combine their business and form a partnership. The statement of financial position of Boruto and Mitsuki on March 1, before adjustments is presented below. Boruto Cash Accounts Receivable Inventories Furnitures and Fixtures (Net) Office Equipment (Net) Prepaid Expenses Accounts Payable Boruto, Capital Mitsuki, Capital Mitsuki P90,000 185,000 300, 000 300,000 115,000 63,750 P1,053,750 P457,500 596,250 P1,053,750 P37,500 135,000 195,000 90,000 27,500 30,000 P515,000 P180,000 335,000 P515,000 They agreed to provide P5,550 and P4,050 respectively for uncollectible accounts on their present accounts receivable and found Mitsuki’s furniture to be underdepreciated by P9,000. If each partner’s share in equity is to be equal to the net assets invested, the capital accounts of Boruto and Mitsuki would be: a. P581,700 and P330,950 respectively b. P583,200 and P329,450 respectively c. P590,700 and P321,950 respectively d. P1,048,200 and P501,950 respectively 6. Using the information in no. 5, and assuming the partners agreed that equity is to be 60% and 40% to Boruto and Mitsuki respectively, the capital accounts would be: a. P547,590 and P365,060 respectively b. P590,700 and P321,950 respectively c. P930,900 and P620,060 respectively d. P558,750 and P372,500 respectively 7. Jessie J. and Arianna are combining their separate businesses to form a partnership. Cash and non-cash assets are to be contributed for a total capital of P300,000. The non-cash assets to be contributed and the liabilities to be assumed are: Account Receivable Inventories Equipment Accounts Payable Page 5 of 10 Jessie J. Book Value Fair Value 20,000 20,000 30,000 40,000 60,000 45,000 15,000 15,000 Arianna Book Value Fair Value 20,000 40,000 10,000 25,000 50,000 10,000 The partners’ capital accounts are to be equal after all contribution of assets and assumption of liabilities. The amount of cash to be contributed by Jessie J. is a. P60,000 b. P85,000 c. P150,000 d. P210,000 8. Using the information in no. 7, the total assets of the partnership is a. P170,000 b. P180,000 c. P315,000 d. P325,000 9. The partnership of Vayne and Janna was formed on March 31, 2018. On this date, Vayne contributed P50,000 cash and office equipment valued at P30,000. Janna invested P70,000 cash, merchandise valued at P100,000, and furniture valued at P100,000 subject to a notes payable of P50,000, which the partnership assumes. The partnership provides that Vayne and Janna share profit and losses 25:75, respectively. The agreement further provides that the partners should initially have an equal interest in the partnership capital. The total capital of the partnership after the formation is: a. P300,000 b. P310,000 c. P350,000 d. P360,000 10. GD and CL decided to form a partnership on October 1, 2018. Their Statement of Financial Position on that date was : GD Cash Accounts Receivable Merchandise Inventory Equipment Total Accounts Payable Capital Total CL 65,625 1,487,500 875,000 656,250 3,084,375 459,375 2,625,000 3,084,375 164,062.50 896,875 885,937.5 1,268,750 3,215,625 1,159,375 2,056,250 3,215,625 They agreed to the following adjustments: Equipment of GD is overvalued by P87,500 and that CL’s is undervalued by P131,250. Allowance for Doubtful Accounts is to be set-up to P297,500 for GD and P196,875 for CL. Inventories of P21,875 and P15,312.50 are worthless in the books of GD and CL, respectively. The partnership agreement provides for a profit and loss ratio of 7:3 for GD and CL, respectively. How much is the agreed capital of GD to bring the capital balances proportionate to their profit and loss ratio? a. b. c. d. 11. 2,935,406.25 2,390,937.50 2,218,125 1,024,687.50 Evie and Leo are partners who agreed to share profits and losses in the following manner: Evie Leo Page 6 of 10 Annual Salaries P261,000 P259,000 = 520k Interest on Average Capital 5% 30k 10% 30k= 60k Bonus (based on net income 10% after salaries and interest) Remainder 50% (2.5) 50% (2.5) = 5k During the current year, the partnership’s result of operation was P575,000 profit before any deduction. Evie and Leo’s average capital balances for the year are P600,000 and P300,000, respectively. How much is the total share of Leo in the net income for the current year? a. P287,500 b. P286,500 c. P288,500 d. P295,665 12. Canlas, a partner in the 3C partnership, has a 30% participation in the partnership profit and losses. Canlas’ capital account had a net decrease of P120,000 during the calendar year of 2018. During 2018, Canlas withdrew P260,000 (charged against his capital account) and contributed property valued at P50,000 to the partnership. What was the profit of 3C Partnership? a. P300,000 b. P466,667 c. P700,000 d. P1,100,000 13. Partners Fojas and Gomez share profits and loss equally after each has been credited in all circumstances will annual salary allowances of P30,000 and P24,000, respectively. Under this arrangement, in which of the following circumstances will Fojas benefit by P6,000 more than Gomez? a. Only if the partnership has earning of P54,000 or more for the year b. Only if the partnership does not incur a loss for the year c. In all earnings or loss situation d. Only if the partnership has earnings of at least P6,000 for the year 14. Ramos, Campos and Ocampo are partners with average capital balances in 2018 of P240,000, P120,000 and P80,000, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P60,000 to Ramos and P40,000 to Campos, the residual profit or loss is divided equally. In 2018, the partnership sustained a loss of P66,000 before salaries and interest to partners. By what amount should Ramos’ capital account change? a. P14,000 decrease b. P22,000 decrease c. P70,000 decrease d. P84,000 decrease 15. How much is the share of Campos in the loss? a. P(18,000) b. P26,000 c. P(22,000) d. P(24,667) 16. Tamayo, Banson and Vidal formed a partnership on January 1,2017 with the following initial investments: Tamayo P100,000 Banson P150,000 Vidal P225,000 The partnership agreement stated that profits and losses are to be shared equally by the partners after consideration is made for the following: Salaries allowed to partners: P60,000 for Tamayo; P48,000 to Banson and P36,000 for Vidal. Page 7 of 10 10% Interest on average capital for each partner. Additional Information: On June 30,2017, Tamayo invested additional P60,000 Vidal withdrew P70,000 from the partnership on Sept. 30, 2017 Share on the remaining profit was P3,000 for each partner. Interest on the average capital balances of the partners totaled: a. P48,750 b. P53,750 c. P57,625 d. P60,625 17. Using the information in no. 16, the partnership net profit for 2017 before salaries, interests and partners’ share on the remainder was: a. P199,750 b. P201,750 c. P207,750 d. P211,625 18. ABC Partnership was formed by A, B, and C last December 1, 2017. The original investments of the partner was: A-P200,000 1667 B-P500,000 4167 C-P300,000 2500 8334 On January 1,2018, the capital balances of the partners are: A-P500,000 B-P900,000 C-P700,000 The Profit and Loss Sharing agreement of the partners provide the following: 10% annual interest on capital Annual Salaries: A-P50,000 4167 B-P60,000 5 C-P70,000 5833 15 Remainder to be shared equally Assuming the partnership operation for the year, 2018, resulted to P300,000 profit. How much is the share of C in the profit? a. P106,667 b. P110,000 c. P101,555 d. None of the choices 19. Assuming for the year 2017, there is a profit of P10,000, how much is the share of A? Answer: P1,389 20. Marvin, Gerwin and Grace formed a partnership on July 1,2017 with the following investments: Marvin P200,000 Gerwin P300,000 Grace P450,000 The partnership agreement provides that profits and losses are to be shared equally by partners after consideration for the following: Annual Salaries to partners:P60,000 for Marvin, P48,000 for Gerwin, P36,000 for Grace 72000 10% interest on average capital 49250 10% net profit after salaries and interest as bonus to Marvin as the Managing Partner Additional information: Page 8 of 10 On October 1, 2017, Marvin made additional investment of P60,000 Grace invested P30,000 on December 1, 2017 If each partner received P30,000 on the residual profit after salaries, interest and bonus, the net income reported by the partnership was: a. P196,625 b. P220,750 c. P176,962.50 d. P221,250 21. Considering your answer in no. 20, the capital balance of Marvin on December 31, 2017 is: a. P81,500 b. P101,500 c. P341,500 d. P335,750 22. Presented below is the balance sheet of the partnership KK, LL and MM who share profit and losses in the ratio of 6:3:1, respectively: Cash Other Assets Liabilities P80,000 KK, Capital 252,000 LL, Capital 126,000 MM, Capital 42,000 Total P500,000 Total P500,000 The partners agree to sell NN 20% of their respective capital and profit and loss interest for a total payment of P90,000. The payment by NN is to be made directly to the individual partners. The capital balances of KK, LL and MM, respectively after the admission of NN are: a. P198000; P99000; P33000 b. P201600; P100800; P33600 c. P246000; P108000; P36000 d. P255600; P127,800; P42600 23. Using the same information in no.22, assuming that revaluation of asset is to be recorded prior to the acquisition by NN. The capitals of KK, LL and MM, respectively after the admission of NN are: a. b. c. d. 198000 201600 216000 255600 P85,000 415,000 99000 100800 108000 127800 33000 33600 36000 42600 24. Capital balances and profits sharing percentages for the partnership of Charlene, April and Raven on January 1, 2018 are as follows: Charlene (36%) P280,000 April (24%) 200,000 Raven (40%) 320,000 On January 5, 2018 the partners agreed to admit Angel into the partnership for a 25% interest in capital and earnings for her investment of P240,000. The partnership assets are not to be revalued. The capital balance and new profit and loss sharing ratio of Charlene after the admission of Angel is _________ and _____________, respectively. a. P260,000; 27% c. P259,200; 27% b. P251,200, 36% d. P272,800; 27% Page 9 of 10 25. The total of the partners’ capital accounts was P110,000 before the recognition of partnership asset revaluation in preparation for the withdrawal of a partner whose profit and loss sharing ratio is 2/10. He was paid P28,000 by the firm in the final settlement for his interest. The remaining partners’ capital accounts, excluding their share of the asset revaluation totaled P90,000 after his withdrawal. How much was the agreed total asset revaluation of the firm? a. P8,000 c. P20,000 b. P140,000 d. P40,000 26. A, B, C are partners in the accounting firm. Their capital account balances at year-end were: A, P90,000; B, P110,000; C, P50,000. They share profits and losses in a 4:4:2 ratio, after the following special terms: Partner C is to receive a bonus of 10% of the net income after bonus. Interest of 10% shall be paid on that portion of a partner’s capital in excess of P100,000. Salaries of P10,000 and P12,000 shall be paid to partners A and C, respectively. Assuming a net income of P44,000 for the year, the total profit share of partner C would be: a. P7,800 c. P19,400 b. P16,800 d. P19,800 27. Anna, Karen and Nina are partners sharing profits in the ratio of 3:3:2. On June 30, their capital balances are: Anna – P600,000; Karen – P400,000; Nina – P300,000. The partners agree to admit Philomena on the following agreement: 1. Philomena is to pay Anna P400,000 for a ½ interest of Anna’s interest. 2. Philomena is also to invest P300,000 in the partnership. 3. The total capital of the partnership is to be P2,000,000, of which Philomena’s interest is to be 25%. What are the capital balances of Anna, Karen and Nina after the admission of Philomena? a. P487,500; P587,500; P425,000 b. P400,000; P300,000; P300,000 c. P300,000; P400,000; P300,000 d. P187,500; P187,500; P125,000 28. Bonus Page 10 of 10