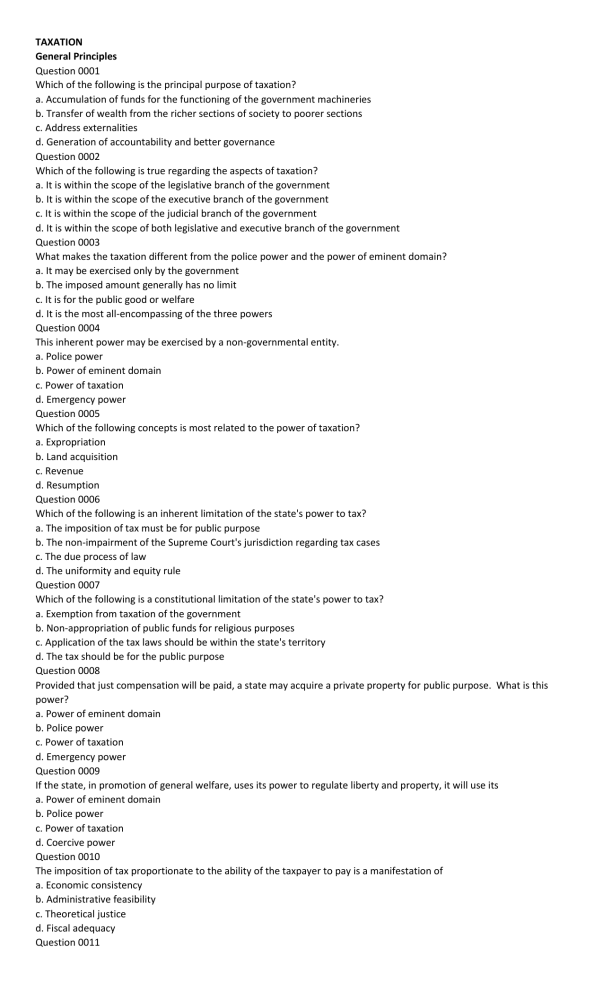

TAXATION General Principles Question 0001 Which of the following is the principal purpose of taxation? a. Accumulation of funds for the functioning of the government machineries b. Transfer of wealth from the richer sections of society to poorer sections c. Address externalities d. Generation of accountability and better governance Question 0002 Which of the following is true regarding the aspects of taxation? a. It is within the scope of the legislative branch of the government b. It is within the scope of the executive branch of the government c. It is within the scope of the judicial branch of the government d. It is within the scope of both legislative and executive branch of the government Question 0003 What makes the taxation different from the police power and the power of eminent domain? a. It may be exercised only by the government b. The imposed amount generally has no limit c. It is for the public good or welfare d. It is the most all-encompassing of the three powers Question 0004 This inherent power may be exercised by a non-governmental entity. a. Police power b. Power of eminent domain c. Power of taxation d. Emergency power Question 0005 Which of the following concepts is most related to the power of taxation? a. Expropriation b. Land acquisition c. Revenue d. Resumption Question 0006 Which of the following is an inherent limitation of the state's power to tax? a. The imposition of tax must be for public purpose b. The non-impairment of the Supreme Court's jurisdiction regarding tax cases c. The due process of law d. The uniformity and equity rule Question 0007 Which of the following is a constitutional limitation of the state's power to tax? a. Exemption from taxation of the government b. Non-appropriation of public funds for religious purposes c. Application of the tax laws should be within the state's territory d. The tax should be for the public purpose Question 0008 Provided that just compensation will be paid, a state may acquire a private property for public purpose. What is this power? a. Power of eminent domain b. Police power c. Power of taxation d. Emergency power Question 0009 If the state, in promotion of general welfare, uses its power to regulate liberty and property, it will use its a. Power of eminent domain b. Police power c. Power of taxation d. Coercive power Question 0010 The imposition of tax proportionate to the ability of the taxpayer to pay is a manifestation of a. Economic consistency b. Administrative feasibility c. Theoretical justice d. Fiscal adequacy Question 0011 "Sufficiency of the state's revenue is based on the demands of public expenditures" - is most related to which of the following? a. Revenue sourcing b. Administrative feasibility c. Equality or theoretical justice d. Fiscal adequacy Question 0012 The tax system should be capable of being properly and efficiently administered by the government and enforced with the least inconvenience to the taxpayer. a. Public capability b. Administrative feasibility c. Equality or theoretical justice d. Fiscal adequacy Question 0013 Statement I: All revenues and assets of non-stock, non-profit educational institutions used actually, directly, and exclusively for educational purposes shall be exempt from taxes and duties. Statement II: The President shall have the power to veto any particular item or items in a tariff bill and will affect all the items in the particular bill. Which of the foregoing statements is/are true? a. I only b. II only c. Both I and II d. Neither I nor II Question 0014 This is a burden, generally in form of money, forced by the government on entities (persons or property) for public use. a. Assessment b. Tax c. License fee d. Toll Question 0015 By principle, when persons or things of the same class are taxed at the same rate, there is a. Uniformity b. Equality c. Reciprocity d. Simplicity Question 0016 The following are essential characteristics of tax, except for: a. Levied by the lawmaking body of the state b. Payable in cash or money c. Enforced contribution d. The amount that can be imposed is unlimited Question 0017 The following are essential characteristics of the special assessment, except for: a. Based exclusively on the derived benefit by the landowners b. Not a personal liability of the persons assessed c. Based on public necessity d. Levied on land Question 0018 It is the reduction or removal of liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. a. Tax credit b. Tax amnesty c. Tax exemption d. Tax incentive Question 0019 Statement I: Revenue laws are political in nature. Statement II: Tax laws are general laws Which of the foregoing statements is/are true? a. I only b. II only c. Both I and II d. Neither I nor II Question 0020 Statement I: The amount taxed is limited to the cost of regulation. Statement II: Non-payment of tax makes a business illegal. Which of the foregoing statements is/are true? a. I only b. II only c. Both I and II d. Neither I nor II Answer Key! 1. A 2. D 3. B 4. B 5. C 6. A 7. B 8. A 9. B 10. C 11. D 12. B 13. A 14. B 15. A 16. D 17. C 18. C 19. D 20. D Question 0021 This is the utilization of illegal means to avoid tax payment a. Evasion b. Avoidance c. Exemption d. Shifting Question 0022 This is the utilization of means allowed by law to avoid tax payment a. Evasion b. Avoidance c. Exemption d. Shifting Question 0023 This is another term for tax evasion a. Tax benefit b. Tax exemption c. Tax avoidance d. Tax dodging Question 0024 This is another term for tax minimization a. Tax evasion b. Tax exemption c. Tax avoidance d. Tax dodging Question 0025 When in doubt, tax statutes are construed a. Liberally in favor of both the government and the taxpayer b. Strictly against both the government and the taxpayer c. Liberally in favor of the government and strictly against the taxpayer d. Strictly against the government and liberally in favor of the taxpayer Question 0026 When in doubt, tax exemptions are construed a. Liberally in favor of both the government and the taxpayer b. Strictly against both the government and the taxpayer c. Liberally in favor of the government and strictly against the taxpayer d. Strictly against the government and liberally in favor of the taxpayer Question 0027 When there is a conflict between the Tax Code and the Philippine Financial Reporting Standards or PFRS a. The taxpayer has the discretion on what to use b. Modified cash basis shall be used c. Tax Code shall prevail d. PFRS shall prevail Question 0028 For a specific territory, this is the fixed amount tax imposed upon the residing people. a. Progressive b. Excise c. Property d. Poll Question 0029 Tax on properties proportional to its value or other reasonable measurement bases. a. Progressive b. Excise c. Property d. Poll Question 0030 Tax on occupation engagement. a. Progressive b. Excise c. Property d. Poll Question 0031 A tax, such as income tax, which is levied on the income or profits of the person who pays it, rather than on goods or services. a. Income b. Excise c. Indirect d. Direct Question 0032 A tax collected by an intermediary from the person who bears the ultimate economic burden of the tax. a. Income b. Excise c. Indirect d. Direct Question 0033 A tax that is defined as a fixed amount for each unit of a good or service sold, such as peso per kilogram. a. Income b. Excise c. Ad valorem d. Specific Question 0034 A tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction. a. Income b. Excise c. Ad valorem d. Specific Question 0035 A tax imposed so that the tax rate is fixed, with no change as the taxable base amount increases or decreases. a. Direct b. Regressive c. Progressive d. Proportional Question 0036 This tax imposes a greater burden on the poor than on the rich. a. Direct b. Regressive c. Progressive d. Proportional Question 0037 Tax in which the tax rate increases as the taxable amount increases. a. Direct b. Regressive c. Progressive d. Proportional Question 0038 This is also called 'per unit tax'. a. Progressive b. Excise c. Ad valorem d. Specific Question 0039 Negative income tax is a a. Progressive b. Excise c. Regressive d. Proportional Question 0040 Which of the following is not a constitutional limitation of the power of taxation? a. No person shall be deprived of life, liberty, or property without due process of law, nor shall any person be denied the equal protection of the law. b. The rule of taxation shall be uniform and equitable c. No person shall be imprisoned for debt and non-payment of a poll tax. d. The tax must be for a public purpose. Answer Key! 21. A 22. B 23. D 24. C 25. D 26. C 27. C 28. D 29. C 30. B 31. D 32. C 33. D 34. C 35. D 36. B 37. C 38. D 39. A 40. D