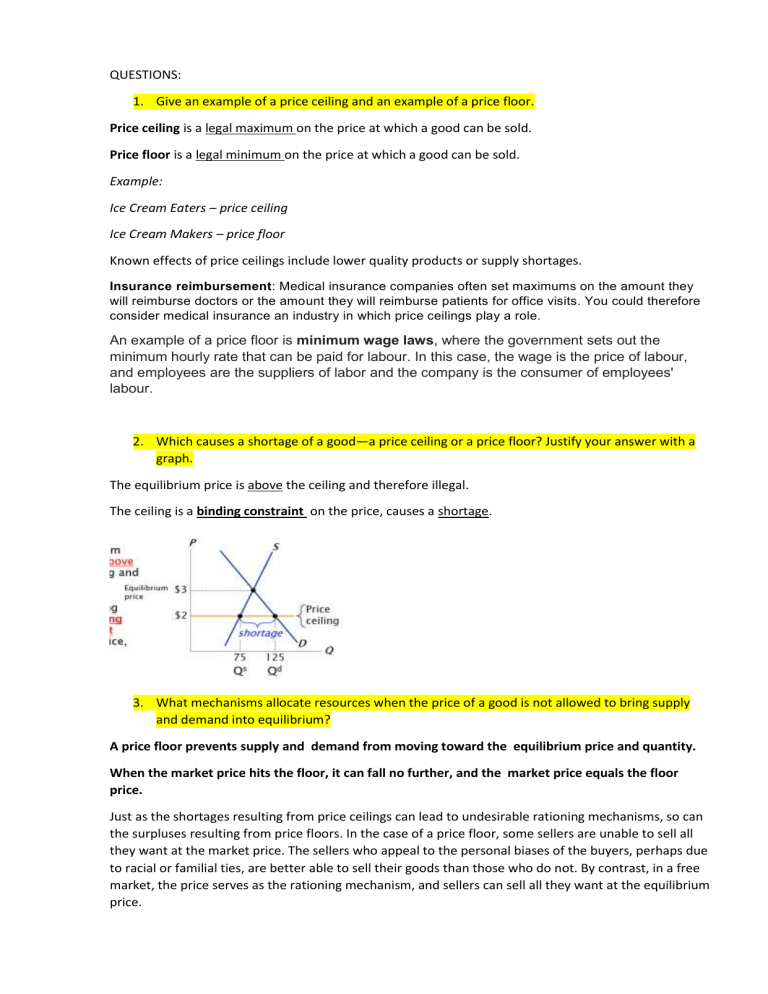

QUESTIONS: 1. Give an example of a price ceiling and an example of a price floor. Price ceiling is a legal maximum on the price at which a good can be sold. Price floor is a legal minimum on the price at which a good can be sold. Example: Ice Cream Eaters – price ceiling Ice Cream Makers – price floor Known effects of price ceilings include lower quality products or supply shortages. Insurance reimbursement: Medical insurance companies often set maximums on the amount they will reimburse doctors or the amount they will reimburse patients for office visits. You could therefore consider medical insurance an industry in which price ceilings play a role. An example of a price floor is minimum wage laws, where the government sets out the minimum hourly rate that can be paid for labour. In this case, the wage is the price of labour, and employees are the suppliers of labor and the company is the consumer of employees' labour. 2. Which causes a shortage of a good—a price ceiling or a price floor? Justify your answer with a graph. The equilibrium price is above the ceiling and therefore illegal. The ceiling is a binding constraint on the price, causes a shortage. 3. What mechanisms allocate resources when the price of a good is not allowed to bring supply and demand into equilibrium? A price floor prevents supply and demand from moving toward the equilibrium price and quantity. When the market price hits the floor, it can fall no further, and the market price equals the floor price. Just as the shortages resulting from price ceilings can lead to undesirable rationing mechanisms, so can the surpluses resulting from price floors. In the case of a price floor, some sellers are unable to sell all they want at the market price. The sellers who appeal to the personal biases of the buyers, perhaps due to racial or familial ties, are better able to sell their goods than those who do not. By contrast, in a free market, the price serves as the rationing mechanism, and sellers can sell all they want at the equilibrium price. 4. Explain why economists usually oppose controls on prices. The reason most economists are usually appose about price controls Is that they distort the allocation of resources. Price ceilings, which prevent prices from exceeding a certain maximum, cause shortages. Price floors, which prohibit prices below a certain minimum, cause surpluses, at least for a time. For example, let's say that the supply and demand for milk and eggs are balanced at the current price, and that the government then fixes a lower maximum price. 5. Suppose the government removes a tax on buyers of a good and levies a tax of the same size on sellers of the good. How does this change in tax policy affect the price that buyers pay sellers for this good, the amount buyers are out of pocket including the tax, the amount sellers receive net of the tax, and the quantity of the good sold? Removing a tax paid by buyers and replacing it with a tax paid by sellers has no effect on the price that buyers pay, the price that sellers receive, and the quantity of the good sold. 6. How does a tax on a good affect the price paid by buyers, the price received by sellers, and the quantity sold? A tax on a good raises the price buyers pay, lowers the price sellers receive, and reduces the quantity sold. 7. What determines how the burden of a tax is divided between buyers and sellers? Why? The burden of a tax is divided between buyers and sellers depending on the elasticity of demand and supply. Elasticity represents the willingness of buyers or sellers to leave the market, which in turns depends on their alternatives. When a good is taxed, the side of the market with fewer good alternatives cannot easily leave the market and thus bears more of the burden of the tax. Tax imposed who bears the most burden who ever has the most inelastic curve