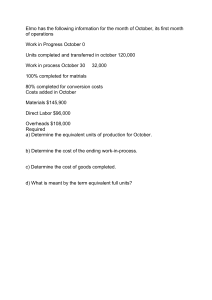

Exercise 17-24, 25, 26 (14th edition) Given: Tomlinson Corporation is a biotech company based in Milpitas. It makes a cancer-treatment drug in a single processi department . Direct materials are added at the start of the process. Conversion costs are added evenly during the pr Tomlinson Corporation uses the weighted-average method of process costing. The following information for July 201 available. Equivalent Units Physical Direct Conversion Units Materials Costs Work-in-process, July 1 (DM -- 100%; CC -- 25%) 8,700 8,700 2,175 Started during July 34,500 Completed and transferred out during July 32,000 32,000 32,000 Work-in-process, July 31 (DM -- 100%; CC -- 70%) 11,200 11,200 7,840 Total Costs for July 2014 Work in process, beginning Direct materials Conversion costs Direct materials added during July Conversion costs added during July Total costs to account for $61,500 43,200 $104,700 301,380 498,624 $904,704 Exercise 17-24 Weighted-average Method, assigning costs Required: 1. Calculate cost per equivalent unit for direct materials and conversion costs. 2. Summarize the total costs to account for, and assign total costs to units completed (and transferred out) and to un Exercise 17-25 1. Do Exercise 17-24 using the Fifo method. 2. Tomlinson's management seeks to have a more consistent cost per equivalent. Which method of process costing company choose and why? W/A because the cost of the BI is mixed together with the costs added each per Exercise 17-26 (14th edition) Refer to the information in Exercise 17-24. Suppose Tomlinson determines standard cost of $8.60 per equivalent unit materials and $13.50 per equivalent unit for conversion costs for both beginning work in process and work done in th period. Tomlinson Corporation Equivalent Units Tomlinson Corporation Cost of Production Report Physical Flow D/M Degree of Completion Added Beginning Evenly Units to Account for: D/M Conversion BWIP (7/1/14) 100% 25% 8,700 Started during July 34,500 Total 43,200 Units Accounted for: Work Done This Period Completed Units 32,000 From BWIP 0% 75% 8,700 0 Started And Completed 100% 100% 23,300 23,300 EWIP 100% 70% 11,200 11,200 Total 43,200 Calculation of Equivalent Units FIFO Equivalent Units Plus BWIP EU from previous period Weighted Average Equivalent Units Costs to Account for: BWIP Current Costs Added This Period Total Cost per Equivalent Unit: FIFO Weighted Average Standard Cost Costs Accounted for: Fifo Method Costs Associated with Completed Units From BWIP Costs Assigned to BWIP D/M Conversion Costs Total From Units Started & Completed Total Cost Associated with Units Transferred-out Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Cost Assigned to EWIP Total Costs Accounted for Costs Accounted for: Weighted Average Method Costs Associated with Completed Units Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Total Costs Accounted for Costs Accounted for: Standard Cost Method Costs Associated with Completed Units From BWIP Costs Assigned to BWIP (assuming same std. costs values) D/M Conversion Costs Total From Units Started & Completed Total Cost Associated with Units Transferred-out Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Cost Assigned to EWIP Total Standard Costs Accounted for Standard Cost Variances (A) (B) 34,500 8,700 43,200 (1) (2) D/M $61,500 301,380 $362,880 (1) / (A) (2) / (B) $8.736 $8.400 $8.600 $61,500 $0 $61,500 $203,541 $265,041 $97,839 $97,839 $362,880 32,000 $268,800 $94,080 $94,080 $362,880 $74,820 $0 $74,820 $200,380 $275,200 $96,320 $96,320 $371,520 Associated with BWIP and recognized last time period (favorable) Associated with current period (favorable) Total cost accounted for (13,320) 4,680 $362,880 Journal Entries for FIFO, W/A, and Standard Cost Methods Work-in-Process DM Variances Direct Materials Inventory To record direct material usage. Fifo Method Dr Cr 301,380 301,380 Work-in-Process Conversion Variances Various Accounts To record direct labor and MOH usage. 498,624 Finished Goods Work-in-Process To record the transfer production costs of completed units to finished goods. 703,076 498,624 703,076 FIFO WIP 104,700 301,380 498,624 201,628 703,076 nt drug in a single processing added evenly during the process. ng information for July 2014 is Started & Completed 23,300 23,300 d transferred out) and to units in EWIP. method of process costing should the h the costs added each period. of $8.60 per equivalent unit for direct rocess and work done in the current Tomlinson Corporation Equivalent Units Conversion 6,525 B 23,300 C 7,840 D 37,665 B+C+D 2,175 A 39,840 A+B+C+D Conversion $43,200 498,624 $541,824 $13.238 $13.600 $13.500 $43,200 Total $104,700 A 800,004 B,C,D $904,704 A,B,C,D $21.974 $22.000 $22.100 $86,381 $129,581 $308,455 $438,035 $104,700 A $0 B $86,381 B $191,081 $21.963 $511,995 $21.974 $703,076 $21.971 $103,789 $103,789 $541,824 $97,839 $103,789 $201,628 $904,704 $435,200 $704,000 $106,624 $106,624 $541,824 $94,080 $106,624 $200,704 $904,704 $29,363 $88,088 $117,450 $314,550 $432,000 $104,183 $0 $88,088 $192,270 $514,930 $707,200 $105,840 $105,840 $537,840 $96,320 $105,840 $202,160 $909,360 $22.00 $704,000 $22.10 $22.10 $22.10 $192,270 $514,930 $707,200 $275,200 $432,000 $707,200 13,838 (9,854) $541,824 518 (5,174) $904,704 Weighted Average Method Dr Cr 301,380 Standard Cost Method Dr Cr 296,700 4,680 301,380 301,380 $296,700 508,478 $508,478 498,624 9,854 498,624 498,624 704,000 707,200 704,000 707,200 Weighted Average WIP 104,700 301,380 704,000 498,624 200,704 Std. Cost WIP 104,183 296,700 707,200 508,478 202,160 Exercise 17-26 Given: Tomlinson Corporation is a biotech company based in Milpitas. It makes a cancer-treatment drug in a single processi department . Direct materials are added at the start of the process. Conversion costs are added evenly during the pr Tomlinson Corporation uses the weighted-average method of process costing. The following information for July 201 available. Equivalent Units Physical Direct Conversion Units Materials Costs Work-in-process, July 1 (DM -- 100%; CC -- 25%) 8,700 8,700 2,175 Started during July 34,500 Completed and transferred out during July 32,000 32,000 32,000 Work-in-process, July 31 (DM -- 100%; CC -- 70%) 11,200 11,200 7,840 Total Costs for July 2011 Work in process, beginning Direct materials Conversion costs Direct materials added during July Conversion costs added during July Total costs to account for $61,500 43,200 $104,700 301,380 498,624 $904,704 Required: Refer to the information in Exercise 17-24. Suppose Tomlinson determines standard cost of $8.60 per equivalent unit materials and $13.50 per equivalent unit for conversion costs for both beginning work in process and work done in th period. Tomlinson Corporation Equivalent Units Tomlinson Corporation Cost of Production Report Physical Flow D/M Degree of Completion Added Beginning Evenly Units to Account for: D/M Conversion BWIP (7/1/14) 100% 25% 8,700 Started during July 34,500 Total 43,200 Units Accounted for: Completed Units 32,000 From BWIP 0% 75% 8,700 0 Started And Completed 100% 100% 23,300 23,300 EWIP 100% 70% 11,200 11,200 Total 43,200 Calculation of Equivalent Units FIFO Equivalent Units 34,500 Plus BWIP EU from previous period 8,700 Weighted Average Equivalent Units 43,200 Costs to Account for: BWIP Standard Costs Added This Period D/M $74,820 296,700 Total Standard Cost per Equivalent Unit: Costs Accounted for: Standard Cost Method Costs Associated with Completed Units From BWIP Costs Assigned to BWIP (assuming same std. costs values) D/M Conversion Costs Total From Units Started & Completed Total Cost Associated with Units Transferred-out Total Cost Associated with Units Transferred-out Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Cost Assigned to EWIP Total Standard Costs Accounted for 2. Calculate the Standard Cost Variances Associated with BWIP and recognized last time period Actual costs assigned to BWIP under FIFO and weighted average methods Standard Costs assigned to BWIP (assuming standards have not changed) Total standard cost variances recognized in previous period (favorable) Associated with current period (unfavorable) Actual costs assigned this period Standard costs assigned to production this period Total standard cost variances recognized this period (favorable) $371,520 $8.600 $8.600 $8.600 $74,820 $0 $74,820 $200,380 $275,200 $275,200 $96,320 $96,320 $371,520 D/M $61,500 74,820 ($13,320) $301,380 296,700 $4,680 Journal Entries for Standard Cost Method: Work-in-Process DM Variances Direct Materials Inventory To record direct material usage. Standard Cost Method Dr 296,700 4,680 Work-in-Process Conversion Variances Various Accounts To record direct labor and MOH usage. 508,478 Finished Goods Work-in-Process To record the transfer production costs of completed units to finished goods. 707,200 Standard Cost Method WIP 104,183 296,700 508,478 202,160 drug in a single processing ded evenly during the process. g information for July 2014 is Started & Completed 23,300 23,300 $8.60 per equivalent unit for direct cess and work done in the current Tomlinson Corporation Equivalent Units Conversion 6,525 b 23,300 c 7,840 d 37,665 b+c+d 2,175 a 39,840 a+b+c+d Conversion $29,363 508,478 Total $104,183 805,178 $537,840 $13.500 $13.500 $13.500 $909,360 $22.100 $29,363 $88,088 $117,450 $314,550 $432,000 $432,000 $104,183 $0 $88,088 $192,270 $514,930 $707,200 $707,200 $105,840 $105,840 $537,840 $96,320 $105,840 $202,160 $909,360 Conversion Total $43,200 29,363 $13,838 $104,700 104,183 $518 $498,624 508,478 ($9,854) $800,004 805,178 ($5,174) Standard Cost Method Cr $296,700 $296,700 301,380 $508,478 $508,478 9,854 498,624 707,200 Standard Cost Method $22.10 $22.10 $22.10 WIP 707,200 Problem 17- 38 Modified (Transferred-in costs, weighted-average method) Given: Publishers, Inc., has two departments: printing and binding. Each department has one direct-cost category (DM) and indirect-cost category (conversion costs). This problem focuses on the binding department. Books that have underg the printing process are immediately transferred to the binding department. Direct material is added when the binding process is 70% complete. Conversion costs are added evenly during binding operations. When those operations are the books are immediately transferred to finished goods. Publishers, Inc., uses the weighted average method of proc costing. The following is a summary of the April, 2014 operations of the binding department. When are costs incurred Beginning work-in-process inventory Transferred in during April from printing Completed and T/O during April Ending work-in-process April 30 Total costs added during April Degree of Completion Trans-in D/M Conversion 70% Uniformly Beginning 100% 0% 60% 100% 100% 100% 100% Physical Units (Cases) 1,260 2,880 3,240 900 100% 75% Required: 1. Using the weighted-average method, summarize the total Drying and Packaging Department costs for week 37, and total costs to units completed (and transferred out) and to units in ending work-in-process inventory. Binding Department Cost of Production Report: April 2014 (WA) Physical Flow Degree of Completion Units to Account for: Trans-in D/M Conversion BWIP 100% 0% 60% 1,260 Transferred-in from printing during April 2,880 Total 4,140 Units Accounted for: Units completed 3,240 1,980 From BWIP 1,980 0% 100% 40% 1,260 Started And Completed 100% 100% 100% 1,980 EWIP 100% 100% 75% 900 Total 4,140 Calculation of Equivalent Units FIFO Equivalent Units (A) Plus BWIP EU from previous period Weighted Average Equivalent Units (B) Costs to Account for: BWIP Current Costs Added This Period Total Cost per Equivalent Unit: Weighted Average Costs Accounted for: Weighted Average Method Costs Associated with Completed Units Cost Assigned to EWIP Units (1) (2) (2) / (B) Transferred-in Costs D/M Costs Conversion Costs Total Total Costs Accounted for Journal Entries Work-in-Process -- Binding Department Work-in-Process -- Printing Department To record the transfer of partially completed units from the Printing Department to the Binding Department. Weighted Average Method Dr 155,520 Cr 155,520 Work-in-Process -- Binding Department Direct Materials Inventory To record direct material usage during April 28,188 Work-in-Process -- Binding Department Various Accounts To record conversion costs during April 84,240 Finished Goods Inventory Work-in-Process -- Binding Department To record the transfer of finished units to finishing goods inventory. 257,612 28,188 84,240 257,612 Weighted Average WIP - Binding 55,440.00 155,520.00 28,188.00 84,240.00 65,776.10 257,611.90 ect-cost category (DM) and one nt. Books that have undergone l is added when the binding When those operations are done, ed average method of process Trans-in Costs Direct Material Conversion Costs $39,060 $0 $16,380 $155,520 $28,188 $84,240 ment costs for week 37, and assign ess inventory. Trans-in Equivalent Units D/M Conversion 0 1,980 900 1,260 1,980 900 504 b 1,980 c 675 d 2,880 1,260 4,140 4,140 0 4,140 3,159 b,c,d 756 a 3,915 a,b,c,d Trans-in $39,060.00 $155,520.00 $194,580.00 D/M $0.00 $28,188.00 $28,188.00 Conversion $16,380.00 $84,240.00 $100,620.00 $47.0000 $6.8087 $25.7011 $79.5098 $152,280.00 $22,060.17 $83,271.72 $257,611.90 Total $55,440.00 a $267,948.00 b,c,d $323,388.00 a.b.c.d $257,612 $42,300.00 $6,127.83 $42,300.00 $194,580.00 $6,127.83 $28,188.00 $17,348.28 $17,348.28 $100,620.00 $42,300.00 $6,127.83 $17,348.28 $65,776.10 $323,388.00 Problem 17- 39 Modified (Transferred-in costs, FIFO method) Given: Publishers, Inc., has two departments: printing and binding. Each department has one direct-cost category (DM) and indirect-cost category (conversion costs). This problem focuses on the binding department. Books that have undergo the printing process are immediately transferred to the binding department. Direct material is added when the binding process is 70% complete. Conversion costs are added evenly during binding operations. When those operations are the books are immediately transferred to finished goods. Publishers, Inc., uses the FIFO method of process costing. The following is a summary of the April, 2014 operations of the binding department. When are costs incurred Beginning work-in-process inventory Transferred in during April from printing Completed and T/O during April Ending work-in-process April 30 Total costs added during April Degree of Completion Physical Units Trans-in D/M Conversion (Cases) 70% Uniformly Beginning 100% 0% 60% 1,260 2,880 100% 100% 100% 3,240 100% 100% 75% 900 Required: 1. Using the weighted-average method, summarize the total Drying and Packaging Department costs for week 37, and total costs to units completed (and transferred out) and to units in ending work-in-process inventory. Binding Department Cost of Production Report: April 2014 (FIFO) Physical Flow Degree of Completion Units to Account for: Trans-in D/M Conversion BWIP 100% 0% 60% 1,260 Transferred-in from printing during April 2,880 Total 4,140 Units Accounted for: Units completed 3,240 1,980 From BWIP 1,980 0% 100% 40% 1,260 Started And Completed 100% 100% 100% 1,980 EWIP 100% 100% 75% 900 Total 4,140 Calculation of Equivalent Units FIFO Equivalent Units (A) Plus BWIP EU from previous period Weighted Average Equivalent Units (B) Costs to Account for: BWIP Current Costs Added This Period Total Cost per Equivalent Unit: FIFO Costs Accounted for: FIFO Costs Associated with Completed Units From BWIP Costs Assigned to BWIP Transferred-in costs D/M (1) (2) (1) / (A) Conversion Costs Total From Units Started & Completed Total Cost Associated with Units Transferred-out Cost Assigned to EWIP Units Transferred-in Costs D/M Costs Conversion Costs Total Total Costs Accounted for Journal Entries Work-in-Process -- Binding Department Work-in-Process -- Printing Department To record the transfer of partially completed units from the Printing Department to the Binding Department. FIFO Method Dr $149,760 Cr $149,760 Work-in-Process -- Binding Department Direct Materials Inventory To record direct material usage during April 28,188 Work-in-Process -- Binding Department Various Accounts To record conversion costs during April 84,240 Finished Goods Inventory Work-in-Process -- Binding Department To record the transfer of finished units to finishing goods inventory. 251,740 28,188 84,240 251,740 FIFO Method WIP - Binding 60,480.00 149,760.00 28,188.00 84,240.00 70,927.83 251,740.17 322,668.00 322,668.00 irect-cost category (DM) and one ent. Books that have undergone al is added when the binding When those operations are done, method of process costing. Trans-in Costs Direct Material Conversion Costs $44,100 $0 $16,380 $149,760 $28,188 $84,240 tment costs for week 37, and assign cess inventory. Trans-in Equivalent Units D/M Conversion 0 1,980 900 1,260 1,980 900 504 b 1,980 c 675 d 2,880 1,260 4,140 4,140 0 4,140 3,159 b,c,d 756 a 3,915 a,b,c,d Trans-in $44,100 $149,760 $193,860 D/M $0 28,188 $28,188 Conversion $16,380 84,240 $100,620 $52.000 $6.809 $26.667 $85.475 $44,100.00 $0.00 $0.00 $16,380.00 $60,480.00 $0.00 $8,578.96 $8,578.96 Total $60,480 a 262,188 b,c,d $322,668 a.b.c.d $44,100.00 $102,960.00 $147,060.00 $8,578.96 $13,481.22 $22,060.17 $13,440.00 $29,820.00 $52,800.00 $82,620.00 $46,800.00 $6,127.83 $46,800.00 $193,860.00 $6,127.83 $28,188.00 $18,000.00 $18,000.00 $100,620.00 $13,440.00 $82,498.96 $169,241.22 $251,740.17 $46,800.00 $6,127.83 $18,000.00 $70,927.83 $322,668.00 $322,668.00 $65.475 $85.475 $77.698 Problem 17-42 Operation Costing Given: Gregg Industries manufactures plastic molded chairs. The three models of molded chairs, all variations of the same d Standard, Deluxe, and Executive. The company uses an operation-costing system. Gregg has extrusion, form, trim, and finish operations. Plastic sheets are produced by the extrusion operation. Durin operation, the plastic sheets are molded into chair seats and the legs are added. The Standard model is sold after thi During the trim operation, the arms are added to the Deluxe and Executive models and the chair edges are smoothed. Executive model enters the finish operation, in which padding is added. All of the units produced receive the same st each operation. The May units of production and direct material costs incurred are as follows: Standard model Deluxe model Executive model Units Produced 6,000 3,000 2,000 11,000 Extrusion Materials $72,000 36,000 24,000 $132,000 Form Materials $24,000 12,000 8,000 $44,000 The total conversion costs for the month of May are: Total conversion costs Extrusion Operation $269,500 Trim Materials $0 9,000 6,000 $15,000 Finish Materials $0 0 12,000 $12,000 $203,000 Form Trim Finish Operation Operation Operation $132,000 $69,000 $42,000 Required: 1. Calculate the costs of each product type in total and on a per unit basis. Number of plastic molded chairs produced Cost Assignment Direct Material Costs -- Directly Traced to Product Required Operations Operation Standard Deluxe Executive Directly Traced Extrusion Yes Yes Yes Yes Form Yes Yes Yes Yes Trim No Yes Yes Yes Finish No No Yes Yes Direct Material Costs -- Directly Traced to Product Conversion Costs Assigned by Operation Required Operations Operation Standard Deluxe Executive Charging Rate Extrusion Yes Yes Yes $24.50 Form Yes Yes Yes $12.00 Trim No Yes Yes $13.80 Finish No No Yes $21.00 Standard 6,000 Per Unit Type of Product Deluxe 3,000 $72,000 24,000 $12.00 4.00 $36,000 12,000 9,000 $96,000 $16.00 $57,000 $147,000 72,000 $24.50 12.00 $73,500 36,000 41,400 Conversion Costs Assigned by Operation Total costs assigned to products Total costs per unit 2. $219,000 $315,000 $52.50 $36.50 $52.50 $150,900 $207,900 $69.30 Calculate the costs assigned to 1,000 units of Deluxe EWIP which are 100% complete except for trim operations Cost Assignment Direct Material Costs -- Directly Traced to Product Required Operations Operation Standard Deluxe Executive Directly Traced Extrusion Yes Yes Yes Yes Form Yes Yes Yes Yes Trim No Yes Yes Yes Finish No No Yes Yes Direct Material Costs -- Directly Traced to Product Conversion Costs Assigned by Operation Required Operations Operation Standard Deluxe Executive Charging Rate Extrusion Yes Yes Yes $24.50 Form Yes Yes Yes $12.00 Trim No Yes Yes $13.80 Finish No No Yes $21.00 Conversion Costs Assigned by Operation Total costs assigned to Deluxe EWIP Deluxe 1,000 $12,000 $4,000 $3,000 $19,000 600 $8,280 $24,500 12,000 8,280 $44,780 $63,780 all variations of the same design, are extrusion operation. During the forming dard model is sold after this operation. chair edges are smoothed. Only the duced receive the same steps within Type of Product Deluxe Executive Per Unit 2,000 Per Unit $12.00 4.00 3.00 $19.00 $24.50 12.00 13.80 Total 11,000 $24,000 8,000 6,000 12,000 $50,000 $12.00 4.00 3.00 6.00 $25.00 $132,000 44,000 15,000 12,000 $203,000 $49,000 24,000 27,600 42,000 $24.50 12.00 13.80 21.00 $269,500 132,000 69,000 42,000 $50.30 $69.30 $142,600 $192,600 $96.30 $71.30 $96.30 except for trim operations which are 60% complete. Deluxe Per Unit $12.00 4.00 3.00 $19.00 $24.50 12.00 13.80 $8,280 $512,500 $715,500 Problem 17-35, 36, 37 Ashworth Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the Assembly Department and the Finishing Department. This problem focuses on the Assembly Department. The process-costing system at Ashworth has a single direct-cost category (direct materials) and single indirect-cost category (conversion costs). Direct materials are added when the Assembly Department process is 10% complete. Conversion costs are added evenly during the Assembly Department's process. Ashworth uses the weighted-average method of process costing. Consider the following data for the Assembly Department in April 2012: Degree of Completion Physical Units Direct Conversion D/M Conversion (Frames) Materials Costs Work-in-Process, April 1 100% 40% 95 $1,665 $988 Started during April 2012 490 Completed during April 2012 455 Work-in-Process, April 30 100% 30% 130 Total costs added during April 2012 $17,640 $11,856 Problem 17-35: Weighted average method; Problem 17-37: FIFO method Required: Summarize total Assembly Department costs for April 2012, and assign total costs to units completed (and transferred out) and to units in ending work-in-process. Equivalent Units Forming Department Cost of Production Report Physical Flow D/M Conversion Degree of Completion Units to Account for: D/M Conversion BWIP (4/1/12) 100% 40% 95 Started during April 490 Total 585 Units Accounted for: Completed Units 455 From BWIP 0% 60% 95 0 57 Started And Completed 360 100% 100% 360 360 360 EWIP 100% 30% 130 130 39 Total 585 Calculation of Equivalent Units FIFO Equivalent Units (A) 490 456 Plus BWIP EU from previous period 95 38 Weighted Average Equivalent Units (B) 585 494 Costs to Account for: D/M Conversion b c d b+c+d a a+b+c+d Total BWIP $17.53 $26.00 Current Costs Added This Period Total Cost per Equivalent Unit: FIFO Weighted Average Costs Accounted for: Fifo Method Costs Associated with Completed Units From BWIP Costs Assigned to BWIP D/M Conversion Costs Total From Units Started & Completed Total Cost Associated with Units Transferred-out Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Cost Assigned to EWIP Total Costs Accounted for Costs Accounted for: Weighted Average Method Costs Associated with Completed Units Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Total Costs Accounted for $43.53 (1) (2) (1) / (A) (2) / (B) $1,665 17,640 $19,305 $988 11,856 $12,844 $2,653 a$ 29,496 b$,c$,d$ $32,149 $36.000 $33.000 $26.000 $26.000 $62.000 $59.000 $1,665 $0 $988 $1,482 $2,470 $9,360 $11,830 $2,653 $0 $1,482 $4,135 $22,320 $26,455 $4,680 $19,305 $1,014 $1,014 $12,844 $4,680 $1,014 $5,694 $32,149 $15,015 $11,830 $26,845 $1,014 $1,014 $12,844 $4,290 $1,014 $5,304 $32,149 $1,665 $12,960 $14,625 $4,680 $4,290 $4,290 $19,305 Problem 17-36 Journal Entries for both FIFO and Weighted Average Methods Work-in-Process -- Assembly Department Direct Materials Inventory To record direct materal usage for April Fifo Method Weighted Average Method Dr Cr Dr Cr 17,640 17,640 17,640 17,640 Work-in-Process -- Assembly Department Various Accounts To record direct labor and MOH usage for April 11,856 Work-in-Process -- Finishing Department 26,455 11,856 11,856 11,856 26,845 $43.53 $62.00 $58.14 $59.00 Work-in-Process -- Assembly Department To record the transfer of partially completed units to the finishing department for additional production activities. 26,455 26,845 FIFO Weighted Average WIP - Assembly Department WIP - Assembly Department 2,653 17,640 11,856 5,694 26,455 2,653 17,640 11,856 5,304 26,845 Problem 17-29 Operation Costing Given: Feather Light Shoe Company manufactures two styles of men's shoes: Designer and Regular. Designer style is made from leather, and Regular style uses synthetic materials. Three operations -- cutting, sewing, and packing -- are common to both styles, but only Designer style passes through a lining operation. The conversion cost rates for 2007 are: Rate per unit (pair) Cutting $10 Sewing $15 Lining $8 Details of two work orders processed in August are: Number of units Direct materials costs Style Work Order #815 1,000 $30,000 Designer Work Order #831 5,000 $50,000 Regular Required: Calculate the costs of work orders #815 and #831 using Operation Costing. Number of units (pairs of shoes) Style of shoe Cost Assignment Direct Material Costs -- directly traced Conversion Costs Assigned by Operation Required Operations Operation Designer Regular Charging Rate Cutting Yes Yes $10 Sewing Yes Yes $15 Lining Yes No $8 Packing Yes Yes $2 Total costs assigned to work orders Total costs per unit Work Order Number 815 831 1,000 5,000 Designer Regular $30,000 $50,000 10,000 15,000 8,000 2,000 $65,000 $65 50,000 75,000 10,000 $185,000 $37 Packing $2 In-class Group Quiz on Process Costing Star Toys manufactures one type of wooden toy figure. It buys wood as its direct material for the Forming Department. Semi-completed toys are transferred from the Forming Department to the Finishing Department where the manufacturing process is completed. The accounting system at Star Toys has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the Forming Department's process. Conversion costs are added evenly during production operations. The chief accountant has collected the following data concerning the Forming Department's operations during April 2007: WIP, April 1 Started during April Completed during April WIP, April 30 New costs added in April Degree of Completion DM Conversion 100% 40% 100% 25% Physical Direct Units Materials Conversion (Toys) Costs Costs 300 $7,500 $2,125 2,200 2,000 500 $70,000 $42,500 Star Toys uses a process costing system to record operation. Required: Answer the following questions in the space allotted. 1. Prepare a schedule which displays the physical flow of operations for April 2007. Physical Flow Units to Account for: BWIP (4/1/07) Started during April Total 300 2,200 2,500 Units Accounted for: Completed Units From BWIP (4/30/07) Started and completed 300 1,700 1,700 1,700 EWIP Total 2. 500 2,500 Prepare a schedule which displays the production costs to be accounted for during April 2007. Costs to Account for: D/M Conversion Total BWIP $7,500 $2,125 $9,625 Current Costs Added This Period 70,000 42,500 112,500 $77,500 $44,625 $122,125 Total 3. Prepare a schedule which displays the equivalent units of production using the FIFO method. Degree of Completion D/M Conversion Physical Equivalent Units Flow D/M Conversion Units to Account for: BWIP (4/1/07) 100% 40% Started during April 300 2,200 Total 2,500 Units Accounted for: Completed Units 2,000 From BWIP Started And Completed EWIP (4/30/07) 100% 25% Total 300 0 180 1,700 1,700 1,700 500 500 125 2,200 2,005 2,500 Calculation of FIFO Equivalent Units 4. Prepare a schedule which displays the equivalent unit conversion from the FIFO method of calculating equivalent units to the weighted-average method of calculating equivalent units. FIFO Equivalent Units 2,200 2,005 Plus BWIP EU from previous period 300 120 Weighted Average Equivalent Units 2,500 2,125 5. Show how the cost per equivalent unit is determined for both direct materials and conversion costs under both the FIFO and the weighted average methods. Costs to Account for: D/M BWIP $7,500 Current Costs Added This Period Conversion $2,125 Total $9,625 70,000 42,500 112,500 (1) $77,500 $44,625 $122,125 (2) FIFO Equivalent Units 2,200 2,005 (A) Weighted Average Equivalent Units 2,500 2,125 (B) Total Cost per Equivalent Unit: FIFO (1) / (A) $31.818 $21.197 $53.015 Weighted Average (2) / (B) $31.000 $21.000 $52.000 6. Prepare a schedule which displays the costs of production accounted for using the weighted average method. D/M Costs Associated with Units Completed $62,000 Conversion $42,000 Total $104,000 Cost Assigned to EWIP Units D/M Costs $15,500 Conversion Costs Total Total Costs Accounted for $15,500 $2,625 $2,625 $15,500 $2,625 $18,125 $77,500 $44,625 $122,125 7. Prepare a schedule which displays the costs of production accounted for using the FIFO method. Costs Associated with Units Completed D/M Conversion Total From BWIP Costs Assigned to BWIP $7,500.00 D/M Conversion Costs Total From Units Started & Completed Total cost associated with units transferred-out $2,125.00 $9,625.00 3,815.46 3,815.46 $5,940.46 $13,440.46 0.00 $7,500.00 0.00 54,090.91 36,034.91 90,125.82 $61,590.91 $41,975.37 $103,566.28 Cost Assigned to EWIP Units D/M Costs $15,909.09 Conversion Costs Total Cost Assigned to EWIP Total Costs Accounted for $15,909.09 $2,649.63 2,649.63 $15,909.09 $2,649.63 $18,558.72 $77,500.00 $44,625.00 $122,125.00 8. Prepare the general journal entry to record the transfer of partially completed units from the Forming Department to the Finishing Department assuming that the FIFO method of process costing is used. Fifo Method Dr Work-in-Process -- Finishing Department Cr 103,566 Work-in-Process -- Forming Department 103,566 To record the transfer of partially completed units to the finishing department for additional production activities. 9. Prepare the general journal entry to record the transfer of partially completed units from the Forming Department to the Finishing Department assuming that the weighted-average method of process costing is used. Weighted Average Method Dr Work-in-Process -- Finishing Department Work-in-Process -- Forming Department To record the transfer of partially completed units to the finishing department for additional production activities. Cr 104,000 104,000 B C D B+C+D Problem 17-38 (Weighted Average Method) Finishing Department Cost of Production Report Units to Account for: BWIP (4/1/04) (D/M 100% C; CC 40% C) Transferred-in from Forming during April Total Units Accounted for: From BWIP Started And Completed EWIP Total Calculation of Equivalent Units FIFO Equivalent Units Plus BWIP EU from previous period Weighted Average Equivalent Units Physical Flow Trans-in 100% Degree of Completion D/M Conversion 0% 60% 100% 0% 500 2,000 2,500 500 1,600 400 2,500 30% (A) (B) Costs to Account for: BWIP Current Costs Added This Period Total Cost per Equivalent Unit: Weighted Average Costs Accounted for: Weighted Average Method Costs Associated with Completed Units Cost Assigned to EWIP Units Transferred-in Costs D/M Costs Conversion Costs Total Total Costs Accounted for (1) (2) (2) / (B) Problem 17-38 Journal Entries for Weighted Average Methods Weighted Average Method Work-in-Process -- Finishing Department Work-in-Process -- Forming Department To record the transfer of partially completed units to the finishing department for additional production activities. Dr 104,000 Cr 104,000 Work-in-Process -- Finishing Department Direct Materials Inventory To record direct materal usage for the month of April 23,100 Work-in-Process -- Finishing Department Various Accounts To record conversion costs usage for the month of April 38,400 23,100 38,400 Finished Goods Inventory Work-in-Process -- Finishing Department To record the transfer of finished units to the finishing goods inventory. 168,552 168,552 Weighted Average WIP - Finishing Department 25,000 104,000 23,100 38,400 21,948 168,552 Trans-in Equivalent Units D/M Conversion 0 1,600 400 500 1,600 0 200 1,600 120 2,000 500 2,500 2,100 0 2,100 1,920 300 2,220 Trans-in $17,750 104,000 $121,750 D/M $0 23,100 $23,100 Conversion $7,250 38,400 $45,650 Total $25,000 165,500 $190,500 $48.700 $11.000 $20.563 $80.263 $102,270.00 $23,100.00 $43,182.43 $168,552.43 $2,467.57 $2,467.57 $45,650.00 $19,480.00 $0.00 2,467.57 $21,947.57 $190,500.00 $19,480.00 $0.00 $19,480.00 $121,750.00 $0.00 $23,100.00 Problem 17-39 Finishing Department Cost of Production Report Units to Account for: BWIP (4/1/04) (D/M 100% C; CC 40% C) Transferred-in from Forming during April Total Units Accounted for: From BWIP Started And Completed EWIP Total Calculation of Equivalent Units FIFO Equivalent Units Plus BWIP EU from previous period Weighted Average Equivalent Units Physical Flow Trans-in 100% Degree of Completion D/M Conversion 0% 60% 100% 0% Costs to Account for: BWIP Current Costs Added This Period Total Cost per Equivalent Unit: FIFO Costs Accounted for: Fifo Method Costs Associated with Completed Units From BWIP Costs Assigned to BWIP Transferred-in costs D/M Conversion Costs Total From Units Started & Completed Total Cost Associated with Units Transferred-out Cost Assigned to EWIP Units D/M Costs Conversion Costs Total Cost Assigned to EWIP Total Costs Accounted for 30% 500 2,000 2,500 500 1,600 400 2,500 (A) (B) (1) (2) (1) / (A) Problem 17-39 Journal Entries for both FIFO and Weighted Average Methods Work-in-Process -- Finishing Department Work-in-Process -- Forming Department To record the transfer of partially completed units to the finishing department for additional production activities. FIFO Method Dr 103,566 Work-in-Process -- Finishing Department Direct Materials Inventory To record direct materal usage for the month of April 23,100 Work-in-Process -- Finishing Department Various Accounts To record conversion costs for the month of April 38,400 Finished Goods Inventory Work-in-Process -- Finishing Department To record the transfer of finished units to the finishing goods inventory. 166,723 FIFO WIP - Finishing Department 24,770 103,566 23,100 38,400 23,113 Trans-in Equivalent Units D/M Conversion 0 1,600 400 500 1,600 0 200 1,600 120 2,000 500 2,500 2,100 0 2,100 1,920 300 2,220 Trans-in $17,520 103,566 $121,086 D/M $0 23,100 $23,100 Conversion $7,250 38,400 $45,650 Total $24,770 165,066 $189,836 $51.783 $11.000 $20.000 $82.783 $17,520.00 0.00 $0.00 $7,250.00 $24,770.00 4,000.00 $11,250.00 32,000.00 $43,250.00 5,500.00 4,000.00 $34,270.00 132,452.80 $166,722.80 $2,400.00 $2,400.00 $45,650.00 $20,713.20 2,400.00 $23,113.20 $189,836.00 5,500.00 $17,520.00 82,852.80 $100,372.80 $5,500.00 17,600.00 $23,100.00 $20,713.20 $0.00 $20,713.20 $121,086.00 FIFO Method Cr 103,566 $0.00 $23,100.00 23,100 38,400 166,723 FIFO WIP - Finishing Department 166,723