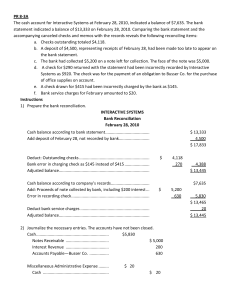

Bank reconciliation A bank reconciliation is the process of matching the balances in an entity's accounting records for a cash account to the corresponding information on a bank statement . • Deposit in transit. Cash and/or checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the entity deposits the funds. • Outstanding check. A check payment that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from cash. • NSF check. A check that was not honored by the bank of the entity issuing the check, on the grounds that the entity's bank account does not contain sufficient funds. Example :- It shows from the sent statement to free company's credit balance of($2,405,000) while the bank balance of a debtor in the books (records) of amount ($2,545,000) When checking the cause of the difference was found the following : 1.the statement expenses is appear in the bank statement of amount ($2,000) but did not appear in the books (records). 2.deposits recorded in the books(records) of amount ($205,000)but did not appear in the bank statement. 3. the interests are collected on the notes receivable at the bank of amount ($40,000) appear in the statement but did not appear in the books (records). 4.checks are paid but Did not review their owners of the bank to be drawn of amount ($32,000). 5.Deposit for $ 5,000 by error. 6.paid The amount to accounts payable of $ 20,000 in check, and when the audit shows that the correct amount of $ 30,000. Required :- prepare the Bank Reconciliation Statement by three methods. Example :- It shows from the sent statement to free company's credit balance of($3,000,000) while the bank balance of a debtor in the books (records) of amount ($3,500,000) When checking the cause of the difference was found the following : 1.the statement expenses is appear in the bank statement of amount ($200,000) but did not appear in the books (records). 2.deposits recorded in the books(records) of amount ($450,000)but did not appear in the bank statement. 3. the interests are collected on the notes receivable at the bank of amount ($50,000) appear in the statement but did not appear in the books (records). 4.checks are paid Did not review their owners to be drawn of amount ($100,000). Required :- prepare the Bank Reconciliation Statement by three methods. Example :- At the beginning of June 2014, Baghdad company received a bank statement the showed the current account balance as at 31 May amounting to ID 3250. However, the general ledger showed a book balance of ID 2760. Baghdad Co. issued the following checks Check no. 112 of ID 900 Check no. 116 of ID 1350 Check no. 122 of ID 750 to the suppliers , but the payment did not appear in the bank statement because it was not yet received by the bank. In addition, Baghdad Co. deposited ID 2500 at the end of the month, but this was also not appear in the bank statement. Besides that, the bank had debited Baghdad's Co. account with ID 10 being the service charge. Required:- Prepare a bank reconciliation statement at 31 May, 2014, by using Adjustments the two balances to reach to one corrected balance method. Baghdad Company Bank Reconciliation Statement 31 May, 2014 Balance as per bank statement,31 May, 2014 Add: Deposit in transit Deduct: Outstanding(undrawn) checks = Adjusted bank balance Balance as per book balance Deduct: bank service charge = Adjusted Book balance 3250 2500 (3000) 2750 2760 (10) 2750