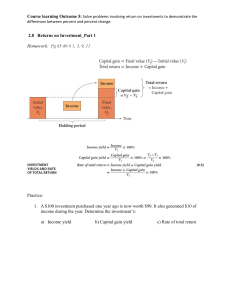

CHAPTER 15 The Term Structure of Interest Rates INVESTMENTS | BODIE, KANE, MARCUS McGraw-Hill/Irwin Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved. 15-2 Overview of Term Structure • The yield curve is a graph that displays the relationship between yield and maturity. • Information on expected future short term rates can be implied from the yield curve. INVESTMENTS | BODIE, KANE, MARCUS 15-3 Figure 15.1 Treasury Yield Curves See Many other interesting links, for example: Treasury.gov stockcharts.com INVESTMENTS | BODIE, KANE, MARCUS 15-4 Bond Pricing • Yields on different maturity bonds are not all equal – there is a term structure. • We need to consider each bond cash flow as a stand-alone zero-coupon bond. • The value of the bond should be the sum of the values of its parts. • Bond stripping and bond reconstitution offer opportunities for arbitrage. INVESTMENTS | BODIE, KANE, MARCUS 15-5 Table 15.1 Prices and Yields to Maturities on Zero-Coupon Bonds ($1,000 Face Value) These prices are in the form: CashFlowt Price t 1 ytm INVESTMENTS | BODIE, KANE, MARCUS 15-6 Example 15.1 Valuing Coupon Bonds • Value a 3 year, 10% coupon bond using discount rates from Table 15.1: $100 $100 $1100 Price 2 3 1.05 1.06 1.07 • Price = $1082.17 • YTM = 6.88% • 6.88% is less than the 3-year rate of 7%. INVESTMENTS | BODIE, KANE, MARCUS 15-7 Two Types of Yield Curves Pure Yield Curve On-the-run Yield Curve • The pure yield curve • The on-the-run yield uses stripped or zero curve uses recently coupon Treasuries. issued coupon bonds selling at or near par. • The pure yield curve may differ • The financial press significantly from the typically publishes onon-the-run yield the-run yield curves. curve. INVESTMENTS | BODIE, KANE, MARCUS 15-8 Yield Curve Under Certainty • Suppose you want to invest for 2 years: – Buy and hold a 2-year zero -or– Rollover a series of 1-year bonds • Equilibrium (or no arbitrage) requires that both strategies provide the same return. 1+r 1+r 1 2 (1+y2)2 INVESTMENTS | BODIE, KANE, MARCUS 15-9 Figure 15.2 Two 2-Year Investment Programs (1+y2)2 1+r1 1+r2 INVESTMENTS | BODIE, KANE, MARCUS 15-10 Yield Curve Under Certainty • Buy and hold vs. rollover: 1 y2 2 1 r1 1 r2 1 y2 1 r1 1 r2 1 2 1+r1 1+r2 (1+y2)2 • Next year’s 1-year rate (r2) is just enough to make rolling over a series of 1-year bonds equal to investing in the 2year bond. INVESTMENTS | BODIE, KANE, MARCUS 15-11 Spot Rates vs. Short Rates • Spot rate – the rate that prevails today for a given maturity • Short rate – the rate for a given maturity (e.g. one year) at different points in time. • A spot rate is the geometric average of its component short rates. yn 1 r1 1 r2 ... 1 rn n 1 1 INVESTMENTS | BODIE, KANE, MARCUS 15-12 Short Rates and Yield Curve Slope • When next year’s short rate, r2 , is greater than this year’s short rate, r1, the yield curve slopes up. – May indicate market expects rates to rise. • When next year’s short rate, r2 , is less than this year’s short rate, r1, the yield curve slopes down. – May indicate market expects rates to fall. INVESTMENTS | BODIE, KANE, MARCUS 15-13 Figure 15.3 Short Rates versus Spot Rates INVESTMENTS | BODIE, KANE, MARCUS 15-14 Forward Rates from Observed Rates (1 yn ) (1 f n ) n 1 (1 yn 1 ) n fn = one-year forward rate for period n yn = yield for a security with a maturity of n (1 yn 1 ) n 1 (1 f n ) (1 yn ) n 1+fn (1+yn-1)n-1 (1+yn)n INVESTMENTS | BODIE, KANE, MARCUS 15-15 Example 15.4 Forward Rates • The forward interest rate is a forecast of a future short rate implied by the market. • Example: compute forward rate for year 4: – rate for 4-year maturity = 8% – rate for 3-year maturity = 7% 1 y4 1 f4 3 1 y3 4 4 1.08 1.1106 3 1.07 f 4 11.06% INVESTMENTS | BODIE, KANE, MARCUS 15-16 Interest Rate Uncertainty • Suppose that today’s rate is 5% and the expected short rate for the following year is E(r2) = 6%. The value of a 2-year zero is: $1000 1.051.06 $898.47 • The value of a 1-year zero is: $1000 $952.38 1.05 INVESTMENTS | BODIE, KANE, MARCUS 15-17 Interest Rate Uncertainty • The investor wants to invest for 1 year. – Buy the 2-year bond today and plan to sell it at the end of the first year for $1000/1.06 =$943.40. or: – Buy the 1-year bond today and hold to maturity. INVESTMENTS | BODIE, KANE, MARCUS 15-18 Interest Rate Uncertainty • What if next year’s interest rate is more (or less) than 6%? –The actual return on the 2-year bond is uncertain! INVESTMENTS | BODIE, KANE, MARCUS 15-19 Interest Rate Uncertainty • Investors require a risk premium to hold a longer-term bond. • This liquidity premium compensates short-term investors for the uncertainty about future prices. INVESTMENTS | BODIE, KANE, MARCUS 15-20 Theories of Term Structure • Expectations –Forward rates come from market consensus • Liquidity Preference –Upward bias over expectations due to premium the market requires INVESTMENTS | BODIE, KANE, MARCUS 15-21 Expectations Theory • Observed long-term rate is a function of today’s short-term rate and expected future short-term rates. (1 y2 ) (1 y1 )(1 f 2 ) 2 (1 y2 ) (1 y1 )(1 Er2 ) 2 • fn = E(rn) and liquidity premiums are zero. INVESTMENTS | BODIE, KANE, MARCUS 15-22 Liquidity Premium Theory • Long-term bonds carry more risk; therefore, fn generally exceeds E(rn) • The excess of fn over E(rn) is the liquidity premium • The yield curve has an upward bias built into the long-term rates because of the liquidity premium INVESTMENTS | BODIE, KANE, MARCUS 15-23 Figure 15.4 Yield Curves - A INVESTMENTS | BODIE, KANE, MARCUS 15-24 Figure 15.4 Yield Curves - B INVESTMENTS | BODIE, KANE, MARCUS 15-25 Figure 15.4 Yield Curves - C INVESTMENTS | BODIE, KANE, MARCUS 15-26 Figure 15.4 Yield Curves - D INVESTMENTS | BODIE, KANE, MARCUS 15-27 Interpreting the Term Structure • The yield curve reflects expectations of future interest rates. • The forecasts of future rates are clouded by other factors, such as liquidity premiums. • An upward sloping curve could indicate: – Rates are expected to rise – And/or – Investors require large liquidity premiums to hold long term bonds. INVESTMENTS | BODIE, KANE, MARCUS 15-28 Interpreting the Term Structure • The yield curve is a good predictor of the business cycle. – Long term rates tend to rise in anticipation of economic expansion. – Inverted yield curve may indicate that interest rates are expected to fall and signal a recession. INVESTMENTS | BODIE, KANE, MARCUS 15-29 Figure 15.6 Term Spread: Yields on 10-year vs. 90-day Treasury Securities INVESTMENTS | BODIE, KANE, MARCUS 15-30 Forward Rates as Forward Contracts • In general, forward rates will not equal the eventually realized short rate – Still an important consideration when trying to make decisions: • Locking in loan rates INVESTMENTS | BODIE, KANE, MARCUS 15-31 Figure 15.7 Engineering a Synthetic Forward Loan INVESTMENTS | BODIE, KANE, MARCUS