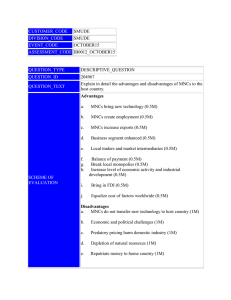

Disadvantages of Foreign Direct Investment (FDI) FDI: LONG-TERM INVESTMENT BY PRIVATE MULTINATIONAL ENTERPRISES/CORPORATIONS IN COUNTRIES OVERSEAS. Disadvantage 1 Limited employment to local people What MNCs do? 1. Bring own management teams 2. Use inexpensive low skilled workers 3. Provide no education/training Thus, host countries has little ability to acquire new technologies. Disadvantage 2 MNCs has too much power due to its size What MNCs gain? 1. Large tax advantages 2. Subsidies Therefore, reduce potential government income in developing countries. Disadvantage 3 MNCs practise transfer pricing Effect: Developing countries: Reap little tax reward Developed countries: Lose potential tax revenue Overall, a potentially large loss of revenue to governments. Disadvantage 4 MNCs causes damage for the environment of the host country How it happens? MNCs situate themselves in countries where legislation on pollution is not effective Therefore, reduce private costs while creating external costs. Disadvantage 5 Exploitation of local workers How it happens? MNCs set up in countries where labour laws are weak What MNCs exploit? 1. Low wage levels 2. Poor working conditions Disadvantage 6 Host countries lose the profits from their resources Why? MNCs enter a country to extract particular resources; metals, stones, strip them and leave Disadvantage 7 MNCs use capital-intensive production methods Effect: Not greatly improve levels of employment in the host country Solution: Change to labour-intensive production methods Disadvantage 8 and 9 No actual money is used in the host country’s economy Why? MNCs buy domestic firms with shares (stock) MNCs may repatriate their profits - THANK YOU -