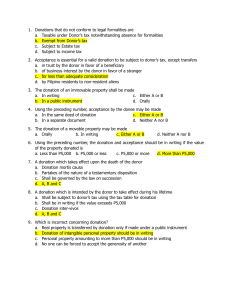

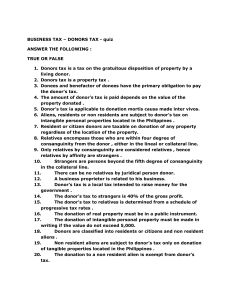

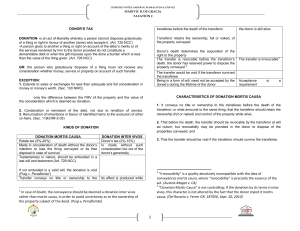

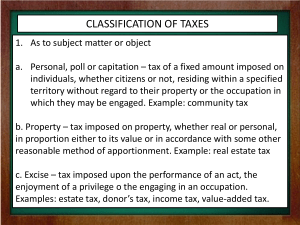

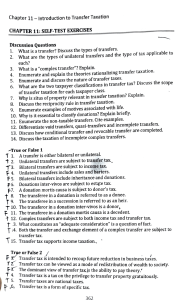

1. Which is an incorrect statement? a. Donor’s tax is imposed on donation inter-vivos b. Estate tax is imposed on donation mortis causa c. Income tax is imposed on income generated by businesses and individuals within their jurisdiction d. None of these D 1. Which type of consumption will pay consumption tax? a. Domestic consumption b. Foreign consumption c. Both domestic and foreign consumption d. Neither domestic nor foreign consumption 2. Which is a tax upon the usage of income? a. Savings tax b. Investment tax c. Consumption tax d. Business tax 2. Donor’s tax is not intended to a. raise money for the government b. recoup government loss on future tax revenue c. control tax evasion of income tax d. provide a system of business regulation. D 3. Who is the one directly liable to the payment of donor’s tax? a. The donor b. The donee c. The person in possession of the property upon discovery of the donation d. Any of these A 3. Which is an incorrect statement regarding consumption taxes? a. They are always indirect in nature b. They effectively tax everyone in the state c. They apply only when the goods or services are destined consumption within the Philippines d. Consumption taxes may encourage savings formation.