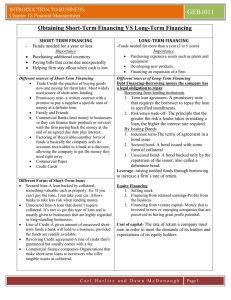

UNIVERSITY OF SANTO TOMAS AMV College of Accountancy ACC 7 – Management Consultancy Short-Term Credit Financing Reasons for short-term financing: 1. 2. 3. 4. Short-term financing (or current liabilities) is intended to primarily sustain short-term investment (or current assets) operations. Inasmuch as current assets are expected to be recovered within a short period of time, normally not exceeding a year, the current liabilities are likewise expected to be paid within a year. Short-term financing is tapped to lessen the equity exposure and risk of the firm to finance its operating activities. Since, operating suppliers benefit significantly from the enterprise’s operations, they are inherently willing to equitably share in financing and sustaining the operating activities of the firm. WC Financing Policies 1. Aggressive Financing Strategy – operations are conducted with a minimum amount of working capital. This is also known as restricted policy. 2. Conservative Financing Strategy – a company seeks to minimize liquidity risk by increasing working capital. This is also known as relaxed policy. 3. Moderate Financing Strategy – also known as semi-aggressive or semi-conservative financing strategy. Under this strategy, working capital maintained is relatively not too high (conservative) nor too low (aggressive). This is also known as balanced policy. 4. Matching Policy – This is achieved by matching the maturity of financing source with an asset’s useful life. This is also known as self-liquidating policy or hedging policy. Short-term assets are financed with short-term liabilities. Long-term assets are funded by long-term financing sources. Hedging – financing assets with liabilities of similar maturity. Illustration: Aggressive vs. Conservative Financing Strategies Venom Corporation’s permanent financing requirement is P300,000 per quarter, composed of P200,000 for fixed assets, and P100,000 for current assets. However, the financing requirements for current assets are expected to increase by P30,000 in the first quarter, P20,000 in the second quarter, P40,000 in the third and P10,000 in the fourth. Required: Determine the amount of working capital to maintain under: 1. Aggressive financing strategy P100,000 2. Conservative financing strategy P140,000. 3. Moderate financing strategy P125,000 – approx. Exercises: 1. Amazing Company’s total assets fluctuate between P320,000 and P410,000, while its fixed assets remain constant at P260,000. If the firm follows a maturity matching or moderate working capital financing policy, what is the likely level of its long-term financing? P320,000 2. Great Company has P8,000,000 in current assets, P3,500,000 of which are considered permanent current assets. In addition, the firm has P6,000,000 invested in fixed assets. Great Company wishes to finance all fixed assets and permanent current assets plus half of its temporary current assets with long-term financing costing 15%. 1|Page Short-term financing currently costs 10%. Great Company’s earnings before interest and taxes are P2,200,000. Income tax rate is 40%. How much would Real Company’s earnings after taxes be under this financing plan? P127,500 3. Normal Company has total fixed assets of P100,000 and no current liabilities. The table below displays its wide variation in current asset components: Cash Accounts receivable Inventory Total 1st Qtr P 20,000 66,000 20,000 P106,000 2nd Qtr P 10,000 25,000 65,000 P100,000 3rd Qtr P 15,000 47,000 59,000 P121,000 4th Qtr P 20,000 88,000 10,000 P118,000 If Normal’s policy is to finance all fixed assets and half the permanent current assets with long-term financing and the rest with short-term financing, what is the level of long-term financing? P150,000 Cost of Bank Loans: Without compensating balance: i. If not discounted (cash proceeds normally equal face value): Cost = Interest / Amount Received (Face) ii. If discounted (cash proceeds is net of interest deducted in advance): Cost = Interest / Face Value – Interest With compensating balance: i. If not discounted: Cost = Interest / (Face Value – CB) ii. If discounted: Cost = Interest / (Face Value – Interest – CB) Illustration: Eddie Trading Co. was granted a P200,000 bank loan with 12% stated interest. Required: The effective annual rate, under the following cases: 1. Eddie receives the entire amount of P200,000. 12% 2. Eddie was granted a discounted loan. 3. Eddie is required to maintain a CB of P10,000 under the non-discounted loan. 4. Eddie is required to maintain a CB of 10% under a discounted loan. 5. Assuming the same data in No. 4 but in addition, the compensating balance bears interest equivalent to 4% annually. 6. Assuming the same data in No. 5 but the term of the loan is only for 60 days. Compound Interest Illustration: Peter borrowed P100,000 from a bank on a one-year 8% term loan, with interest compounded quarterly. What is the effective annual interest on the loan? Add-on Interest What is an 'Add-On Interest'? A method of calculating interest whereby the interest payable is determined at the beginning of a loan and added onto the principal. The sum of the interest and principal is the amount repayable upon maturity. EIR, Add-on = Interest expense / Average principal 2|Page Where: Average principal = Principal + (Principal/12*) 2 * assuming the loan is payable in 12 equal monthly installments. Illustration: Stark Company borrowed from a bank an amount of P1,000,000. The bank charged a 12% stated rate in an addon arrangement, payable in 12 equal monthly installments. Required: 1. Compute for the effective interest rate. 2. Compute for the effective interest rate assuming the loan is payable for 9 months only. Costs of Short-Term Trade Credit – is the cost of not availing the purchase discounts. Cost of Trade Credit with supplier*: Cost = [Discount rate / (100% - Discount rate)] x [360 days / (Credit period – Discount period)] Illustration: PROBLEM 1 Clark Trading Co. purchases merchandise for P200,000, 2/10, n/30. Required: Determine: 1. The annual cost of trade credit 36.73% 2. The annual cost of trade credit if term is changed to 1/15, n/20 72.73% 3. Free trade credit P5,444 4. Costly trade credit P10,889 5. Total trade credit P16,333 PROBLEM 2 An invoice of a P100,000 purchase has credit terms of 1/10, n/40. A bank loan for 8% can be arranged at any time. When should the customer pay the invoice? a. Pay on the 1st b. Pay on the 10th c. Pay on the 40th d. Pay on the 60th Cost of Commercial Papers: Commercial paper – is an unsecured, short-term debt instrument issued by a corporation, typically for the financing of accounts receivable, inventories and meeting short-term liabilities. Maturities on commercial paper rarely range any longer than 270 days. Commercial paper is usually issued at a discount from face value and reflects prevailing market interest rates. Cost = [(Interest + Issue Costs) / (Face Value – Interest – Issue Costs)] x (360 days / Term) Illustration: PROBLEM 1 Bruce Co. plans to sell P100,000,000 in 180-day maturity paper, which it expects to pay discounted interest at an annual rate of 12%. Due to this commercial paper, Bruce expects to incur P100,000 in dealer placement fees and paper issuance costs. What is the effective cost of the commercial paper? 3|Page PROBLEM 2 A firm issued P2 million worth of commercial paper that has a 90-day maturity and sells for P1,900,000. The annual interest rate on the issue of commercial paper is 21% Cost of Factoring EIR = Costs (e.g., Factor’s Fee, Interest) / Net proceeds Illustration: PROBLEM 1 Groot Company provided the following data regarding its factoring of receivables for the year 2018: Face of the receivables factored Credit term Factor’s fee Factor’s holdback (reserve) Interest rate P 200,000 30 days 1% 6% 12% Compute for the effective annual financing cost. 26.09% PROBLEM 2 Star Lord Company has just acquired a large account and needs to increase its working capital by P100,000. The controller of the company has identified the source of funds given below. Pay a factor to buy the company’s receivables, which average P125,000 per month and have an average collection period of 30 days. The factor will advance up to 80% of the face value of receivables at 10% and charge a fee of 2% on all receivables purchased. The controller estimates that the firm would save P24,000 in collection expenses over the year. Assume the fee and interest are not deductible in advance. 16.0% Revolving Credit Agreements Revolving credit is a line of credit where the customer pays a commitment fee and is then allowed to use the funds when they are needed. It is usually used for operating purposes and can fluctuate each month depending on the customer's current cash flow needs. Revolving lines of credit can be taken out by corporations or individuals. Line of Credit Line of credit is generally an informal arrangement in which a bank agrees to lend up to a specified maximum amount of funds during a designated period. Interest is charged on the amount actually borrowed and a fee may be charged by the bank on the remaining line-of-credit not in service. Illustration: The Hulk Company, a real estate developer, has a P2 million revolving credit arrangement with a bank. Its average borrowing under the agreement for the past year was P1.5 million. The bank charges a commission fee of 1%. The nominal rate on used fund is 12%. Determine the effective cost of the revolving credit agreement. 12.33% Additional Funds Needed (AFN)/External Financing Needed (EFN) Additional funds needed (AFN) is the amount of money a company must raise from external sources to finance the increase in assets required to support increased level of sales. 4|Page Financial management requires thorough analysis of the firm’s capital requirements. Generally, the “additional (external) funds needed” can be determined by using the following formula: Required increase in assets - Spontaneous increase in liabilities - Increase in retained earnings * ADDITIONAL FUNDS NEEDED ∆ in Sales x (Assets/Sales) ∆ in Sales x (Liabilities/Sales) Earnings after tax – Dividend payment * Alternative computation: Increase in retained earnings = (Expected sales x profit margin) x retention ratio Key financial ratios: Capital intensity ratio = Assets ÷ Sales Retention ratio = 100% - Dividend payout ratio Illustration: PROBLEM 1 Drax Corporation’s sales are expected to increase from P5,000,000 in 2016 to P6,000,000 in 2017. Its assets totaled P3,000,000 at the end of 2016. Drax has full capacity, so its assets must grow in proportion to projected sales. At the end of 2016, current liabilities are P1,000,000, (P200,000 of accounts payable, P500,000 of notes payable and P300,000 of accruals). The after-tax profit margin is projected to be 10%. The forecasted pay-out ratio is 75%. Required: Determine the additional funds needed from external sources. Answer: P350,000 PROBLEM 2 The following is the balance sheet for 2017 for Marvel Inc. Marvel Inc. Balance Sheet December 31, 2017 ASSETS Cash Accounts receivable Inventory Current assets Fixed assets P 150,000 900,000 600,000 P 1,650,000 600,000 TOTAL ASSETS P 2,250,000 LIABILITIES & EQUITY Accounts payable P 900,000 Notes payable 300,000 Accrued expenses 75,000 Current liabilities P 1,275,000 Ordinary shares 750,000 Retained earnings 225,000 TOTAL LIAB. & EQUITY P 2,250,000 Sales for 2017 were P3,000,000. Sales for 2018 have been projected to increase by 20%. Marvel Inc. is operating below capacity. The company has an 8% return on sales and 70% is paid out as dividends. The amount of new funds required is P48,600 QUIZZER – WCF, AFN 1. The belief that current assets should always be financed by current liabilities A. Does not necessarily hold true. B. Will often result in bankruptcy for the firm. C. Is sound financial practice and should always be followed. D. Is grounded in the belief that a permanent building of current assets occurs. 2. Determining the appropriate level of working capital for a firm requires A. Offsetting the profitability of current assets and current liabilities against the probability of technical insolvency. B. Maintaining a high proportion of liquid assets to total assets in order to maximize the return on total investments. C. Evaluating the risks associated with various levels of fixed assets and the types of debt used to finance these assets. 5|Page D. Maintaining short-term debt at the lowest possible level because it is ordinarily more expensive than longterm debt. 3. Compared to other firms in the industry, a company that maintains a conservative working capital policy will tend to have a A. Higher total asset turnover. B. Greater percentage of short-term financing. C. Higher ratio of current assets to fixed assets. D. Greater risk of needing to sell current assets to repay debt. 4. The working capital financing policy that subjects the firm to the greatest risk of being unable to meet the firm’s maturing obligations is the policy that finances A. Permanent current assets with short-term debt. B. Permanent current assets with long-term debt. C. Fluctuating current assets with short-term debt. D. Fluctuating current assets with long-term debt. 5. ABC Company buys on terms of 2/15, net 30. It does not take discounts, and it typically pays 30 days after the invoice date. Net purchases amount to Php720,000 per year. On average, how much “free” trade credit does ABC receive during the year? P30,000 6. What is the current price of a Php80,000 treasury bill due in 180 days on a 12% discount basis? P75,200 7. What is the annual cost (in percentage) for the issuance of Php695,250 of 4-month commercial paper to net Php660,000 and that a new paper will be issued every 4 months. 16.02% Items 8 to 10 are based on the following information: A company has accounts payable of Php1,845,000 with terms 2/10, n/50. The company has two options in settling this payable: (A) Borrow funds from a bank at an annual rate of 20%; or (B) Wait until the last day (50th) when it will receive revenues to cover the payment of Php1,845,000. Required: 8. What is the equivalent annual interest rate if the company foregoes the discount of the purchase? 18.37% 9. What option should the company choose? (Write A or B) B 10. In relation to the previous question, what would be the net benefit from choosing said option over the other? P3,280 11. What is the effective annual interest rate on a 9% annual percentage rate automobile loan that has monthly payments? 9.38% 12. What is the annual cost (in percentage) for borrowing from a commercial bank an amount that will net Php350,000 after deducting a compensating balance of 20% and interest of 10%. 14.29% 13. A company obtained a short-term discounted loan from a bank in the amount of Php1,750,000. The stated interest rate was 15%. What is the effective interest rate? 17.65% 14. A company received a line of credit from its bank. The stated interest rate is 6% to be deducted in advance. The line of credit agreement requires that an amount equal to 20% of the loan be deposited into a compensating balance account. On July 1, the company drew down the entire usable amount of the loan and received the proceeds of Php482,800. How much is the principal amount of the loan? P652,432.43 Items 15 and 16 are based on the following information: ABC Company obtained a short-term bank loan of Php920,000 at an annual interest rate of 8%. The bank requires that a compensating balance of 20% be maintained in the borrower’s account. The compensating balance will earn interest of 2% per annum, payable on the maturity of the loan. Required: 15. What is the effective interest rate of the loan? 9.5% 16. Assume that the Company already has Php64,000 maintained in its account, such that any deficiency from the amount needed to comply with the compensating balance requirement will be taken from the loan principal, what is the effective interest rate of the loan? 8.9% Items 17 to 19 are based on the following information: ABC company obtained a short-term loan in the amount of Php750,000 with a stated interest rate of 12% to be paid after a year. 6|Page Required: 17. What is the effective interest rate? 12% 18. Assuming that the loan is discounted, what is the effective interest rate? 13.64% 19. Assuming that the loan is discounted and is to be paid after 9 months, what is the effective interest rate? 13.19% Items 20 to 24 are based on the following information: The statement of financial position and statement of comprehensive income of ABC Company is presented below: Assets Liabilities and SHE Current Assets: Cash AR Inventory Total CA NCA P 271,400 542,800 814,200 P 1,628,400 1,085,600 Total Assets P 2,714,000 Current Liabilities: Accounts payable Notes payable Total CL I/S P 542,800 462,800 P 1,005,600 Sales CGS EBIT Tax NIAT P 2,031,000 1,320,150 710,850 213,255 P 497,595 Long term Debt 678,500 SHE Common stock 407,100 Retained earnings 622,800 Total Liabilities and SHE P 2,714,000 The Company declared and distributed dividends amounting to Php298,557. The Company forecasted a growth rate of 25% but assumes that the profit margin and dividend pay-out ratio be constant. Required: 20. 21. 22. 23. 24. Determine Determine Determine Determine Determine the the the the the profit margin. 24.5% retention rate (plowback ratio). 40% EFN given that the Fixed Assets are being utilized at full capacity. P294,002.50 EFN given that the Fixed Assets are currently being utilized at 70% of capacity. P22,602.50 EFN given that the Fixed Assets are currently being utilized at 96% capacity. P239,722.50 25. BH Inc. determines that sales will rise from P300,000 to P500,000 next year. Spontaneous assets are 70% of sales and spontaneous liabilities are 30% of sales. BH has a 10% profit margin and a 40% dividend payout ratio. What is the level of required new funds? a. P50,000 c. P100,000 b. P20,000 d. BH is in balance and no new funds are needed 26. A financing gap (additional funds needed) occurs when a. Required assets exceed available equities b. The budgeted cash balance goes below the minimum required balance c. Budgeted cash receipts are less than budgeted cash disbursements d. Internal source of financing covers all requirements for additional capital 27. What is called a spontaneous financing source? a. Debentures b. Trade credit c. Notes payable d. Preferred stock 28. The following vendors have submitted their proposed terms for Mustafa Center Company which uses a 360day calendar year for business purposes: Vendor A: 2/10, n/35 Vendor C: 3/20, n/50 Vendor B: 1/15, n/25 Which vendor shall be chosen by Mustafa based on the lowest annual cost of trade credit? a. Vendor A b. Vendor B c. Vendor C d. Cannot be determined 29. The most important considerations with respect to short-term investments are a. Return and value b. Risk and liquidity c. Return and risk d. Growth and value 30. XYZ Company enters into an agreement with the firm that will buy XYZ Company’s account receivable and assume the risk of collection. Details about the agreement are as follows: Average Amount of Receivable to be factored each month Average Collection Period Amount to be advanced by the factor Interest rate, deductible in advance Factor’s Fee, deductible in advance What is XYZ Company’s effective annual cost rate of financing? a. 29.14% b. 25% c. 26.095 P1,000,000 60 days 80% of the face amount of receivables 10% p.a. 2% d. 20% 7|Page 31. A company enters into an agreement with a firm who will factor the company’s accounts receivable. The factor agrees to buy the company’s receivables, which average $100,000 per month and have an average collection period of 30 days. The factor will advance up to 80% of the face value of receivables at an annual rate of 10% and charge a fee of 2% on all receivables purchased. The controller of the company estimates that the company would save $18,000 in collection expenses over the year. Fees and interest are not deducted in advance. Assuming a 360-day year, what is the annual cost of financing? a. 10.0% b. 14.0% c. 16.0% d. 17.5% 32. The least likely factor to be considered when selecting a source of short-term credit is the: a. financial market environment. b. availability of credit in the amount needed. c. influence of the use of a particular credit source on the cost of other sources of financing. d. influence of the use of a particular credit source on the availability of other sources of financing 33. Sagrada Company must maintain a compensating balance of P 50,000 in its checking account as one of the conditions of its short-term 6% bank loan of P 500,000. Sagrada’s checking account earns 2% interest. Ordinarily, Sagrada would maintain a P 20,000 balance in the account for transaction purposes. What is the loan’s approximate effective interest rate? a. 5.88% b. 6.17% c. 6.25% d. 6.38% 34. What is the effective rate of a 15% discounted loan for 90 days, P200,000, with 10% compensating balance? Assume 360-day year. a. 20.0% b. 15.0% c. 17.4% d. 22.2% 35. What is the effective rate if the company borrows P200,000 on a 6% discounted loan with a 10% compensating balance for 3 months? a. 7.14% b. 6.00 % c. 6.78% d. 6.44% 36. Picard Orchards requires a P100,000 annual loan in order to pay laborers to tend and harvest its fruit crop. Picard borrows on a discount interest basis at a nominal annual rate of 11 percent. If Picard must actually receive P100,000 net proceeds to finance its crop, then what must be the face value of the note? a. 111,000 b. 100,000 c. 112,360 d. 108,840 37. The Manila Commercial Bank and Bank Rap Corp. signed a loan agreement subject to the following terms: a. Stated interest rate of 18% on a one-year loan; and b. 15% compensating non-interest bearing checking account balance to be maintained by Bank Rap with Manila Commercial Bank. The net proceeds of the loan was P1 million. The principal amount of the loans was a. P1,176,471 b. P1,000,000 c. P1,492,537 d. P1,219,512 38. The bank offers you a term loan at 10% on condition that you maintain a 10% compensating balance. What is the effective rate of interest? a.9.0% b. 10.0% c. 13.7% d. 11.1% 39. On January 1, 2019, Olin Company borrows P2,000,000 from National Bank at 12% annual interest. In addition, Olin is required to keep a compensatory balance of P200,000 on deposit at National Bank which will earn interest at 4%. The effective interest that Olin pays on its P2,000,000 loan is a. 10.0% b. 11.6% c. 12.0%. d. 12.8% 40. To raise money for working capital, The Bigger Donut is considering a one-year loan from the Philtrust Bank. Two alternatives are available; Alternative 1: a P70,000, 15% note issued at face value. Alternative 2: a P70,000, non-interest bearing note discounted at 15%. The company plans to borrow on November 1, 1993 and the accounting period follows the calendar. If you are asked by the Chief Executive Officer on the preferable alternative to take, assuming whatever difference is material in amount and based on your knowledge of accounting for notes, what advise should you give the CEO of The Bigger Donut? a. alternative 1 b. either alternative c. alternative 2 d. both alternatives 41. The cost of discounts missed on credit terms of 2/10, n/60 is: a. 2.0% b. 14.9% c. 12.4% d. 21.2% 42. The cost of giving up a cash discount under the terms of sale 1/10 net 60 (assume a 360-day year) is a. 7.2% b. 6.1% c. 14.7% d. 12.2% WORKING CAPITAL MANAGEMENT 1. Which of the following effects would a lockbox most likely provide for receivable management? a. Minimized collection float c. Minimized disbursement float b. Maximized collection float d. Minimized disbursement float 8|Page 2. Changmai Company is evaluating a proposed credit policy change. The proposed policy would change the average number of days for collection from 60 to 27 days and would reduce total sales by 25%, all of the decrease due to credit sales. Under the current policy, next year’s sales are estimated at P 128 million, with 75% of them being credit sales. Based on a 360-day year, what is the decrease in Changmai’s average accounts receivable balance of implementing the proposed credit policy change? a. P 4.8 million b. P 10.0 million c. P 11.2 million d. P 16.0 million 3. A banking system with a reserve ratio of 20% and a change in reserves of P 1,000,000 can increase its total demand deposits by a. P5,000,000 b. P1,000,000 c. P800,000 d. P200,000 4. A firm is evaluating whether to establish a concentration banking system. The bank will charge Php5,000 per year for maintenance and transfer fees. The firm estimates that the float will be reduced by two days if the concentration banking is put into place. Assuming that average daily receipts are Php115,000 and short-term interest rates are 4%, what decision should the firm make regarding the concentration banking system? a. Do not establish the concentration banking system because the net cost is Php5,000. b. Do not establish the concentration banking system because the net cost is Php21,000. c. Establish the concentration banking system because the net benefit is Php115,000. d. Establish the concentration banking system because the net benefit is Php4,200 5. Analyzing days sales outstanding (DSO) and the aging schedule are two common methods for monitoring receivables. However, they can provide erroneous signals to credit managers when a. Customers’ payments patterns are changing. b. Sales fluctuate seasonally. c. Some customers take the discount and others do not. d. Sales are relatively constant, either seasonally or cyclically. 6. XYZ Inc. has correctly computed its economic order quantity as 500 units. However, management would rather order 600 quantities. How will XYZ Inc.’s total annual purchase order costs and total annual carrying cost for an order quantity of 600 units compare to the respective amounts for an order quantity of 500 units? a. higher purchase order cost and higher carrying cost b. lower purchase order cost and lower carrying cost c. higher purchase order cost and lower carrying cost d. lower purchase order cost and higher carrying cost 7. Sisa Corporation has the following data: Selling price per unit Variable cost per unit Annual credit sales Collection period Rate of return Sisa Corporation is considering easing its period will increase to 45 days; bad debts collection costs will increase by P31,645. net benefit (loss) for Sisa Corporation is: P70 P45 50,400 30 days 20% credit standards. If it does, sales will increase by 25%; collection losses are anticipated to be 4% of the incremental sales; and If the proposed relaxation in credit standards is implemented, the P215,000 8. If a company tends to be more conservative with respect to its working capital policy, then it would tend to have a(n) a. Increase in the normal operating cycle b. Decrease in the normal operating cycle c. Increase in the ratio of current assets to current liabilities d. Decrease in the ratio of current assets to current liabilities 9. When would a retailer tend to decrease the safety stock of inventory? a. Sales variability increases b. Transportation time increases c. Sales volume permanently increases d. Cost of carrying inventory increases 10. Milan Company has average daily cash collections of P 3 million, based on a 360-day year. A new system is estimated to reduce the average collection period by two days without affecting sales. The new system’s annual cost is P 100,000 plus 0.01% of collections. Milan estimates that it would earn 6% on additional funds. What is the estimated annual net benefit from the new system? a. P 152,000 b. P 180,000 c. P 260,000 d. P 360,000 11. Lourdes Company’s present current ratio is 4 times. What transaction will most likely cause the current ratio of the company to increase? a. Purchase of inventory on credit c. Payment of current tax obligations b. Collection of trade receivables d. Borrowing of cash based a 12-month loan 12. If a company’s cash conversion cycle increases, then the company a. Becomes more profitable c. Increases its investment in working capital b. Incurs more shortage or stockout costs d. Reduces its payable deferral period (age of payable) 9|Page 13. Monte Carlo Company is considering a change in collection procedures that would result in an increase of the average collection period from 28 to 36 days. Monte Carlo anticipates that next year’s sales to be P 9 million and that 80% of the sales will be on credit. Monte Carlo estimates short-term interest rates at 6% and uses a 360-day year for decision making. What minimum savings in collection costs would the procedure change have to generate to offset the increased investment in accounts receivable? a. P 1,200 b. P 9,600 c. P 12,000 d. P 33,600 14. UK Company wants to determine the optimum safety stock level for drug Metro-2. The annual carrying cost of Metro-2 is 25% of the inventory investment. The inventory investment averages P 10 per unit. The stock out cost is estimated at P 2 per unit. UK orders Metro-2 20 times annually. UK defines the total costs of safety stock as carrying costs plus expected stock out costs. With 100 units of safety stock, there is a 15% probability of a 30-unit stock out per order cycle. What is the total annual cost of the 100 units of Metro-2 safety stock? a. P 250 b. P 259 c. P 277 d. P 430 All of the following are factors considered in credit policy administration, EXCEPT: a. Terms of trade b. Credit standards c. Collection policy d. Amount of receivable Items 15 and 16 are based on the following information Big Ben buys tennis balls at P 25 per dozen from its wholesaler. Big Ben will sell 35,000 dozens of tennis balls evenly throughout the year. Big Ben desires a 12% percent return on investment (cost of capital) on its inventory investment. In addition, rent, insurance and related taxes for each dozen tennis balls in inventory amounts to P 0.50. The cost per order is P 8. Big Ben uses a 350-day year. 15. What is the average number of tennis balls does Big Ben maintain? a. 200 tennis balls b. 400 tennis balls c. 2,400 tennis balls d. 4,800 tennis balls 16. How often shall Big Ben place the orders within a year? a. Every 4 days b. Every 5 days c. Every 6 days d. Every week 17. The normal operating cycle is 150 days while payable turnover is 6 times. How many cash conversion cycles are there within a 300-day year? a. 3 cycles b. 4 cycles c. 5 cycles d. 6 cycles 18. When a specified level of safety stock is carried for an item in inventory, the average inventory level for that item a. Is 50% of the level of the safety stock b. Decreases by the amount of the safety stock c. Increases by 50% of the amount of safety stock d. Increases by the number of units of the safety stock 19. Each stock of Product AX by Axiom, Inc. costs P 87,500 per occurrence. The carrying cost per unit of inventory is P250 per year, and the company orders 1,500 units of product 24 times a year at a cost of P5,000 per order. The probability of stockout at various levels of safety stock is: Units of safety stock 0 100 200 300 400 Probability of stockout .50 .30 .14 .05 .01 The optimal safety stock level for the company is a. 300 units b. 100 units c. 200 units d. 400 units 20. A softdrinks distributor which buys in a pre-sell basis is discussing with the route salesman on the proper cases to be ordered and the frequency of call. From the route book and other records, the following are available: prior year’s purchases, 50,000 cases; carrying cost per case of inventory, P1.20; distributor’s discount, 1 case for every 10 cases bought; cost of placing an order, P3.00; weekly demand is approximately 962 cases. Safety stock required is 140 cases. No change in demand is expected this year. (use a 365-day, 52week year) Determine the EOQ and ROP, in cases, assuming a two-day lead time EOQ ROP EOQ a. 481 500 c. 962 b. 500 414 d. 250 ROP 275 280 21. An organization offers its customers credit terms of 5/10, net 20. One-third of the customers take the cash discount and the remaining customers pay on day 20. On average, 20 units are sold per day, priced at P 10,000 each. The rate of sales is uniform throughout the year. Using a 360-day year, the organization has days’ sales outstanding in accounts receivable, to the nearest full day, of a. 13 days b. 15 days c. 17 days d. 20 days 22. Which of the following actions would not be consistent with good management of cash? a. Increase synchronization of cash flows b. Minimize the use of float 10 | P a g e c. Maintaining an average cash balance equal to that required as a compensating balance or that which minimizes total cost d. Use checks and drafts in disbursing funds 23. Three suppliers of Phil Corp. offer different credit terms. Ronnie Co. offers terms of 1½/15, net 30. Dexter Corp. offers terms of 1/10, net 30. Flex, Inc. offers terms of 2/10, net 60. Phil Corp. would have to borrow from a bank at an annual rate of 12% in order to take any cash discounts. Which one of the following would be the most attractive for Phil Corp.? (Assume 360 days) Purchase from a. Ronnie, pay in 15 days and borrow any money needed from the bank. b. Ronnie, pay in 30 days and borrow any money needed from the bank. c. Flex, pay in 60 days and borrow any money needed from the bank. d. Dexter and pay 30 days. 24. Which of the following current assets is the most productive? a. cash on hand b. cash in bank c. receivables d. inventory 25. Emmanuel Corp uses the EOQ model for inventory control. The company has an annual demand of 50,000 units for part number 6702 and has computed an optimal lot size of 6,250 units. Carrying cost per unit and stockout costs are P9 and P4, respectively. The following data have been gathered in an attempt to determine an appropriate safety stock level: Units short because of excess demand during the lead time 100 200 300 400 Number of times short in the last 40 reorder cycles 8 10 14 8 What is the optimal safety stock level? 11 | P a g e