IFM Chapter 01 Multinational Financial Management An Overview

advertisement

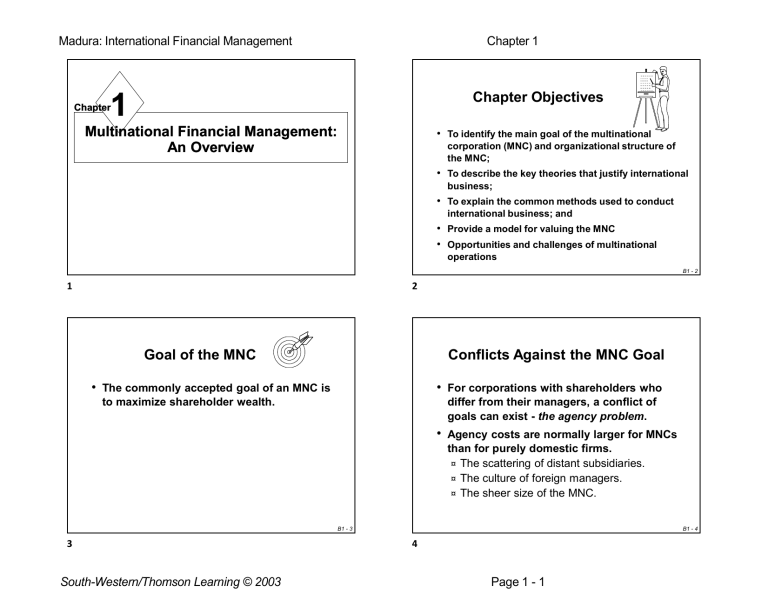

Madura: International Financial Management Chapter 1 1 Chapter Objectives Chapter Multinational Financial Management: An Overview • To identify the main goal of the multinational corporation (MNC) and organizational structure of the MNC; • To describe the key theories that justify international business; • To explain the common methods used to conduct international business; and • Provide a model for valuing the MNC • Opportunities and challenges of multinational operations B1 - 2 1 2 Goal of the MNC Conflicts Against the MNC Goal • The commonly accepted goal of an MNC is • For corporations with shareholders who to maximize shareholder wealth. differ from their managers, a conflict of goals can exist - the agency problem. • Agency costs are normally larger for MNCs than for purely domestic firms. ¤ The scattering of distant subsidiaries. ¤ The culture of foreign managers. ¤ The sheer size of the MNC. B1 - 3 3 South-Western/Thomson Learning © 2003 B1 - 4 4 Page 1 - 1 Madura: International Financial Management Chapter 1 Parent Control of Agency Problems Impact of Management Control • The parent corporation of an MNC may be • The magnitude of agency costs can vary able to prevent most agency problems with proper governance. ¤ Clearly communicate the goals for each subsidiary ¤ Oversee subsidiary decisions ¤ Implement compensation plans with the management style of the MNC. • A centralized management style reduces agency costs. However, a decentralized style gives more control to those managers who are closer to the subsidiary’s operations and environment. B1 - 5 5 B1 - 6 6 Centralized Multinational Financial Management Decentralized Multinational Financial Management for an MNC with two subsidiaries, A and B for an MNC with two subsidiaries, A and B Cash Management at A Inventory and Accounts Receivable Management at A Financing at A Capital Expenditures at A Financial Managers of Parent Cash Management at B Cash Management at A Inventory and Accounts Receivable Management at B Financial Managers of A Inventory and Accounts Receivable Management at A Financing at B Financing at A Capital Expenditures at B South-Western/Thomson Learning © 2003 Cash Management at B Inventory and Accounts Receivable Management at B Financing at B Capital Expenditures at A B1 - 7 7 Financial Managers of B Capital Expenditures at B B1 - 8 8 Page 1 - 2 Madura: International Financial Management Chapter 1 Impact of Management Control Impact of Management Control • Some MNCs attempt to strike a balance - • Electronic networks make it easier for the they allow subsidiary managers to make the key decisions for their respective operations, but the decisions are monitored by the parent’s management. parent to monitor the actions and performance of foreign subsidiaries. • For example, corporate intranet or internet email facilitates communication. Financial reports and other documents can be sent electronically too. B1 - 9 9 B1 - 10 10 Corporate Control of Agency Problems Theories of International Business • Various forms of corporate control can Why are firms motivated to expand their business internationally? reduce agency costs. ¤ The threat of a hostile takeover. ¤ Monitoring and intervention by institutional investors. Theory of Comparative Advantage ¤ Specialization by countries can increase production efficiency. Imperfect Markets Theory ¤ The markets for the various resources used in production are “imperfect.” B1 - 11 11 South-Western/Thomson Learning © 2003 B1 - 12 12 Page 1 - 3 Madura: International Financial Management Chapter 1 Theories of International Business Product Life Cycle (PLC) Theory Why are firms motivated to expand their business internationally? Product Cycle Theory ¤ As a firm matures, it may recognize additional opportunities outside its home country. ¤ As products mature both the location of sales and the optimal production location will change affecting the flow and direction of trade. B1 - 13 13 B1 - 14 14 The International Product Life Cycle Firm creates product to accommodate local demand. a. Firm differentiates product from competitors and/or expands product line in foreign country. Firm exports product to accommodate foreign demand. or b. Firm’s foreign business declines as its competitive advantages are eliminated. International Business Methods Firm establishes foreign subsidiary to establish presence in foreign country and possibly to reduce costs. There are several methods by which firms can conduct international business. • International trade is a relatively conservative approach involving exporting and/or importing. ¤ The internet facilitates international trade by enabling firms to advertise and manage orders through their websites. B1 - 15 15 South-Western/Thomson Learning © 2003 B1 - 16 16 Page 1 - 4 Madura: International Financial Management Chapter 1 International Business Methods International Business Methods • Licensing allows a firm to provide its technology • Franchising is a specialized form of licensing in which the franchiser not only sells intangible property (normally a trademark) to the franchisee, but also insists that the franchisee agree to abide by strict rules as to how it does business. in exchange for fees or some other benefits. • An arrangement whereby a licensor grants the rights to intangible property to another entity (the licensee) for a specified period, and in return, the licensor receives a royalty fee from the licensee. • The franchiser will also often assist the franchisee to run the business on an ongoing basis. • As with licensing, the franchiser typically receives a • Intangible property includes patents, inventions, royalty payment, which amounts to some percentage of the franchisee's revenues. formulas, processes, designs, copyrights, and trademarks. • Whereas licensing is pursued primarily by manufacturing firms, franchising is employed primarily B1 - 18 by service firms. B1 - 17 17 18 International Business Methods International Business Methods • Firms may also penetrate foreign markets • Firms can also penetrate foreign markets by engaging in a joint venture (joint ownership and operation) with firms that reside in those markets. by establishing new foreign subsidiaries. • In general, any method of conducting business that requires a direct investment in foreign operations is referred to as a direct foreign investment (DFI). • Acquisitions of existing operations in foreign countries allow firms to quickly gain control over foreign operations as well as a share of the foreign market. • The optimal international business method may depend on the characteristics of the MNC. B1 - 19 19 South-Western/Thomson Learning © 2003 B1 - 20 20 Page 1 - 5 Madura: International Financial Management Chapter 1 Overview of an MNC’s Cash Flows Valuation Model for an MNC • Domestic Model E (CF$,t ) = expected cash flows to be received at the end of period t n = the number of periods into the future in which cash flows are received k = the required rate of return by investors B1 - 21 21 B1 - 22 22 Valuation Model for an MNC Uncertainty Surrounding an MNC’s Cash Flows • Valuing International Cash Flows Value = ∑ E CF , • Exposure to International Economic ×E 𝑺, Conditions 1+𝑘 • Exposure to International Political Risk • Exposure to Exchange Rate Risk E (CFj,t ) = expected cash flows denominated in currency j to be received by the U.S. parent at the end of period t E (Sj,t ) = expected exchange rate at which currency j can be converted to dollars at the end of period t k = the weighted average cost of capital of the U.S. parent company B1 - 23 23 South-Western/Thomson Learning © 2003 B1 - 24 24 Page 1 - 6 Madura: International Financial Management Chapter 1 How Uncertainty Affects the MNC’s Cost of Capital The Opportunities of Multinational Operations • If there is suddenly more uncertainty about • Multinational Investment Opportunities an MNC’s future cash flows, then investors will expect to receive a higher rate of return. ¤ ¤ • If the uncertainty surrounding conditions Enhancing Revenues Reducing Operating Costs • Multinational Financial Opportunities that influence cash flows declines, the uncertainty surrounding cash flows of MNCs also declines and results in a lower required rate of return and cost of capital for MNCs. ¤ ¤ ¤ Reducing cost of capital Reducing taxes through multinational operations Financial market arbitrage B1 - 25 25 B1 - 26 26 Challenges of Multinational Operations Exposure to International Risk International business usually increases an MNC’s exposure to: • Cultural differences • Differences in legal, accounting, and tax Country risk Political risks Financial risks. systems • • • • • Differences in personnel management Differences in marketing Currency risk—also called foreign exchange risk or forex (FX) risk Differences in distribution Differences in financial markets Differences in corporate governance B1 - 27 27 South-Western/Thomson Learning © 2003 B1 - 28 28 Page 1 - 7 Madura: International Financial Management Chapter 1 B1 - 29 29 South-Western/Thomson Learning © 2003 Page 1 - 8