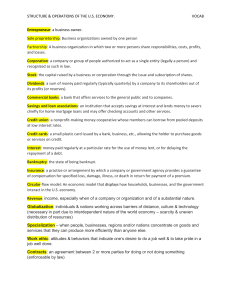

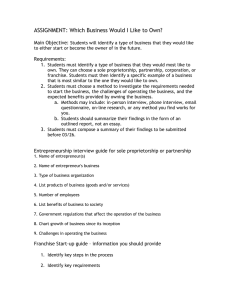

INTRODUCTION TO FINANCE FIN242 MR. KHAIRUL LATIF • • • • Definition of finance The goal of the firm Basic principles of foundation of finance The role of finance in business What is finance • Definition : • Finance is the process by which money is transferred (financing and investing) among businesses, individuals, and governments. (sources: introduction to finance, Pearson. 1.Lawrence J. Gitman 2.Jeff Madura) • Finance also is the study of how people and businesses evaluate investments and raise capital to fund them • Financial management is planning, organizing and controlling the acquisition and use of financial resources for the purpose of achieving organizational goal. The goal of the firm • The fundamental goal of a business is to create value for the company’s owners (that is, its shareholders). • “maximization of shareholder wealth” • Making decision that will maximize the price of the existing common stock Principles That form the foundations of Finance • • • • • Cash flow is what matter Money has a time value Risk requires as a reward Market price are generally right Conflict of interest cause agency problems Cash flow is what matter • Company profit can differ dramatically from its cash flow • Cash flow, not profit, represent money that can be spent. • Cash flow, not profits, that determines the value of a business. • For this reason when we analyze the consequences of managerial decision, we focus on the resulting cast flow, not profits. • For example: Was Harry potter and the order of the phoenix a successful movie? discuss Money has a time value • Money has a “time” value • Simply, a RM receive today is more valuable than a RM receive one year from now – “You have a choice of receiving RM1000 either today or one year from now. If you decide to receive it a year from now, you will have passed up the opportunity to earn a year’s interest on the money” • Opportunity cost is the highest- valued alternative that you had to give up when you made the choice • Finance focus on the creation and measurement of value • We use the concept of the time value of money to bring future benefits and costs of project, measured by its cash flow, back to the present. Risk Requires a Reward • Investor expect to receive a return on their investment. – A return for delaying consumption – An additional return for taking on risk Keep referring to the expected return rather than the actual return Market Price Are Generally Right • Efficient market is one where the prices of the assets traded in that market fully reflect all available information at any instant in time • Thus stock price are useful indicator of the value of the firm. Price changes reflect in expected future cash flow. Good decision will tend to increase the stock price and verse versa. • Example: – While Nike CEO William Perez flew aboard the company’s Gulfstream jet one day in November 2005, traders on the ground sold of a significant amount of Nike’s stock. Why? Conflicts of Interest Cause Agency Problems. • The separation of management and the ownership of the firm creates an agency problem. Manager may make decisions that are not consistent with the goal of maximizing shareholder wealth. • Agency conflict is reduced through monitoring (ex. Annual reports), compensation scheme, etc. • Example: – Shutting down an unprofitable plant is the best interests of the firm’s stockholders, but in doing so the managers will find themselves out of a job or having to transfer to a different job. What will happen? The Role of Finance in Business • Three basic type of issues that are addressed by the study of finance: • Capital budgeting: What long term investment should the firm undertake? (where to invest) • Capital structure decision: How should the firm raise money to fund these investment? (how to raise capital) • Working capital management: How can the firm best manage its cash flows as they arise in its day-to-day operation? (how to manage The role of Financial Manager The Legal Forms of Business Organization • Sole Proprietorships • Partnerships • Corporations Sole Proprietorships • A business owned by an individual Advantages Easily established Minimal organizational cost Does not have to share profits or control with others Disadvantages Unlimited liability for the owner Owner must absorb all losses Termination occurs on owner’s death or by owner’s choice Partnerships • Partnership an association of two or more individuals joining together as co-owners to operate a business for profit • Two type of partnership – General partnership: a partnership in which all partners are fully liable for the indebtedness incurred by the partnership. – Limited partnership: a partnership in which one or more of the partner has limited liability, restricted to the amount of capital he or she invests in the partnership. Corporation • Corporation an entity that legally functions separate and apart from its owners. • Owner (shareholder) dictate direction and policies of the corporation • Ownership is reflected in common stock certificates • The number of shares owned/total number of shares outstanding determines the proportionate ownership of the stockholder in business. • Owner elect a board of directors whose members select the president, vice president, secretary, and treasurer. Double taxation • This occurs when a corporation earns a profit, pays taxes on those profits (the 1st taxation of earnings), and pays some of those profits back to the shareholder in the form of dividend, and then the shareholders pay personal income taxes on those dividend (the 2nd taxation of those earnings) QnA