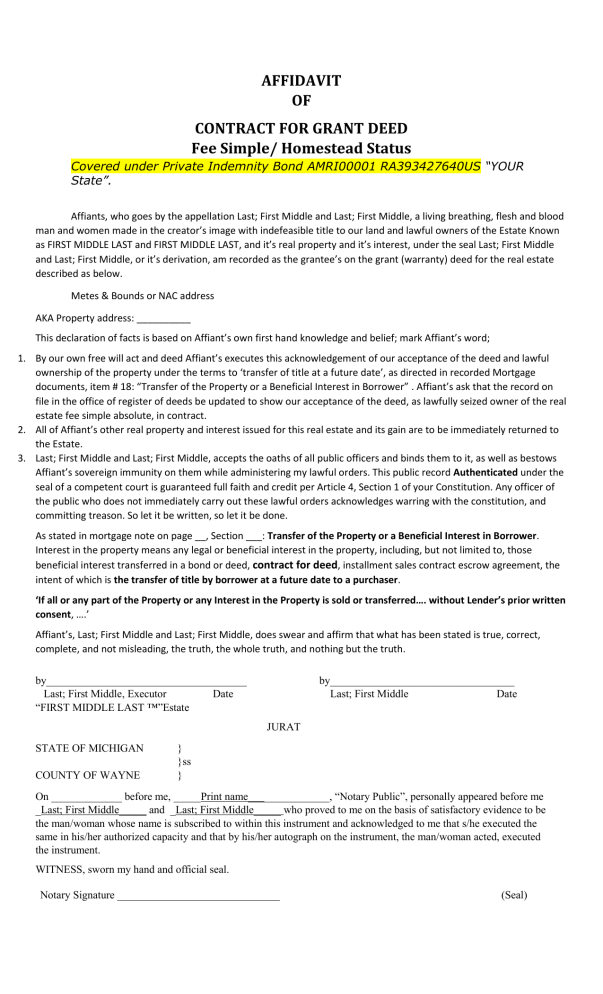

AFFIDAVIT OF CONTRACT FOR GRANT DEED Fee Simple/ Homestead Status Covered under Private Indemnity Bond AMRI00001 RA393427640US “YOUR State”. Affiants, who goes by the appellation Last; First Middle and Last; First Middle, a living breathing, flesh and blood man and women made in the creator’s image with indefeasible title to our land and lawful owners of the Estate Known as FIRST MIDDLE LAST and FIRST MIDDLE LAST, and it’s real property and it’s interest, under the seal Last; First Middle and Last; First Middle, or it’s derivation, am recorded as the grantee’s on the grant (warranty) deed for the real estate described as below. Metes & Bounds or NAC address AKA Property address: __________ This declaration of facts is based on Affiant’s own first hand knowledge and belief; mark Affiant’s word; 1. By our own free will act and deed Affiant’s executes this acknowledgement of our acceptance of the deed and lawful ownership of the property under the terms to ‘transfer of title at a future date’, as directed in recorded Mortgage documents, item # 18: “Transfer of the Property or a Beneficial Interest in Borrower” . Affiant’s ask that the record on file in the office of register of deeds be updated to show our acceptance of the deed, as lawfully seized owner of the real estate fee simple absolute, in contract. 2. All of Affiant’s other real property and interest issued for this real estate and its gain are to be immediately returned to the Estate. 3. Last; First Middle and Last; First Middle, accepts the oaths of all public officers and binds them to it, as well as bestows Affiant’s sovereign immunity on them while administering my lawful orders. This public record Authenticated under the seal of a competent court is guaranteed full faith and credit per Article 4, Section 1 of your Constitution. Any officer of the public who does not immediately carry out these lawful orders acknowledges warring with the constitution, and committing treason. So let it be written, so let it be done. As stated in mortgage note on page __, Section ___: Transfer of the Property or a Beneficial Interest in Borrower. Interest in the property means any legal or beneficial interest in the property, including, but not limited to, those beneficial interest transferred in a bond or deed, contract for deed, installment sales contract escrow agreement, the intent of which is the transfer of title by borrower at a future date to a purchaser. ‘If all or any part of the Property or any Interest in the Property is sold or transferred…. without Lender’s prior written consent, ….’ Affiant’s, Last; First Middle and Last; First Middle, does swear and affirm that what has been stated is true, correct, complete, and not misleading, the truth, the whole truth, and nothing but the truth. by_____________________________________ Last; First Middle, Executor Date “FIRST MIDDLE LAST ™”Estate by__________________________________ Last; First Middle Date JURAT STATE OF MICHIGAN COUNTY OF WAYNE } }ss } On _____________ before me, _____Print name_______________, “Notary Public”, personally appeared before me _Last; First Middle_____ and _Last; First Middle_____ who proved to me on the basis of satisfactory evidence to be the man/woman whose name is subscribed to within this instrument and acknowledged to me that s/he executed the same in his/her authorized capacity and that by his/her autograph on the instrument, the man/woman acted, executed the instrument. WITNESS, sworn my hand and official seal. Notary Signature ______________________________ (Seal) Notes 1. Label of cover letter to file this document in your ‘Register of Deed’ as: NOTICE OF CONTRACT OF GRANT DEED (Instructions) 2. Make sure you state: EXHIBIT “A” copy of page with Section 18 on Mortgage, EXHIBIT “B” Affidavit your new Grant Deed, EXHIBIT ”C” original Warranty Deed and purchase Agreement 0r HUD Contract Agreement. 3. Verify cover letter Notice to “Register of Deed” page format, Michigan 2-1/2 inches from top, ½” on sides and drafted by: on bottom. 4. Locate similar form 2766 in your State as in Michigan to denote transfer of real estate for the assessor office. If Exemption from property taxes needed use Other: Common Law Contract, ‘Grantor-Grantee’, Private Trust purchased for 21 gold or silver per 7th Amendment and private Consumer Goods. 5. Transfer title to a domestic “Property Management Trust”. This is a sale to the Trust for 21 gold pieces per 7TH Amendment. Government must use common law(equity) court & jury. Do not file the now trust Title in Register of Deed. 6. Setup a lease agreement between tenant & the trustee. Also state the gold sale on a receipt, notary as witness is nice. 7. File the lease & receipt in the ‘Register of Deed’ office. Do not state the Trust name on record only trustee name representing the Trust. ****** State a “Letter of Confidentiality” was signed by both parties not to reveal Trust Name. 8. Overstand, the whole Mortgage Loan Process was “HYPOTHECATION” get a copy of “Dictionary of Banking Terms”, by Thomas P. Fitch, $10. Your property “TITLE” was not really completely transferred to you even after paying off the loan. This process above is still needed. The title and property are out of their reach in foreclosures (still paying on mortgage loan) or taxes ( even after loan paid). 9. Later transfer title using “Irreversible Power of Attorney” to a “98 Foreign Trust”. Third(3rd) title transfers pretty much makes the title lose to the public. *** Land contracts not included, maybe Land Patent. Possible Condo can use this, if your name on paperwork only, must read your agreement, not a contract, only one signature. Contracts require two signatures. Any other steps you find needed & important, email me: ricehome12074@juno.com. Remember this is in your Mortgage Agreement!!! There is so much winning stuff to use in Mortgage & Note documents. Read Mortgage Insurance in definition & Section 10, 2nd paragraph. Both states Lender will be reimburse if borrower goes into default. This answer the Accelerated payment option the lender may use. Ask lender to file a claim with its Insurance Company!