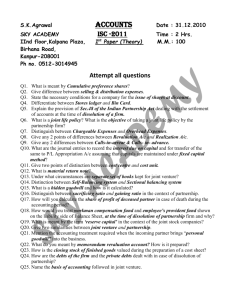

CAUSES FOR JUDICIAL DISSOLUTION – Art 1831 DISSOLUTION AND WINDING UP • Dissolution - is a change in the relation of the partners caused by any partner ceasing to be associated in the carrying on as distinguished from the winding up of the business . Examples: retirement, death, or admission LIABILITY CREATED BY ANY PARTNER AFTER DISSOLUTION Requirements of Art. 1833 a)dissolution is caused by act, death or insolvency • Winding up – is the process of settling business affairs after dissolution; it involves the collection and distribution of partnership assets, payment of debts, etc. b) partner acted for the partnership without any knowledge of the dissolution c)effect: other partners shall be held liable • Termination – is the point in time after all the partnership affairs have been wound up INSTANCES WHEN PARTNER CAN BIND DISSOLVED PARTNERSHIP TO 3RD PERSONS EFFECTS OF DISSOLUTION Requirements of Art. 1833 • Partnership not terminated, but continues until the winding up • Not automatically the termination of the legal personality • Partnership continues for a limited purpose • Transaction of new business is not allowed a) dissolution is caused by act, death or insolvency b) partner acted for the partnership without any knowledge of the dissolution c)effect: other partners shall be held liable Notice of dissolution to creditors – partnership not liable if creditors have knowledge of the dissolution CAUSES FOR EXTRAJUDICIAL DISSOLUTION 2 EXISTING LIABILITY OF ANY PARTNER Kinds of Dissolution -> Extrajudicial – Art. 1830 and Judicial – Art. 183 No violation of the agreement *Expiration – continue (PAW – Art. 1785) *Express will of any partner – must be in good faith; if not, liable for damages *Express will of all partners (no strings attached) - voluntary Involuntary *Violation of the agreement *Partner expressly withdrawing in bad faith *Liable for damages *Unlawful of the business *Loss of specific thing – if not specific check Art. 1786 and 1788; determine time of loss; determine the nature of contribution *Death of any partner *Insolvency of any partner – must be adjudged by a court *Civil interdiction – cannot validly give consent *By decree of court under the ff article • Dissolution does not discharge the existing liability of a partner • A partner may be relieved from all existing liabilities by an agreement to that effect bet. Himself, the partnership creditor, and other partners • Liability of estate of deceased partner – the estate shall be liable for all obligations of the partnership incurred while he was a partner WINDING UP *It may be done either judicially or extrajudicially *Persons authorized to wind a) the partners designated by the agreement b) if no agreement, all the partners who have not wrongfully dissolved the partnership c) legal representative of the last surviving partner d) the court appointed receiver Powers of liquidating patner a) make new contracts – limited for one specific purpose – winding up b) raise money to pay partnership debts c) incur obligations to complete existing contracts or preserve partnership assets a) if partnership not continued by others, to have the partnership property applied to discharge its liabilities and to receive in cash his share of the surplus less damages caused by his wrongful dissolution b) if the business is continued: i) to have the value of his interest in the partnership at the time of the dissolution to his co-partners, ascertained and paid in cash or secured by bond approved by the court ii) to be released from all existing and future liabilities of the partnership d) incur expenses necessary in the conduct of litigation PAYMENT • Rights where dissolution not in contravention of agreement a) to have the partnership property applied to discharge the liabilities of the partnership b) to have the surplus, if any, applied to pay in cash the net amount owing to the respective partners • PARTNERSHIP CONTRACT RESCINDED • Rights of the injured partner are the ff: • a) right of a lien on, or retention of, the surplus of partnership property after satisfying partnership liabilities for any sum of money paid or contributed by him • b) right to subrogation in a place of partnership creditors after payment of partnership liabilities • c) right of indemnification by the guilty partner against all debts and liabilities of the partnership Rights where dissolution in contravention of agreement A. rights of partner who has not caused the dissolution wrongfully: a) to have partnership property applied for the payment of its liabilities and to receive in cash his share of the surplus RULES IN SETTLING ACCOUNTS – Art 1839 b)to be indemnified for damages caused by the partner guilty of wrongful dissolution CASES WHEREIN CREDITORS OF THE DISSOLVED PARTNERSHIP ARE ALSO CREDITORS OF THE PERSON/PARTNERSHIP CONTINUTING THE BUSINESS – Art 1840 c) to continue the business in the same name during the agreed term of the partnership, by themselves or jointly with others d) to possess partnership property should they decide to continue the business • Right of partner who has wrongfully caused the dissolution: BUSINESS IS CONTINUED BUT NO SETTLEMENT OF ACCOUNTS • The retiring partner or legal rep. of the deceased partner shall have the right: 1) to have the value of the interest of the retiring partner or deceased partner in the partnership ascertained as of the date of retirement or death 2) to receive thereafter, as an ordinary creditor, an amt = to the value of his share in the dissolved partnership with interest, or , at his option, in lieu of interest, the profits attributable to the use of his right ARTICLE 1842 • Liquidation is necessary for determination of partner’s share • Liquidation is not required when there is settlement or an agreement as to what he shall receive LIMITED PARTNERSHIP See Article 1843 • Composed of two classes of partners; limited and general • Exception to Article 1816, has the same type of liability as stockholder in a corporation Characteristics of limited partnership: i. Formed by compliance w/ the statutory requirements ii. 1 or more general partners control the business and are personally liable to creditors iii. 1 or more limited partners contribute to the capital and share in the profits, but do not participate in the mgmt. of the business and not liable beyond the amt of their capital contri iv. Limited partners may ask for the return of their capital contributions under the conditions prescribed by law v. Partnership debts are paid out of common fund and individual properties of the general partners vi. Difference bet. a general partner/partnership and a limited partner/partnership REQUIREMENTS FOR FORMATION OF A LIMTED PARTNERSHIP See Article 1844 Two essential requirements for the formation i. Certificate or articles of the limited partnership ii. Such certificate must be filed for record in the SEC • The filing constitutes as notice to any potential creditors or persons dealing with the partnership • Compliance required: substantial compliance in good faith LIABILITY FOR FALSE STATEMENT IN CERTIFICATE • Example: C, a limited partner, appeared as a general partner in the certificate/AOP. Question? What is the treatment? General or Limited? Answer: General partner to innocent 3rd persons who relied on the certificate. Co-partners w/ knowledge of the falsity will be held liable GENERAL PARTNER IN A LIMITED PARTNERSHIP RETURN OF CONTRIBUTION OF LIMITED PARTNER • • Similar to general partnership/ acts of administration except 1 to 7 of Art. 1850 • No power to bind the limited partners beyond the latter’s investment • No power to act for the firm beyond the purpose and scope of the partnership • No authority to change the nature of the business w/out consent of the limited partners NOT REALLY A LIMITED PARTNER • Article 1852 • If a person erroneously believes himself/herself to be a limited partner, he/she may be exempted from liability as a general partner, provided: 1. On ascertaining the mistake, he promptly renounces his interest in the profits of the business or other compensation by way of income 2. His surname does not appear in the partnership name 3. He does not participate in the mgmt. of the bus.345 Limited partner may dissolved the partnership: 1. his demand for the return of his contribution is denied 2. when his contribution is not paid although he is entitled to its return because the other liabilities of the partnership have not been paid or the partnership property is insufficient for their payment Note: regardless of his contribution, limited partner has only the right to demand and receive cash in return of his contribution LIABILITIES OF A LIMITED PARTNER Liability for unpaid contribution 1. Difference bet. his contribution as actually made and that stated in the certificate 2. Unpaid contribution w/c he/she agreed in the certificate to make in the future Liability as trustee 1. Specific property stated in the certificate as contributed by him but w/c s/he had not contributed BUSINESS TRANSACTIONS W/ LIMITED PARTNERSHIP 2. Specific property of the partnership w/c had been wrongfully returned to him/her • 3. Money wrongfully paid or conveyed to him on account of his contribution • Limited partner is not prohibited granting loans to the partnership, transacting other business w/ it, and receiving a pro rata share of the partnership assets w/ general creditors of he is not also a gen. partner The limited partner is considered as a non-partner creditor. But, 3rd persons enjoy preferential rights insofar as partnership assets are concerned 4. Other property wrongfully paid or conveyed to him on account of his contribution 5. Liabilities of a limited partner may be waived, provided: 6. Consent of all members 7. Does not prejudice partnership creditors who extended credit or whose claims arose before the cancellation or amendment of the certificate 8. Please read Art. 1859 - 1866