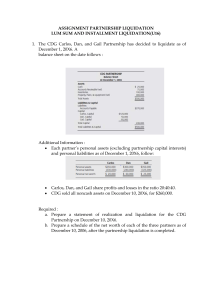

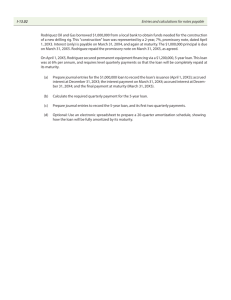

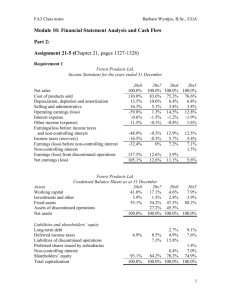

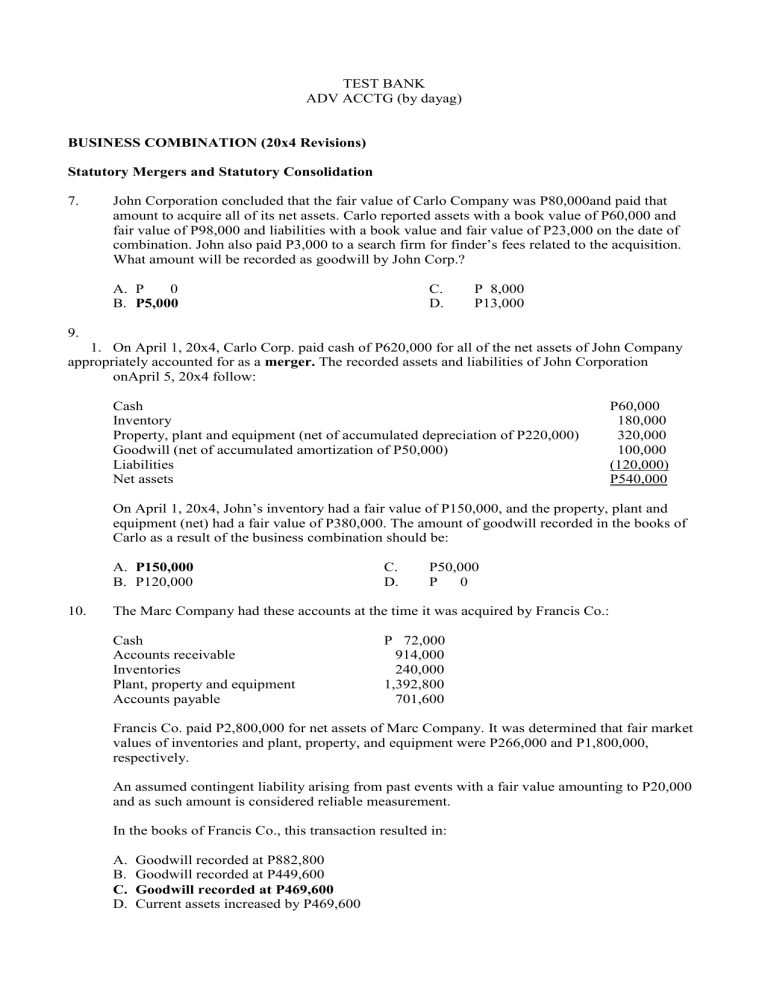

TEST BANK ADV ACCTG (by dayag) BUSINESS COMBINATION (20x4 Revisions) Statutory Mergers and Statutory Consolidation 7. John Corporation concluded that the fair value of Carlo Company was P80,000and paid that amount to acquire all of its net assets. Carlo reported assets with a book value of P60,000 and fair value of P98,000 and liabilities with a book value and fair value of P23,000 on the date of combination. John also paid P3,000 to a search firm for finder’s fees related to the acquisition. What amount will be recorded as goodwill by John Corp.? A. P 0 B. P5,000 C. D. P 8,000 P13,000 9. 1. On April 1, 20x4, Carlo Corp. paid cash of P620,000 for all of the net assets of John Company appropriately accounted for as a merger. The recorded assets and liabilities of John Corporation onApril 5, 20x4 follow: Cash Inventory Property, plant and equipment (net of accumulated depreciation of P220,000) Goodwill (net of accumulated amortization of P50,000) Liabilities Net assets P60,000 180,000 320,000 100,000 (120,000) P540,000 On April 1, 20x4, John’s inventory had a fair value of P150,000, and the property, plant and equipment (net) had a fair value of P380,000. The amount of goodwill recorded in the books of Carlo as a result of the business combination should be: A. P150,000 B. P120,000 10. C. D. P50,000 P 0 The Marc Company had these accounts at the time it was acquired by Francis Co.: Cash Accounts receivable Inventories Plant, property and equipment Accounts payable P 72,000 914,000 240,000 1,392,800 701,600 Francis Co. paid P2,800,000 for net assets of Marc Company. It was determined that fair market values of inventories and plant, property, and equipment were P266,000 and P1,800,000, respectively. An assumed contingent liability arising from past events with a fair value amounting to P20,000 and as such amount is considered reliable measurement. In the books of Francis Co., this transaction resulted in: A. B. C. D. Goodwill recorded at P882,800 Goodwill recorded at P449,600 Goodwill recorded at P469,600 Current assets increased by P469,600 12. 2. On December 1, 20x4. Darlene Ltd. acquired all assets and liabilities of Shyndelle Ltd with DarleneLtd. issuing 100,000 shares to acquire these net assets. The fair value of ShyndellesLtd’s. assetsand liabilities at this date were: Cash Furniture and fittings Accounts receivable Plant Accounts payable Current tax liability Provision for annual leave P 50,000 20,000 5,000 125,000 15,000 8,000 2,000 The financial year for Darlene Ltd.is January- December. The fair value of each Darlene Ltd. Share at acquisition date is P1.90. At acquisition date, the acquirer could only determine a provisional fair value for the plant. On March 1, 20x5, Darlene Ltd. received the final value from the independent appraisal, the fair value at acquisition date being P131,000. Assuming the plant had a further five-year life from the acquisition date. The amount of goodwill arising from the business combination at December 1, 20x4: A. P15,000 B. P13,000 C. D. P5,000 P 0 18-27. Francis acquires assets and liabilities of Marc Company on January 1, 20x5. To obtain these shares, Francis pays P800 (in thousands) and issues 20,000 shares of P20 par value common stock on this date. Francis stock had a fair value of P36 per share on that date. Francis also pays P30 (in thousands) to a local investment firm for arranging the transaction. An additional P20 (in thousands) was paid by Francis in stock issuance costs. The book values for both Francis and Marc as of January 1, 20x5 follow. The fair value of each of Francis and Marc accounts is also included. In addition, Marc holds a fully amortized trademark that still retains an P80 (in thousands) value. The figures below are in thousands. Any related question also is in thousands. Marc Company Francis, Inc. Book Value Fair Value Cash P1,800 P160 P160 Receivables 960 360 320 Inventory 1,320 520 600 Land 600 240 Buildings (net) 2,400 440 Equipment (net) 720 200 Accounts payable 960 120 Long-term liabilities 2,280 680 Common stock 2,400 160 Retained earnings 2,160 960 260 560 150 120 600 Assuming the combination is accounted for as an acquisition, immediately after the acquisition, in the balance sheet of Francis: What amount will be reported for goodwill? A. P110 B. P130 C. P140 D. P270 Using the same information above, what amount will be reported for receivables? A. P1,320 B. P1,280 C. P1,000 D. P 920 Using the same information above, what amount will be reported for inventory? A. P1,920 B. P1,840 C. P1,400 D. P1,240 Using the same information above, what amount will be reported for buildings (net)? A. P2,840 B. P2,520 C. P2,280 D. P2,960 Using the same information above, what amount will be reported for equipment (net)? A. P770 B. P670 C. P870 D. P720 Using the same information above, what amount will be reported for long-term liabilities? A. P2,960 B. P2,880 C. P2,360 D. P2,200 Using the same information above, what amount will be reported for common stock? A. P2,400 B. P2,560 C. P2,800 D. P2,960 Using the same information above, what amount will be reported for retained earnings? A. P2,130 B. P2,160 C. P3,050 D. P3,120 Using the same information above, what amount will be reported for additional paid in capital? A. P330 B. P300 C. P320 D. P350 Using the same information above, what amount will be reported for cash after the purchase transaction? A. P1,960 B. P1,800 29. C. P1,750 D. P1,110 On January 1, 20x5, the fair values of Pia’s net assets were as follows: Current Asset Equipment Land Buildings Liabilities P200,000 300,000 100,000 600,000 160,000 On January 1, 20x5, Ruth Company purchased the net assets of Pia Company by issuing 200,000 shares of its P1 par value stock when the fair value of the stock was P6.20. It was further agrees that Ruth’s would pay an additional amount on January 1, 20x7, if the average income during the 2-year period of 20x5-20x6 exceeded P160,000 per year. The expected value of this consideration was calculated as P268,000; the measurement period is one year. What amount will be recorded as goodwill on January 1, 20x5? A. Zero B. P200,000 C. P360,000 D. P568,000 Using the same information above, assuming that on August 1, 20x5 the contingent consideration happens to be P340,000, what amount will then be recorded as goodwill on the said date? A. Zero B. P172,000 C. P332,000 D. P540,000 Using the same information above, assuming that on January 1, 20x7, the date of settlement of the contingent consideration clause agreement for P350,000, the entry should be: A. Estimated liability for contingent consideration P340,000 Loss on estimated contingent consideration 10,000 Cash P350,000 B. Estimated liability for contingent consideration Cash 350,000 C. Estimated liability for contingent consideration 368,000 Cash Gain on estimated contingent consideration 350,000 350,000 18,000 D. No entry required. 35. Mark Corporation acquired Ray Company through an exchange of common shares. All of the Ray’s assets and liabilities were immediately transferred to Mark. Mark’s common stock was trading at P20 per share at the time of exchange. Following selected information is also available. Par value of shares outstanding Additional paid in capital Before Acquisition P200,000 350,000 After Acquisition P250,000 550,000 Based on the preceding information, what number of shares was issued at the time of the exchange? A. P 5,000 B. P10,000 C. P12,500 D. P17,500 Using the same information above, what is the par value of Mark’s common stock? A. P10 B. P 5 C. P 4 D. P 1 Using the same information above, what is the fair value of Ray’s net assets, if goodwill of P56,000 is recorded? A. P194,000 B. P244,000 C. P300,000 D. P306,000 38. AB Corporation acquired all the assets and liabilities of RG Corporation by issuing shares of its common stock on January 1, 20x4. Partial balance sheet data for the companies prior to the business combination and immediately following the combination is provided: AB Book Value Cash P 65,000 Accounts receivable 72,000 Inventory 33,000 Buildings and equipment (net) 400,000 Goodwill Total Assets P 570,000 Accounts Payable Bonds payable Common stock, P2 par Additional paid-in capital Retained earnings Total Liabilities and Equities P 50,000 250,000 100,000 65,000 105,000 P 570,000 RG Book Value P 25,000 20,000 45,000 150,000 ? P 240,000 P 25,000 100,000 25,000 20,000 70,000 P 240,000 Combination P 90,000 94,000 88,000 650,000 P ? P 75,000 350,000 160,000 245,000 ? P ? What number of shares did AB issue for this acquisition? A. B. C. D. 39. 80,000 50,000 30,000 17,500 At what price was AB stock trading when stock was issued for this acquisition? A. B. C. D. P2.00 P5.63 P6.00 P8.00 40. What was the fair value of the net assets held by RG at the date of combination? A. B. C. D. P115,000 P227,000 P270,000 P497,000 41. What amount of goodwill will be reported by the combined entity immediately following the combination? A. B. C. D. P 13,000 P125,000 P173,000 P413,000 42. What balance in retained earnings will the combined entity report immediately following the combination? A. B. C. D. P 35,000 P 70,000 P105,000 P175,000 46. 1. Companies A and B decide to consolidate. Asset and estimated annual earnings contributions are as follows: Co. A Co. B Total Net asset contribution P300,000 P400,000 P700,000 Estimated annual earnings contribution 50,000 80,000 130,000 Stockholders of the two companies agree that a single class of stock be issued, that their contributions be measured by net assets plus allowances for goodwill, and that 10% be considered as a normal rate of return. Earnings in excess of the normal rate of return shall be capitalized at 20%in calculating goodwill. It was also agreed that the authorized capital stock of the new corporation shall be 20,000 shares with a par value of P100 a share. The amount of goodwill credited to Co. A A. P120,000 B. P150,000 C. D. P100,000 P200,000 Total contribution of Co. B (net assets plus goodwill): A. P400,000 B. P500,000 C. D. P600,000 P700,000 48. 1. DG Inc., a new corporation formed and organized because of the recent consolidation of R Inc. and G Inc., shall issue 10% participating preferred stocks with a par value of P100 for D Inc and G Inc. net assets contributions, and common shares with a par value of P50 for the difference between the total shares to be issued and the preferred shares to be issued. The total shares to be issued by DG shall be equivalent to average annual earnings capitalized at 10%. Relevant data on D Inc. and G Inc. follows: Total Assets Total Liabilities Annual earnings (average) D Inc. P720,000 432,000 46,080 The total preferred shares to be issued by DG Inc. A. B. C. D. 8,640 5,760 2,880 7,280 The amount of goodwill to be recognized by DG Inc. A. B. C. D. P288,000 P280,000 P864,000 P860,000 G Inc. P921,600 345,600 69,120 CONSOLIDATED Finc’l Statement– Stock Acquisition 1-4 Company A acquires 80% of Company B for P5,000,000, carrying value of Company B net assets at time of acquisition being P3,000,000 and fair value of these net identifiable assets being P4,000,000. Goodwill arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: A. P 800,000 B. P1,000,000 C. P1,800,000 D. P2,250,000 Using the same information above, the amount of non-controlling interest arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: A. P600,000 B. P800,000 C. P1,250,000 D. P1,500,000 Using the same information above, the amount of goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: A. P800,000 B. P1,000,000 C. P1,800,000 D. P2,250,000 Using the same information above, the amount of non-controlling interest arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: A. P600,000 B. P800,000 9-13 C. P1,250,000 D. P1,500,000 Pine Company acquires 15 percent of Shine Company’s common stock for P1,000,000 cash and carries the investment using the cost method. A few months later, Pine purchases another 60 percent of Shine Company’s stock for P4,320,000. At that date, Shine Company reports identifiable assets with a book value ofP7,800,000 and a fair value of P10,200,000, and it has liabilities with a book value and fair value of P3,800,000. The fair value of the 25% noncontrolling interest in Shine Company is P1,800,000. Goodwill arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: A. P168,000 B. P200,000 C. P600,000 D. P800,000 Using the same information above, the amount of non-controlling interest arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: A. P 600,000 B. P1,000,000 C. P1,600,000 D. P1,800,000 Using the same information above, the amount of goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: A. P168,000 B. P200,000 C. P600,000 D. P800,000 Using the same information above, the amount of non-controlling interest arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: A. P600,000 B. P1,000,000 C. P1,600,000 D. P1,800,000 Using the same information above, the amount of gain or loss should be recognized when the additional shares are acquired: A. Zero B. P80,000 gain C. P 80,000 loss D. P136,000 loss 14-17. 1. On September 1, 20x4, Company A acquires 75% (750,000 ordinary shares) of Company B for P7,500,000 (P10per share). In the period around the acquisition date, Company B’s shares are trading at about P8 per share. Company A pays a premium over market because of the synergies it believes it will get. It is therefore reasonable to conclude that the fair value of Company B’s as a whole may not be P10,000,000. In fact, an independent valuation shows that the value of company B is P9,700,00 (fair value of Company B). Assuming that the fair value of the net identifiable assets is P8,000,000 ( carrying value is P6,000,000). Goodwill arising on consolidation is to be valued on the proportionate basis or “Partial” Goodwill: A. P 200,000 B. P1,500,000 15. C. D. P2,000,000 P2,200,000 Using the same information above, the amount of Goodwill arising on consolidation is to be valued on the full (fair value) basis or “Full/Gross-up” Goodwill: A. P 200,000 B. P1,500,000 17. P1,700,000 P2,000,000 Using the same information above, the amount of non-controlling interest arising on consolidation is to valued on the proportionate basis or “Partial” Goodwill A. P1,500,000 B. P1,875,000 16. C. D. C. D. P1,700,000 P2,000,000 Using the same information above, the amount of non-controlling interest arising on consolidation is tovalued on the full (fair value) basis or “Full/Gross-up” Goodwill: A. P1,500,000 B. P1,875,000 C. D. P2,000,000 P2,200,000 18-19. All the issued and outstanding common stock of Dau Company were bought by Angeles Companyon October 1, 20x4 for P700,000. The assets and liabilities of Dau Company were: Cash Accounts receivable (net of P25,000 allowance for doubtful accounts) Inventory Property & equipment (net of P100,000 allowance for depreciation) Accounts/ Notes Payable P 50,000 250,000 150,000 300,000 130,000 On October 1, 20x4 the fair value of the following assets were as follows: Accountsreceivable (net) P235,000 Inventory 130,000 Property & equipment (net) 400,000 There is unrecorded warranty liability on prior-product sales estimated P20,000 discounted cash flow based on estimated future cash flows. The amount of goodwill as a result of the business combination should be: A. B. C. D. 19. Using the same information above, the amount of goodwill in the books of Angeles Co, as a result of the business combination should be: A. B. C. D. 20. P 0 P 35,000 P 65,000 P100,000 P 0 P 35,000 P 65,000 P100,00 On January 1, 20x5, Lotto Company acquires 80% ownership in Dagupan Corporation for P400,000. The fair value of the non-controlling interest at that time is determined to be P100,000. It reports net assets with a book value of P400,000 and fair value of P460,000. Lotto Company reports net assets with a book value of P1,200,000 and a fair value of P 1,300,000 at that time, excluding its investment in Dagupan. What will be the amount of goodwill that would be reported immediately after the combination under current accounting practice if the option of full-goodwill method is used? A. P100,000 B. P 80,000 21. C. P60,000 D. P40,000 Mark acquired 70% of the net assets of Ray for P1.1 million. The assets of Ray have a book value of 1.2 million and a fair market value of P1.3 million; its liabilities are P.2 million. What is the amount of “excess of cost over book value of subsidiary” on the consolidated balance sheet? A. P0 million B. P.1 million 23. C. D. P.2 million P.4 million Rupert Corporation issued 100,000 shares of P20 for common stock for all the outstanding stock of Rita Corporation in a business combination consummated on July 1, 20x4. Rupert Corporation common stock was selling at P30 per share at the time of the business combination was consummated. Out-of-pocket costs of the business combination were as follows: Finder’s fee P50,000 Accountant’s fee (advisory) 10,000 Legal fees (advisory) 20,000 Printing costs 5,000 SEC registration costs and fees 12,000 P97,000 The fair value of the consideration transferred accounting will be: A. P3,097,000 B. P3,080,000 26. C. D. P3,017,000 P3,000,000 Sun Inc. bought all outstanding shares of Shine Corporation on January 1, 20x4, for P700,000 in cash. The portion of the consideration transferred results in a fair-value allocation of P35,000 to equipment and goodwill of P88,000. At the acquisition date, Sun also agrees to pay Shine’s previous owners and additional P110,000 on January 1, 20x6, if Shine earns a 10 percent return on the fair value of its assets in 20x4 and 20x5. Sun’s profits exceed this threshold in both years. Under which of the following is true? A. The additional P110,000 payment is a reduction in retained earnings. B. The fair value of the expected contingent payment increases goodwill at the acquisition date. C. Goodwill as of January 1, 20x6, increases by P110,000. D. The P110,000 is recorded as an expense in 20x6. 30. On June 30, 20x4, Moon Corporation purchased for cash at P10 per share all 100,000 shares of the outstanding common stock of the River Company. The total fair value of all identifiable net assets of River was P1,400,000. The only noncurrent asset is property with a fair value of P350,000. The consolidated balance sheet of Moon and its wholly owned subsidiary on June 30, 20x4, should report: A. B. C. D. 33. A retained earnings balance that is inclusive of a gain of P400,000 Goodwill of P400,000 A retained earnings balance that is inclusive of a gain of P350,000 A gain of P400,000 Pia Co. owns 80,000 shares of Rose Corp.’s 100,000 outstanding common shares, acquired at book value. The December 31, 20x4, consolidated balance sheet presented by Pia and Rose included netassets of Rose in the amount of P600,000. On January 1, 20x5, Pia sells 70,000 shares of Rose for P490,000. The fair value of Pia’s remaining 10% interest in Rose is P70,000. What amount of gainor loss, if any, should be recognized on the sale of Pia’s shares resulting in deconsolidation, and how much of that should be attributed to Pia? Determine the gain or loss on disposal (or deconsolidation) should be: A. P40,000 loss B. P80,000 loss 34. C. D. P10,000 gain P80,000 gain Darlene Ltd. Has an 80% investment in Syndelle Ltd. With a carrying amount of P80,000,000. The fair value of Syndelle Ltd. Is P200,000,000. The following year, Darlene Ltd. Decided to sell a 29% interest in Subsidiary to a third party in exchange for cash. Determine the gain or loss on disposal of shares to be recognize in the profit or loss statement: A. Zero B. P29,000,000 gain 36. D. C. P29,000,000 loss P3,000,000 loss John company owns 80,000 shares of Carlo Corporation’s 100,000 outstanding common shares, acquired at book value. The December 31, 20x4, consolidated balance sheet presented by John and Carlo included net assets of Carlo in the amount of P600,000. On January 1, 20x5, John sells 10,000shares (10%) of its Carlo stock to unrelated parties for P70,000. Determine the gain or loss on disposal of shares to be recognized in the profit or loss statement: A. Zero B. P10,000 gain C. D. P10,000 loss P 5,000 loss 38. Darlene, Inc. buys 60% of the outstanding stock of Shyndelle Inc. in an acquisition that resulted in the acquisition of goodwill. Shyndelle owns a piece of land that cost P200,000 but was worth P500,000 at the acquisition date. What value should be attributed to this land in a consolidated balance sheet at the date of takeover? A. P120,000 B. P300,000 41. C. D. P380,000 P500,000 Jack company had common stock of P350,000 and retained earnings of P490,000. Jill Inc. had common stock of P700,000 and retained earnings of P980,000. On January 1, 20x4, Jill issued 34,000 shares of common stock with a P12 par value and a P35 fair value for all of Jack Company’s outstanding common stock. This combination was accounted for as an acquisition. Immediately after the combination, what was the consolidated net asset? A. P2,870,000 B. P2,520,000 C. D. P1,680,000 P1,190,000 42-43. Bea Company acquired 100 percent of the voting common shares of Ali Corporation, its bitter rival, by issuing bonds with a par value and fair value of P300,000. Immediately prior to the acquisition, Bea reported total assets of P1,000,000, liabilities of P560,000, and stockholders’ equity of P440,000. At that date, Ali reported total assets of P800,000, liabilities of P500,000, andstockholders equity of P300,00. Included in Ali’s liabilities was an accounts payable to Bea in the amount of P40,000, which Bea included in its accounts receivable. Based on the preceding information, what amount of total assets did Bea report in its balance sheet immediately after the acquisition? A. P1,000,000 B. P1,300,000 C. P1,500,000 D. P1,800,000 Using the information above, what amount of total assets was reported in the consolidated balance sheet immediately after acquisition? A. P1,300,000 B. P1,760,000 C. P1,840,000 D. P1,500,000 44-52. The financial statements for Good, Inc and Best Company for the year ended December 31, 20x5, prior to Good’s business combination transaction regarding Best Co., follow (in thousands): Good Inc. BestCo. Revenues P 1,350 P 300 Expenses 990 200 Net income P 360 P 100 Retained earnings, 1/1 Net income Dividends Retained earnings, 12/31 Cash Receivables and Inventory Buildings (net) Equipment (net) Total Assets Liabilities Common stock P 1,200 360 ( 135) P 1,425 P 120 600 1,350 1,050 P 3,120 P 750 540 P ( P 200 100 0) 300 P 110 170 300 600 P 1,180 P 410 200 Additional paid-in capital Retained earnings Total liabilities and Stockholders’ equity 405 1,425 P 3,120 270 300 P 1,180 On December 31, 20x5, Good Inc issued P300 in debt and 15 shares of its P10 par value common stock to the owners of Best to purchase all of the outstanding shares of that company. Good Inc. shares had a fair value of P40 per share. Good Inc. paid P12.50 to a broker for arranging the transaction. Good Inc. paid P17.50 in stock issuance costs. Best’s equipment was actually worth P700 but its building were only valued at P280. What amount is the investment recorded on Good Inc’s. books? A. P770 B. P900 C. P912.50 D. P930 Using the same information above, compute the consolidated revenues for 20x5. A. P1,650 B. P1,350 C. P770 D. P360 Using the same information above, compute the consolidated expenses for 20x5. A. P 990 B. P1,002.50 C. P1,007.5 D. P1,020 Using the same information above, compute the consolidated cash account at December 31, 20x5. A. P 230 B. P 217.50 C. P 412.50 D. P 200 Using the same information above, compute the consolidated buildings (net) account at December 31,20x5: A. P 1,350 B. P 1,685 C. P 1,630 D. P 1,650 Using the same information above, compute the consolidated goodwill account at December 31, 20x5: A. P 0 B. P 50 C. P 62.5 D. P 80 Using the same information above, compute the consolidated common stock account at December 31, 20x5: A. P 540 B. P 690 C. P 740 D. P 1,140 Using the same information above, compute the consolidated additional paid-in capital account at December 31, 20x5: A. P 405 B. P 675 C. P 837.50 D. P 955 Using the same information above, compute the consolidated retained earnings account at December 31, 20x5: A. P1,400 B. P1,412.50 57. C. P1,425 D. P1,712.50 On January 1, 20x4, Maru Corporation and NongCorporaton and their condensed balance sheet are as follows: Current Assets Non-current Assets Total Assets Current Liabilities Long-term Debt Stockholders’ Equity Total Liabilities & Equities Maru Corp. P 140,000 180,000 P320,000 P 60,000 100,000 160,000 P320,000 Nong Corp P 40,000 80,000 P 120,000 P 20,000 100,000 P 120,000 On January 2, 20x4,Maru Corporation borrowed P120,000 and used the proceeds to obtain 80% of the outstanding common shares of Nong Corporation. The acquisition price was considered proportionate to Nong’s fair value. The P120,000 debt is payable in 10 equal annual principal payments, plus interest, beginning December 31, 20x4. The excess fair value of the investment over the underlying book value of the acquired net assets is allocated to inventory (60%) and to goodwill (40%). On a consolidated balance sheet as of January 2, 20x4, what should be the amount for each of the following? The amount of goodwill using proportionate basis (partial): A. B. C. D. 58. Using the same information above, the amount of goodwill using full fair value (full/gross-up) basis: A. B. C. D. 59. P210,000 P204,000 P200,000 P180,000 Using the same information above, the amount of non-current asset using proportionate basis (partial) in computing goodwill should be: A. B. C. D. 61. P 0 P16,000 P20,000 P40,000 Using the same information above, the amount of current assets should be: A. B. C. D. 60. P 0 P16,000 P20,000 P40,000 P260,000 P268,000 P276,000 P280,000 Using the same information above, the amount of non-current asset using full fair value basis (full/gross-up) in computing goodwill should be: A. B. C. D. 62. Using the same information above, the amount of current liabilities should be: A. B. C. D. 63. P220,000 P208,000 P 180,000 P 100,000 Using the same information in above, the amount of stockholders’ equity using proportionate (partial goodwill) basis to determine non-controlling interest should be: A. B. C. D. 65. P100,000 P92,000 P80,000 P60,000 Using the same information above, the amount of non-current liabilities should be: A. B. C. D. 64. P260,000 P268,000 P276,000 P280,000 P 160,000 P 186,000 P 190,000 P 260,000 Using the same information above, the amount of stockholders’ equity using full fair value (full/gross-up goodwill) basis to determine non-controlling interest should be: A. B. C. D. P160,000 P186,000 P190,000 P260,000 Subsequent to date of acquisition 69-71. Willie’s Inc. acquires all of the outstanding stock of Vina Corporation on January 1, 20x5. At that date, Vina owns only three assets and has no liabilities: Inventory Equipment (10-year life) Building (20-year life) Book Value P 80,000 160,000 200,000 Fair Value P 100,000 150,000 600,000 If Willie pays P900,000 in cash for Vina, what amount would be represented as the subsidiary’s Building in a consolidation at December 31, 20x7, assuming the book value at that date is still P400,000? A. P400,000 B. P510,000 C. P 570,000 D. P 600,000 Using the same information above, if Willie pays P800,000 in cash for Vina, what amount would be represented as the subsidiary’s Building in a consolidation at December 31, 20x7, assuming the book value at that date is still P400,000? A. P400,000 B. P510,000 C. P570,000 D. P600,000 Using the same information above, if Willie pays P900,000 in cash for Vina, what amount would be represented as the subsidiary’s Equipment in a consolidation at December 31, 20x7, assuming the book value at that date is still P160,000? A. P140,000 B. P147,000 C. P135,000 D. P160,000 76-79. Mark Company acquired 90 percent of Angel Company on January 1, 20x5, for P468,000 cash. Angel’s stockholders’ equity consisted of common stock of P320,000 and retained earnings of P160,000. An analysis of Angel’s net assets revealed the following: Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years. Building (10-year life) Equipment (4-year life) Land Book value P 20,000 28,000 10,000 Fair value P16,000 36,000 24,000 In consolidation at January 1, 20x5, what adjustment is necessary for Angel’s Buildings account? A. P4,000 increase B. P4,000 decrease C. P3,600 increase D. P3,600 decrease In consolidation at December 31, 20x5, what adjustment is necessary for Angel’s Buildings account? A. P 3,240 increase B. P3,240 decrease C. P 3,600 increase D. P3,600 decrease In consolidation at January 1, 20x5, what adjustment is necessary for Angel’s Land account? A. P14,000 increase B. P14,000 decrease C. P12,600 increase D. P12,600 decrease In consolidation at December 31, 20x6, what adjustment is necessary for Angel’s Land account? A. P 0 B. P14,000 increase C. P12,600 increase D. P12,600 decrease 80-84. Darlene Company acquires 80% of Juanito Company for P250,000 on January 1, 20x4. Juanito reported common stock of P150,000 and retained earnings of P100,000 on that date. Equipment was undervalued by P15,000 and buildings were undervalued by P20,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. Juanito earn income and pays dividends as follows: Net income Dividends 20x4 20x520x6 P 50,000 P 60,000 20,000 25,000 P 65,000 30,000 Assume the initial value method (or cost method) is applied. Compute Darlene’s Investment in Juanito at December 31, 20x4. A. B. C. D. 81. Using the same information above, compute Darlene’s Investment in Juanito at December 31, 20x6? A. B. C. D. 82. P24,000 P25,200 P28,000 P49,200 Using the same information above, compute the non-controlling interest in the net income of Juanito at December 31, 20x5? A. B. C. D. 84. P338,000 P312,500 P296,200 P250,000 Using the same information above, how much does Darlene report as Income from Juanito/ Dividend Income for the year ended December 31, 20x6? A. B. C. D. 83. P250,000 P271,200 P287,200 P312,500 P 7,000 P 9,200 P11,300 P12,000 Using the same information above, compute the non-controlling interest of Juanito using fullgoodwill method at December 31, 20x5? A. B. C. D. P P P P 80,000 53,900 70,000 80,400 86. (ICFA SY1415) On January 1, 20x4, Peter Company purchased 80% of the common stock of Pan Company for P316,000. On this date, Pan Company had common stock, other paid-in capital, and retained earnings of P40,000, P120,000, and P190,000, respectively. Peter Company’s common stock amounted to P500,000 and retained earnings of P200,000. On January 1, 20x4, the only tangible assets of Pan that were undervalued were inventory and building. Inventory, for which the FIFO is used.was worth P5,000 more than cost. Building whichwas worth P15,000 more than book value, has a remaining life of 8 years, and a straight line depreciation is used. Any remaining excess is full goodwill with an impairment for 20x4 amountingto P3,000. Pan Company reported net income of P50,000 and paid dividends of P10,000 in 20x4, while the parent’s reported net income amounted to P100,000 and paid dividends of P20,000. Determine the Consolidated Net Income Attributable to Controlling Interest/Profit Attributable to Equity Holders of Parent: A. B. C. D. 87. Using the same information above, compute the Consolidated Net Income Attributable to Controlling Interest/Profit Attributable to Equity Holders of Parent: A. B. C. D. 88. P142,000 P132,125 P126,500 P124,100 P142,000 P132,125 P126,500 P124,100 Using the same information above, compute the non-controlling in Net Income / CNI attributable to Non-controlling interest using Partial Goodwill: A. B. C. D. P10,000 P 8,600 P 8,025 P 8,625 Using the same information above, compute the non-controlling in Net Income / CNI attributable to Non-controlling interest using Full Goodwill: A. B. C. D. 89. Using the same information above, compute the Equity Holders of Parent – Retained Earnings / Controlling Interest in the Consolidated Retained Earnings A. B. C. D. 90. P10,000 P 8,600 P 8,625 P 8,025 P200,000 P304,100 P324,100 P342,125 Using the same information above, compute the Consolidated/ Group Retained Earnings on fullgoodwill approach: A. B. C. D. P200,000 P304,100 P324,100 P342,125 91-103.On January 1, 20x5, Euro Company acquired 90% of Pacific Company in exchange for 10,800 shares of P10 par common stock having a market value of P241,200. Euro and Pacific condensed balance sheets were as follows: Euro Company and Pacific Company Balance Sheets at January 1, 20x5 (before combination) Euro Co. Assets Cash Accounts receivable (net) Pacific Co. P61,800 P74,800 68,400 18,200 Inventories Equipment (net) Patents Total Assets 45,800 358,000 P534,000 Liabilities and stockholders’ equity Accounts payable Bonds payable, 10% Common stock, P10 par Additional paid-in capital Retained earnings Total liabilities and stockholders’ equity P 8,000 200,000 200,000 30,000 96,000 P534,000 32,200 80,000 20,000 P225,200 P 13,200 100,000 30,000 82,000 P225,200 At the date of acquisition, all assets and liabilities of Pacific Company have a book value approximately equal to their respective market values except the following as determined by appraisal as follows: Inventories (FIFO method) Equipment (net – remaining life – 4 yrs.) Patents (remaining life 10 yrs.) Goodwill (no impairment) P34,200 96,000 26,000 Compute the amount of partial goodwill on January 1, 20x5: A. P5,200 B. P7,600 C. P28,800 D. P50,400 Using the same information above, compute the non-controlling interests (in net assets) on January 1,20x5: A. P21,200 B. P22,400 C. P23,600 D. P26,180 Using the same information above, compute the Consolidated Retained Earnings, January 1, 20x5: A. P 96,000 B. P104,200 C. P169,800 D. P198,000 Using the same information above, compute the Equity Holders of Parent - Retained Earnings, January 1, 20x5: A. P 96,000 B. P104,200 C. P169,800 D. P198,000 In addition to the information above, assuming that on December 31, 20x5, the following results were given: Dividends Paid Net Income Euro Company P 30,000 P60,400 Pacific Company 8,000 18,800 Using cost method to record results of operations, compute the investment balance on December 31, 20x5: A. P 0 B. P241,200 C. P244,320 D. P250,920 Using the information above, compute Dividend Income for 20x5 using cost method: A. P 0 B. P7,200 C. P 8,000 D. P16,800 Using the same information above, compute the Non-Controlling Interest in Net Income on December 31,20x5: A. P 0 B. P1,080 C. P1,220 (?) D. P1,880 (/) Using the same information above, compute the Non-controlling Interests on December 31, 20x5: A. P21,200 B. P22,280 C. P24,020 D. P24,600 Using the same information above, compute the Profit for the period attributable to Equity Holders of Parent on December 31, 20x5: A. P53,200 B. P64,180 C. P72,000 D. P88,200 Using the same information above, compute the Consolidated/ Group Net Incomeon December 31, 20x5: A. P53,200 B. P64,180 C. P65,400 D. P88,200 Using the same information above, compute the Consolidated Retained Earnings, December 31, 20x5: A. P129,520 B. P130,180 C. P138,800 D. P139,600 Using the same information above, compute the Equity Holders of Parent – Retained Earnings, December 31, 20x5: A. P129,520 B. P130,180 C. P138,800 D. P139,600 Using the same information above, compute the Consolidated Total Equity (Stockholders’ Equity) on December 31, 20x5: A. P216,180 B. P601,380 C. P625,400 D. P634,820 104 - 105.Pete Co. acquires Dale, Inc on January 1, 20x4. The consideration transferred exceeds the fair value of Dale’s net assets. On that date, Pete has a building with a book value of P1,200,000 and a fair value of P1,500,000. Dale has a building with a book value of P400,000 and a fair value of P500,000. What amounts in the Building account appear on Dale’s separate balance sheet and on the consolidated balance sheet immediately after acquisition? Push-down Accounting A. P400,000 and P1,600,000 B. P500,000 and P1,700,000 C. P400,000 and P1,700,000 D. P500,000 and P2,000,000 No push-down Accounting A. P500,000 and P2,000,000 B. P400,000 and P1,700,000 C. P500,000 and P1,700,000 D. P400,000 and P2,000,000 112. On January 2, 20x4, John Company acquired 80 percent of Carlo Corporation’s common stock forP344,000 in cash. At the acquisition date, the book values and fair values of Carlo’s assets and liabilities were equal and the fair value of the non-controlling interest was equal to 20 percent of the total book value of Carlo. The stockholders’ equity accounts of the two companies at the acquisition date are: Common stock, P5 par value Additional paid –in capital Retained earnings Total Stockholders’ Equity John Carlo P 500,000 P 300,000 350,000 P1,150,000 P 200,000 80,000 150,000 430,000 Non-controlling interest was assigned income of P11,000 in John’s consolidated income statement for 20x4. What will be the amount of net income reported by Carlo corporation in 20x4? A. B. C. D. P44,000 P55,000 P66,000 P36,000 Using the same information above, what amount will be assigned to the non-controlling interest on January 2, 20x4, in the consolidated balance sheet? A. B. C. D. P86,000 P44,000 P68,800 P50,000 Using the same information above, what will be the total stockholders’ equity in the consolidated balance sheet as of January 2, 20x4? A. B. C. D. 117. P1,580,000 P1,064,000 P1,150,000 P1,236,000 Shyn Corporation’s outstanding capital stock (paid-in capital) has been P200,000 since the company was organized in 20x3. Shyn’s retained earnings account since 20x3 is summarized as follows: Debit: Dividends December 1, 20x3 Dividends December 1, 20x4 Retained Earnings Credit: P20,000 Net income 20x3 20,000 Net income 20x4 P50,000 70,000 Dividends December 1, 20x5 Dividends December 1, 20x6 30,000 40,000 Net income 20x5 Net income 20x6 10,000 60,000 Delle Corporation purchased 20% of Shyn’s outstanding stock on January 1, 20x5, for P300,000. During 20x6Delle’s income, excluding its investment income from Shyn’s was P90,000. Goodwill impairment for the year 20x3-20x6 amounted to P2,250 per year. Compute the balance of Delle’s Investment in Shyn account at December 31, 20x6 under the cost method: A. B. C. D. P285,000 P295,500 P300,000 P315,000 INTERCOMPANY SALES – INVENTORY 118. Pia Corporation owns an 80% interest in Euro Corporation; and at December 31, 20x5, Pia investment in Euro on a cost basis was equal to 80% of Euro’s stockholders equity. During 20x6, Euro sold merchandise to Pia to P200,000 at a gross profit to Euro of P40,000. At December 31, 20x6 half of this merchandise is included in Pia’s inventory. Separate incomes for Pia and Euro for20x6 are summarized as follows: Sales Cost of sales Gross profit Operating expenses Separate incomes Pia P1,000,000 500,000 P 500,000 250,000 P 250,000 Euro P 600,000 400,000 P 200,000 80,000 P 120,000 The income from Euro for 20x6 is: A. P96,000 B. P80,000 C. P16,000 D. P 0 The Consolidated/Group cost of sales for 20x6 is: A. P920,000 B. P900,000 C. P880,000 D. P720,000 The Non-controlling interest in net income for 20x6 is: A. P120,000 B. P 96,000 C. P24,000 D. P20,000 121-124. The separate incomes (which do not include investment income) of Pia Corporation and Rose Corporation, its 80% owned subsidiary, for 20x5wee determined as follows: Sales Cost of sales Gross profit Other expenses Separate incomes Pia P800,000 400,000 P400,000 200,000 P200,000 Rose P200,000 120,000 P 80,000 60,000 P 20,000 During 20x6Pia sold merchandise that cost P40,000 to Rose for P80,000, and at December 31, 20x5 half of these inventory items remained unsold by Rose. The Minority interest in net income for 20x6: A. P 0 B. P4,000 C. P16,000 D. P20,000 The Consolidated sales for 20x6: A. P1,000,000 B. P 960,000 C. P920,000 D. P800,000 The Consolidated cost of sales for 20x6: A. P460,000 B. P496,000 C. P540,000 D. P600,000 The Profit attributable to Equity Holders of Parent or NCI Contributable to controlling interest for 20x6: A. P216,000 B. P200,000 125. C. P196,000 D. P160,000 Income statement information for the year 20x6 for Marc Corporation and its Francis 60% owned subsidiary, Francis Corporation, is as follows: Sales Cost of sales Gross Profit Operating expenses Francis’s net income Marc’s separate income Marc P1,800,000 800,000 P1,000,000 500,000 Francis P700,000 500,000 P200,000 100,000 P100,000 P 500,000 Intercompany sales for 20x6 are upstream (from Francis to Marc) and total P200,000. Marc’s December 31, 20x5 and December 31, 20x6 inventories contain unrealized profits of P10,000 and P20,000, respectively. The consolidated sales for 20x6: A. P1,800,000 B. P2,300,000 C. P2,380,000 D. P2,500,000 The consolidated cost of sales for 20x6: A. P1,090,000 B. P1,100,000 C. P1,110,000 D. P1,120,000 The Profit attributable to Equity Holders of Parent or CNI Contributable to Controlling Interests for 20x6: A. P554,000 B. P560,000 129. C. P564,000 D. P610,000 Mars Corporation owns an 80% interest Mallow Company acquired several years ago. Mallow regularly sells merchandise to its parent at 125% of Mallow’s cost. Gross profit data of Mars and Mallows for the year 20x6 are as follows: Sales Cost of sales Gross Profit Mars P500,000 400,000 P100,000 Mallow P400,000 320,000 P 80,000 During 20x6, Mars purchased inventory items from Mallows at a transfer price of P200,000. Mars December 31, 20x5 and 20x6 inventories included goods acquired from Mallow of P50,000 and P62,500, respectively. The Consolidated sales or Mars Corporation and subsidiary for 20x6 were: A. P900,000 B. P712,500 C. P700,000 D. P620,000 Using the same information above, the Unrealized profits in the year-end 20x5 and 20x6 inventories were: A. B. C. D. P 50,000 and P62,500, respectively P400,000 and P50,000, respectively P 10,000 and P12,500, respectively P 8,000 and P10,000, respectively Using the same information above, the Consolidated cost of goods sold of Mars and subsidiary for 20x6 was: A. P512,000 B. P522,500 132. C. P526,400 D. P528,000 Marc Co. is a manufacturer and Francis Co.., its 100%-owned subsidiary, is a retailer. The companies are vertically integrated. Thus, Francis purchases all of its inventory from Marc. On January 1, 20x6, Francis’s inventory was P60,000. For the year ended December 31, 20x6, its purchases were P300,000, and its cost of sales was P333,000. Marc’s sales to Francis reflect a 50% markup on cost. Francis then resells the goods to outside entities at a 100% markup on cost. At what amount should the intercompany inventory purchased from Marc be reported in the consolidated balance sheet at December 31, 20x6? A. P 6,000 B. P18,000 133. C. P27,000 D. P92,000 Francis Company owns 80% of Ryan Corp.’s common stock. During October 20x6, Ryan sold merchandise to Francis for P500,000. At December 31, 20x6, one-half of the merchandise remained in Francis inventory. For 20x6, gross profit percentages were 30% for Francis and 40% for Ryan. The amount of unrealized intercompany profit in ending inventory at December 31, 20x6 that should be eliminated in consolidation is: A. P 200,000 B. P 100,000 135. C. P80,000 D. P75,000 Rose Corp. acquired a 70% interest in Bud Co. in 20x5. For the year ended December 31, 20x5 and20x6, Bud Co. reported net income of P320,000 and P360,000, respectively. During 20x5, Bud sold merchandise to Rose Corp. for P40,000 at a profit of P8,000. The merchandise was later resold by Rose Corp. to outsider for P60,000 during 20x6. For consolidation purposes, what is the non-controlling interest’s share of Bud’s net income for 20x5 and 20x6, respectively? 20x5 20x6 A. P93,600 B. P 96,000 C. P 98,000 D. P106,400 P110,400 P108,000 P105,600 P100,000 INTERCOMPANY SALES – DEPRECIABLE AND NON-DEPRECIABLE ASSETS Items 136-138 are based on the following information: Income information for 20x6 taken from the separate company financial statements of Pia Corporation and its 75% owned subsidiary, Ruth Corporation is presented as follows:. Sales Gain on sale of building Dividend income Cost of goods sold Depreciation expense Other expenses Net income Pia P 500,000 10,000 37,500 ( 250,000) ( 50,000) ( 100,000) P 147,500 Ruth P230,000 ( 130,000) ( 30,000) ( 20,000) P 50,000 Pia’s gain on sale of building relates to a building with a book value of P 20,000 and a ten-year remaining useful life that was sold to Ruth for P30,000 on January 1, 20x6. At what amount will the gain on sale of building appear on the consolidated/group income statement of Pia and Ruth for the year 20x6 should be: A. Zero B. P2,500 C. P7,500 D. P10,000 The Consolidated/group depreciation expense for 20x6 should be: A. P79,000 B. P80,000 (?) C. P81,000 D. P90,000 The Profit attributable to Equity Holders of Parent or CNI Contributable to Controlling Interests for 20x6 should be: A. P147,500 B. P138,500(?) C. P137,500 D. P110,000 142-145. Marc Corporation is a 90% owned subsidiary of Francis Corporation acquired several years ago at book value equal to fair value. For the years 20x5 and 20x6, Francis and Mark report the following: Francis separate income Marc’s net income 20x5 P600,000 160,000 20x6 P800,000 120,000 The only intercompany transaction between Francis and Marc during 20x5 and 20x6 was the January 1, 20x5 sale of land. The land had a book value of P40,000 and was sold intercompany for P60,000, its appraised value at the time of sale. If the land was sold by Francis to Marc (downstream sales) and that Marc still owns the land at December 31, 20x6, compute the Profit Attributable to Equity Holders of Parent for 20x5 and 20x6: 20x5 20x6 20x5 A. P726,000 P908,000 B. P724,000 P908,000 20x6 C. P744,000 D. P724,000 P920,000 P920,000 Using the same information above, the Consolidated/group net income for 20x5 and 20x6: 20x5 20x6 20x5 A. P724,000 P908,000 B. P760,000 P920,000 20x6 C. P740,000 D. P744,000 P920,000 P920,000 Using the same information above, except that the land was sold by Marc to Francis (upstream sales) and Francis still owns the land at December 31, 20x6, compute the Profit Attributable to Equity Holders Of Parent or CNI Attributable to Controlling Interests for 20x5 and 20x6: 20x5 20x6 20x5 A. P726,000 P908,000 B. P724,000 P908,000 146. P2,000 P 0 P2,000 P 0 On January 1, 20x6, Pine Corp. sold machine for P1,800,000 to Shine Corp., its wholly owned subsidiary. Pine paid P2,200,000 for this machine, which had accumulated depreciation of P500,000. Pine estimated a P200,000 salvage value and depreciated the machine on the straightline method over 20 years, a policy which Shine continued. In Pine’s December 31, 20x5, consolidated balance sheet, this machine should be included in cost and accumulated depreciation as: A. B. C. D. 148. P920,000 P920,000 Panga Corp. owns 100% of Sinan Corp.’s common stock. On January 2, 20x5, Panga sold to Sinan for P80,000 machinery with a carrying amount of P60,000. Sinan is depreciating the acquired machinery over a five year life by the straight-line method. The net adjustments to compute20x5 and 20x6 Profit Attributable to Equity Holders of Parent or CNI Attributable to Controlling Interests before income tax would be an increase (decrease) of: 20x5 20x6 A. P( 8,000) B. P( 8,000) C. P(10,000) D. P(10,000) 147. 20x6 C. P744,000 D. P724,000 Cost P2,200,000 P2,200,000 P1,800,000 P1,700,000 Accumulated depreciation P600,000 P580,000 P 80,000 P 85,000 On January 1, 20x6, Jhon Company purchased 90% equity of Joy Company. On January 3, 20x6. Joy sold equipment (with original cost of P1,500,000 and carrying cost of P750,000) to Jhon for P1,080,000. The equipment have a remaining life of three (3) years and was depreciated using the straight-line method by both companies. In Jhon consolidated balance sheet as of December 31, 20x6, Cost should be reported at: A. P1,500,000 B. P1,080,000 C. P 750,000 D. P1,350,000 Accumulated depreciation should be reported at: A. P1,000,000 C. P 750,000 B. P1,500,000 D. P1,000,000 Net Book Value should be reported at: A. P750,000 B. P735,000 149. On January 1, 20x6, Josh Corporation sold equipment with a three-year remaining useful life and a book value of P50,000 to its 70%-owned subsidiary for a price of P57,500. In the consolidation working papers for the year ended December 31, 20x6, the elimination entry concerning this transaction will include: A. B. C. D. 150. C. P 0 D. P500,000 A debit to equipment for P7,500. A debit to gain on equipment for P7,500. A credit to depreciation expense for P7,500. A debit to gain on equipment sale for P5,000. On January 1, 20x6, Pam Corp. sold a warehouse with a book value of P160,000 and a 20-year remaining useful life to its wholly-owned subsidiary, Spam Corporation, for P240,000. Both Pam and Spam use the straight-line depreciation method. On December 31, 20x6, the separate company financial statements contained the following balances connected with the warehouse: Gain on sale of warehouse Depreciation expense Warehouse Accumulated depreciation Pam P80,000 Spam P 12,000 240,000 12,000 A working paper entry to consolidate the financial statements of Pam and Spam on December 31, 20x6 will include: A. B. C. D. 153. A debit to gain on sale of warehouse for P76,000. A debit to gain sale of warehouse for P80,000. A debit to accumulated depreciation for P4,000. A credit to depreciation expense for P12,000. Sophie Corporation is an 80% owned subsidiary of Pat Corporation. In 20x5, Sophie sold land net cost P15,000 to Pat for 25,000. Pat held the land for eight years before reselling it in 20x6 to Eden Company, an unrelated entity, for P55,000. The consolidated income statement for Pat and its subsidiary in 20x6, Sophie, will show a gain on the sale of land of:. A. P40,000 B. P32,000 154. C. P30,000 D. P24,000 Marc Co. owned 80% of Francis Corp. during 20x5, Marc sold to Francis land with a book value of P48,000. The selling price was P70,000. In its accounting records, Marc should: A. B. C. D. Not recognize a gain on the sale of the land since it was made to a related party. Recognize a gain of P17,600. Defer recognition of the gain until Francis sells the land to a third party. Recognize a gain of P22,000. INTERCOMPANY ACCOUNTS 155. Pink Corp. owns 60% of Sun Corp.’s outstanding capital stock. On May 1, 20x5, Pink advanced P140,000 in cash, which was still outstanding at December 31, 20x6. What portion of this advance should be eliminated in the preparation of the December 31, 20x6 consolidated balance sheet? A. P140,000 B. P84,000 156. During 20x6, Pine Corp. sold goods to its 80% owned subsidiary, Crest Corp. at December 31, 20x6, one-half (1/2) of these goods were included in Crest’s ending inventory. Reported 20x6 selling expenses were P2,200 and P400,000 for Pine and Crest, respectively. Pine’s selling expenses included P100,000 in freight-out costs for goods sold to Crest. What amount of selling expenses should be reported in Pine’s consolidated income statement? A. P3,000,000 B. P2,960,000 157. C. P350,000 D. P270,000 Choco Company’s current receivables from affiliated companies at December 31, 20x5 are (1) a P150,000 cash advance to Candy Corporation (Choco owns 30% of the voting stock of Candy and accounts for the investment by the equity method), (2) a receivable of P520,000 from Cake Corporation for administrative and selling services (Cake is 100%-owned by Choco and is included in Choco’s consolidated financial statements), and (3) a receivable of P400,000 from Wheat Corporation for merchandise sales on credit (Wheat is a 90%-owned, unconsolidated subsidiary of Choco accounted for by the equity method). In the current assets section of its December 31, 20x5 consolidated balance sheet, Choco should report accounts receivable from investee in the amount of: A. P360,000 B. P310,000 161. C. P460,000 D. P400,000 Nenita, Inc owns 100% of Vilma Corporation, a consolidated subsidiary, and 80% of Willie, Inc., an unconsolidated subsidiary at December 31. On the same date, Nenita has receivables of P400,000 from Vilma and P350,000 from Willie. In its December 31 consolidated balance sheet, Nenita should report accounts receivable from investee at A. P 0 B. P70,000 160. C. P2,950,000 D. P2,900,000 At December 31, 20x6, Green, Inc. owned 90% of White Corp., a consolidated subsidiary, and 20% of Blue Corp., an investee over which Green cannot exercise significant influence. On the same date, Green had receivables of P600,000 from White and P400,000 from Blue. In its December 31, 20x6 consolidated balance sheet, Green should report accounts receivable from affiliates of: A. P1,000,000 B. P 680,000 158. C. P56,000 D. P 0 C. P 550,000 D. P1,70,000 Golden Corporation owns a 70% interest in Bay Corporation, acquired several years ago at book value. On December 31, 20x5, Bay mailed a check for P20,000 to Golden in part payment of a P40,000 account with Golden. Golden had not received the check when its books were closed on December 31. Golden Corporation had accounts receivable of P300,000 (including the P40,000 from Bay) and Bay had accounts receivable at P440,000 at year-end. In the consolidated balance sheet of Golden Corporation and Subsidiary at December 31, 20x5, accounts receivable will be shown in the amount of: A. P740,000 B. P720,000 C. P700,000 D. P608,000 COMMON CONTROL 165. Mr. Garcia owns four corporations. Combined financial statements are being prepared for these corporations, which have intercompany profits of P1,000,000. What amount of these intercompany loans and profits should be included in the combined financial statements? A. B. C. D. Intercompany Loans Profits P400,000 P 0 P400,000 P1,000,000 P 0 P 0 P 0 P1,000,000 TOA - VALIX 46-16. 1. Consolidated financial statements are I. The financial statements of a group presented as those of a single economic entity. II. The financial statements presented by a parent in which the investments are accounted for on the basis of the direct equity interest rather than on the basis of the reported results and net assets of the subsidiary. A. I only B. II only C. Both I and II D. Neither I nor II 2. A “group” for consolidation purposes is A. A parent and all of its subsidiaries. B. An entity that has one or more subsidiaries. C. An entity, including an unincorporated entity such as partnership, that is controlled by another entity. D. An entity that obtains control over entities or businesses. 4. The following statements relate to consolidated financial statements. Which statements is incorrect? A. A parent shall present consolidated financial statements in which it consolidates its investment in subsidiaries. B. Consolidated financial statements shall include all subsidiaries of the parent. C. A subsidiary is excluded from consolidation if the investor is a venture capital organization, mutual fund, unit trust or similar entity. D. A subsidiary is not excluded from consolidation even if its business activities are dissimilar from the other entities within the group. 5. A parent is not required to present consolidated financial statements under all of the following conditions, except A. When the parent is itself a wholly-owned subsidiary, or is partially-owned subsidiary and its owners do not object to the parent not representing consolidated financial statements. B. When the parent’s debt and equity instruments are not traded in public market. C. When the parent has filed or it is in the process of filing its financial statements with SEC for the purpose of issuing any class of instruments in a public market. D. When the ultimate or any intermediate parent of the parent produces consolidated financial statements for public use that comply with PFRS. 7. Control is presumed to exist when the parent owns directly or indirectly through subsidiaries A. More than half of the equity of an entity. B. More than half of the ordinary shares of an entity. C. More than half of the preference and ordinary shares of an entity. D. More than half of the voting power of an entity. 8. Control exists even if the parent owns half or less of the voting power of an entity where there is ( choose the incorrect one) A. Power over more than half of the voting rights by virtue of an agreement with other investors, B. Power to govern the financial and operating policies of the entity under a statute or an agreement. C. Power to appoint or remove the key officers and employees of the entity. D. Power to cast the majority of votes at meetings of the board of directors or equivalent governing body. 10. What is the initial measurement of an investment in subsidiary retained by the investor when control is lost? A. Fair value at the date when control is lost. B. Fair value at the beginning of the reporting period C. Carrying amount at the date when control is lost D. Carrying amount at the beginning of the reporting period 12. Which statement is incorrect concerning the preparation of consolidated financial statements? A. The financial statements of the parent ant its subsidiaries shall be consolidated on a line by line basis. B. Intragroup balances, transactions, income and expenses shall be eliminated in full. C. When the reporting dates of the parent and a subsidiary are different, the difference shall be no more than six months. D. Consolidated financial statements shall be prepared using uniform accounting policies for like transactions and other events in similar circumstances. 15. Which is incorrect concerning the cost method of accounting? A. The investment is recognized at cost. B. The investor recognizes income from investment only to the extent that the investor receives distributions from accumulated profits of the investee arising after the date of acquisition. C. Distributions received in excess of profits after acquisition are regarded as a reduction of the cost of the investment. D. The investment is initially recorded at cost and any changes in value of the investment at each reporting date are recognized in profit or loss. 45-18 10. An entity shall account for each business combination by applying the A. Acquisition method only B. Pooling method only C. Either acquisition method or pooling method D. Neither acquisition method nor pooling method 45-19. 12. In a business combination achieved in stages, the acquirer shall A. Not measure the previously held equity interest. B. Remeasure the previously held interest at fair value with any resulting gain or loss included in profit or loss. C. Remeasure the previously held interest at fair value with any resulting gain or loss included in other comprehensive income. D. Remeasure the previously held interest at fair value with the resulting gain or loss included in retained earnings. 13. In a business combination, goodwill is measured as the excess of A. The consideration transferred over the identifiable net assets acquired B. The total of the consideration transferred and the amount of any noncontrolling interest in the acquire over the identifiable net assets acquired. C. The total of the consideration received and the fair value of the previously held interest in the acquire over the identifiable net assets acquired. D. The total consideration received, the amount of any noncontrolling interest in the acquiree over the identifiable net assets acquired. 46-16 6. A parent loses control of a subsidiary (choose the incorrect one) A. When there is a change in absolute or relative ownership level. B. When a subsidiary becomes subject to the control of a government, court, administrator or regulator. C. When the loss of control is the result of a contractual agreement. D. When the subsidiary is operating under severe long-term restrictions that impair its ability to transfer funds to the parent. 13. The noncontrolling interests shall be presented in the consolidated statement of financial position A. As part of the parent shareholders’ equity B. As part of current liabilities C. As part of the noncurrent liabilities D. Within equity, separately from the equity of the owners of the parent. 46-17 6. Which of the following terms best describes the financial statement of a parent in which the investments are accounted for on the basis of the direct equity interest? A. Single financial statements B. Combined financial statements C. Separate financial statements D. Consolidated financial statements 45-20 7. An acquirer shall at the acquisition date recognize goodwill acquired in a business combination as anasset. Goodwill shall be accounted for as which of the following? A. Recognize as an intangible asset and amortize over its useful lie. B. Write off against retained earnings C. Recognize as an intangible asset and impairment test when trigger event occurs. D. Recognize as an intangible asset and annually impairment test or more frequently if impairment is indicated. 10. PFRS 3 requires that the contingent consideration of the acquired entity shall be recognized at fair value. The existence of contingent consideration is often reflected in a lower purchase price. Recognition of such contingent consideration shall A. Decrease the value attributed to goodwill, thus decreasing the risk of impairment of goodwill. B. Decrease the value attributed to goodwill, thus increasing the risk of impairment of goodwill. C. Increase the value attributed to goodwill, thus decreasing the risk of impairment of goodwill. D. Increase the value attributed to goodwill, thus increasing the risk of impairment of goodwill. FOREIGN CURRENCY 4. On September 3, 20x3, Pia placed a noncancellable purchase order with a Japanese company for a custom-built machine. The contract price was 1,000,000 yens. The machine was delivered on December 23, 20x3. The invoice was dated November 13, 20x3, the shipping date (FOB shipping point). The vendor was paid on January 7, 20x4. The spot direct exchange rates for the Japanese yenson the respective dates are as follows: Sept. 3, 20x3 Nov.13, 20x3 Dec. 23, 20x3Dec. 31, 20x3 Jan. 7, 20x4 P.20 P.21 P.22 P.23 P.24 What amount is the capitalizable cost of the equipment? A. P200,000 C. B. P210,000 D. P220,000 P230,000 5. What is the reportable foreign exchange gain or loss amount in Pia’s20x3 income statement? A. P10,000 loss C. P30,000 loss B. P20,000 gain D. P20,000 loss 6. What is the reported value of the payable to the vendor at December 31, 20x3? A. P200,000 C. P220,000 B. P210,000 D. P230,000 7. During July 20x4, Mark Corporation had the following transactions with foreign businesses: Vendor A Date 7/1/10 7/10/10 7/31/10 Nature of Transaction Billing CurrencyExchange Rate (Direct) Imported merchandise costing 100,000 Rupees from Pakistan wholesaler Rupee P.82 Paid 40% of amount owed .83 Paid remaining amount owed .78 Customer A 7/15/10 Sold merchandise for 50,000 pound to Syrian wholesaler 7/20/10 Received 20% payment 7/30/10 Received remaining amount owed Pound* P.95 .90 .91 *Syrian pound. What is the capitalized cost of inventory purchase from the Pakistan wholesaler? A. P 0 C. P82,000 B. P78,000 D. P83,000 8. Using the same information in No.7 , what is the foreign exchange gain or loss on July 31, 20x4 transaction arising from the Pakistan wholesaler? A. P1,000 loss C. P400 gain B. P1,000 gain D. P400 loss 9. Using the same information in No. 7 ,what is the foreign exchange gain or loss on July 31, 20x4 transaction arising from Pakistan wholesaler? A. P4,000 gain C. P2,400 loss B. P4,000 loss D. P2,400 gain 10. Using the same information in No. ,what is the reportable sales amount in the income statement in 20x4? A. P38,000 C. P45,500 B. P45,000 D. P47,500 11. Using the same information in No. ,what is the foreign exchange gain or loss on July 20, 20x4 transaction arising from Syrian wholesaler? A. P500 gain C. P2,500 gain B. P500 loss D. P2,500 loss 12. Using the same information in No. ,what is the foreign exchange gain or loss on July 30, 20x4 transaction arising from Syrian wholesaler? A. P1,600 loss C. P2,000 gain B. P1,600 gain D. P2,000 loss 13. Quezon Exports Corp. sold metal crafts to a US firm for S70,000 dollar and pertinent information on exchange conversion rates related to this transaction were as follows: Nov. 04 Nov. 22 Dec. 31 Jan. 06 Conversion Rate (Peso to US Dollar) P27.40 27.50 27.60 27.00 Receipt of order Date of shipment Balance sheet date Date of collection The sale would be appropriately recorded at: A. P1,890,000 C. B. P1,918,000 D. 14. P1,925,000 P1,932,000 On October 1, 20x3, Matt Co. purchased merchandise worth a total of 100,000 Swiss francs from its Swiss supplier, payable within 30 days under an open account arrangement. Matt Co. issued a 30-day, notes payable in Swiss francs. On October 31, 20x3, Matt Co. paid the note. The following information on spot rates (P/SF) is provided: October 01, 20x3 October 31, 20x3 Buying P24.03 24.10 Selling P24.15 24.22 Matt Co.’s foreign exchange gain or loss on the transaction is: A. P5,040 loss C. P12,075 gain B. P7,000 loss D. P19,110 loss 15. The accounts of Juanito International, a Philippine corporation, show P81,300 accounts receivableand P38,900 accounts payable at December 31, 20x3, before adjusting entries are made. In analyzing the balances reveals the following: Accounts Receivable: Accounts Receivable in Phil. Pesos Receivable denominated in 20,000 foreign currency 1 Receivable denominated in 25,000 foreign currency 2 Total P28,500 11,800 41,000 P81,300 Accounts Payable: Payable denominated in Phil. Pesos Payable denominated in 10,000 foreign currency 3 Payable denominated in 10,000 foreign currency 2 Total P 6,950 7,600 24,450 P38,900 Current exchange rates for foreign currency 1, foreign currency 2, and foreign currency 3 at December 31, 20x3 are P.66, P1.65 and P.70, respectively. Determine the net exchange gain or loss that should be reflected in Juanito’s income statement for 20x3 from year-end exchange adjustments. A. P1,950 C. P1,650 B. P(1,950) D. P (300) 16. Using the same information in No. , determine the amounts at which the accounts receivable should be included in Juanito’s December 31, 20x3: Accounts Receivable A. P79,332 B. P82,950 C. D. P134,145 P 53,658 17. Using the same information in No. , determine the amounts at which the accounts payable should be included in Juanito’s December 31, 20x3: A. P64,185 C. P27,230 B. P38,600 D. P38,000 18. Exchange rate is A. B. C. D. The ratio of exchange for two currencies The spot exchange rate at balance sheet date The exchange rate for immediate delivery The difference resulting from translating a given number of units of one currency into another currency at different exchange rates. 19. It is the currency of the primary economic environment in which the entity operates. A. Reporting currency C. Presentation currency B. Functional currencyD. Foreign currency 20. These are money held and financial assets to be received and financial liabilities to be paid in fixed or determinable amount of money. A. Foreign currency loansC. Monetary items B. Long-term items D. Nonmonetary items 21. Which statement is incorrect? A. Functional currency is the currency of the primary economic environment in which he entity operates. B. Foreign currency is a currency other than the functional currency of the entity. C. Presentation currency is the currency in which the financial statements are presented. D. Net investment in a foreign operation is the amount of the reporting entity’s interest in the total assets of that operation. 22. A foreign currency transaction is a transaction which is denominated or requires settlement in a foreign currency and includes I. Purchase and sale of goods and services whose price is denominated in a foreign currency. II. Borrowing and lending of funds when the amounts payable or receivable are denominated in a foreign currency. A. I only B. II only 23. C. Both I and II D. Neither I nor II Initially, a foreign currency transaction shall be recorded by applying to the foreign currency amount A. B. C. D. 24. The spot exchange rate at the date of transaction The closing rate at the end of reporting period The average exchange rate during the year The spot rate at the date of the settlement of the transaction. Foreign currency monetary items are subsequently translated at A. Closing rate C. Forward rate B. Historical rate D. Spot exchange rate 25. Nonmonetary items that are measured in terms of the historical cost denominated in a foreign currency shall be reported using the A. Exchange rate at the date of transaction B. Closing rate 26. C. Average rate D. Spot exchange rate Exchange differences arising from foreign currency transactions shall A. B. C. D. Be recognized in profit or loss of the period in which they arise Be recognized as component of other comprehensive income Be deferred and amortized over a reasonable period Not be recognized Exchange differences arising on a monetary item that forms part of a reporting entity’s net investment in a foreign operation shall be recognized I. In profit or loss in the separate financial statements of the reporting entity or the individual statements of the foreign operation. II. In other comprehensive income in the consolidated financial statements of the reporting entity and the foreign operation and recognized in profit or loss on disposal of the net investment. 27. A. I only B. II only 28. C. Both I and II D. Neither I nor II The following statements relate to the recognition of exchange differences in respect of foreign currency transactions reported in an entity’s functional currency. Which statement is true? I. Any exchange difference on the settlement of a monetary item shall be recognized in profit or loss. II. Any exchange difference on the translation of a monetary item at a rate different from that used at initial recognition shall be recognized in other comprehensive income. A. I only B. II only 29. C. Both I and II D. Neither I nor II It is a subsidiary, associate, joint venture or a branch of a reporting entity whose activities are based or conducted in a country or currency other than that of the reporting entity. A. Multinational company C. Foreign entity B. Foreign operationD. Affiliated company 30. In translating financial statements of a foreign operation, assets and liabilities are translated at A. Closing rateC. Forward rate B. Spot rate D. Historical rate 31. In translating the financial statements of foreign operation, income and expenses are translated at A. Closing rate C. Exchange rate at the date of transaction B. Average rate D. Forward rate 32.Exchange differences arising from the translation of financial statements of a foreign operation shall be accounted for as A. B. C. D. Translation gain or loss as component of other comprehensive income Translation gain or loss as component of profit or loss Translation gain or loss as component of other comprehensive income Transaction gain or loss as component of profit or loss DERIVATIVES 24-19. 1. It is a financial instrument that derives its value from another underlying item such as a share price, exchange rate or interest rate. A. Derivative B. Financial asset 2. Financial liability Equity instrument Which of the following is not a derivative? A. B. C. D. 3. C. D. Interest rate swap agreement Futures contract Option Regular way purchase or sale The characteristics of a derivative include (choose the incorrect one) A. The value of the derivative changes in response to the change in an “underlying” variable. B. A derivative has no notional amount. C. The derivative requires either no initial net investment or a little net investment than would be required for other types of contracts that have a similar response to changes in market factors. D. The derivative is settled at a future date by a net cash payment. 4. An example of a notional amount is A. Number of barrels of oil B. Interest rate 5. C. D. An average daily temperature All of the above could be underlying An agreement between two parties to exchange a specified amount of a commodity, security of foreign currency at a specified date in the future with the price or exchange rate being set now is referred to as A. Interest swap B. Forward contract 7. Currency swap Share price Which one is underlying? A. A credit rating B. A security price 6. C. D. C. D. Futures contract Option A contract, traded on an exchange, that allows a company to buy specified quantity of commodity or a financial security at a specified price on a specified future date is referred to as A. Interest rate swap C. Futures contract B. Forward contract 8. Option A contract giving the owner the right, but not the obligation, to buy or sell an asset at a specified price any time during a specified period in the future is referred as A. Interest rate swap B. Forward contract 9. D. C. D. Futures contract Option Which is incorrect concerning an option? A. A call option is the right to purchase an asset at a specified price during an indefinite period at some future time. B. A put option is the right to sell an asset at a specified price during a definite period at some future time. C. An option is a right and not an obligation to purchase or sell an asset. D. An option requires no payment. 10. Derivatives are measured at A. Fair value B. Cost C. D. Fair value less cost to sell Higher between fair value and cost 24-20. 1. All of the following are characteristics of a derivative except A. It is acquired or incurred by the entity for the purpose of generating a profit from short-term fluctuations in market factors. B. Its value changes in response to the change in a specified underlying. C. It requires no initial investment or an initial net investment. D. It is settled at a future date. 2. The basic purpose of derivative financial instruments is to manage some kind of risk such as all of the following except A. Share price movement B. Interest rate variation 3. Interest rate risk Exchange rate risk C. D. Interest rate risk Exchange rate risk Which of the following risk is inherent in an interest rate swap agreement? I. The risk of exchanging a lower interest rate for a higher interest rate. II. The risk of nonperformance by the counterparty to the agreement. A. I only B. II only 6. C. D. Uncertainty about the future market value of an asset is referred to as A. Price risk B. Credit risk 5. Currency fluctuations Uncollectibility of accounts receivable Uncertainty that the party on the other side of an agreement will abide by the terms of the agreement is referred to as A. Price risk B. Credit risk 4. C D. C. D. Both I and II Neither I nor II In exchange for the right inherent in an option contract, the owner of the option will typically pay a price. A. B. C. D. 7. Only when a call option is exercised. Only when a put option is exercised. When either a call option or a put option is exercised. At the time the option is received regardless of whether the option is exercised or not. Which type of contract is unique in that it protects the owner against unfavorable movement in the price or rate while allowing the owner to benefit from favorable movement? A. Interest rate swap B. Forward contract 8. Strike price Intrinsic value C. D. On the money Out of the money Which choice best describes the information that should be disclosed related to derivative contracts? A. Fair value only B. Notional amount only 114. C. D. If the price of the underlying is greater than the strike or exercise price, the call option is A. At the money B. In the money 10. Futures contract Option An entity enters into a call option contract with an investment bank on December 31, 20x3. This contract gives the entity the option to purchase 10,000 shares at P100 per share. The option expires on April 30, 20x4 the shares are trading at P100 per share on December 31, 20x3, at which time the entity pays P40,000 for the call option. The P40,000 paid by the entity to the investment bank is referred to as A. Option premium B. Notional amount 9. C. D. C. D. Both fair value and nominal amount Neither fair value nor nominal amount On March 1, 20x4, Cherry Corporation entered into a firm commitment to purchase specialized equipment from the Ruby trading company for Y80,000,000 on June 1. The exchange rate on March 1, is Y100 = P1. To reduce the exchange rate risk that could increase the cost of the equipment in pesos, Cherry pays P20,000 for a call option contract. This contract gives Cherry the option to purchase Y80,000,000 at an exchange rate of Y 100 = P1 on June 1. On June 1, the exchange rate is Y105=P1. How much did Cherry save by purchasing the call option (answers rounded to the nearest peso)? A. B. C. D. P20,000 P27,619 P47,619 Cherry would have been better off not to have purchased the call option.