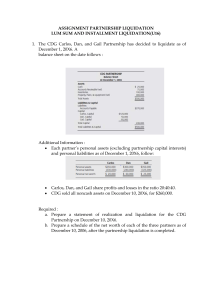

PARTNERSHIP LIQUIDATION PROBLEM M: The following condensed statement of financial position is presented for the partnership of AA, BB and CC, who share profits and losses in the ratio of 4:4:2, respectively: Cash P160,000 Other assets Total Liabilities P180,000 AA, capital 48,000 BB, capital 216,000 CC, capital Total The partners agreed to dissolve the partnership after selling the other assets for P200,000. Requirements: 1. How much should each partner receive upon liquidation? AA : 4 BB : 4 CC: 2 Total Capital/Interest 48,000 216,000 36,000 300,000 +/- Gains & Losses (48,000) (48,000) (24,000) (120,000) Realization (200,000 – 320,000) Remaining 0 168,000 12,000 180,000 Interest 2. Assume instead that the other assets were sold for P10,000 and that deficient partners, if any, are solvent. How much should each partner receive upon liquidation? AA:4 BB:4 CC:2 Total Capital/Interest 48,000 216,000 36,000 300,000 +/- Gain & Losses (124,000) (124,000) (62,000) (310,000) Realization 10,000 – 320,000 Remaining (76,000) 92,000 (26,000) (10,000) Interest Investment 76,000 26,000 102,000 Distribution to 0 92,000 0 92,000 partners 3. Assume instead that the other assets were sold for P50,000 and that deficient partners, if any, are insolvent. How much should each partner receive upon liquidation? AA BB CC Total Capital/Interest 48,000 216,000 36,000 300,000 +/- Gains & Losses (108,000) (108,000) (54,000) (270,000) 50,000-320,000 Remaining (60,000) 108,000 (18,000) 30,000 Interest Absorption of loss 60,000 (78,000) 18,000 0 Distribution to 0 30,000 0 30,000 Partners 4. Assume instead that the partnership is dissolved and liquidated by installments. The first realization of P40,000 cash is on the sale of other assets with book value of P80,000. 60% of the liabilities were liquidated. Liquidation expenses paid amounted to P2,000 while future liquidation expenses are estimated to be P3,000. How much should each partner receive on the first installment? 5. Using information in item 4, assume that in the second realization of P50,000 cash is on the sale of other assets with book value of P95,000. The remaining liabilities were liquidated. Liquidation expenses paid amounted to P500 with P2,500 estimated to be incurred in the future. How much should each partner receive on the second installment? ANSWER TO 4-5 CASH PRIORITY PROGRAM Interest LAP BB P216,000 P540,000 CC 36,000 180,000 Difference P 360,000 60,000 AA 48,000 Cash, Beginning Add: Proceeds Liquidation Expense paid Liquidation ExpenseAnticipated Liabilities paid Liabilities unpaid Cash Available for distribution 120,000 Priority 1st BB 144,000 2nd BB 24k CC 12K P36,000 3rd prio P&L ratio 1st Installation P 160,000 40,000 (2,000) (3,000) 2nd Installation 75,000 50,000 (500) (2,500) (108,000) (72,000) 15,000 (72,000) 50,000 st st 1 priority (1 installment) 2nd Installment AA - BB 15,000 CC - TOTAL 15,000 - 50,000 - 50,000 PROBLEM N: AA, BB and CC decided to liquidate their partnership on November 30, 2021. Their capital balances and profit ratio, before closing entries were made, follow: AA, capital (40%) P50,000 BB, capital (30%) 60,000 CC, capital (30%) 20,000 The net income from January 1 to November 30 is P44,000. On date of liquidation, the cash and liabilities are P40,000 and P90,000, respectively. Requirements: 1. How much must be realized from the sale of the non-cash assets in order for AA to receive P55,200 in full settlement of his interest in the firm? Total Capital ( P50,000 + P60,000 + P20,000 + P44,000) Total Liabilities Total Assets Less: Cash Non-cash assets Less: Loss on realization: (P55,200 - P67,600*) / 40% Proceeds from sale * [P50,000 + (P44,000 x 40%)] (P50,00 + P17,600) P67,600 P174,000 90,000 P264,000 40,000 P224,000 31,000 P 193,000 PROBLEM O AA, BB and CC are partners in ABC Partnership and share profits and losses 50%, 30% and 20%, respectively. The partners have agreed to liquidate the partnership and some liquidation expenses to be incurred. Prior to the liquidation, the partnership statement of financial position reflects the following book values: Cash P 25,200) Non-cash assets 297,600) Payable to CC 38,400) Other liabilities 184,800) AA, capital 72,000) BB, capital ( 12,000) CC, capital 39,600) Actual liquidation expenses are P16,800 and that the non-cash assets with a book value of P240,000 were sold for P216,000. Requirements: 1. How much cash should each partner receive? AA: 5 BB: 3 CC: 2 Total Capital/Interest 72,000 (12,000) 39,600 99,600 Payable to CC 38,400 38,400 Total Interest/ 72,000 (12,000) 78,000 138,000 Capital +/- Gains or (24,000) Losses 240,000-216,000 (20,400) (12,240) (8,160) Liquidation expense Remaining bal. 51,600 24,240 69,840 (16,800) 97,200 Loss on possible unrealization of noncash assets: (P297,600P240,000) Remaining balance. Absorption Loss Remaining Bal. Absorption cost Distribution to partners (28,800) (17,280) (11,520) (57,600) 22,800 (41,520) 58,320 39,600 (29,657) (6,857) (6,875) 0 41,520 0 0 0 (11,863) 46,457 (6,875) 39,600 39,600 39,600 PROBLEM P: The partnership of AA, BB and CC was liquidated on June 30, 2021 and account balances after non-cash assets were converted into cash on September 1, 2021 are: Cash P50,000 Accounts payable P120,000) AA, capital (30%) 90,000) BB, capital (30%) (60,000) CC, capital (40%) (100,000) Personal assets and liabilities of the partners at September 1, 2021 are: Personal Personal Assets Liabilities AA P80,000 P90,000 BB 100,000 61,000 CC 190,000 80,000 CC contributes P70,000 to the partnership in order to have sufficient cash to pay partnership creditors. Requirements: 1. How much should each partner receive as a result of liquidation? Interest Investment of C Balance Additional Investment Balance AA 90,000 BB (60,000) 90,000 (60,000) 39,000 90,000 (21,000) CC (100,000) 70,000 (30,000) Total (70,000) 70,000 39,000 79,000 Loss of absorption (9,000) bal 81,000 Additional Investment of CC Distribution to 81,000 prtaners 21,000 0 (12,000) (42,000) 42,000 39,000 0 0 81,000