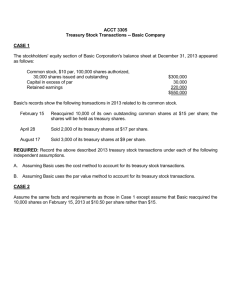

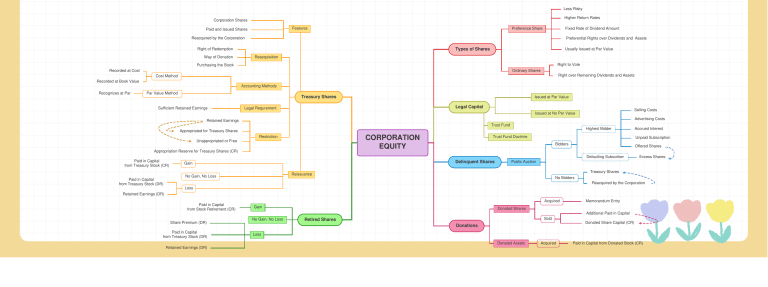

Less Risky Higher Return Rates Corporation Shares Features Paid and Issued Shares Preference Share Fixed Rate of Dividend Amount Reacquired by the Corporation Preferential Rights over Dividends and Assets Types of Shares Right of Redemption Way of Donation Usually Issued at Par Value Reacquisition Right to Vote Purchasing the Stock Recorded at Cost Ordinary Shares Right over Remaining Dividends and Assets Cost Method Recorded at Book Value Accounting Methods Recognizes at Par Par Value Method Treasury Shares Sufficient Retained Earnings Issued at Par Value Legal Capital Legal Requrement Selling Costs Issued at No Par Value Advertising Costs Retained Earnings Trust Fund Highest Bidder Appropriated for Treasury Shares CORPORATION EQUITY Restriction Unappropriated or Free Appropriation Reserve for Treasury Shares (CR) Trust Fund Doctrine Unpaid Subscription Bidders Offered Shares Defaulting Subscriber Paid in Capital from Treasury Stock (CR) Paid in Capital from Treasury Stock (DR) Delinquent Shares Gain Excess Shares Public Auction Treasury Shares Reissuance No Gain, No Loss Accrued Interest No Bidders Reacquired by the Corporation Loss Retained Earnings (DR) Paid in Capital from Stock Retirement (CR) Acquired Gain Memorandum Entry Donated Shares Additional Paid in Capital Share Premium (DR) Paid in Capital from Treasury Stock (DR) No Gain, No Loss Sold Retired Shares Donated Share Capital (CR) Donations Loss Donated Assets Retained Earnings (DR) Acquired Paid in Capital from Donated Stock (CR)