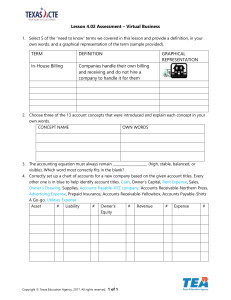

COMPETENCY BASED LEARNING MATERIAL ILOILO CITY LOGO ILOILO PROVINCE LOGO SECTOR HEALTH, SOCIAL AND OTHER COMMUNITY DEVELOPMENT SERVICES SECTOR QUALIFICATION BOOKKEEPING NC III UNIT OF COMPETENCY PREPARE TRIAL BALANCE MODULE TITLE PREPARING TRIAL BALANCE LEARN, EDUCATE, TRAIN, SERVE ACADEME (L.E.T.S. PROAC), INC. PROFESSIONAL HOW TO USE THIS MODULE Welcome to the Module in “Preparing Trial Balance”. This module contains training materials and activities for you to complete. The unit of competency Prepare Trial Balance contains knowledge, skills and attitudes required for BOOKKEEPING NC III qualification. You are required to go through a series of learning activities in order to complete each of the learning outcomes of the module. In each learning outcome there are Information Sheets, Task Sheets, and Activity Sheets. Follow these activities on your own and answer the Self-Checks at the end of each section. If you have questions, don’t hesitate to ask you teacher for assistance. Recognition of Prior Learning (RPL) You may already have some of the knowledge and skills covered in this module because you have: been working for some time already have completed training in this area If you can demonstrate to your trainer that you are competent in a particular skill or skills, talk to him/her about having them formally recognized so you don’t have to do the same training again. If you have a qualification or Certificate of Competency from previous trainings show it to your trainer. If the skills you acquired are still current and relevant to this module, they may become part of the evidence you can present for Review of Previous Learning (RPL). If you are not sure about the currency of your skills, discuss it with your trainer. After completing this module, ask your teacher to assess your competency. Result of your assessment will be recorded in your competency profile. All the learning, activities are designed for you to complete at your own pace. Inside this module you will find the activities for you to complete followed by relevant information sheets for each learning outcome. Each learning outcome may have more than one learning activity. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 1 of 31 Developed by: Patricia A. Tamayo Revision # 00 SUMMARY OF COMPETENCY-BASED LEARNING MATERIALS List of Core Competencies No. Unit of Competency Module Title Code 1. Journalize transactions Journalizing transactions HCS412301 2. Post transactions Posting of transactions HCS412302 3. Prepare trial balance Preparing balance HCS412303 4. Prepare financial reports Preparing reports 5. Review internal control Reviewing the system Control System BOOKKEEPING NC III Preparing Trial Balance the the Date Developed: trial financial HCS412304 Internal Document No. Issued by: Page 2 of 31 Developed by: Patricia A. Tamayo HCS412305 Revision # 00 Table of Contents How to Use this Module ........................................................................................................................... 1 Summary of Competency Based Learning Material .................................................................................... 2 Table of Contents .................................................................................................................................... 3 Module Content ....................................................................................................................................... 4 Learning Outcome Summary ..................................................................................................................... 6 Learning Experiences ................................................................................................................................ 7 Information Sheet 3.1-1 ............................................................................................................................ 9 Trial Balance .................................................................................................................................................. 14 Self Check 3.1-1 ...................................................................................................................................... 15 Answer Key 3.1-1 .................................................................................................................................. 17 Task sheet 3.1-1 ..................................................................................................................................... 18 Suggested Answer to Task Sheet 3.1-11 .................................................................................................. 21 Performance Criteria Checklist ................................................................................................................ 22 Information sheet 3.1-2 .................................................................................................................... 23-25 Self Check 3.1-2 ...................................................................................................................................... 26 Suggested Answers to Self Check 3.1-2 ................................................................................................... 27 Self Check 3.1-2 .................................................................................................................................... 28 Sheet 3.1-2 ............................................................................................................................................ ………29 Suggested Answers to Task sheet 3.1-2 ................................................................................................ 30 References ............................................................................................................................................ 31 BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 3 of 31 Developed by: Patricia A. Tamayo Revision # 00 MODULE CONTENT QUALIFICATION Bookkeeping NC III UNIT OF COMPETENCY Prepare Trial Balance MODULE TITLE Preparing Trial Balance INTRODUCTION: This module covers the knowledge, skills and attitudes in preparing trial balance for all types of business organizations. NOMINAL DURATION: 16 HOURS LEARNING OUTCOMES: LO1. List account titles LO2. Transfer balances from the ledger LO3. Summarize trial balance ASSESSMENT CRITERIA: 1. 2. 3. 4. 5. 6. List asset, liability, and equity account titles in accordance with Chart of Account. List income and expense account titles in accordance with Chart of Accounts. Transfer asset, liability, and equity balances in accordance with Chart of Accounts Transfer income and expense balances in accordance with Chart of Accounts Total debits and credits with 100% accuracy Extract Trial Balances with 100% accuracy. Prerequisite: None LEARNING OUTCOME 01 List account titles CONTENTS: 1.1 Listing of Account Titles BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 4 of 31 Developed by: Patricia A. Tamayo Revision # 00 ASSESSMENT CRITERIA: List asset, liability, and equity account titles in accordance with Chart of Account. List income and expense account titles in accordance with Chart of Accounts. CONDITION: Trainees must be provided with the following: 1. Workplace Location : Bookkeeping NC III Training Laboratory 2. Tools, accessories & supplies Learning Packages Pencil Eraser Worksheet Paper Ledger Ruler 3. Equipment Laptop/Desktop LCD projector 4. Training Materials Competency Based Learning Manual (CBLM) Bookkeeping Manuals ASSESSMENT METHODS: Written test Practical/performance test BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 5 of 31 Developed by: Patricia A. Tamayo Revision # 00 LEARNING OUTCOME SUMMARY LEARNING OUTCOME #01 List account titles CONTENTS: Listing account titles ASSESSMENT CRITERIA Asset, liability, and equity account titles are listed in accordance with Chart of Accounts Income and expense account titles are listed in accordance with Chart of Accounts CONDITION: Trainees must be provided with the following: 1. Workplace location: Bookkeeping NC III Training laboratory 2. Equipment Projector laptop 3. Training materials CBLM Manuals Calculator Paper Learning Materials Pencil Eraser Worksheet Ruler EVALUATION METHOD: Written test Practical/performance test BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 6 of 31 Developed by: Patricia A. Tamayo Revision # 00 LEARNING EXPERIENCES LEARNING OUTCOME #1: List Account Titles Learning Activities 1. Read Information sheet 3.1-1 on Procedures in Listing the Asset, Liability and Equity Account Titles according to the chart of accounts 2. Observe the trainer in demonstrating procedure in listing of account titles based on the chart of accounts 3. Answer Self Check 3.1-1 Special Instructions If you have some problem on the content of the information sheet don’t hesitate to approach your facilitator. If you feel that you are knowledgeable on the content of the information sheet, you can now answer self-check provided in the module. If you have some problem on the demonstration don’t hesitate to approach your facilitator. If you feel that you are knowledgeable on the demonstration proceed to answer self check 3.1-1 and perform task sheet 3.3-1.If not have some don’t hesitate to approach your facilitator. Refer your key 3.1-1 required to not, read again to correctly. answers to the answer for self-check. You are get all answers correct. If the information sheets answer all questions 4. Perform task sheet 3.1-1 on listing of Asset, Liability and Equity Account Titles according to the chart of accounts Compare your work to the Performance Criteria Checklist 3.1-1. If you got 100% correct answer in this task, you can now move to the next activity. If not review the operation sheet and go over the task again. 5. View video presentation on procedure in Procedures in Listing the Asset, Liability and Equity Account Titles according to the chart of accounts If you feel that you are knowledgeable on the presentation, you can now answer oral questioning. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 7 of 31 Developed by: Patricia A. Tamayo Revision # 00 6. Read Information sheet 3.1-2 on Procedures in Listing the Income and expense account titles in accordance with Chart of Accounts. If you have some problem on the content of the information sheet don’t hesitate to approach your facilitator. If you feel that you are knowledgeable on the content of the information sheet, you can now answer self-check provided in the module. 7. Answer Self-check No. 3.1-2 Refer your answers to the answer key 3.1-2 for self-check. You are required to get all answers correct. If not, read the information sheets again to answer all questions correctly 8. Answer oral question See that you got all answer correctly before you could proceed to the next activity. 9. Observe the trainer in demonstrating procedure in listing of account titles based on the chart of accounts If you have some problem on the demonstration don’t hesitate to approach your facilitator. 10. Perform task sheet 3.1-2 on listing of Asset, Liability and Equity Account Titles according to the chart of accounts Compare your work to the Performance Criteria Checklist 3.1-2. If you got 100% correct answer in this task, you can now move to the next activity. If not review the operation sheet and go over the task again. If you feel that you are knowledgeable on the demonstration perform task sheet 3.3-1a.If not have some don’t hesitate to approach your facilitator. Congratulations! You are done with the activities of LO1 and is now ready for the institutional assessment. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 8 of 31 Developed by: Patricia A. Tamayo Revision # 00 INFORMATION SHEET 3.1-1 Procedure in listing of Asset, liability, and equity account in accordance with Chart of Accounts Learning Objectives: After reading this INFORMATION SHEET, YOU MUST be able to execute correctly the procedure in Listing the Asset, Liability and Equity Account Titles according to the Chart of Accounts Introduction A trial balance is a list of accounts and their balances at a given time. Customarily, companies prepare a trial balance at the end of an accounting period. They list accounts in the order in which they appear in the ledger. Debit balances appear in the left column and credit balances in the right column. The trial balance proves the mathematical equality of debits and credits after posting. Under the double-entry system, this equality occurs when the sum of the credit and the debit account balances. A trial balance may also uncover errors in journalizing and posting. In addition, a trial balance is useful in the preparation of financial statements. The steps for preparing a trial balance are: 1. List account titles 2. Transfer balances from the ledger 3. Summarize trial balance In this information sheet, we are going to discuss Step #1 or Learning Outcome 01 with the following assessment criteria: 1. Asset, liability, and equity account titles are listed in accordance with Chart of Account. 2. Income and expense account titles are listed in accordance with Chart of Accounts. If you can remember the previous Units of Competencies and the respective Module Titles which are: As a review and for ease of reference, below is the definition and characteristics of the different Balance Sheet Accounts: BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 9 of 31 Developed by: Patricia A. Tamayo Revision # 00 Asset Are things, properties or resources of value owned and controlled by the business entity. They have value because they can be used or exchanged to produce the services or products of the business. They possess service potential or utility to the owner they can be measured and expressed in money terms. Liability Are the present obligations or debts by the business arising from transactions on account or are premises to pay in the future Capital/Equity Represents the residual interest of the owners in the assets of the business after deducting the equity if the creditors or the liabilities. It is also called net worth , proprietorship or residual equity. In summary: Account Name Increases Decreases Normal Balance Asset Debit Credit Debit Liability Credit Debit Credit Owner’s Equity Credit Debit Credit Refer to the ‘T’ Accounts of the company “TLC Wedding Services’. The balance of each account has been determined. Illustration 3.1-1a TLC Wedding Services T Accounts. Cash 22,000 Office Equipment 60,000 Accounts Receivable 12,000 Notes Payable 210,000 Supplies Accounts Payable BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 10 of 31 Developed by: Patricia A. Tamayo Revision # 00 53,000 18,000 Prepaid Rent 8,000 Utilities Payable 1,400 Prepaid Insurance 14,000 Unearned Revenues 10,000 Service Vehicle 420,000 Consulting Revenues 62,400 Furniture & Fixtures 4,400 Notes Receivable 13,800 Torres, Withdrawals 14,000 Torres, Capital 250,000 BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 11 of 31 Developed by: Patricia A. Tamayo Revision # 00 Following is the Chart of Account: Illustration 3.1-1b TLC Wedding Services Chart of Accounts: TLC Wedding Services Chart of Accounts Balance Sheet Accounts Assets 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Supplies 140 Prepaid Rent 150 Prepaid Insurance 160 Service Vehicle 165 Accumulated Depreciation 170 Office Equipment 175 Accumulated Depreciation 180 Furnitures & Fixtures Liabilities 210 Notes Payable 220 Accounts Payable 230 Salaries Payable 240 Utilities Payable 250 Interest Payable 260 Unearned Revenues Owner's Equity 310 Torres, Capital 320 Torres, Withdrawal 330 Income Summary 410 420 510 520 530 540 550 560 570 580 590 Income Statement Accounts Income Consultng Reveneus Referral Revenues Expenses Salaries Expense Supplies Expense Rent Expense Insurance Expense Utilities Expense Depreciation Expense - Service Vehicle Depreciation Expense - Office Equipment Miscellaneous Expense Interest Expense Learning Objective 01 focuses on the Balance Sheet accounts. Proceed to list the account titles as it appears in the Chart of Accounts, with their respective balances. Note that there is the account Consulting Revenue with Credit Balance of P62,400.00. Take note of this as this is shall be included in the Information Sheet 3.1-2 under the Assessment Criteria Listing of Income and Expense Accounts in accordance to the Chart of Accounts. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 12 of 31 Developed by: Patricia A. Tamayo Revision # 00 In reference to Illustration 3.1-1c, the balance of the accounts are posted across the account titles. The Debit balance under the Debit Column (Left Side), and the Credit Balance under the Credit Column (Right Side). To check that the accounts are listed correctly and completely, the totals of Debit and Credit must be equal, under the principle of double-entry accounting system. The trial balance is a control device that helps minimize accounting errors. When the totals are equal, the trial balance is in balance. The equality provides an interim proof of the accuracy of the records but it does not signify the absence of errors. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 13 of 31 Developed by: Patricia A. Tamayo Revision # 00 Illustration 3.1-1c TLC Wedding Services Trial Balance Trial Balance TLC Wedding Services Balance Sheet Accounts Assets 110 120 125 130 140 150 160 165 170 175 180 210 220 230 240 250 260 310 320 330 410 420 510 520 530 540 550 560 570 580 590 Debit Credit Cash 22,200 Accounts Receivable 12,000 Notes Receivable 13,800 Supplies 18,000 Prepaid Rent 8,000 Prepaid Insurance 14,400 Service Vehicle 420,000 Accumulated Depreciation Office Equipment 60,000 Accumulated Depreciation Furnitures & Fixtures 4,400 Liabilities Notes Payable 210,000 Accounts Payable 53,000 Salaries Payable Utilities Payable 1,400 Interest Payable Unearned Revenues 10,000 Owner's Equity Torres, Capital 250,000 Torres, Withdrawal 14,000 Income Summary Income Statement Accounts Income Consultng Reveneus 62,400 Referral Revenues Expenses Salaries Expense Supplies Expense Rent Expense Insurance Expense Utilities Expense Depreciation Expense - Service Vehicle Depreciation Expense - Office Equipment Miscellaneous Expense Interest Expense 586,800 586,800 BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 14 of 31 Developed by: Patricia A. Tamayo Revision # 00 SELF- CHECK 3.1-1 Instruction: Identify what is being ask in the statement. Encircle your answer. 1. Which of the following classification of accounts has/have a normal credit balance? a. Withdrawal b. Revenues c. Revenue and liabilities d. All of these 2. A purchase is recognized in the accounting records when a. title transfer from the seller to the buyer b. payment is made for the item purchased c. the purchase requisition is sent to the purchasing department d. the buyer receives the seller’s bill 3. The primary purpose of the trial balance is to test the a. equality of debit and credit entries in the journal b. recording of transactions c. equality of debit and credit balances in the ledger d. analysis of transactions 4. The general journal does not have a column titled a. Date b. Description c. Posting Reference d. Account Balance 5. To find an explanation for a transaction, one should look at the a. chart of accounts b. description c. Posting Reference d. Account Balance 6. Which of the following errors will cause a trial balance to be out of balance? a. a journal entry was accidentally posted twice b. A credit was posted to an account as a debit c. The bookkeeper forgot to journalize a transaction d. The bookkeeper forgot to post a journal entry to the ledger 7. A P800 credit item is accidentally posted as a debt. The trial balance column totals will differ by a. P0 b. P400.00 c. P800.00 d. P1,600.00 BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 15 of 31 Developed by: Patricia A. Tamayo Revision # 00 8. Which of the following entries records the withdrawal of cash for personal use by Catherine Viesca, the owner of a business? a. Debit Cash and credit Viesca, Withdrawals b. Debit Cash and Credit Salary Expense c. Debit Salary Expense and credit Cash d. Debit Viesca, Withrawals 9. The trial balance will not expose which of the following problems? a. Recording half an entry b. leaving out an entire entry c. Recording both halves of an entry on the same side d. Recording half an entry and leaving out an entire entry e. Recording half an entry and recording both halves of an entry on the same side 10. Which of the following describes the classification and normal balance of Doringer Cabrera, Capital? a. Asset, debit b. Revenue, credit c. Owner’s Equity, debit d. Expense, debit e. None of these BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 16 of 31 Developed by: Patricia A. Tamayo Revision # 00 ANSWER KEY 3.1-1 1. d 2. a 3. c 4. c 5. c 6. b 7. a 8. a 9. c 10. a BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 17 of 31 Developed by: Patricia A. Tamayo Revision # 00 TASK SHEET 3.1-1 Title: List Asset, Liability and Equity account titles in accordance with Chart of Accounts Performance Objective: Given the necessary tool, materials, and equipment you need to List Asset, Liability and Equity account titles in accordance with Chart of Accounts for 1.5 hours. Duration 1.5 hours Supplies/Materials Journals Pencil/Ballpen Eraser Tools/Equipment : Ledgers : Calculator Assessment Method : Performance Test Steps and Processes 1. Refer to the T-Accounts and the Chart of Accounts provided 2. From the given information in #1, List the Asset, Liability and Equity account titles in accordance with the Chart of Accounts 3. Once finished, check your answers against suggested answers. If you don’t get the perfect answer, perform the task sheet all over until you get the correct answers. 4. Once you get the correct answers, you are ready to move to the next step. 5. Return tools, materials and equipment. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 18 of 31 Developed by: Patricia A. Tamayo Revision # 00 Refer to the T Accounts Below Cash Accounts Payable 8,000 603,000 Accounts Receivable 20,000 Employee Cash Advance 30,000 Notes Payable 60,000 Food and Beverage Inventory 10,000 Furnitures & Fixtures 70,000 Office Supplies 5,000 Prepaid Rent Office Equipment 150,000 Oscares, Capital 800,000 Prepaid Advertising 4,000 Unearned Revenue 80,000 Vehicle 200,000 Notes Receivable 25,000 Sales Revenue 180,000 Marketing Materials 6,000 Oscares, Drawing 5,000 Use the following Chart of Accounts: Balance Sheet Accounts Assets 2001 2010 2019 2028 2037 2046 2055 2064 2073 2082 2091 5110 5120 Cash Accounts Receivable Notes Receivable Food and Beverage Inventory Office Supplies Employee Cash Advances Marketing Materials Prepaid Advertising Office Equipment Vehicle Furnitures & Fixtures Liabilities Notes Payable Accounts Payable BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 19 of 31 Developed by: Patricia A. Tamayo Revision # 00 5130 5140 5150 5160 6010 6020 6030 7010 7020 8010 8020 8030 8040 8050 8060 8070 8080 8090 Salaries Payable Utilities Payable Interest Payable Unearned Revenues Owner's Equity Oscares, Capitl Oscares, Drawing Income Summary Income Statement Accounts Income Consultng Reveneus Sales Revenue Expenses Salaries Expense Supplies Expense Rent Expense Insurance Expense Utilities Expense Depreciation Expense - Service Vehicle Depreciation Expense - Office Equipment Miscellaneous Expense Interest Expense BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 20 of 31 Developed by: Patricia A. Tamayo Revision # 00 Suggested Answer to Task Sheet 3.1-1 Balance Sheet Accounts Assets 2001 2010 2019 2028 2037 2046 2055 2064 2073 2082 2091 5110 5120 5130 5140 5150 5160 6010 6020 6030 7010 7020 8010 8020 8030 8040 8050 8060 8070 8080 8090 Cash Accounts Receivable Notes Receivable Food and Beverage Inventory Office Supplies Employee Cash Advances Marketing Materials Prepaid Advertising Office Equipment Vehicle Furnitures & Fixtures Liabilities Notes Payable Accounts Payable Salaries Payable Utilities Payable Interest Payable Unearned Revenues Owner's Equity Oscares, Capitl Oscares, Drawing Income Summary Income Statement Accounts Income Consultng Reveneus Sales Revenue Expenses Salaries Expense Supplies Expense Rent Expense Insurance Expense Utilities Expense Depreciation Expense - Service Vehicle Depreciation Expense - Office Equipment Miscellaneous Expense Interest Expense Debit Credit 603,000 20,000 25,000 10,000 5,000 30,000 6,000 4,000 150,000 200,000 70,000 60,000 8,000 80,000 800,000 5,000 180,000 1,128,000 BOOKKEEPING NC III Preparing Trial Balance Date Developed: 1,128,000 Document No. Issued by: Page 21 of 31 Developed by: Patricia A. Tamayo Revision # 00 PERFORMANCE CRITERIA CHECKLIST 3.1-1 Did I? List the Asset, Liability and equity account titles in accordance with the Chart of Accounts List the Income and Expense account titles in accordance with the Chart of Accounts BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 22 of 31 Developed by: Patricia A. Tamayo Revision # 00 INFORMATION SHEET 3.1-2 Procedure in listing of Income and Expense account in accordance with Chart of Accounts Learning Objectives: After reading this INFORMATION SHEET, YOU MUST be able to execute correctly the procedure in Listing Income and Expense Account Titles in accordance to the Chart of Accounts Introduction The procedure in Listing the Asset, Liability and Equity Account Titles according to the Chart of Accounts discussed in Information Sheet 3.1-1 is very similar to the Listing Income and Expense Account Titles in accordance to the Chart of Accounts which is the topic of Information Sheet 3.1-2. As you may recall, the definition of a Trial Balance: It is a list of accounts and their balances at a given time. Customarily, companies prepare a trial balance at the end of an accounting period. They list accounts in the order in which they appear in the ledger. Debit balances appear in the left column and credit balances in the right column. The trial balance proves the mathematical equality of debits and credits after posting. Under the double-entry system, this equality occurs when the sum of the credit and the debit account balances. A trial balance may also uncover errors in journalizing and posting. In addition, a trial balance is useful in the preparation of financial statements. The steps for preparing a trial balance are: 1. List account titles 2. Transfer balances from the ledger 3. Summarize trial balance We are going to discuss Step #1 or Learning Outcome 01 with the following assessment criteria: 1. Asset, liability, and equity account titles are listed in accordance with Chart of Account. 2. Income and expense account titles are listed in accordance with Chart of Accounts. As a review and for ease of reference, below is the definition and characteristics of the different Income Statement Accounts: BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 23 of 31 Developed by: Patricia A. Tamayo Revision # 00 Expense An expense is the cost of operations that a company incurs to generate revenue. Understanding Expense One of the main goals of company management teams is to maximize profits. This is achieved by boosting revenues while keeping expenses in check. Slashing costs can help companies to make even more money from sales. However, if expenses are cut too much it could also have a detrimental effect. For example, paying less on advertising reduces costs but also lowers the company’s visibility and ability to reach out to potential customers. How Expenses Are Recorded Companies break down their revenues and expenses in their income statements. Accountants record expenses through one of two accounting methods: cash basis or accrual basis. Under cash basis accounting, expenses are recorded when they are paid. In contrast, under the accrual method, expenses are recorded when they are incurred. For example, if a business owner schedules a carpet cleaner to clean the carpets in the office, a company using cash basis records the expense when it pays the invoice. Under the accrual method, the business accountant would record the carpet cleaning expense when the company receives the service. Expenses are generally recorded on an accrual basis, ensuring that they match up with the revenues reported in accounting periods. Different Types of Expenses There are two main categories of business expenses in accounting: Operating expenses: Expenses related to the company’s main activities, such as the cost of goods sold, administrative fees and rent. Non-operating expenses: Expenses not directly related to the business' core operations. Common examples include interest charges and other costs associated with borrowing money. BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 24 of 31 Developed by: Patricia A. Tamayo Revision # 00 Examples of compensation-related operating expenses Compensation and related payroll tax expenses for non-production employees Sales commissions (though this could be interpreted as a variable cost that is therefore part of the cost of goods sold) Benefits for non-production employees Pension plan contributions for non-production employees Examples of office-related operating expenses Accounting expenditures Depreciation of fixed assets assigned to non-production areas Insurance costs Legal fees Office supplies Property taxes Rent costs for non-production facilities Repair costs for non-production facilities Utility costs Examples of sales and marketing-related operating expenses Advertising costs Direct mailing costs Entertainment costs Sales material costs (such as brochures) Travel costs BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 25 of 31 Developed by: Patricia A. Tamayo Revision # 00 Self Check 3.1-2 Instruction: Choose the best letter of the best answer. 1. The following are in the income statement, except the following: a. Expenses b. Revenue c. Net income d. Accounts Payable 2. The balance sheet accounts are the following except: a. Cash b. Accounts Receivable c. Sales d. Luzarita, Capital 3. When an entity receives cash for services rendered, a. An asset is decreased b. A liability is increased c. Owner’s Equity is Increased d. Revenue is increased 4. When an entity receives cash for services rendered, a. The owner’s equity is decreased b. The Liability is increased c. The asset is increased d. The asset is decreased BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 26 of 31 Developed by: Patricia A. Tamayo Revision # 00 Suggested Answers to Self Check 3.1-2 1. d 2. c 3. a 4. c BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 27 of 31 Developed by: Patricia A. Tamayo Revision # 00 Self Check 3.1-2 Instruction: Write T if the statement is True and F if the statement is False. 1. What are the two Assessment Criteria under the Learning Objective: List the Account Titles? 2. What are the major account groups and which financial statement can you find these? 3. What are the range of variables for the accounts Assets, Liability and Equity account titles. Give one example for each. 4. What are the range of variables for the accounts Income and Expense account titles. Give one example for each. Suggested Answers to Oral Questioning 1. The assessment criteria for the Learning Objective: List Account Titles are: a. Asset, liability, and equity account titles are listed in accordance with Chart of Account. b. Income and expense account titles are listed in accordance with Chart of Accounts. 2. The Account titles are generally grouped into: Account Title Asset Liability Owner’s Equity Expense Income/Revenue Normal Balance Debit Credit Credit Debit Credit 3. Variable Asset Liability Equity Range Cash Loans Payable Barbo, Capital 4. Variable Income Expense Range Rent Income Rent Expense BOOKKEEPING NC III Preparing Trial Balance Date Developed: Financial Statement Balance Sheet Balance Sheet Balance Sheet Income Statement Income Statement Document No. Issued by: Page 28 of 31 Developed by: Patricia A. Tamayo Revision # 00 Sheet 3.1-2 List the Income and Expense Account in accordance to the Chart of Accounts. Use the following ‘T’ Accounts, the balances have been determined. Salaries Expense 30,000 Rent Expense 25,000 Interest Expense 4,000 Utilities Expense 6,000 Cash 65,000 Use the following Chart of Accounts 2001 2010 2019 2028 2037 2046 2055 2064 2073 2082 2091 5110 5120 5130 5140 5150 5160 6010 6020 6030 Balance Sheet Accounts Assets Cash Accounts Receivable Notes Receivable Food and Beverage Inventory Office Supplies Employee Cash Advances Marketing Materials Prepaid Advertising Office Equipment Vehicle Furnitures & Fixtures Liabilities Notes Payable Accounts Payable Salaries Payable Utilities Payable Interest Payable Unearned Revenues Owner's Equity Oscares, Capitl Oscares, Drawing Income Summary BOOKKEEPING NC III Preparing Trial Balance 7010 7020 8010 8020 8030 8040 8050 8060 8070 8080 8090 Income Statement Accounts Income Consultng Reveneus Sales Revenue Expenses Salaries Expense Supplies Expense Rent Expense Insurance Expense Utilities Expense Depreciation Expense - Service Vehicle Depreciation Expense - Office Equipment Miscellaneous Expense Interest Expense Date Developed: Document No. Issued by: Page 29 of 31 Developed by: Patricia A. Tamayo Revision # 00 Suggested Answer to Task Sheet 3.1-2 Balance Sheet Accounts Assets 2001 2010 2082 2091 5110 5120 5130 5140 5150 5160 6010 6020 6030 7010 7020 Debit Credit Cash Accounts Receivable Vehicle Furnitures & Fixtures Liabilities Notes Payable Accounts Payable Salaries Payable Utilities Payable Interest Payable Unearned Revenues Owner's Equity Oscares, Capitl Oscares, Drawing Income Summary Income Statement Accounts Income Consultng Reveneus Sales Revenue Expenses 65,000 8010 8020 Salaries Expense Supplies Expense 30,000 8030 8040 8050 8060 8070 8080 8090 Rent Expense Insurance Expense Utilities Expense Depreciation Expense - Service Vehicle Depreciation Expense - Office Equipment Miscellaneous Expense Interest Expense 25,000 6,000 4,000 65,000 BOOKKEEPING NC III Preparing Trial Balance Date Developed: 65,000 Document No. Issued by: Page 30 of 31 Developed by: Patricia A. Tamayo Revision # 00 REFERENCES 1. Cabanilla, E. A Manual in Accounting I 2. Ballada, W. Basic Accounting. 20th Ed., 2015 BOOKKEEPING NC III Preparing Trial Balance Date Developed: Document No. Issued by: Page 31 of 31 Developed by: Patricia A. Tamayo Revision # 00