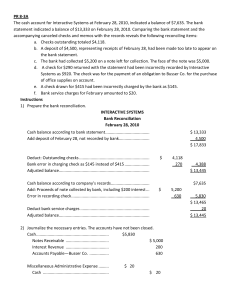

PROBLEM 2-1 Apathy Company provided the following information: Date Check No. Dec. 2 Dec. 18 104 Dec. 20 101 Dec. 22 106 Dec. 27 Dec. 29 Dec. 29 103 Dec. 29 CM Dec. 31 Service Charge DM Apathy Company Withdrawal Deposits 100,000 10,000 5,000 25,000 50,000 10,000 40,000 30,000 2,000 Dec. 1 Deposit 100,000 Dec. 21 Deposit 50,000 Dec. 27 Deposit 10,000 Dec. 31 Deposit 80,000 First Bank Dec. 101 Dec. 102 Dec. 103 Dec. 104 Dec. 105 Dec. 106 Dec. 107 Balance 100,000 90,000 85,000 60,000 110,000 120,000 80,000 110,000 108,000 4 Check No. 5,000 6 Check No. 15,000 8 Check No. 40,000 8 Check No. 10,000 10 Check No. 30,000 14 Check No. 25,000 28 Check No. 50,000 The credit made by the bank on December 29 represents the proceeds of a note received from a customer which was given to the bank for collection by the entity on December 26. Required: a. Prepare a bank reconciliation using adjusted balance method. b. Prepare adjusting entries PROBLEM 2-10 In preparing the bank reconciliation for the month of August, Apex Company provided the following information: Balance per bank statement Deposit in transit Return of customer check for insufficient fund Outstanding checks Bank service charge for August 1,805,000 325,000 60,000 275,000 10,000 What is the adjusted cash in bank? a. 1,855,000 b. 1,795,000 c. 1,785,000 d. 1,755,000 PROBLEM 2-11 Core Company provided the following data for the purpose of reconciling the cash balance per book with the cash balance per bank statement on December 31: Balance per book Balance per bank statement Outstanding checks, including certified check of P100,000 Deposit in transit December NSF checks, of which P50,000 had been redeposited and cleared on December 27 Erroneous credit to Core’s account, representing proceeds of loan granted to another company Proceeds of note collected by bank for Core, net service charge of P20,000 What amount should be reported as cash in bank at year-end? a. 1,500,000 b. 1,400,000 c. 1,800,000 d. 1,450,000 850,000 2,000,000 500,000 200,000 150,000 300,000 750,000 PROBLEM 2-12 In preparing the bank reconciliation for the month of December, Case company provided the following data: Balance per bank statement Deposit in transit Amount erroneously credited by bank to Case’s account Bank service charge for December NSF Check Outstanding checks 3,800,000 520,000 40,000 5,000 50,000 675,000 What is the unadjusted cash in bank balance per book? a. 3,550,000 b. 3,660,000 c. 3,610,000 d. 3,655,000 PROBLEM 2-13 Able Company received the bank statement for the month of March. However, the closing balance of the account was unreadable. Attempt to contact the bank after office hours did not secure the desired information. February 28 book balance Note collected by bank Interest earned on note NSF check of customer Bank service charge on NSF check Other bank service charge Outstanding checks Deposit of February 28 placed in night depository Checks issued by Axle Company charged to Able’s account What is the cash balance per bank statement? a. 1,435,000 b. 1,530,000 c. 1,340,000 d. 1,550,000 1,460,000 100,000 10,000 130,000 2,000 3,000 200,000 85,000 20,000 PROBLEM 2-14 Laconic Company received the bank statement for the month of April which included the following information: Bank service charge for April Check deposited by Laconic during April was not collectible and has been marked “NSF” by the bank and returned Deposits made but not yet recorded by bank Checks written and mailed but not yet recorded by bank 15,000 40,000 130,000 100,000 The entity found a customer check for P35,000 payable to the entity that had not yet been deposited and had not been recorded. The general ledger showed a bank account balance of P920,000. What amount should be reported as adjusted cash in bank on April 30? a. 900,000 b. 865,000 c. 930,000 d. 965,000 PROBLEM 2-15 Sapphire Company provided the following information for the month of December: Balance per bank statement December 31 Bank service charge for December Interest paid by bank to Sapphire Company for December Deposits made but not yet recorded by the bank Checks written but not yet recorded by the bank 2,800,000 12,000 10,000 350,000 650,000 The entity discovered that it had drawn and erroneously recorded a check for P46,000 that should have been recorded for P64,000. What is the cash balance per ledger on December 31? a. 2,500,000 b. 2,520,000 c. 2,540,000 d. 2,800,000 PROBLEM 2-16 Adversary Company kept all cash in a checking account. An examination of the accounting records and bank statement for the month of Lune revealed the following information: • • • • • • • The cash balance per book on June 30 is P8,500,000. A deposit of P1,000,000 that was placed in the bank’s night depository on June 30 does not appear on the bank statement. The bank statement shows on June 30, the bank collected note for Adversary Company and credited the proceeds of P950,000 to the entity’s account. Checks outstanding on June 30 amount to P300,000. Adversary Company discovered that a check written in June for P200,000 in payment of an account payable had been recorded in the entity’s records as P20,000. Included with the June bank statement was NSF check for P250,000 that Adversary Company had received from a customer on June 26. The bank statement shows a P20,000 service charge for June. What amount should be reported as cash in bank on June 30? a. 9,180,000 b. 9,360,000 c. 9,000,000 d. 3,300,000 What is the net adjustment to cash in bank on June 30? a. Net debit P950,000 b. Net credit P450,000 c. Net debit P500,000 d. Net debit P860,000 PROBLEM 2-17 Timex Company provided the following data relating to the cash transactions and bank account for the month of July: Cash balance per ledger Cash balance per bank statement Debit memo for July service charge Deposit of July 31 not recorded by bank until August 1 Outstanding checks, including certified check of P50,000 Proceeds of bank loan not recorded in ledger Proceeds from customer note, face P400,000, collected by bank, collection fee of P15,000 A creditor check has been entered in the book as P20,000, and was erroneously deducted by bank at A customer check was returned by bank marked DAIF Correct cash balance What is the cash balance per ledger? a. 2,120,000 b. 3,055,000 c. 2,55,000 d. 2,065,000 What is the cash balance per bank statement? a. 3,700,000 b. 3,070,00 c. 3,050,00 d. 2,370,000 ? ? 5,000 450,000 750,000 500,000 435,000 200,000 50,000 3,000,000 PROBLEM 2-18 Jane Company provided the following information at month-end: Cash in bank per bank statement Deposit in transit Outstanding checks, including certified checks of P200,000 Amount erroneously credited by bank to Jane’s account Note collected by bank for Jane Company, including interest of P100,000 Service charge for the current month NSF checks of customers returned by bank Error in recording a check in the book. The correct amount as paid by the bank is P100,000 instead of P200,000 as recorded in the book Saving deposit in other bank closed by BSP Currency and coins on hand Petty cash fund What is the adjusted cash in bank at month-end? a. 7,750,000 b. 7,900,000 c. 8,050,000 d. 7,550,000 What is the unadjusted cash in bank per ledger at month-end? a. 7,070,000 b. 7,220,000 c. 7,270,000 d. 7,750,000 What total amount of cash should be reported as current asset? a. 8,700,000 b. 9,700,000 c. 8,020,000 d. 8,850,000 8,000,000 1,200,000 1,500,000 150,000 1,100,000 20,000 500,000 100,000 1,000,000 900,000 50,000 PROBLEM 2-19 Pearl Company maintains a checking account at the City Bank. The bank provides a bank statement along with canceled checks on the last day of each month. The July bank statement included the following information: Balance, July 1 Deposits Checks processed Service charge NSF check Monthly loan payment deducted by bank from account 550,000 1,800,000 1,400,000 30,000 120,000 100,000 Deposits outstanding totaled P100,000 and all checks written by the depositor were processed by the bank except for check of P150,000. A P200,000 July deposit from accredit customer was recorded as P20,000 debit cash and credit accounts receivable. A check correctly recorded by the entity as P30,000 disbursement was incorrectly processed by the bank as P300,000 disbursement. What is the balance per bank on July 31? a. 700,000 b. 550,000 c. 800,000 d. 950,000 What amount should be reported as cash in bank on July 31? a. 650,000 b. 920,000 c. 380,000 d. 970,000 What is the cash in bank balance per ledger on July 31? a. 1,350,000 b. 1,170,000 c. 990,000 d. 890,000