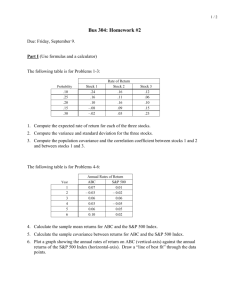

Concept Check Comprehensive on Income Statement ABC Inc. reported during 2020 the following information: 4%, Preferred Stocks, $50, par Common Stocks, $2 par Paid-in Capital in excess of par Retained Earnings Less: Treasury Stocks ($10 cost) Total Stockholders’ Equity 2019 $500,000 1,000,000 800,000 400,000 $2,700,000 2020 $500,000 1,000,000 800,000 ???? (100,000) ????? The firm generated net sales of $2,200,000 during 2020. Its cost of goods sold amounts to $600,000. The total operating expenses amount to $700,000 out of which $200,000 is allocated for depreciation and amortization expense. ABC reported during 2020: interest expense $50,000, gain on disposal of plant assets of $10,000, dividend revenue on preferred stocks of $40,000, and interest revenue of $20,000. ABC maintains a retention ratio of 20%. ABC Inc. utilizes the U.S progressive tax rate system. Taxable Income Marginal Tax Rate $0-$50,000 15% $50,001-$75,000 25% $75,001-$100,000 34% $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% Over $18,333,333 35% Instructions: 1- Compute ABC’s EPS. 2- Compute ABC’s DPS. 3- Compute the ending balance in retained earnings for 2020.