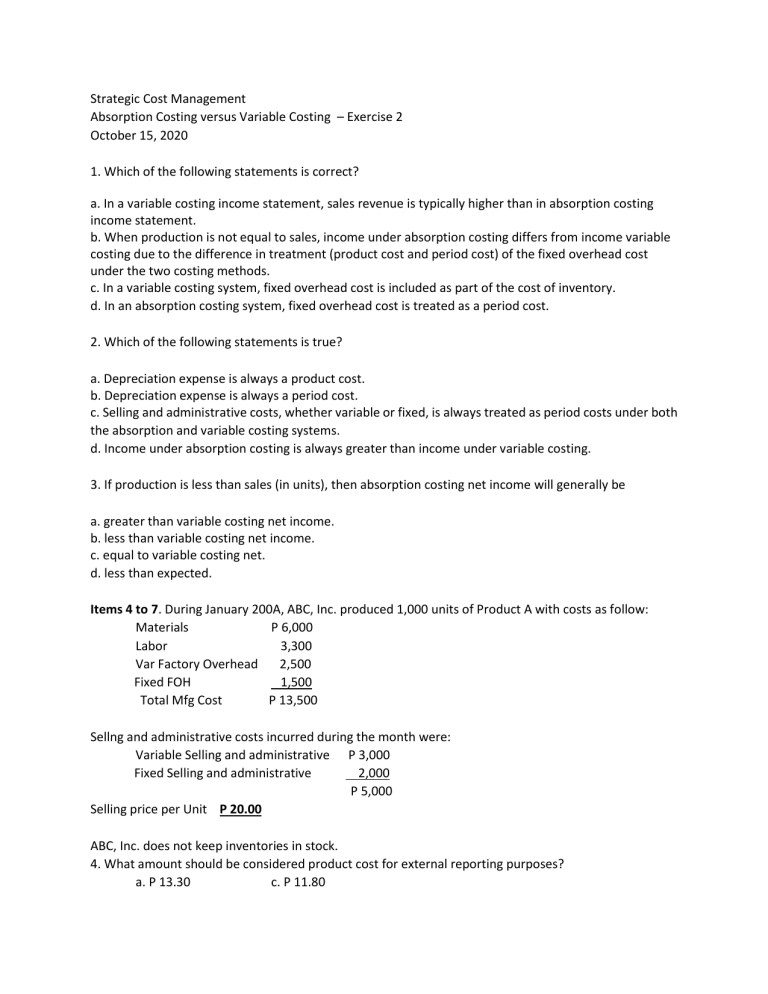

Strategic Cost Management Absorption Costing versus Variable Costing – Exercise 2 October 15, 2020 1. Which of the following statements is correct? a. In a variable costing income statement, sales revenue is typically higher than in absorption costing income statement. b. When production is not equal to sales, income under absorption costing differs from income variable costing due to the difference in treatment (product cost and period cost) of the fixed overhead cost under the two costing methods. c. In a variable costing system, fixed overhead cost is included as part of the cost of inventory. d. In an absorption costing system, fixed overhead cost is treated as a period cost. 2. Which of the following statements is true? a. Depreciation expense is always a product cost. b. Depreciation expense is always a period cost. c. Selling and administrative costs, whether variable or fixed, is always treated as period costs under both the absorption and variable costing systems. d. Income under absorption costing is always greater than income under variable costing. 3. If production is less than sales (in units), then absorption costing net income will generally be a. greater than variable costing net income. b. less than variable costing net income. c. equal to variable costing net. d. less than expected. Items 4 to 7. During January 200A, ABC, Inc. produced 1,000 units of Product A with costs as follow: Materials P 6,000 Labor 3,300 Var Factory Overhead 2,500 Fixed FOH 1,500 Total Mfg Cost P 13,500 Sellng and administrative costs incurred during the month were: Variable Selling and administrative P 3,000 Fixed Selling and administrative 2,000 P 5,000 Selling price per Unit P 20.00 ABC, Inc. does not keep inventories in stock. 4. What amount should be considered product cost for external reporting purposes? a. P 13.30 c. P 11.80 b. P 18.30 d. P 14.80 5. What is the product cost per unit under variable costing? a. P 13.30 c. P 11.80 b. P 18.30 d. P 14.80 6. What is the variable cost per unit for purposes of computing the contribution margin? a. P 13.30 c. P 11.80 b. P 18.30 d. P 14.80 7. Under absorption costing, income for January 200A was a. P 8,200 c. P 6,700 b. P 5,200 d. P 1,700 8. What would be the income if variable costing were used? a. Equal to income under absorption costing because that should be the case. b. Equal to income under absorption costing because the total fixed overhead costs expensed under both methods are the same. c. An amount greater than that under absorption costing because production is equal to sales. d. An amount less than that under absorption costing because there is no change in inventory. ***Nothing Follows***