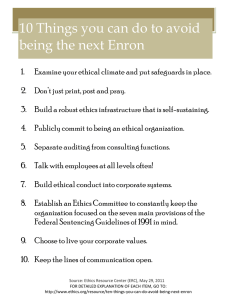

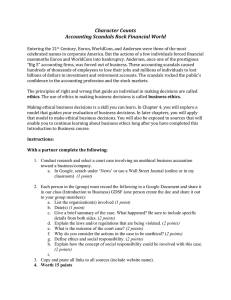

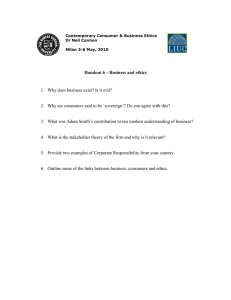

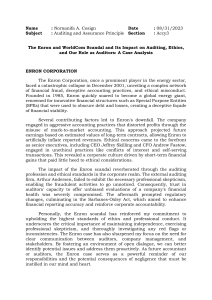

Ma. Theresa A. Aclan AIS (10:00-11:30AM) 45022 September 21, 2020 REFLECTION PAPER – WORST ACCOUNTING SCANDALS IN HISTORY As I am studying the degree of accountancy, frauds or embezzlement and bankruptcy due to mismanagement are some of the cases I came to learn. Before entering college all I know is that corruption exists only in the government. I do not know that this also happens even in private institutions. I also didn’t know how it works and who may be the people involved. I am not aware of these situations where money and status of the company can be manipulated. The first video stated that an ethics may be in the good or bad way. Ethics doesn’t mean only good morals. Upon watching it, I know in myself that I have the ethics and it is the good one. The Worldcom accounting fraud may be simple at the quarter 1 where the anomaly started. Entering a bogus entry may not affect the books at first glance but repetition will surely cause an imbalance. If I were to be the controller of the company, firmly I would not do the things that he have done. A decrease in profit cannot be fixed by an entry just to make the books good at sight. An appropriate strategy must have been taken. The CFO must think of that action first. It is clear that the company still ended up at filing bankruptcy. So what is the difference? Did the company regain its losses just by an entry? It all ended up in the closing of the company. Violating the rules of objectivity and the matching principle is really an inappropriate solution to cover up losses. Enron case shows the problem of internal control. The Sarbane’s Oxley Act was not followed by the company. The overconfidence of the Enron Company pulled them at the bottom. They thought that they were in control of the future value of their stocks in the market. The collapse was caused by the arrogance of risking more than what they really can afford. With these cases I can only conclude that an accountant/ professional should not disobey the rules. Even the narrator in the video said that the action is “extremely wrong” so why insist of doing it? The video also stated the jail time suffered by the controller, CFO and CEO. As a professional I will not choose to be in that situation. It is easier to accept the bankruptcy without doing any violation. We should always consider its effects to all the stakeholders. A small act could always cause harm at the end.