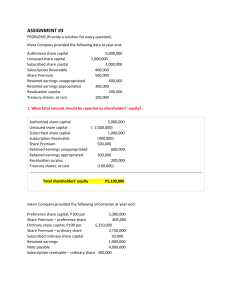

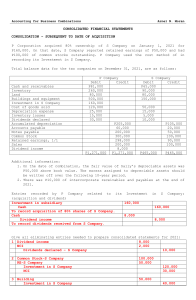

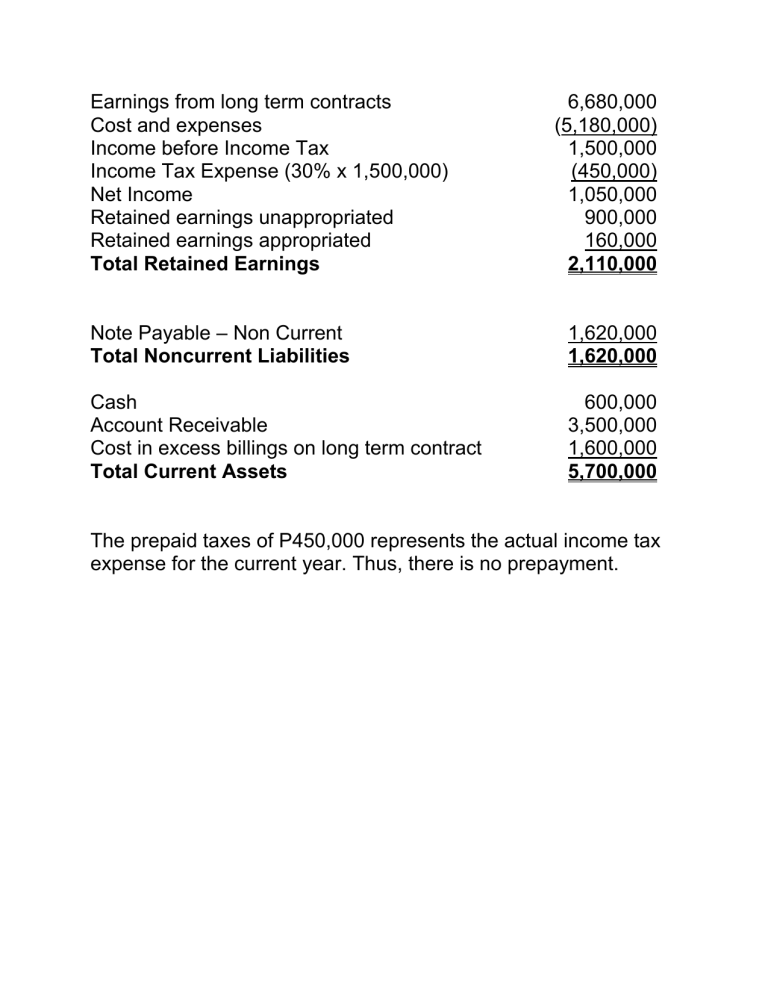

Earnings from long term contracts Cost and expenses Income before Income Tax Income Tax Expense (30% x 1,500,000) Net Income Retained earnings unappropriated Retained earnings appropriated Total Retained Earnings 6,680,000 (5,180,000) 1,500,000 (450,000) 1,050,000 900,000 160,000 2,110,000 Note Payable – Non Current Total Noncurrent Liabilities 1,620,000 1,620,000 Cash Account Receivable Cost in excess billings on long term contract Total Current Assets 600,000 3,500,000 1,600,000 5,700,000 The prepaid taxes of P450,000 represents the actual income tax expense for the current year. Thus, there is no prepayment.